2023 First-half

results

H1 revenue: €1,087.1

millionOrganic acceleration of

activity and order book

in the second quarterGuidance

confirmed

Paris, July 25, 2023 - Revenue

for the 1st half-year stands at €1,087.1 million, down 3.1% on last

year, including -1.1% organic growth, -1.8% currency effects linked

to the appreciation of the euro against emerging currencies and the

pound sterling, and -0.1% scope effect.

As expected, organic growth in the second

quarter returned to positive territory at 0.5%, after -2.8% in the

first quarter.

PERFORMANCE BY QUARTER

|

|

H1 2023 vs. H1 2022 |

|

In millions of Euros |

Revenue 2023 |

Totalgrowth |

Organicgrowth |

|

1st quarter |

532.0 |

-2.9% |

-2.8% |

|

2nd quarter |

555.1 |

-3.3% |

0.5% |

|

Half-year total |

1,087.1 |

-3.1% |

-1.1% |

PERFORMANCE BY REGION

|

In millions of Euros |

H1 2022 |

Contribution |

Total growth H1 2023/H1

2022 |

Organic growthH1 2023/H1

2022 |

|

Reminder: Organic growth

H1 2022 vs H1 2021 |

|

EMEA |

475.7 |

44% |

-4.6% |

-1% |

|

-1% |

|

Americas |

421.4 |

39% |

-2.0% |

-3% |

|

16% |

|

Asia-Pacific |

190.1 |

17% |

-1.7% |

3% |

|

10% |

|

Revenue |

1,087.1 |

100% |

-3.1% |

-1.1% |

|

6.9% |

|

Of which |

|

|

|

|

Developed countries |

71% |

-5.8% |

-5% |

|

Emerging countries |

29% |

4.2% |

9% |

Performance by region in the first half shows a

sharp contrast between solid growth momentum in emerging countries

(close to 9%) and a decline in business of nearly 5% in developed

countries.

Our EMEA business posted an

organic decline of 1%, mainly due to the end of the major Covid

contracts. Excluding the impact of these contracts, organic growth

is close to 4%, and rebounded to 6% between the 1st and 2nd

quarters on the back of good momentum in Continental, Western and

Eastern Europe.

Revenue in the Americas fell

organically by nearly 3%. This reflects contrasting realities, with

very good momentum in Latin America (organic growth above 8%) and a

decline in sales of around 4% in North America, penalized compared

to an excellent first half 2022 (16% organic growth in the region)

by (i) the drop in demand from major Tech customers and (ii)

contract delays in our Public Affairs business in the United

States, linked in part to the debate in the second quarter on the

US government spending cap.

Finally, the Asia-Pacific

region posted organic growth of 3%, with a clear upturn in the 2nd

quarter (7% compared with -2% in the first quarter), driven by very

good momentum in India and Southeast Asia. As expected, business

activity in China picked up in the second quarter (6.5%) following

the end of the zero-Covid policy at the start of the year, but the

rebound of the Chinese economy after the pandemic remains lower

than that seen in the West after the lockdowns.

PERFORMANCE BY AUDIENCE

|

In millions of Euros |

H1 2023 |

Contribution |

Organic growthH1 2023/H1

2022 |

|

Reminder: Organic growth H1 2022 vs H1

2021 |

|

Consumers1 |

513.2 |

47% |

3% |

|

14% |

|

Clients and employees2 |

240.1 |

22% |

0.5% |

|

9% |

|

Citizens3 |

163.9 |

15% |

-12.5% |

|

-12% |

|

Doctors and patients4 |

169.9 |

16% |

-3% |

|

8% |

|

Revenue |

1,087.1 |

100% |

-1.1% |

|

6.9% |

Breakdown of Service Lines by audience segment:1- Brand Health

Tracking, Creative Excellence, Innovation, Ipsos UU, Ipsos MMA,

Market Strategy & Understanding, Observer (excl. public

sector), Social Intelligence Analytics, Strategy32- Automotive

& Mobility Development, Audience Measurement, Customer

Experience, Channel Performance (Mystery Shopping and Shopper),

Media development, ERM, Capabilities3- Public Affairs, Corporate

Reputation4- Pharma (quantitative and qualitative)

