Ethereum Open Interest Rises By $1.5 Billion – What This Means

July 27 2024 - 6:30AM

NEWSBTC

Ethereum (ETH) recorded a significant loss in price this week

following the trading debut of Ethereum spot ETFs. According to

data from CoinMarketCap, ETH has declined by 6.60% in the last

seven days, falling as low as $3,100. However, amidst this price

crash, CryptoQuant analyst burakkesmeci has made an important

observation with a potential impact on market movement. Related

Reading: Ethereum Targets Recovery: Can It Mirror Bitcoin’s

Performance? Ethereum Open Interest Surges By $1.5 Billion In Three

Weeks In a Quicktake post on CryptoQuant, burrakesmeci shared that

the Open Interest (OI) on Ethereum has risen by a remarkable $1.5

billion in the past three weeks. For context, Open Interest refers

to the total number of outstanding positions for a particular

asset. Generally, an increase in Open Interest indicates a rise in

market participation for any asset i.e., more traders are opening

long or short positions on Ethereum. With this rise in open

positions, there is likely an equal increase in the number of

leverage trades. Burakkesmeci expressed that a surge in

liquidations should also be expected as leveraged trades, which are

open with borrowed funds, are always closed once an insufficient

price margin occurs. Furthermore, This increase in leverage trading

liquidations is expected to produce a high market volatility,

resulting in unpredictable and rapid price movements. In

regards to price action, a rise in Open Interest indicates the

current market trend is gaining stronger. Therefore, despite

Ethereum’s price dip in the last week, the prominent altcoin is

likely to extend its 7.01% gain of the past three weeks in the

coming months. At the time of writing, Ethereum presently

trades at $3,278.80 with a 3.46% increase in the last 24 hours. The

altcoin appears to be attempting a market recovery with a strong

resistance expected at the $3,500 region. However, if the current

buying pressure proves insufficient to break past this barrier,

Ethereum could return to the $3,100 price mark or even slide as low

as $2,900. Related Reading: Ethereum Whales Rapidly Accumulate ETH

Amid Price Decline Ethereum Spot ETFs Net Outflows Reach $469

Million In another development, the newly launched Ethereum Spot

ETF market has now recorded a cumulative outflow of $469.83 million

in its first three days of trading. Data from Farside Investors

identifies Grayscale’s ETHE with a total outflow of $1.51 billion

as the major cause of this current market position.

Meanwhile, BlackRock’s ETHA continues to lead the market with

inflows worth $354.8 million, followed closely by Bitwise’s ETHW

with $265.9 million. Like their Bitcoin counterparts, the

debut of the Ethereum spot ETF has been accompanied by a

significant price drop. However, it remains uncertain whether these

Ethereum ETFs will eventually trigger a price surge akin to the one

experienced in the Bitcoin market during the initial two months of

BTC Spot ETF trading. Featured image from Investopedia, chart from

Tradingview.com

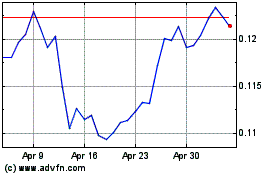

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024