Improvement in all financial metrics in 2021 in line with the

good performance posted in 2020:

- Revenues: +16.3% to €1,911 million

- Underlying operating income: +25.0% to €75.6

million

- Cash flow from operations: +22.5% to €188.9 million after

investments in operations

- Financial debt: limited to 0.9x EBITDA excluding IFRS

16

Regulatory News:

ID Logistics, (ISIN: FR0010929125, Mnémo: IDL)

one of the European leaders in contract logistics, announces its

2021 results with revenues up 16.3% to €1,911 million and

underlying operating income of €75.6 million, an increase of

+25.0%.

Eric Hémar, Chairman and CEO of ID Logistics, commented:

« ID Logistics posted strong growth in all its 2021 financial

metrics. This good performance reflects the strength of our model,

both in France and internationally, as the increase of our sites

productivity has enabled us to offset the numerous start-ups. In

addition, strengthened by these good results, we were able to sign

three strategic acquisitions, in the Benelux, the United States,

and in e-commerce distribution to individuals in France. »

In €m

2021

2020

Change

Revenues

1,910.9

1,642.8

+16.3%

EBITDA

270.6

223.8

+20.9%

As a % of revenues

14.2%

13.6%

+60 bps

Underlying operating income

75.6

60.5

+25.0%

As a % of revenues

4.0%

3.7%

+30 bps

Consolidated net income

35.7

28.2

+26.6%

As a % of revenues

1.9%

1.7%

+20 bps

Cash flow from operations after

operating investments

188.9

154.2

+22.5%

Net financial debt / EBITDA

excluding IFRS 16

0.9x

0.7x

ANOTHER YEAR OF SUSTAINED REVENUE GROWTH AT +16.3%

ID Logistics' 2021 revenues amounted to €1,910.9 million, up

+16.3% and +17.0% on a like-for-like basis:

- In France, revenues amounted to €775.9 million, up 7.6%.

This increase was driven in particular by the 14 projects started

since 2020.

- Outside France, revenues reached €1,135.0 million, again

up sharply by 23.1%. This performance includes a currency effect

that remains unfavorable overall, particularly in Latin America,

and the consolidation at the end of 2021 of GVT, a company acquired

in Benelux. Excluding these items, revenues rose by 24.4% in

2021.

This performance of the ID Logistics Group is even more

remarkable since the activity in 2020 had already recorded a growth

of +7.1% compared to 2019. The share of e-commerce activity

continues to grow and will reach 28% in 2021.

UNDERLYING OPERATING INCOME UP +25.0% TO €75.6m

Despite the Covid-19 crisis and the costs associated with the

start-up of 22 new sites in 2021, the Group's operating

profitability continued to improve, with underlying operating

income up 25.0% to €75.6 million, compared with €60.5 million in

2020, or an underlying operating margin of 4.0%, up 30 basis

points:

- In France, underlying operating income recovered sharply

to €32.2 million in 2021, or 4.2% of revenues, compared with €26.6

million and 3.7% in 2020. In 2021, ID Logistics has better offset

the direct and indirect additional costs related to the Covid-19

health crisis, and above all has continued to increase the

productivity of recent projects while ensuring good control of the

start-ups made this year.

- Outside France, underlying operating income continued to

grow, reaching €43.4 million, representing a margin of 3.8%,

compared with €33.9 million and 3.7% in 2020. As in France, the

effects of the Covid-19 crisis have now been completely absorbed

and recent projects have seen a clear overall improvement in

productivity.

NET INCOME UP 26.6% TO €35.7m

Net income for 2021 includes non-recurring expenses of €9.8

million (compared to €3.4m in 2020), including €7.2 million in

costs, mainly social, related to the closure of all unprofitable

activities for Opel in Spain.

Overall, net income will be €35.7 million in 2021, up 26.6%

compared to 2020.

GOOD CASH GENERATION AND STRONG INVESTMENT CAPACITY

In 2021, ID Logistics has proven its good management of working

capital requirements. The Group also accelerated the pace of its

investments by €82.4 million in 2021 compared to €57.8 million in

2020. Finally, cash flow from operations amounted to €188.9

million, up +22.5% compared to 2020.

ID Logistics has completed in December 2021 the acquisition of

GVT in the Benelux for a total cash consideration of € 67.7

million, including acquisition costs.

After this acquisition, net financial debt excluding IFRS 16

remains under control at €105.1m at the end of 2021, compared with

€61.0m at the end of 2020. It is limited to 0.9x EBITDA.

