Biotalys announces Closing of Private Placement

Information on the total number of voting rights and

shares

Ghent, BELGIUM, Oct. 16, 2024 (GLOBE NEWSWIRE)

-- Press Release

Regulated information

Biotalys NV (Euronext Brussel : BTLS) (the

“Company” or “Biotalys”), an Agricultural Technology (AgTech)

company developing protein-based biocontrol solutions for

sustainable crop protection, today announced the closing of its

previously announced private placement of 5,300,352 new shares

(being approximately 16.5% of the Company’s shares outstanding

prior to the transaction) at an issue price of EUR 2.83 per share

representing a discount of 10% compared to the volume weighted

average price of the Company’s share on Euronext Brussels during

the period of 30 days from (and including) 11 September 2024 till

(and including) 10 October 2024.

The new shares are listed on Euronext Brussels

since 16 October 2024. These new shares have the same rights and

benefits as, and rank pari passu in all respects with, the existing

and outstanding shares of Biotalys at the moment of their

issuance.

KBC Securities NV, Belfius Bank NV/SA in

cooperation with Kepler Cheuvreux SA, and Coöperatieve Rabobank

U.A. acted as Joint Global Coordinators of the private

placement.

Information on the total number of

voting rights and shares

In view hereof, and in accordance with article

15 of the Belgian Act of 2 May 2007 on the disclosure of major

shareholdings (the “Belgian Act”), that the

outstanding share capital and outstanding voting securities of the

Company can be summarised as follows:

- Share capital: EUR

5,538,755.50 EUR

- Total number of

securities carrying voting rights: 37,457,562 (all ordinary

shares)

- Total number of

voting rights (= denominator): 37,457,562 (all relating to ordinary

shares)

- Number of rights to

subscribe for securities carrying voting rights not yet issued:

- 1,989,400 “ESOP

Warrants”, entitling their holders to subscribe for a total number

of 1,989,400 profit certificates which will, if and when issued,

automatically convert into a total number of maximum 994,698

securities carrying voting rights (all ordinary shares)

- 1,013,352 “ESOP IV

Warrants”, entitling their holders to subscribe for a total number

of maximum 1,013,352 securities carrying voting rights (all

ordinary shares).

- 84.746 “ESOP V Warrants”, entitling their holders to subscribe

for a total number of maximum 84.746 securities carrying voting

rights (all ordinary shares).

- 23,926 share units,

awarded in aggregate to the independent directors of the Company in

the framework of its remuneration policy. Each share unit

contains the obligation – subject to vesting of all share units –

to subscribe to one new share of the Company at an issue price of

one EUR per share-unit. Cash settlement is possible. The

conditions of the share units are described in the remuneration

policy of the Company.

- The Company has no

outstanding convertible bonds or non-voting shares.

Pursuant to the Belgian Act, a notification to

the Company and the Belgian Financial Services and Markets

Authority (FSMA) is required by all natural and legal persons in

each case where the percentage of voting rights attached to the

securities held by such persons in the Company reaches, exceeds or

falls below the threshold of 5%, 10%, and every subsequent multiple

of 5%, of the total number of voting rights in the Company.

About Biotalys

Biotalys is an Agricultural Technology (AgTech)

company developing protein-based biocontrol solutions for the

protection of crops and aiming to provide alternatives to

conventional chemical pesticides for a more sustainable and safer

food supply. Based on its novel AGROBODY™ technology platform,

Biotalys is developing a strong and diverse pipeline of effective

product candidates with a favorable safety profile that aim to

address key crop pests and diseases across the whole value chain,

from soil to plate. Biotalys was founded in 2013 as a spin-off from

the VIB (Flanders Institute for Biotechnology) and has been listed

on Euronext Brussels since July 2021. The company is based in the

biotech cluster in Ghent, Belgium. More information can be found on

www.biotalys.com.

For further information, please

contact:

Toon Musschoot, Head of IR &

Communication

T: +32 (0)9 274 54 00

E: IR@biotalys.com

Important notices

This announcement is for informational purposes

only and is directed only at persons who are located outside the

United States. This announcement does not constitute an offer to

sell or the solicitation of an offer to buy shares or any other

security and shall not constitute an offer, solicitation or sale in

the United States or in any jurisdiction in which, or to any

persons to whom, such offering, solicitation or sale would be

unlawful. The shares have not been, and will not be, registered

under the U.S. Securities Act or the securities laws of any state

of the United States or any other jurisdiction, and may not be

offered or sold within the United States, or to, or for the account

or benefit of, U.S. persons, except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the U.S. Securities Act and applicable state or local securities

laws. Accordingly, the shares are being offered and sold (i) in the

United States only to qualified institutional buyers in accordance

with Rule 144A under the U.S. Securities Act and (ii) in “offshore

transactions” to non-U.S. persons outside the United States in

accordance with Regulation S under the U.S. Securities Act. There

is no assurance that the offering will be completed or, if

completed, as to the terms on which it will be completed.

This announcement has been prepared on the basis

that any offer of the shares in any Member State of the European

Economic Area (the “EEA”) is or will be made pursuant to an

exemption under the Prospectus Regulation from the requirement to

publish a prospectus for offers of the shares. The expression

“Prospectus Regulation” means Regulation (EU) 2017/1129 (as amended

or superseded) any implementing measure in each relevant Member

State of the EEA.

This announcement is only addressed to and

directed at persons in Member States of the EEA who are "qualified

investors" within the meaning of Article 2(e) of the Prospectus

Regulation, or such other investors as shall not constitute an

offer to the public within the meaning of Article 3.1 of the

Prospectus Regulation.

The offer, sale and admission to trading of the

shares will be made pursuant to an exception under the Prospectus

Regulation from the requirement to produce a prospectus for offers

or admissions to trading of securities. This press release does not

constitute a prospectus within the meaning of the Prospectus

Regulation or an offer to the public.

The distribution of this press release into

certain jurisdictions may be restricted by law. Persons into whose

possession this announcement comes should inform themselves about

and observe any such restrictions. Any failure to comply with these

restrictions may constitute a violation of the laws of any such

jurisdiction.

Biotalys, its business, prospects and financial

position remain exposed and subject to risks and

uncertainties. A description of and reference to these risks

and uncertainties can be found in the annual report on the

consolidated annual accounts published on the company’s

website.

This announcement contains statements which are

"forward-looking statements" or could be considered as such. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the words ‘aim’, 'believe',

'estimate', 'anticipate', 'expect', 'intend', 'may', 'will',

'plan', 'continue', 'ongoing', 'possible', 'predict', 'plans',

'target', 'seek', 'would' or 'should', and contain statements made

by the company regarding the intended results of its strategy. By

their nature, forward-looking statements involve risks and

uncertainties and readers are warned that none of these

forward-looking statements offers any guarantee of future

performance. Biotalys’ actual results may differ materially from

those predicted by the forward-looking statements. Biotalys makes

no undertaking whatsoever to publish updates or adjustments to

these forward-looking statements, unless required to do so by

law.

- Biotalys PIPE Closing Press Release 16 October 2024 (ENG)

- Biotalys PIPE Closing persbericht 16 oktober 2024 - NED

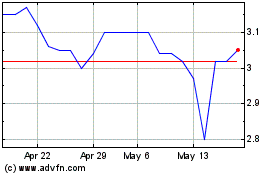

Biotalys (EU:BTLS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Biotalys (EU:BTLS)

Historical Stock Chart

From Jan 2024 to Jan 2025