Sidetrade: +25% of Bookings, +19% of Revenue for H1 2024

All-time performance for half-year

bookings

- €7.42 million in new Annual Contract Value (ACV): up

25%

- With €3.95 million in SaaS bookings (ARR): up

20%

- And €3.47 million in Services bookings: up

32%

- United States now represents 45% of total

bookings

Strong revenue growth, up 19%,

with SaaS subscriptions up 18%

- Robust revenue growth in the United States, up

40%

- International markets now account for 60% of revenue,

with 32% in the United States

Double-digit growth in sales confirmed

for 2024

Sidetrade, the global

leader in AI-powered Order-to-Cash applications, today announces

bookings up 25% with a 19% increase in revenue for the first half

of 2024.

Olivier Novasque, CEO of Sidetrade

commented:

“This first half of the year saw us deliver

our best performance to date, with robust bookings – up 25% in

Annual Contract Value – and never-before-seen revenue for a half

year, close to the €25 million mark, representing a 19% increase.

On top of these record bookings, which will generate more than

€7 million in additional revenue for the coming year, it’s how

we accomplished this performance that gives us signs of

encouragement as we look to the quarters ahead. Above all, we must

highlight our consistent results in two consecutive quarters with

binding contract commitments averaging 45 months for our large

accounts, despite current macroeconomic uncertainty. Our growth

driver is now almost perfectly balanced between the United States

and Europe, with each region accounting for 45% and 55% of

bookings. Though France represents 31% of total bookings, its

contribution must be relativized over time. Lastly, despite the

fact that Q3 is traditionally the weakest period for bookings,

assuming this trend continues into H2 2024, it would only further

enhance the robustness of our economic model which – as a reminder

– is 90%-based on recurring revenue.

In revenue terms, Sidetrade turned in an

excellent half-year performance, aligning with 2023 and posting

growth of 19%. This double-digit figure is driven both by our

expansion in the United States (+40%) and by a significant increase

in our subscription revenue with multinationals generating $2.5

billion-plus revenue (+34%). With more than 60% of our

revenue now achieved through international markets including 32% in

North America, combined with 90% recurring revenue and an

increasingly powerful growth driver, Sidetrade is showcasing its

robust development strategy against an uncertain economic and

geopolitical backdrop. The ongoing acquisition of SHS Viveon AG in

Germany means that we are in pole position to cement our global

leader status in the Order-to-Cash market and to

execute our Fusion100 strategic plan, targeting $100 million in

revenue by the end of 2026.”

All-time performance for half-year

bookings: ACV up 25%

Sidetrade

(€m) |

H1 2024 |

H1 2023 |

Change |

| New SaaS

subscriptions (New ARR) |

3.95 |

3.30 |

+20% |

|

Services bookings |

3.47 |

2.62 |

+32% |

|

New Annual Contract Value (ACV) |

7.42 |

5.92 |

+25% |

2024 information is from consolidated,

unaudited data.

In H1 2024, Sidetrade set

another record for bookings, adding €7.42 million

in new Annual Contract Value (ACV) versus €5.92 million in H1 2023,

representing a substantial increase of 25%. It

should be noted that H1 2023, which saw growth of 21% versus H1

2022 (€4.81 million), already turned in the Company’s best

performance to date in ACV terms, representing a challenging base

effect. On balance, between H1 2022 and H1 2024, Sidetrade reported

an increase of more than 54% in its ability to win new

bookings.

This first-half performance is partly due to the

Company’s success in North America since it represents new ACV of

€3.34 million, accounting for 45% of total

bookings. Sidetrade’s development model now shows a

near-perfect balance between North America (45%) and Europe (55%).

Within Europe, France accounted for 31% of total bookings, serving

as a relative contributor to Sidetrade’s future growth.

In H1 2024, the initial contract period

for new customers (excluding renewals) rose to 45

months (vs. 44.8 months a year earlier), considerably

above SaaS industry peers who generally run contract periods

between 24 and 36 months. This is a clear testament to new

customers’ confidence in Sidetrade’s solutions despite prevailing

economic and political uncertainties. Looking to the quarters and

years ahead, new customers’ binding contract period serves to

increase the Company revenue model’s predictability and

resilience.

New SaaS bookings (New ARR)

totaled €3.95 million, up 20% on

H1 2023 (€3.30 million), reaching an unprecedented level for a

first half in Sidetrade's history, even though Q2 2023 remains the

best-performing single quarter to date in terms of bookings. Q1 and

Q2 2024 recorded more regular and steadier new SaaS bookings

compared to the same periods last year, posting €1.85

million (Q1 2024) and €2.10 million (Q2

2024) versus €0.89 million (Q1 2023) and €2.41 million (Q2

2023).

Overall, in H1 2024, Total Contract Value

(TCV) increased to €12.24 million

versus €10.87 million a year earlier.

Parallel to this, services

bookings, with almost all invoiced within 12 months of

their signing, totaled €3.47 million for the first

half of 2024, up 32% on the same period the

previous year (€2.62 million). This strong increase is still

attributed to the multiplication of global projects, in line with

the successful business strategy kick-started 24 months ago,

targeting accounts generating $1 billion-plus revenue.

In H1 2024, bookings by new customers

(“New Business”) accounted for 64% of the

total. Cross-selling for new entities

within a Group and/or the sale of other main applications in

Sidetrade’s Order-to-Cash suite, including CashApp, Credit Risk

Expert and e-Invoicing, represented 19% of total new

bookings. Lastly, the remaining 17% of

bookings were driven by Upselling of

additional modules to existing customers.