Our Consumer

business rebounded in the 2nd quarter (+5%) and posted organic

growth of 3% in the first half, on top of 14% last year. The

excellent performance of our brand health monitoring, marketing

spend optimization and market positioning activities reflects our

clients’ need to continue to understand consumer behavior in a

complex, ever-changing world that is increasingly difficult to

decipher.

Our business with Clients

and employees is stable overall, following strong

growth last year. Our service lines dedicated to customer

experience and channel performance evaluation are showing very good

momentum, as economies re-open fully and travel returns but this

audience segment is penalized by the decline in demand from Big

Tech clients.

Work among Citizens fell by

over 12%, reflecting the end of Covid contracts. Underlying revenue

excluding Covid public sector contracts grew organically by 3.5%.

The need for governments and institutions to understand the

dynamics of public opinion and the expectations of citizens is

important in a context marked by multiple crises: geopolitical,

democratic, economic and ecological.

Lastly, our business with

doctors and patients stabilized

in the second quarter and posted an organic decline of 3% for the

first half as a whole. Business suffered from delays in

decision-making by certain pharmaceutical industry customers, who

have suffered extended delays in the approval of new drugs, and a

wide range of restructuring post pandemic. That said, sales

momentum is good, and the order book for our healthcare business

line has grown organically close to 9% since January. We are also

pleased to announce the appointment of Bonnie Bain as the new head

of this service line, whose experience will enable us to accelerate

our development with customers in the healthcare sector.

Overall growth in the 1st half should be

assessed in the light of a number of factors:

- Firstly, the excellent performance

achieved in the 1st half of 2022, which led to unfavorable base

effects. As a result, revenue for the 1st half of 2023 is almost

€100 million higher than for the first half of 2021, representing

organic growth of 6% over 2 years.

- Secondly, the impact of the end of

the major Covid pandemic monitoring contracts, mainly in the first

quarter. Excluding the impact of these contracts, underlying

business for the first half rose organically by 1.1%.

- Lastly, the decline in business

from major Tech customers undergoing restructuring (down 18% in the

first half compared with the same period last year). These

customers experienced exceptional growth during the pandemic,

before entering a period of uncertainty from last summer onwards.

To date, the situation of these customers is varied: while demand

for studies has rebounded in some cases, it remains low in others.

We have a number of major contracts under discussion, both for

traditional activities (product testing, brand health research,

mystery shopping, etc.) and for numerous opportunities linked to

generative artificial intelligence. We therefore expect a recovery

in the coming months, but the timing remains uncertain.

FINANCIAL PERFORMANCE FOR THE FIRST HALF

Summary income statement

|

In millions of Euros |

June 30, 2023 |

June 30, 2022 |

Change |

Reminder Dec. 31,

2022 |

|

Revenue |

1,087.1 |

1,121.7 |

-3.1% |

2,405.3 |

|

Gross margin |

736.1 |

739.7 |

-0.5% |

1,594.1 |

|

Gross margin / revenue |

67.7% |

65.9% |

|

66.3% |

|

Operating margin |

94.3 |

126.8 |

-25.6% |

314.7 |

|

Operating margin / revenue |

8.7% |

11.3% |

|

13.1% |

|

Other non-recurring / recurring income and expenses |

(0.9) |

0.9 |

|

3.7 |

|

Finance costs |

(6.6) |

(6.2) |

|

(13.2) |

|

Tax |

(20.9) |

(29.5) |

|

(72.8) |

|

Net profit attributable to the owner of the parent |

56.4 |

85.5 |

|

215.2 |

|

Adjusted net profit* attributable to the owner of the

parent |

70.1 |

97.5 |

-28.1% |

232.3 |

*Adjusted net income is calculated before (i) non-cash items

related to IFRS 2 (share-based payment), (ii) amortization of

acquisition-related intangibles (customer relations), (iii) the

impact net of tax of other non-recurring income and expenses, (iv)

non-cash impacts on changes in puts in other financial income and

expenses and (v) before deferred tax liabilities related to

goodwill for which amortization is deductible in certain

countries.

