Bitcoin And Crypto Face Turbulence As 10-Year US Treasury Yield Hits 15-Year High

September 22 2023 - 6:30AM

NEWSBTC

In an environment of soaring interest rates and economic

unpredictability, Bitcoin and the broader crypto market face

increased headwinds. The shift in the financial landscape was

recently underscored by the Benchmark 10-year US Treasury yield,

which hit a 16-year high this Thursday. Longest Yield Curve

Inversion Ever Historically, an inverted yield curve, where

short-term yields are higher than long-term ones, has been a

harbinger of economic downturns. Notably, the 10-Year minus the

3-Month Treasury Yield curve has been inverted for a record 217

trading days. Past data indicates that the longer the delay between

the inversion and the start of a recession, the more severe the

recession is likely to be. Joe Consorti, Market Analyst at The

Bitcoin Layer, underscored this concern, remarking on Twitter: “The

yield curve is re-steepening at breakneck speed. Up by 10 bps or

more today across the curve. Do you know what happens when the

yield curve steepens, every single time? Hint: not economic

expansion.” Related Reading: Ex-Alameda Employee Claims Firm

Triggered 87% Bitcoin Price Plummet In 2021 The Fed’s recent

signals and policy stance have taken the financial world by storm.

Charlie Bilello, Chief Market Strategist at Creative Planning,

noted, “The 10-Year Treasury Yield moved up to 4.49% today, highest

since October 2007. The Real 10-Year Yield (adjusted for expected

inflation) of 2.11% is now at the highest level since March 2009.”

Bilello also pointed out the significant reduction in the Fed’s

balance sheet, which is currently “over 10% below its April 2022

peak.” The two largest drawdowns over the last 20 years were

between December 2008 and February 2009 with 18.2% (balance sheet

hit a new high in Jan 2010), and from January 2015 to August 2019

with -16.7% (balance sheet hit a new high in March 2020). The rise

in the 10-Year Treasury Yield was reiterated by the analysts from

“The Kobeissi Letter,” who stated: “BREAKING: 10-Year Note Yield

officially hits our 4.50% target… The 10-Year Note Yield is up an

incredible 20 basis points in less than 24 hours… With supply side

inflation out of control and oil prices back to $90+, the Fed has

no choice. Higher for longer is back.” The Federal Reserve’s Stand

During Wednesday’s FOMC meeting, the US central bank and chairman

Jerome Powell have made clear its intentions, signaling the

potential for an additional rate hike this year and forecasting

fewer cuts next year. It now forecasts half a percentage point

of rate cuts in 2024. Prior, the dot plot showed cut rates by a

full percentage point next year. Related Reading: Why Touching This

Bitcoin Level Could Hold The Key For A Rally This “higher for

longer” strategy seems to diverge from the market’s prior

expectations, despite three months of seemingly positive inflation

data. Moreover, Powell conveyed confidence in the US. economy,

emphasizing the need to ensure interest rates are adjusted

correctly to achieve the central bank’s 2% inflation target.

However, the market remains uncertain, with the CME Group’s

FedWatch Tool indicating only a 32% chance of another rate hike in

November and a 45% likelihood by December. Implications For Bitcoin

And Crypto Risk assets, including Bitcoin and other

cryptocurrencies, have historically been sensitive to increases in

the 10-Year Treasury Yield. Charles Edwards, founder of Capriole

Investments, highlighted the challenges for the Bitcoin and crypto

sector: The Fed wants more unemployment. The job market is still

too strong. They’ve raised the expected 2024 rates as a result and

the 10YR has broken out to new decade highs. As long as the 10YR is

breaking upwards like this, risk assets are going to see further

headwinds. Historically, rising yields are indicative of an

expectation of higher interest rates, which increase the cost of

borrowing. This scenario often leads to a reduction in speculative

investments, with investors favoring more stable, yield-bearing

assets over riskier options such as Bitcoin and crypto. Another

problem for the market is the “higher for longer” approach and the

massive reduction of the Fed’s balance sheet. Risk assets like

Bitcoin are traditionally a “sponge” for high liquidity, but when

this dries up in the financial market, they usually suffer the

most. In addition, concerns about a possible recession will

continue to rise due to the inverted yield curve. Remarkably,

Bitcoin and crypto have never traded in a recession, the reaction

is uncertain. At press time, Bitcoin traded at $26,655. Featured

image from Shutterstock, chart from TradingView.com

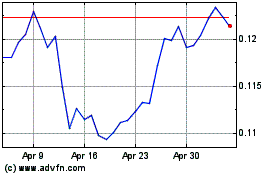

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025