Biotalys Strengthens Relationship with Investors via Private Placement of New Shares for €7 million

June 07 2023 - 12:00AM

Biotalys Strengthens Relationship with Investors via Private

Placement of New Shares for €7 million

Press release - Regulated information - Inside

Information

Biotalys NV

(Euronext Brussel : BTLS) (the “Company” or “Biotalys”), an

Agricultural Technology (AgTech) company developing protein-based

biocontrol solutions for crop and food protection, today announced

that it has successfully obtained subscription commitments for an

amount of EUR 7 million by means of a private investment in a

public equity (“PIPE”). The transaction involves the issue of

1,135,257 new shares (being approximately 3.67% of the Company’s

shares outstanding prior to the transaction) at an issue price of

EUR 6.166 per share representing a premium of approximately 1%

compared to the closing price of the Biotalys share on Euronext

Brussels on Tuesday 6 June 2023.

Investors are the existing shareholders Agri

Investment Fund BV (“AIF”) and the Belgian Sovereign Wealth Fund

Federale Participatie- en Investeringsmaatschappij NV (“SFPIM”).

AIF is the private equity and venture capital fund of the Belgian

Farmers Union (Boerenbond) focusing on Ag-Tech and Agro-Food

companies that contribute to a stronger and more sustainable

agriculture and horticulture. AIF’s participation in the present

capital increase is in line with its ambition to support companies

to bring their innovations to the agricultural market. To

further strengthen the relationship with AIF, Biotalys will propose

its shareholders to nominate AIF’s CEO Patrik Haesen to join the

Board of Directors of Biotalys.

Patrik Haesen, CEO of AIF,

commented: “We strongly believe that farmers in Belgium and around

the world require new tools to protect their yields while reducing

the impact on the environment. We have supported Biotalys since its

inception and today want to further build our position as a

committed partner with a long-term vision, who can provide

financial support as well as a large network and professional

advice on various agricultural sectors.”

Patrice Sellès, Biotalys

CEO, said: "After validating our approach with

multiple collaborations, including through the recent strategic

partnership with Syngenta, we welcome the additional support of

current shareholders, bringing us another step closer to our

ultimate goal of providing growers all over the world, and

particularly in our home country Belgium, with innovative and

cost-efficient solutions.”

Biotalys is developing a strong and diverse

pipeline of effective biocontrol products with a favorable safety

profile that aim to address key crop pests and diseases across the

whole value chain, from soil to plate. The pipeline is based on its

proprietary AGROBODY™ technology platform, enabling the discovery

and development of a variety of solutions against multiple targets

such as fungi, harmful insects and bacteria that cause significant

crop losses.

Biotalys currently intends to use the proceeds

of the private placement as follows:

- To further develop and advance the

Company’s pipeline, including discovery and development, aimed at

increasing the number of programs within crop protection and the

food value chain, potentially also through partnerships;

- To fund continuous platform

development and intellectual property capture to maintain the

competitiveness and increase the efficiency of Biotalys’ AGROBODY

Foundry™ platform;

- To support the market calibration

of its first product candidate Evoca™ and preparation of future

commercial launch with field trials, manufacturing scale up and

regulatory approvals;

- To support acquisition of key

talents.

The payment and delivery of the new shares is

scheduled to take place on Monday 12 June 2023. Following such

date, the new shares will also be listed on Euronext Brussels.

These new shares will have the same rights and benefits as, and

rank pari passu in all respects with, the existing and outstanding

shares of Biotalys at the moment of their issuance.

As a result of the issuance of new shares, the

Company’s share capital will increase with EUR 1,634,136 from EUR

44,564,320 to EUR 46,198,456 and its issued and outstanding shares

will increase from 30,959,454 to 32,094,711 shares, representing an

increase of number of shares outstanding of 3.67%.

About Biotalys

Biotalys is an Agricultural Technology (AgTech)

company protecting crops and food with proprietary protein-based

biocontrol solutions and aiming to provide alternatives to

conventional chemical pesticides for a more sustainable and safer

food supply. Based on its novel AGROBODY™ technology platform,

Biotalys is developing a strong and diverse pipeline of effective

product candidates with a favorable safety profile that aim to

address key crop pests and diseases across the whole value chain,

from soil to plate. Biotalys was founded in 2013 as a spin-off from

the VIB (Flanders Institute for Biotechnology) and has been listed

on Euronext Brussels since July 2021. The company is based in the

biotech cluster in Ghent, Belgium. More information can be found on

www.biotalys.com.

For further information, please

contact:

Toon Musschoot, Head of IR & CommunicationT:

+32 (0)9 274 54 00E: Toon.Musschoot@biotalys.com

Important notices

This announcement is for informational purposes

only and is directed only at persons who are located outside the

United States. This announcement does not constitute an offer to

sell or the solicitation of an offer to buy shares or any other

security and shall not constitute an offer, solicitation or sale in

the United States or in any jurisdiction in which, or to any

persons to whom, such offering, solicitation or sale would be

unlawful. The shares have not been, and will not be, registered

under the U.S. Securities Act or the securities laws of any state

of the United States or any other jurisdiction, and may not be

offered or sold within the United States, or to, or for the account

or benefit of, U.S. persons, except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the U.S. Securities Act and applicable state or local securities

laws. Accordingly, the shares are being offered and sold (i) in the

United States only to qualified institutional buyers in accordance

with Rule 144A under the U.S. Securities Act and (ii) in “offshore

transactions” to non-U.S. persons outside the United States in

accordance with Regulation S under the U.S. Securities Act. There

is no assurance that the offering will be completed or, if

completed, as to the terms on which it will be completed.

This announcement has been prepared on the basis

that any offer of the shares in any Member State of the European

Economic Area (the “EEA”) is or will be made pursuant to an

exemption under the Prospectus Regulation from the requirement to

publish a prospectus for offers of the shares. The expression

“Prospectus Regulation” means Regulation (EU) 2017/1129 (as amended

or superseded) any implementing measure in each relevant Member

State of the EEA.

This announcement is only addressed to and

directed at persons in Member States of the EEA who are "qualified

investors" within the meaning of Article 2(e) of the Prospectus

Regulation, or such other investors as shall not constitute an

offer to the public within the meaning of Article 3.1 of the

Prospectus Regulation.

The offer, sale and admission to trading of the

shares will be made pursuant to an exception under the Prospectus

Regulation from the requirement to produce a prospectus for offers

or admissions to trading of securities. This press release does not

constitute a prospectus within the meaning of the Prospectus

Regulation or an offer to the public.

The distribution of this press release into

certain jurisdictions may be restricted by law. Persons into whose

possession this announcement comes should inform themselves about

and observe any such restrictions. Any failure to comply with these

restrictions may constitute a violation of the laws of any such

jurisdiction.

- Biotalys Press Release Private Placement - 7 June 2023

- Biotalys Persbericht Private Plaatsing_7 juni 2023

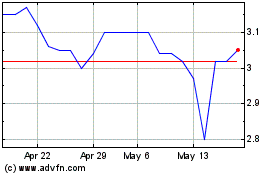

Biotalys (EU:BTLS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Biotalys (EU:BTLS)

Historical Stock Chart

From Mar 2024 to Mar 2025