The gross margin (which is

calculated by deducting external and variable costs associated with

contract performance from revenue) is up 180 basis points to 67.7%

compared to 65.9% for last year at this point. This increase in the

gross margin ratio reflects change in the mix of data collection

methods, and can be explained by (i) the end of major pandemic

monitoring contracts (whose collection costs were higher than the

average) (ii) the increase in the proportion of online surveys

(even though the post-pandemic upturn in business has resulted in a

resumption of offline surveys in less digitalized countries such as

India) (iii), a mix effect linked to the strong growth of our

activity in marketing spend optimization and advisory work which

does not require data collection and whose gross margin is

significantly higher than that of the rest of the Group. Lastly,

the increase in gross margin in the first half also reflects our

ability to increase our prices in a world where inflation is still

present.

In terms of operating costs,

payroll rose by 2.7%, due to the full-year impact

of (i) recruitments carried out in 2022 to cope with growth (ii)

the salary increases granted last year. The ratio of payroll to

gross margin rose to 70% from 68% last year, but remains

significantly lower than the pre-pandemic situation (above 72% in

2019). Our cautious approach to operating costs in the first half

is beginning to bear fruit and will produce its full effect on

profitability in the second half.

Overheads rose by €7 million,

i.e. an increase of 7.1% year-on-year, mainly due to (i) a catch-up

in current IT and technology expenditure and (ii) an increase in

travel expenses. The ratio of overheads to gross profit is down in

the first half to 14.7% from 13.6% last year, but here again, this

ratio remains significantly lower than in 2019 (18.3%).

"Other operating income and

expenses", which mainly consists of severance costs, has a

negative balance of €9.7 million, up €8 million on the previous

year, reflecting the reorganization made necessary by the slowdown

in certain businesses.

Overall, the operating margin

for the first half of 2023 is 8.7%, down 260 basis points compared

to the same period last year.

Net interest expense amounted

to €6.6 million, compared to €6.2 million last year, reflecting the

impact of the rise in benchmark rates on variable interest expense,

offset by higher interest on the Group's cash investment. Note that

at June 30, 2023, 80% of gross debt is at a fixed rate.

The effective tax rate is

25.8%, compared to 25.3% last year.

Net profit attributable to the

owner of the parent is €56 million compared to €85 million in the

first half of 2022.

Adjusted net profit

attributable to the owner of the parent is also down at

€70 million compared to €98 million last year.

Financial

structure

Cash flow from operations

stands at €137 million compared to €172 million in the first half

of 2022, a drop of €35 million euros, in line with the fall in

pre-tax net income.

Working capital requirements

showed a negative variation of €28 million in the first half,

consistent with the negative variation of €22 million in the first

half of 2022.

Investments in property, plant and

equipment and intangible assets consist mainly of

investments in IT infrastructure and technology, and amounted to

€27 million in the first half.

Overall, free cash flow from

operating activities is €24 million, compared to €53 million last

year.

In terms of non-current

investments, Ipsos invested around €5.5 million in the

first half, notably in the acquisition of the Xperiti platform in

the United States to strengthen its B2B research capacity, and of

Focus RX, a pharmaceutical research company in China.

Lastly, financing operations for the first half

of 2023 include the following:

- the continuation of our share buyback

program for cancellation purposes for €27 million and €36

million of share buy-backs under the usual bonus share plans

- repayment of a Schuldschein loan for €30

million

Shareholders' equity stood at

€1,359 million at June 30, 2023 compared to €1,500 million at

December 31, 2022.

