Solana proposal to cut inflation rate by up to 80% fails to pass

March 13 2025 - 9:51PM

Cointelegraph

A proposal to dramatically change Solana’s inflation system has

been rejected by stakeholders but is being hailed as a victory for

the network’s governance process.

“Even though our proposal was technically defeated by the vote,

this was a major victory for the Solana ecosystem and its

governance process,” commented Multicoin

Capital co-founder Tushar Jain on March 14.

Around 74% of the staked supply voted on proposal SIMD-228

across 910 validators, but just 43.6% voted in favor of it, with

27.4% voting against it and 3.3% abstaining,

according to Dune

Analytics. It needed 66.67% approval from participating votes

to pass and only received 61.4%.

Jain added that this was the biggest crypto governance vote

ever, by both the number of participants and the participating

market cap, of any ecosystem, chain or network.

“This was a meaningful scaling stress test — a social,

rather than technical, stress test — and the network passed despite

a wide stratification of diverging opinions and

interests.”

“Solana SIMD-228 voter turnout was higher than every US

presidential election in the last 100 years,”

claimed the team behind

Solana’s X account.

SIMD-228 final vote count. Source:

Dune

SIMD-228 is a proposal to change Solana’s

(SOL) inflation system from a

fixed schedule to a dynamic, market-based model. Instead of a

pre-set decrease in inflation, this new system would dynamically

adjust based on staking participation.

Currently, supply inflation begins at 8% annually, decreasing by

15% per year until it reaches 1.5%. The new mechanism may have

reduced it by as much as 80%, according to some

estimates. Solana

inflation is currently 4.66%, and just 3% of the total supply is

staked, according to Solana Compass.

However, such high inflation can increase selling pressure,

reduce SOL’s price and discourage network use. The proposed system

would have adjusted inflation based on staking levels to stabilize

the network and minimize unnecessary token issuance.

Solana’s current inflation schedule. Source:

Helius

Benefits would have included increased network security due to

dynamically increasing inflation if staking participation drops,

reaction to real-time staking levels rather than following a fixed,

inflexible schedule, and encouraging more active use of SOL in

DeFi, according to Solana developer tools

provider Helius.

However, lower inflation could have made it harder for smaller

validators to stay profitable, the proposed model increased

complexity, and unexpected shifts in staking rates might have led

to instability.

Related: Solana price bottom below $100? Death cross

hints at 30% drop

There was little reaction in SOL prices, with the asset dipping

1.5% on the day to just below $125 at the time of

writing.

However, it has tanked by

almost 60% in just two months as the memecoin bubble burst. Solana

network revenue has also slumped over

90% since it was primarily used to mint and trade

memecoins.

Magazine: Mystery celeb memecoin scam factory, HK firm

dumps Bitcoin: Asia Express

...

Continue reading Solana proposal to cut inflation

rate by up to 80% fails to pass

The post

Solana proposal to cut inflation rate by up to 80%

fails to pass appeared first on

CoinTelegraph.

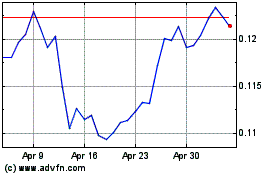

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2025 to Apr 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Apr 2024 to Apr 2025