Excellent commercial trends and solid

operational performance

Organic growth of +4.0% over nine

months

2024 objectives confirmed

Regulatory News:

Vincent Ravat, Mercialys’ (Paris:MERY) Chief Executive Officer:

“While 2024 has seen a significant slowdown in inflation, there is

still a clear perception of purchasing power pressures among

consumers. Mercialys, the leading REIT for accessible retail,

responds to these concerns through its retail mix that is focused

on recurrent purchases covering customers’ essential needs. The

relevance of this positioning is reflected in the strong

outperformance in terms of both site footfall indicators (+130bp)

and the sales recorded by retailers at Mercialys sites (+110bp)

compared with the national indexes. The Company achieved robust

organic growth of +4.0% at end-September 2024 and is able to

confirm its objectives for 2024: growth in net recurrent earnings

(NRE) per share to reach at least +2% and a dividend to range from

75% to 95% of 2024 NRE”.

I. Organic growth in invoiced rents of

+4.0%

At end-September, invoiced rents totaled Euro 134.7

million, with an organic growth rate of +4.0%, while growth

on a current basis came to +1.9%, primarily factoring in the four

hypermarkets sold in July 2024.

(In thousands of euros)

Year to end- September

2023

Year to end- September

2024

Change

Current basis (%)

Change

Like-for-like basis

(%)

Invoiced rents

132,183

134,728

+1.9%

+4.0%

Lease rights

395

270

-31.7%

Rental revenues

132,578

134,998

+1.8%

The organic growth in invoiced rents takes into account the

following factors:

- Positive indexation, which came to

+4.2 points over nine months, reflecting the increase in the

commercial rent index (ILC) observed in 2023 and highlighting

Mercialys’ ability to apply the conditions from its leases, with a

constant focus on maintaining a sustainable occupancy cost ratio

for retailers (10.9% at end-June 2024, excluding large food

stores); - Positive contribution by Casual Leasing for +0.1

points, with a significantly more favorable trend than the first

half of 2024 (-0.2 points). This activity is already benefiting

from the significant increase in hypermarket footfall levels

following the takeover of stores by Auchan, Intermarché and

Carrefour at Mercialys sites during the second quarter of 2024; -

Impact of actions carried out on the portfolio for -0.8

points; - Increase in variable rents by +0.4 points,

reflecting the good level of business for tenants.

Invoiced rents also incorporate other effects, including the

strategic vacancies linked to current development programs

for -0.2 points. Lastly, the scope effects had a Euro -2.5

million impact, with -1.9 points on rental income at September 30,

2024, and they are linked primarily to the disposal, in July 2024,

of four hypermarkets that were 51% owned by Mercialys.

After factoring in the deferrals applicable under IFRS, lease

rights and despecialization indemnities received over the

period represent Euro 0.3 million, compared with Euro 0.4 million

at September 30, 2023.

In view of these elements, rental revenues came to Euro

135.0 million at September 30, 2024, up +1.8% from September 30,

2023.

II. Shopping centers performing very

well in terms of footfall and sales, supporting the rental

activity

For the year to end-June 20241, household consumption stabilized

(+0.3%) and purchasing power increased by +1.5%, in a context of

declining inflation (+1.2% at end-September 2024, with +0.5% for

food). However, consumers continue to be particularly sensitive to

prices in terms of their purchasing decisions, a dimension that

Mercialys’ positioning is built around, illustrated by the latest

openings across the Company’s portfolio.

For instance, the recent openings by the streetwear retailer

Snipes in the Toulouse Fenouillet shopping center, with over 500

sq.m, as well as Intersport in Marseille La Valentine, for over

2,000 sq.m, Normal in Annecy Seynod and an On Air fitness center at

Grenoble Caserne de Bonne have enjoyed great success with customers

and are contributing to the continued adaptation of Mercialys’

retail mix. Similarly, on the segment for accessible retail

incorporating an environmentally responsible dimension, Geev, a

leading circular economy and donations app, with a

subscription-based business model, opened its first Geev Shop in

the Toulouse Fenouillet shopping center in September 2024. This 300

sq.m concept store attracted more than 1,700 visitors and led to an

increase in the site’s footfall by over +15% on the day it opened.

