REGULATED INFORMATION

Nyxoah Reports

Third Quarter

Financial and Operating

ResultsFDA approval on track for first quarter

2025, U.S. commercial team build out in progressCompany fully

funded with cash until mid 2026

Mont-Saint-Guibert, Belgium –

November 6,

2024,

10:05pm

CET /

4:05pm

ET – Nyxoah SA

(Euronext Brussels/Nasdaq:

NYXH) (“Nyxoah” or the “Company”), a medical technology

company that develops breakthrough treatment alternatives for

Obstructive Sleep Apnea (OSA) through neuromodulation, today

reported financial and operating results for the third quarter of

2024.

Recent Financial

and Operating Highlights

- Presented compelling DREAM data

results at International Surgical Sleep Society in September.

- Raised €24.6 million through an ATM

program from a single U.S. healthcare-dedicated fund providing

incremental flexibility as we shift into U.S. commercialization and

extending cash runway until mid 2026.

- Strengthened U.S. organization with

the hiring of John Landry as Chief Financial Officer and the

addition of several key commercial leaders in the U.S.

- Reported third quarter sales of

€1.3 million, representing 30% growth versus third quarter

2023.

- Total cash

position of €71.0 million at the end of the quarter, €95.6 million

proforma including the €24.6 million raised.

“Our actions in the third quarter have further

positioned us well for a successful U.S. commercial launch. On the

back of the robust DREAM data presented in September, we have

raised additional capital and are actively focused on building up

our U.S. commercial team,” commented Olivier Taelman, Nyxoah’s

Chief Executive Officer. “I am more confident than ever that we

have set Genio up for a strong commercial start in the U.S.

immediately after FDA approval.”

Third Quarter

2024 Results

CONSOLIDATED STATEMENTS OF LOSS AND OTHER

COMPREHENSIVE

LOSS (unaudited)(in

thousands)

|

|

For the three months ended

September

30,

|

|

For the nine months

ended September 30,

|

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Revenue

|

1,266

|

|

976

|

|

3,258

|

|

2,524

|

|

Cost of goods sold

|

(482)

|

|

(336)

|

|

(1,217)

|

|

(930)

|

|

Gross profit

|

€ 784

|

|

€ 640

|

|

€ 2,041

|

|

€ 1,594

|

|

Research and Development Expense

|

(7,902)

|

|

(6,568)

|

|

(22,573)

|

|

(19,330)

|

|

Selling, General and Administrative Expense

|

(8,042)

|

|

(5 058)

|

|

(20,396)

|

|

(16,794)

|

|

Other income/(expense)

|

180

|

|

−

|

|

430

|

|

265

|

|

Operating loss for the period

|

€(14,980)

|

|

€(10,986)

|

|

€(40,498)

|

|

€(34,265)

|

|

Financial income

|

1,138

|

|

2,178

|

|

4,615

|

|

3,592

|

|

Financial expense

|

(3,043)

|

|

(1,033)

|

|

(5,480)

|

|

(2,765)

|

|

Loss for the period before taxes

|

€(16,885)

|

|

€(9,841)

|

|

€(41,363)

|

|

€(33,438)

|

|

Income taxes

|

(173)

|

|

2,229

|

|

(724)

|

|

1,119

|

|

Loss for the period

|

€(17,058)

|

|

€(7,612)

|

|

€(42,087)

|

|

€(32,319)

|

|

|

|

|

|

|

|

|

|

|

Loss attributable to equity holders

|

€(17,058)

|

|

€(7,612)

|

|

€(42,087)

|

|

€(32,319)

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income/(loss)

|

|

|

|

|

|

|

|

|

Items that may not be subsequently reclassified to

profit or loss (net of tax)

|

|

|

|

|

|

|

|

|

Currency translation differences

|

(209)

|

|

(10)

|

|

(221)

|

|

(88)

|

|

Total comprehensive loss for the year, net of

tax

|

€(17,267)

|

|

€ (7,622)

|

|

€(42,308)

|

|

€(32,407)

|

|

Loss attributable to equity holders

|

€(17,267)

|

|

€ (7,622)

|

|

€(42,308)

|

|

(32,407)

|

|

|

|

|

|

|

|

|

|

|

Basic loss per share (in EUR)

|

€(0.496)

|

|

€(0.266)

|

|

€(1.346)

|

|

€(1.166)

|

|

Diluted loss per share (in EUR)

|

€(0.496)

|

|

€(0.266)

|

|

€(1.346)

|

|

€(1.166)

|

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION (unaudited)