Net financial debt amounted to

€129 million, up compared to December 31, 2022 (€69 million) and

down from June 30, 2022 (154 million euros). The leverage ratio

(calculated excluding the IFRS 16 impact) was 0.4 times EBITDA

(compared to 0.2 times at December 31, 2022 and 0.4 times at June

30, 2022).

Cash position. Cash at June 30,

2023 amounted to €301 million compared to €386 million at December

31, 2022.

The Group also has nearly €500 million in credit

lines available for more than one year, enabling it to meet its €48

million debt repayments in 2023 and 2024.

Also, with a view to restituting value to

shareholders, we are pursuing our share buy-back program for

cancellation. We plan to buy back around €50 million euros this

year.

OUTLOOK

As we are in the midst of a recovery and our

business is returning to its usual cyclical pattern, first-half

results will be less than half of full-year 2023 results.

The order book is a better forward-looking

indicator. It continues to accelerate, with organic growth of 2.6%

at the end of June (4.1% excluding the impact of Covid contracts),

thanks to 5.3% growth in the 2nd quarter alone.

We are therefore seeing a lag between revenues

and the order book, which can be explained by:

- The end of Covid contracts

concentrated at the beginning of 2022

- The upturn in orders, which

traditionally leads to a lag between the order book and

revenues

- Mix effects linked to the good

momentum of service lines whose average contract maturity is longer

than that of the Group's other services (public affairs and brand

health measurement).

This lag between revenue growth (-1.1%) against

order book growth (+2.6%) will automatically be absorbed in the

second half of the year, leading to revenue growth catching up by

3.7%. This does not take into account the expected further

acceleration in orders over the coming months.

More fundamentally, we are now returning to a

more usual annual pattern, both in terms of business and revenue.

Historically, the first half of the year accounts for around 45% of

full-year revenues and 26% of operating margin.

This confirms what we anticipated in February:

the business profile for 2023 will be the opposite of that for

2022, with revenues, operating margin and cash generation weaker in

the first half and then much stronger in the second half.

First-half results are in line with historical pre-pandemic

benchmarks, as shown in the table below, which helps confirm this

view.

Acquisition rate of key financial

aggregates at end-June

(performance at end-June

/ annual

performance)

| |

|

|

|

|

|

|

|

| |

|

|

Average 2017 -

2022 |

|

|

2023 (*) |

|

| |

|

|

|

|

|

|

| |

Order

book |

|

72% |

|

|

73% |

|

| |

Revenue |

|

45% |

|

|

45% |

|

| |

Gross

margin |

|

46% |

|

|

46% |

|

| |

Operating

margin |

|

29% |

|

|

29% |

|

| |

|

|

|

|

|

|

|

| |

(*) For 2023:

results for the first half/annual objectives |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

The return to a degree of cyclicality in our

business, the expected acceleration in revenues on the back of a

buoyant order book, and the full impact of our cautious approach to

operating costs in the first half will lead to a significant

improvement in our operating margin, net profit and cash generation

in the second half of the year.

All these factors mean that, against a backdrop

of global uncertainty, we are maintaining our guidance for 2023,

with organic growth of around 5% and an operating margin of around

13%. This is based in particular on our belief that business will

rebound in the United States in the second half of the year.

Against that, the euro’s currency appreciation

against many other currencies, if it continues as it did at the

start of the year, could have a downward effect on the Group’s

consolidated revenues.

* * *Presentation of the 2023 half-year

results: Wednesday July 26 at 8:30 am at

Ipsos headquarters, then at 4 pm a conference call

in English. For invitation requests, please contact

IpsosCommunications@Ipsos.comThe event will be broadcast on our

website in French and English.

ABOUT IPSOS

Ipsos is one of the largest market research companies in the

world, present in 90 markets and employing nearly than 20,000

people.