OUTLOOK

ID Logistics recalls that it has no activity in Ukraine and that

its sales in Russia represent about 1% of the Group's revenues.

Despite this limited exposure, the Group is carefully monitoring

the situation.

In 2022, ID Logistics focus will be on the successful

integration of its recent acquisitions: GVT in the Benelux,

Colisweb in France (finalized in January 2022) and above all Kane

Logistics in the United States (acquisition still subject to the

approval of the American antitrust authorities).

ID Logistics also remains focused on increasing the productivity

of recent projects and controlling the start-ups expected in 2022

at a similar level to 2021. At the same time, ID Logistics is

moving ahead with the implementation of its ambitious CSR

(Corporate Social Responsibility) of which the targets have been

presented in October 2021.

Additional note: Audit procedures on the consolidated financial

statements have been performed.The certification report will be

issued after completion of the procedures required for the purpose

of publishing the annual financial report.

NEXT REPORT

Q1 2022 Revenues: April 25, 2022, after market close.

ABOUT ID LOGISTICS

ID Logistics managed by Eric Hémar is an international contract

logistics group, with revenue of €1,911 million ($2,179 million) in

2021. ID Logistics manages 350 sites across 17 countries,

representing nearly 7.0 million square meters of warehousing

facilities in Europe, America, Asia and Africa, with 25,000

employees. With a client portfolio balanced between retail,

industry, detail picking, healthcare and e-commerce sectors, ID

Logistics is characterized by offers involving a high level of

technology. Developing a social and environmental approach through

a number of original projects since its creation in 2001, the Group

is today resolutely committed to an ambitious CSR policy. ID

Logistics is listed on Compartment A of Euronext’s regulated market

in Paris (ISIN Code: FR0010929125, Ticker: IDL).

APPENDIX

- Simplified statement of income

(€m)

2021

2020

France

775.9

721.0

International

1,135.0

921.8

Revenues

1,910.9

1,642.8

France

32.2

26.6

International

43.4

33.9

Underlying operating income

75.6

60.5

Amortization of customer relationships

(1.4)

(1.3)

Non-recurring expenses

(9.8)

(3.4)

Financial result

(14.0)

(12.7)

Income tax

(15.4)

(15.8)

Share in income of associates

0.7

0.8

Consolidated net income

35.7

28.2

o/w attributable to ID Logistics’

shareholders

33.1

25.2

- Simplified statement of cash flows

(€m)

2021

2020

EBITDA

270.6

223.8

Change in working capital and others

22.3

6.6

Other changes

(21.6)

(18.4)

Net investments

(82.4)

(57.8)

Net cash generated/(used) by operating

activities

188.9

154.2

Acquisition of subsidiary

(67.7)

-

Net financing costs

(4.8)

(4.9)

Net debt repayments

(101.2)

(91.9)

Other changes

(2.2)

(3.9)

Increase (decrease) in cash and cash

equivalents

13.0

53.5

Cash and cash equivalent – beginning of

period

144.0

90.5

Cash and cash equivalent – end of

period

157.0

144.0

Definitions

- Like-for-like change: change excluding the impact of:

- acquisitions and disposals: the revenue contribution of

companies acquired during the period is excluded from the same

period, and the revenue contribution made by companies sold during

the previous period is also excluded from that period;

- changes in the applicable accounting principles;

- changes in exchange rates (revenues in the various periods

calculated based on identical exchange rates, so that the reported

figures for the previous period are translated using the exchange

rates for the current period).

- EBITDA: Underlying operating income before net

depreciation of property, plant and equipment and amortisation of

intangible assets

- Net financial debt: Gross debt plus bank overdrafts and

less cash and cash equivalents

- Net debt :Net financial debt plus rent liabilities (IFRS

16)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220316005830/en/

ID Logistics Yann Perot CFO Tel: +33 (0)4 42 11 06 00

yperot@id-logistics.com

Investor Relations NewCap Tel : +33 (0)1 44 71 94 94

idlogistics@newcap.eu

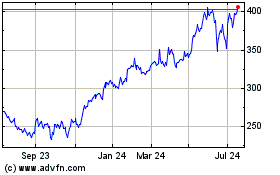

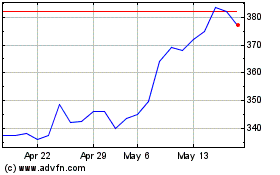

ID Logistics (EU:IDL)

Historical Stock Chart

From Jan 2025 to Feb 2025

ID Logistics (EU:IDL)

Historical Stock Chart

From Feb 2024 to Feb 2025