For the third year running, Sidetrade was

recognized as a Leader in the prestigious Gartner® Magic

Quadrant™ for Invoice-to-Cash applications. This

distinction acknowledges the expertise of Sidetrade’s Integrated

Invoice-to-Cash applications, reflecting the Company’s advancements

in artificial intelligence (see press release of May 8,

2024). Quarter after quarter, Sidetrade consolidates its

leadership in the global Order-to-Cash market.

This first-half 2024 performance reflects the

upward trend in bookings observed during the 2023 fiscal year,

further validating the relevance of the Company’s strategic

decisions, namely: 1/ a business strategy

kick-started 24 months ago, with a focus on companies generating $1

billion-plus revenue, 2/ an increased recognition by

multinationals of Sidetrade's technological edge in AI,

particularly in the United States, and 3/ the development

of a comprehensive Order-to-Cash software suite resulting

from a strategy of continuous innovation.

Strong revenue increase of 19%, with

SaaS subscriptions up 18%

Sidetrade

(€m) |

H1 2024 |

H1 2023 |

Change |

| Order-to-Cash SaaS subscriptions |

20.5 |

17.4 |

+18% |

|

H1 revenue |

24.8 |

20.9 |

+19% |

2024 information is from consolidated,

unaudited data.

In H1 2024, Sidetrade reported strong growth in

revenue for Order-to-Cash SaaS subscriptions,

up 18%.

The Company’s revenue for the

first half of 2024 totaled €24.8 million, also

reporting an increase of 19%. On a Group-wide

basis, this double-digit growth is attributable to:

- Robust revenue growth in the United States, up

40%

Quarter after quarter, the United

States is a growth driver for Sidetrade, posting

revenues up 40% to €7.9 million in H1

2024. International markets account for 60% of the

Company’s total revenue, with 32% coming from

North America. Going forward, the United States will

continue to be pivotal for Sidetrade's growth.

- Ever-increasing demand from multinational

corporations

Analysis of customer profiles is underpinned by

growth of 34% in subscriptions with multinational

corporations on Annual Recurring Revenue (ARR) contracts

in excess of €250,000. These subscriptions now account for

47% of Sidetrade's total subscriptions and are

expected to remain an important growth driver in the quarters

ahead.

- Consolidation of CreditPoint Software

business

Effective July 1, 2023, the consolidation of the

CreditPoint Software business has positively contributed to

Sidetrade's performance. In H1 2024, CreditPoint generated revenue

of €0.8 million, with a 4% impact on

quarterly growth.

It should be noted that all multi-year

Sidetrade contracts are routinely indexed to inflation

(the Syntec for Southern Europe, the UK CPI for Northern Europe and

the US CPI for the United States). This measure alters the total

price of SaaS subscriptions each year by reference to changes in

these price indices, without anticipating contract renewals.

Double-digit growth in sales confirmed

for 2024

On the back of an outstanding first-half performance, the

Group’s management is confident in Sidetrade’s ability to deliver

double-digit growth in the 2024 fiscal year.

Next financial

announcement

First Half Year Results for 2024: September 10, 2024, after the

stock market closes.

Investor

relations

Christelle Dhrif

00 33 6 10 46 72

00

cdhrif@sidetrade.com

Media

relations

Becca

Parlby

00 44 7824 5055

84

bparlby@sidetrade.com

About

Sidetrade

(www.sidetrade.com)

Sidetrade (Euronext Growth: ALBFR.PA) provides a SaaS platform

dedicated to securing and accelerating cash flow. Sidetrade’s

next-generation AI, nicknamed Aimie, analyzes $6.1 trillion worth

of B2B payment transactions daily in the Sidetrade Cloud to predict

customer payment behavior and the attrition risk of more than 38

million buyers worldwide. Aimie recommends the best operational

strategies, intelligently automates actions on the entire

Order-to-Cash process, and dematerializes customer transactions to

enhance productivity, performance, and working capital

improvements.

Sidetrade has a global reach, with 315+ talented employees based in

Paris, London, Birmingham, Dublin, Houston, and Calgary, serving

global businesses in more than 85 countries. Amongst them: Bidcorp,

Biffa, Bunzl, Contentsquare, Engie, Expedia, Inmarsat, KPMG,

Lafarge, Manpower, Opentext, Page, Randstad, Saint-Gobain,

Securitas, Sodexo, Tech Data, UGI, Veolia. Sidetrade is a

participant of the United Nations Global Compact and adheres to its

principles-based approach to responsible business.

For further

information, visit us at www.sidetrade.com and follow us on Twitter

@Sidetrade.

In the event of any discrepancy between the French and

English versions of this press release, only the French version is

to be taken into account

- Sidetrade: First Half Year Revenue for 2024 with a 19% increase

in revenue

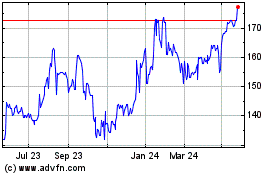

SideTrade (EU:ALBFR)

Historical Stock Chart

From Dec 2024 to Jan 2025

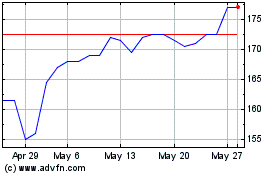

SideTrade (EU:ALBFR)

Historical Stock Chart

From Jan 2024 to Jan 2025