Our passionately curious research professionals, analysts and

scientists have built unique multi-specialist capabilities that

provide true understanding and powerful insights into the actions,

opinions and motivations of citizens, consumers, patients,

customers or employees. Our 75 solutions are based on primary data

from our surveys, social media monitoring, and qualitative or

observational techniques.

"Game Changers" – our tagline – summarizes our ambition to help

our 5,000 clients navigate with confidence our world of rapid

change.

Founded in France in 1975, Ipsos has been listed on the Euronext

Paris since July 1, 1999. The company is part of the SBF 120 and

Mid-60 indices and is eligible for the Deferred Settlement Service

(SRD).ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP

www.ipsos.com

NotesConsolidated

income statement, Interim financial statements at June 30,

2023

|

In thousands of Euros |

30/06/2023 |

30/06/2022 |

31/12/2022 |

|

Revenue |

1,087,127 |

1,121,724 |

2,405,310 |

|

Direct costs |

(351,004) |

(382,060) |

(811,236) |

|

Gross margin |

736,124 |

739,664 |

1,594,074 |

|

Employee benefit expenses – excluding share-based payments |

(515,526) |

(503,320) |

(1,041,565) |

| Employee benefit

expenses - share-based payments * |

(8,521) |

(6,874) |

(14,355) |

| General operating

expenses |

(108,097) |

(100,963) |

(214,875) |

|

Other operating income and expenses |

(9,718) |

(1,747) |

(8,582) |

|

Operating margin |

94,262 |

126,759 |

314,697 |

|

Amortization of intangible assets identified on acquisitions * |

(3,173) |

(4,018) |

(7,414) |

| Other

non-operating income and expenses* |

(923) |

856 |

3,723 |

|

Share of profit/(loss) of associates |

(274) |

99 |

(862) |

|

Operating profit |

89,892 |

123,697 |

310,145 |

|

Finance costs |

(6,588) |

(6,195) |

(13,214) |

|

Other financial income and expenses * |

(2,357) |

(959) |

(3,545) |

|

Net profit before tax |

80,948 |

116,542 |

293,386 |

|

Income tax – excluding deferred tax on goodwill amortization |

(19,476) |

(27,265) |

(70,556) |

|

Deferred tax on goodwill amortization* |

(1,392) |

(2,197) |

(2,249) |

|

Income tax |

(20,868) |

(29,462) |

(72,805) |

|

Net profit |

60,080 |

87,080 |

220,581 |

|

Attributable to the owners of the parent |

56,351 |

85,489 |

215,160 |

|

Attributable to non-controlling interests |

3,729 |

1,590 |

5,421 |

|

Basic net profit per share attributable to the owners of the parent

(in euros) |

1,29 |

1.93 |

4,87 |

|

Diluted net profit per share attributable to the owners of the

parent (in euros) |

1,26 |

1.88 |

4,74 |

| Adjusted

earnings * |

73,823 |

99,077 |

240 341 |

|

Attributable to the owners of the parent |

70,089 |

97,518 |

232 394 |

|

Attributable to non-controlling interests |

3,734 |

1,558 |

7 946 |

| Adjusted basic

earnings per share, attributable to the owners of the parent |

1,60 |

2.20 |

5,26 |

| Adjusted diluted

earnings per share, attributable to the owners of the parent |

1,57 |

2.15 |

5,12 |

* Adjusted for non-cash items related to IFRS 2

(share-based compensation), amortization of intangible assets

identified on acquisitions (customer relations), deferred tax

liabilities related to goodwill for which amortization is

deductible in some countries, the impact net of tax of other

non-operating income and expenses and the non-cash impact of

changes in puts in other financial income and expenses.

