Ipsos launches a voluntary public

takeover offer for infas to acquire the industry leader in German

public sector research

Paris, Hamburg, 23 August 2024

- Ipsos, one of the world’s leading market research companies, has

launched a voluntary public takeover offer for infas Holding AG, an

important player in the field of market, opinion and social

research in Germany.

Based in Bonn, the infas group has more than 300

employees and generated around €50 million in revenue in 2023.

Infas is listed on the Frankfurt Stock Exchange. Its main

shareholders, representing about 77.52% of the ownership structure,

have already given their support to the acquisition.

Infas conducts research for companies, public

bodies and political parties. The group’s range of services

includes customised national and international studies, e.g. labour

market, education and transport research.

With almost 20,000 employees, a strong global

presence in 90 countries and over 5,000 clients worldwide, Ipsos is

one of the largest market research companies in the world. It

provides a vast pool of respondents from diverse markets, ensuring

comprehensive coverage of client needs to deliver reliable

information for a true understanding of Society, Markets and

People. In Germany, Ipsos has over 500 employees at five locations:

Hamburg, Berlin, Munich, Frankfurt and Nuremberg.

This acquisition will allow Ipsos to combine its

global reach and wide expertise with infas’s German legacy,

know-how and reputation. The infas location in Bonn will be added

to the Ipsos network. The combined structure will represent more

than 800 people and will offer its clients an even broader range of

innovative research services under the name Ipsos infas in

Germany.

Ben Page, CEO of Ipsos,

commented: “The new combined entity will be one of the

largest players in Germany, which is a key strategic growth market

for Ipsos, and will benefit from enhanced expertise, expanded

customer reach, and significant synergies. This transaction aligns

perfectly with our 2025 strategic objectives, particularly our

commitment to strengthen our leadership position in serving

governments and public sector clients. Both Ipsos and infas share a

client-centric approach and a dedication to innovation, ensuring a

strong cultural fit and a seamless integration. We are confident

this acquisition will create substantial value for the

shareholders.”

Menno Smid, CEO of

infas, does also see the

potential in a possible acquisition: “If

this transaction with Ipsos were successful, it would be a logical

evolution for infas. Both companies have built their reputations on

their commitment to customer focus, methodologically rigorous

research, and delivering insights that have a real-world impact.

This merger would allow us to amplify these strengths on a European

and global scale and leverage the combined expertise of both teams

to shape the future of market, opinion and social research. We

would be excited to bring the power of both brands to the market,

offering our clients an unparalleled level of service and insight

and offering new opportunities to our employees.”

Voluntary Public Cash Takeover

Offer

Alsterhöhe 15. V V AG (in future: Ipsos DACH

Holding AG), an Ipsos group company, has decided to launch a

voluntary public cash takeover offer for all infas shares. The

price of the public takeover offer will be € 6.80 per share.

This reflects a valuation of infas of € 61.2 million.

The final terms and conditions of the takeover

offer will be included in the offer document which must be approved

by the German Financial Supervisory Authority (BaFin). The offer

document and all further information on the takeover offer will be

available on the following website:

www.2024-offer.com

Timing and approvals

The Takeover Offer and the timetable remain subject to clearance

under applicable merger control regimes. The transaction is

expected to close by the end of 2024.

DISCLAIMER

This press release, from which no legal

consequences may be drawn, is for information purposes only. No

legal consequences of whatsoever kind shall result from this press

release. The release, publication or distribution of this press

release in certain countries may be subject to legal or regulatory

restrictions. Therefore, persons located in jurisdictions where

this press release is released, published or distributed must

inform themselves about such restrictions and comply with them.

Ipsos does not accept any responsibility for any violation of such

restrictions.

This press release contains forward-looking

statements with respect to Ipsos’s financial condition (including

taking into account the acquisition of infas Holding AG), results

of operations, business, strategy and plans. These may prove to be

inaccurate in the future and are subject to a number of risk

factors. Ipsos and its affiliates expressly disclaim any obligation

or undertaking to disseminate updates or revisions to any

forward-looking statements contained herein to reflect any change

in the expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based.

Ipsos will not accept any responsibility for any financial

information contained in this press release relating to the

business or operations or results or financial condition of infas

Holding AG and its Group.

ABOUT IPSOS

Ipsos is one of the largest market research and

polling companies globally, operating in 90 markets and

employing nearly 20,000 people.

Our passionately curious research professionals,

analysts and scientists have built unique multi-specialist

capabilities that provide true understanding and powerful insights

into the actions, opinions and motivations of citizens, consumers,

patients, customers or employees. Our 75 business solutions are

based on primary data from our surveys, social media monitoring,

and qualitative or observational techniques.

“Game Changers” – our tagline – summarizes our

ambition to help our 5,000 clients navigate with confidence our

rapidly changing world.

Founded in France in 1975, Ipsos has been listed

on the Euronext Paris since July 1, 1999. The company is part of

the SBF 120, Mid-60 indices, STOXX Europe 600 and is eligible for

the Deferred Settlement Service (SRD).ISIN code FR0000073298,

Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com

35 rue du Val de Marne75 628 Paris, Cedex 13

FranceTel. +33 1 41 98 90 00

- Press_release_Ipsos-infas_EN_FINAL

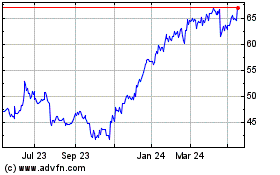

Ipsos (EU:IPS)

Historical Stock Chart

From Feb 2025 to Mar 2025

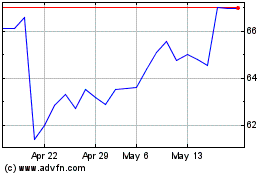

Ipsos (EU:IPS)

Historical Stock Chart

From Mar 2024 to Mar 2025