(in thousands)

|

|

|

|

As at

|

|

|

|

|

September

30,2024

|

|

December 31,

2023

|

|

ASSETS

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

Property, plant and equipment

|

|

|

4,461

|

|

4,188

|

|

Intangible assets

|

|

|

49,558

|

|

46,608

|

|

Right of use assets

|

|

|

3,635

|

|

3,788

|

|

Deferred tax asset

|

|

|

53

|

|

56

|

|

Other long-term receivables

|

|

|

1,475

|

|

1,166

|

|

|

|

|

€ 59,182

|

|

€ 55,806

|

|

Current assets

|

|

|

|

|

|

|

Inventory

|

|

|

5,272

|

|

3,315

|

|

Trade receivables

|

|

|

2,504

|

|

2,758

|

|

Other receivables

|

|

|

2,992

|

|

3,212

|

|

Other current assets

|

|

|

1,837

|

|

1,318

|

|

Financial assets

|

|

|

42,299

|

|

36,138

|

|

Cash and cash equivalents

|

|

|

28,678

|

|

21,610

|

|

|

|

|

€ 83,582

|

|

€ 68,351

|

|

Total assets

|

|

|

€ 142,764

|

|

€ 124,157

|

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES

|

|

|

|

|

|

|

Capital and reserves

|

|

|

|

|

|

|

Capital

|

|

|

5,908

|

|

4,926

|

|

Share premium

|

|

|

290,906

|

|

246,127

|

|

Share based payment reserve

|

|

|

8,943

|

|

7,661

|

|

Other comprehensive income

|

|

|

(84)

|

|

137

|

|

Retained loss

|

|

|

(200,966)

|

|

(160,829)

|

|

Total equity attributable to shareholders

|

|

|

104,707

|

|

€ 98,022

|

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

Financial debt

|

|

|

19,143

|

|

8,373

|

|

Lease liability

|

|

|

2,636

|

|

3,116

|

|

Pension liability

|

|

|

47

|

|

9

|

|

Provisions

|

|

|

398

|

|

185

|

|

Deferred tax liability

|

|

|

12

|

|

9

|

|

|

|

|

€22,236

|

|

€ 11,692

|

|

Current liabilities

|

|

|

|

|

|

|

Financial debt

|

|

|

399

|

|

364

|

|

Lease liability

|

|

|

1,151

|

|

851

|

|

Trade payables

|

|

|

7,109

|

|

8,108

|

|

Current tax liability

|

|

|

2,495

|

|

1,988

|

|

Other payables

|

|

|

4,667

|

|

3,132

|

|

|

|

|

€ 15,821

|

|

€ 14,443

|

|

Total liabilities

|

|

|

€ 38,057

|

|

€ 26,135

|

|

Total equity and liabilities

|

|

|

€ 142,764

|

|

€ 124,157

|

RevenueRevenue was €1.3 million for the third

quarter ending September 30, 2024, compared to €1.0 million for the

third quarter ending September 30, 2023.

Cost of Goods Sold

Cost of goods sold was €482,000 for the three

months ending September 30, 2024, representing a gross profit of

€0.8 million, or gross margin of 62.0%. This compares to total cost

of goods sold of €336,000 in the third quarter of 2023, for a gross

profit of €0.6 million, or gross margin of 66.0%.

Research and DevelopmentFor the third quarter

ending September 30, 2024, research and development expenses were

€7.9 million, versus €6.6 million for the third quarter ending

September 30, 2023.

Operating LossTotal operating loss for the third

quarter ending September 30, 2024, was €15.0 million versus €11.0

million in the third quarter ending September 30, 2023. This

increase was primarily driven by expanded commercial activities,

higher R&D investments, and ongoing clinical activities.

Cash PositionAs of September

30, 2024, cash and financial assets totaled €71.0 million, compared

to €57.7 million on December 31, 2023. Total cash burn was

approximately €5.6 million per month during the third quarter

2024.

Third Quarter

2024Nyxoah’s financial report for the third quarter 2024,

including details of the consolidated results, are available on the

investor page of Nyxoah’s website

(https://investors.nyxoah.com/financials).

Conference call and webcast

presentation Company management will host a conference

call to discuss financial results on Wednesday, November 6, 2024,

beginning at 10:30pm CET / 4:30pm ET.

