Dogecoin Teeters Between ‘Price Discovery’ And ‘Catastrophe’: What’s Next?

December 30 2024 - 3:35AM

NEWSBTC

The Dogecoin price is currently down -34% from its December 8 high

at $0.4843. But according to crypto analyst Kevin

(@Kev_Capital_TA), DOGE has one of “the better looking” charts at

the moment. In a new Broadcast on X, he offered an in-depth look at

Dogecoin, the broader market environment, and key technical

indicators. Dogecoin: Price Discovery Or Catastrophe? Despite the

current retracement, Kevin believes Dogecoin’s chart “looks really

nice at the moment” and appears stronger than many other

cryptocurrencies: “This is a stronger coin compared to a lot of the

market. I mean, Doge really does look good here. […] Can it not

look good in a week from now? Of course it can, but it looks really

good at the moment.” However, he emphasized the possibility of

short-term pullbacks—something that could bring Dogecoin down to

the $.026 region: “In the short term, could we come back down and

test 26 cents? Which I’m gonna throw that out there […] I see no

real reason to be uber bearish […] but is it possible that we come

back down here? Sure.” Related Reading: Dogecoin Price Could Soar

To $23 Based On These Bullish Fractals The $0.26 to $0.28 range

emerged as the critical juncture for Dogecoin’s near-term outlook:

“As long as we remain above this 28 to 26 cent level […] I see no

reason to be super fearful. If we pierce that level […] A loss of

$0.26 cents on weekly closes would be catastrophic.” Kevin traced

this specific target back to November, when he first suggested

Dogecoin would revisit the golden pocket near $0.26. According to

him, many were skeptical, but that level eventually got hit: “I

took a lot of heat for making that call back in early November when

we were at 45 cents […] We ended up coming back down and testing

that.” Looking to the upside, Kevin pinpoints a substantial

resistance area between $0.30 and $0.35, calling it “big, big

resistance.” Following that, he labels $0.94 to $1.00 as his “next

big zone,” though he cautioned traders against assuming a

guaranteed climb. For Dogecoin to breach previous all-time highs

and truly enter “full-blown price discovery,” Kevin wants to see a

break above the 0.703 and 0.786 Fibonacci retracements—roughly

$0.53 and $0.59 cents, respectively: “I don’t see anything holding

Dogecoin back from full-blown price discovery […] We want to break

53 cents […] and then the 0.786 at 59 cents. If we’re durably

breaking past that 60 cent area, I don’t see anything holding

Dogecoin back.” Drawing parallels to past market cycles, Kevin

highlighted how Dogecoin historically checks in with its “bull

market support band” and macro support levels before rallying: “We

came back, we tested structure support […] bull market support band

in this cycle. This is very similar to [the previous cycle]. You

can’t deny the similarities.” He described how Dogecoin’s present

chart mirrors its cycle patterns “almost insanely,” referring to a

breakout followed by a falling wedge, an initial climb, and a

retest of macro support: “Crypto has this insane innate ability to

follow its cyclical nature of performance […] it’s truly amazing,

really.” Related Reading: Dogecoin Whales Bought Over 90 Million

DOGE In 48H – Details Despite Dogecoin’s cyclical consistency,

Kevin reminded viewers that external market factors and Bitcoin’s

performance (which he called “the leader of the market”) could

always derail patterns: “We obviously need Bitcoin to cooperate. We

can’t have any crazy situations happen globally.” Kevin also

examined the DOGE/BTC pair, noting a macro trend line and a golden

pocket test: “We have this macro trend line […] we broke through

that and we came back in. We’re currently at the bull market

support band […] We came back and tested the macro golden pocket

again.” He stressed that if Dogecoin remains above this zone on the

DOGE/BTC chart, it should head higher. A breakdown, however, could

spell trouble: “Kind of like that 26 cent level […] if we come down

and break […] it will coincide with a break of the bull market

support band and this macro golden pocket, in which case we can be

in some pretty deep s**t.” Kevin also delved into macroeconomic and

geopolitical factors that could influence Dogecoin and the wider

crypto sphere. He posited that the President Donald Trump returning

to the White House in January is “very bullish” if it leads to

improved regulations, reduced conflict, and pro-growth policies:

“We have Trump coming in the office in January, meaning we’re going

to have a crypto-friendly administration […] If we can get the

Ukraine and Russia war ended, that’s going to be bullish for

markets […] We can get inflation back down to 2% and then start

lowering interest rates faster.” When And How High Will DOGE Rise

Again? From December dumps to Q1 optimism, Kevin noted how market

participants often front-run expectations by about a month. He

suggested that if January ends up choppy, February might be the

point when markets begin their true climb: “Everyone thought

October was going to be bullish. October was not bullish. November

was bullish. Now everyone thinks January is going to be bullish […]

Maybe February is bullish.” When pressed for specific price

targets, Kevin pointed to several Fibonacci extensions and the Pi

Cycle Top indicator on the Dogecoin chart: “If we break through

previous all-time highs, the next resistance zone is going to be

$0.94 up to $1.32 […] If we break through $1.32, the next big

resistance zone that I’m eyeing is $2.19 up to $2.78.” However, he

made it clear that any long-term price predictions depend heavily

on technical indicators and confirmations. He highlighted multiple

monthly indicators—MACD, RSI, Stoch RSI, and the Pi Cycle Top—as

potential signals to exit positions: “I don’t care what the price

is at that point […] once we get up into that zone, I’m taking

profits off the board. If the monthly indicators start flashing,

I’m getting out.” At press time, DOGE traded at $0.32. Featured

image created with DALL.E, chart from TradingView.com

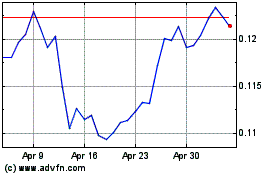

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025