The price repositioning of the hypermarkets anchoring Mercialys’

shopping centers after their operations were taken over by

Intermarché, Auchan and Carrefour between May and June 2024 is also

aligned with consumers’ needs and continued to drive a significant

increase in footfall overall across these stores during the third

quarter.

Illustrating this, footfall in Mercialys’ shopping

centers is up +2.5% at end-September 2024, compared with +1.2% for

the Quantaflow national index. The +130bp performance differential

highlights the relevance of the Company’s positioning on the

consumption segments boosted by their pricing accessibility. This

positive trend is reflected in the sales recorded by

Mercialys’ tenant retailers, up +2.4% at end-August 2024,

outperforming the FACT national panel’s +1.3% growth by +110bp.

Supported by the attractive positioning of the various sites in

their catchment areas, the level of lettings activity at

end-September saw 89 agreements signed for both renewals and

relettings. In a context of very sustained indexation, these leases

secured positive reversion of +0.4% (versus -0.2% at

end-June)2.

Alongside this, the hypermarket operations transition phase

continued moving forward during the third quarter.

On the one hand, on October 2, 2024, the Casino group indicated

that it had completed the disposal of its subsidiary operating its

activities in Corsica, with operations at the five Corsican

hypermarkets and supermarkets owned by Mercialys switching to the

Auchan banner and the stores reopening to the public from October

16.

On the other hand, the Casino group shut down operations at

several hypermarkets where operations were not sold as part of the

overall transactions that it entered into with Auchan, Intermarché

and Carrefour. At the Brest and Niort centers, this concerns two

hypermarkets that are 51% owned by Mercialys. The Casino group is

committed to operating and paying rent on these stores until the

corresponding leases expire at the end of June 2027. These leases

offered the retailer a three-year break during the first half of

2024, while this option was not exercised. The Casino group is

complying with its quarterly payment schedules, including the

fourth quarter of 2024. Operations at four hypermarkets that are

not owned by Mercialys, but that anchor small centers which it owns

(Brive, Aurillac, Valence and Chenove), were also shut down. The

operational and financial stakes for these centers are limited for

Mercialys, as they represent in total 1.0% of the Company’s net

rental income (including Casual Leasing rents and excluding

mid-size units whose flows are not significantly affected by the

large food stores), while Valence and Chenove are subject to

redevelopment projects, dependent on local consultations which are

currently underway. The Casino group’s sales of business operations

in 2023 and 2024 showed the value of spaces in this consumption

segment, making it possible to consider a takeover of operations at

these hypermarkets, including based on optimized spaces.

III. Financing structure further

strengthened

In September 2024, Mercialys successfully placed a Euro 300

million bond issue with a 7-year maturity and 4.0% coupon.

Alongside this, Mercialys exercised the option for the early

redemption of its bond maturing in July 2027, with a residual

nominal total of Euro 200 million and a 4.625% coupon. This

refinancing operation enabled Mercialys to extend the maturity of

its drawn debt from 3.3 years at end-June 2024 to 4.0 years at

end-September 2024, while optimizing its average cost of debt and

further strengthening the liquidity of its balance sheet.

The Company’s solid financial position, illustrated by its loan

to value ratio (LTV including transfer taxes) of 36.9% at end-June

2024, proforma for the sale of the four hypermarkets in July, will

be further strengthened over the second half of 2024 through the

disposal of several assets, which are not significant on the

Company’s scale (Montauban and Rodez centers and ancillary assets

at Millau and Paris Massena). These disposals once again illustrate

the Company’s commitment to realigning its portfolio around the

most dynamic assets in terms of value creation, as well as its

ability to find liquidity for its assets under financial conditions

that are in line with their valuation within the Company’s net

asset value.

Lastly, on October 24, 2024, Standard & Poor’s confirmed its

BBB / stable outlook rating for Mercialys.