Statement of financial

position, Interim financial statements at June 30,

2023

|

In thousands of Euros |

30/06/2023 |

30/06/2022 |

31/12/2022 |

|

ASSETS |

|

|

|

| Goodwill |

1,356,185 |

1,420,712 |

1,370,637 |

| Right-of-use

assets |

108,995 |

134,702 |

118,383 |

| Other intangible

assets |

110,037 |

113,145 |

110,083 |

| Property, plant

and equipment |

32,765 |

34,211 |

33,512 |

| Investments in

associates |

6,509 |

7,732 |

6,048 |

| Other non-current

financial assets |

55,820 |

54,857 |

59,703 |

| Deferred tax

assets |

6,721 |

24,100 |

24,788 |

|

Non-current assets |

1,677,032 |

1,789,460 |

1,723,155 |

| Trade

receivables |

381,283 |

402,949 |

547,167 |

| Contract

assets |

174,107 |

195,388 |

115,872 |

| Current tax |

30,601 |

36,618 |

12,736 |

| Other current

assets |

73,500 |

66,736 |

66,522 |

| Financial

derivatives |

- |

- |

- |

| Cash and cash

equivalents |

300,781 |

338,289 |

385,670 |

|

Current assets |

960,270 |

1,039,980 |

1,127,967 |

|

TOTAL ASSETS |

2,637,303 |

2,829,440 |

2,851,122 |

|

|

|

|

|

|

in thousands of Euros |

30/06/2023 |

June 30, 2022 |

31/12/2022 |

| EQUITY

AND LIABILITIES |

|

|

|

| Share

capital |

11,063 |

11,109 |

11,063 |

| Share paid-in

capital |

495,628 |

507,588 |

495,628 |

| Treasury

shares |

(28,468) |

(794) |

(548) |

| Translation

adjustments |

(148,212) |

(43,895) |

(107,392) |

| Other

reserves |

972,387 |

862,517 |

867,211 |

| Net profit

attributable to the owners of the parent |

56,351 |

85,393 |

215,160 |

|

Equity, attributable to the owners of the

parent |

1,358,749 |

1,421,918 |

1,481,121 |

| Non-controlling

interests |

(248) |

18,515 |

18,808 |

|

Equity |

1,358,501 |

1,440,433 |

1,499,929 |

| Borrowings and

other non-current financial liabilities |

375,104 |

454,784 |

375,256 |

| Non-current

liabilities on leases |

86,726 |

112,472 |

95,625 |

| Non-current

provisions |

4,506 |

8,430 |

4,726 |

| Provisions for

post-employment benefit obligations |

36,065 |

34,394 |

35,938 |

| Deferred tax

liabilities |

70,891 |

94,858 |

72,831 |

| Other non-current

liabilities |

73,560 |

52,574 |

38,011 |

|

Non-current liabilities |

646,851 |

757,512 |

622,387 |

| Trade

payables |

278,976 |

295,921 |

349,970 |

| Borrowings and

other current financial liabilities |

54,497 |

37,051 |

79,541 |

| Current

liabilities on leases |

35,660 |

36,098 |

36,574 |

| Current tax |

14,054 |

7,626 |

23,855 |

| Current

provisions |

6,224 |

10,049 |

9,617 |

| Contract

liabilities |

42,358 |

45,817 |

51,716 |

| Other current

liabilities |

200,181 |

198,932 |

177,533 |

|

Current liabilities |

631,950 |

631,495 |

728,806 |

|

TOTAL LIABILITIES |

2,637,303 |

2,829,440 |

2,851,122 |

Consolidated statement of cash

flows, Interim financial statements at June 30, 2023

|

In thousands of Euros |

30/06/2023 |

30/06/2022 |

31/12/2022 |

|

OPERATING ACTIVITIES |

|

|

|

| NET

PROFIT |

60,080 |

87,080 |

220,581 |

| Items with no

impact on cash flow from operations |

|

|

|

| Amortization

and depreciation of property, plant and equipment and intangible

assets |

43,067 |

43,121 |

88,192 |

| Net profit of

equity-accounted companies, net of dividends received |

274 |

(99) |

862 |

| Losses/(gains)

on asset disposals |

11 |

45 |

187 |

| Net change in

provisions |

(1,593) |

(1,796) |

(6 ,623) |

| Share-based

payment expense |

7,336 |

6,018 |

13,116 |

| Other non-cash

income/(expenses) |

(2,039) |

(687) |

(4,989) |

| Acquisition

costs of consolidated companies |

510 |

227 |

498 |

| Finance

costs |

8,449 |

8,178 |

17,293 |

|

Tax expense |

20,868 |

29,462 |

72,805 |

|

CASH FLOW FROM OPERATIONS BEFORE TAX AND FINANCE COSTS |

136,963 |

171,549 |

401,923 |

| Change in

working capital requirement |

(28,347) |

(22,419) |

(14,364) |

| Income tax

paid |

(34,123) |

(44,961) |

(62,511) |

|

NET CASH FROM OPERATING ACTIVITIES |

74,493 |

104,168 |

325,047 |

| INVESTING

ACTIVITIES |

|

|

|

| Acquisitions

of property, plant and equipment and intangible assets |

(26,533) |

(27,420) |

(54,824) |

| Proceeds from

disposals of property, plant and equipment and intangible

assets |

29 |

35 |

594 |

|

(Increase)/decrease in financial assets |

(2,270) |

(1,658) |

(3,114) |

|

Acquisitions of consolidated activities and companies, net of

acquired cash |

(5,467) |

(2,271) |

(7,284) |

|

CASH FLOW FROM INVESTING ACTIVITIES |

(34,241) |

(31,314) |

(64,627) |

|

FINANCING ACTIVITIES |

|

|

|

| Share capital

increases/(reductions) |

- |

- |

(46) |

| Net

(purchases)/ sales of treasury shares |

(63,637) |

(16,847) |

(29,898) |

| Increase in

long-term borrowings |

22 |

4 |

(985) |

| Decrease in

long-term borrowings |

(29,635) |

(41) |

(30,086) |

| Decrease in

long-term loans from associates |

- |

- |

- |

|

Increase/(decrease) in bank overdrafts |

50 |

302 |

(763) |

| Net repayment

of lease liabilities |

(18,471) |

(18,649) |

(37,480) |

| Net interest

paid |

(1,684) |

(1,199) |

(12,606) |

| Net interest

paid on lease liabilities |

(1,901) |

(1,958) |

(4,081) |

| Acquisitions

of non-controlling interests |

(622) |

(723) |

(2,222) |

| Dividends paid

to the owners of the parent |

- |

- |

(51,066) |

| Dividends paid

to non-controlling interests in consolidated companies |

- |

- |

(1,409) |

| Dividends

received from non-consolidated companies |

- |

- |

- |

|

CASH FLOW FROM FINANCING ACTIVITIES |

(115,879) |

(39,113) |

(170,642) |

|

NET CHANGE IN CASH AND CASH EQUIVALENTS |

(75,627) |

33,742 |

89,778 |

| Impact of

foreign exchange rate movements |

(9,262) |

6,098 |

(2,562) |

|

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE

PERIOD |

385,670 |

298,454 |

298,454 |

|

CASH AND CASH EQUIVALENTS AT THE END OF THE

PERIOD |

300,781 |

338,289 |

385,670 |

- Ipsos - Communiqué de presse - Résultats Semestriels 2023 -

250723_FINAL_ENG

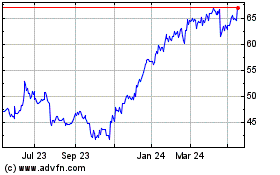

Ipsos (EU:IPS)

Historical Stock Chart

From Dec 2024 to Jan 2025

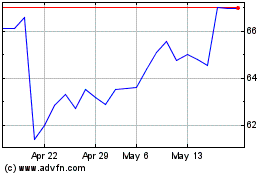

Ipsos (EU:IPS)

Historical Stock Chart

From Jan 2024 to Jan 2025