IV. Full-year objectives confirmed

The performance levels at end-September enable Mercialys to

confirm its objectives for 2024, with:

- Growth in net recurrent earnings (NRE) per share to reach at

least +2.0% in 2024 vs. 2023;

- A dividend to range from 75% to 95% of 2024 net recurrent

earnings.

MERCIALYS RENTAL

REVENUES

2023

Mar 31, 2023

Jun 30, 2023

Sep 30, 2023

Dec 31, 2023

Q1

Q2

Q3

Q4

Invoiced rents

43,501

87,910

132,183

177,495

43,501

44,408

44,273

45,312

Lease rights

132

254

395

515

132

122

141

119

Rental revenues

43,633

88,164

132,578

178,010

43,633

44,531

44,414

45,431

Change in invoiced rents

+0.2%

+2.1%

+2.4%

+2.8%

+0.2%

+4.1%

+3.1%

+4.0%

Change in rental revenues

+0.1%

+2.0%

+2.3%

+2.7%

+0.1%

+3.9%

+3.0%

+3.9%

2024

Mar 31, 2024

Jun 30, 2024

Sep 30, 2024

Dec 31, 2024

Q1

Q2

Q3

Q4

Invoiced rents

45,463

91,385

134,728

45,463

45,922

43,343

Lease rights

82

175

270

82

93

95

Rental revenues

45,545

91,560

134,998

45,545

46,015

43,438

Change in invoiced rents

+4.5%

+4.0%

+1.9%

+4.5%

+3.4%

-2.1%

Change in rental revenues

+4.4%

+3.9%

+1.8%

+4.4%

+3.3%

-2.2%

* * *

This press release is available on

www.mercialys.com.

About Mercialys Mercialys is one of France’s leading real

estate companies. It is specialized in the holding, management and

transformation of retail spaces, anticipating consumer trends, on

its own behalf and for third parties. At June 30, 2024, Mercialys

had a real estate portfolio valued at Euro 2.9 billion (including

transfer taxes). Its portfolio of 1,955 leases represents an

annualized rental base of Euro 178.3 million. Mercialys has been

listed on the stock market since October 12, 2005 (ticker: MERY)

and has “SIIC” real estate investment trust (REIT) tax status. Part

of the SBF 120 and Euronext Paris Compartment B, it had 93,886,501

shares outstanding at June 30, 2024.

IMPORTANT INFORMATION This press release contains certain

forward-looking statements regarding future events, trends,

projects or targets. These forward-looking statements are subject

to identified and unidentified risks and uncertainties that could

cause actual results to differ materially from the results

anticipated in the forward-looking statements. Please refer to

Mercialys’ Universal Registration Document available at

www.mercialys.com for the year ended December 31, 2023 for more

details regarding certain factors, risks and uncertainties that

could affect Mercialys’ business. Mercialys makes no undertaking in

any form to publish updates or adjustments to these forward-looking

statements, nor to report new information, new future events or any

other circumstances that might cause these statements to be

revised.

1 INSEE 2 This reversion does not take into account the

reletting of a mid-size unit, previously leased to H&M, to

Intersport in Marseille La Valentine, with an impact of -2.3%. This

letting supported the strategic repositioning of this center, which

has already made significant progress, around the particularly

dynamic sports segment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024340481/en/

Analyst and investor Olivier Pouteau Tel: +33 (0)6 30 13

27 31 Email: opouteau@mercialys.com

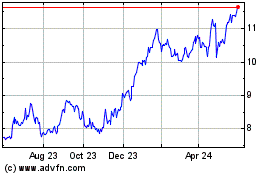

Mercialys (EU:MERY)

Historical Stock Chart

From Dec 2024 to Jan 2025

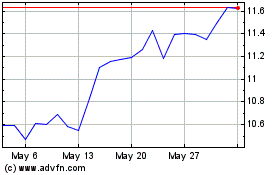

Mercialys (EU:MERY)

Historical Stock Chart

From Jan 2024 to Jan 2025