A webcast of the call will be accessible via the

Investor Relations page of the Nyxoah website or through this link:

Nyxoah's Q3 2024 earnings call webcast. For those not planning to

ask a question of management, the Company recommends listening via

the webcast.

If you plan to ask a question, please use the

following link: Nyxoah’s Q3 2024 earnings call. After registering,

an email will be sent, including dial-in details and a unique

conference call access code required to join the live call. To

ensure you are connected prior to the beginning of the call, the

Company suggests registering a minimum of 10 minutes before the

start of the call.

The archived webcast will be available for

replay shortly after the close of the call.

About NyxoahNyxoah is

reinventing sleep for the billion people that suffer from

obstructive sleep apnea (OSA). We are a medical technology company

that develops breakthrough treatment alternatives for OSA through

neuromodulation. Our first innovation is Genio®, a battery-free

hypoglossal neuromodulation device that is inserted through a

single incision under the chin and controlled by a wearable.

Through our commitment to innovation and clinical evidence, we have

shown best-in-class outcomes for reducing OSA burden.

Following the successful completion of the BLAST

OSA study, the Genio® system received its European CE Mark in 2019.

Nyxoah completed two successful IPOs: on Euronext Brussels in

September 2020 and NASDAQ in July 2021. Following the positive

outcomes of the BETTER SLEEP study, Nyxoah received CE mark

approval for the expansion of its therapeutic indications to

Complete Concentric Collapse (CCC) patients, currently

contraindicated in competitors’ therapy. Additionally, the Company

announced positive outcomes from the DREAM IDE pivotal study for

FDA and U.S. commercialization approval.

Caution – CE marked since 2019.

Investigational device in the United States. Limited by U.S.

federal law to investigational use in the United States.

FORWARD-LOOKING STATEMENTS

Certain statements, beliefs and opinions in this

press release are forward-looking, which reflect the Company's or,

as appropriate, the Company directors' or managements' current

expectations regarding the Genio® system; planned and ongoing

clinical studies of the Genio® system; the potential advantages of

the Genio® system; Nyxoah’s goals with respect to the development,

regulatory pathway and potential use of the Genio® system; the

utility of clinical data in potentially obtaining FDA approval of

the Genio® system; and reporting data from Nyxoah’s DREAM U.S.

pivotal trial; receipt of FDA approval; entrance to the U.S.

market; and the anticipated closing and use of the proceeds from

the offering. By their nature, forward-looking statements involve a

number of risks, uncertainties, assumptions and other factors that

could cause actual results or events to differ materially from

those expressed or implied by the forward-looking statements. These

risks, uncertainties, assumptions and factors could adversely

affect the outcome and financial effects of the plans and events

described herein. Additionally, these risks and uncertainties

include, but are not limited to, the risks and uncertainties set

forth in the “Risk Factors” section of the Company’s Annual Report

on Form 20-F for the year ended December 31, 2023, filed with the

Securities and Exchange Commission (“SEC”) on March 20, 2024,

and subsequent reports that the Company files with the SEC. A

multitude of factors including, but not limited to, changes in

demand, competition and technology, can cause actual events,

performance or results to differ significantly from any anticipated

development. Forward looking statements contained in this press

release regarding past trends or activities are not guarantees of

future performance and should not be taken as a representation that

such trends or activities will continue in the future. In addition,

even if actual results or developments are consistent with the

forward-looking statements contained in this press release, those

results or developments may not be indicative of results or

developments in future periods. No representations and warranties

are made as to the accuracy or fairness of such forward-looking

statements. As a result, the Company expressly disclaims any

obligation or undertaking to release any updates or revisions to

any forward-looking statements in this press release as a result of

any change in expectations or any change in events, conditions,

assumptions or circumstances on which these forward-looking

statements are based, except if specifically required to do so by

law or regulation. Neither the Company nor its advisers or

representatives nor any of its subsidiary undertakings or any such

person's officers or employees guarantees that the assumptions

underlying such forward-looking statements are free from errors nor

does either accept any responsibility for the future accuracy of

the forward-looking statements contained in this press release or

the actual occurrence of the forecasted developments. You should

not place undue reliance on forward-looking statements, which speak

only as of the date of this press release.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy the securities in the

offering, nor shall there be any sale of these securities in any

jurisdiction in which an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

Contacts:

NyxoahLoïc

MoreauIR@nyxoah.com

For MediaIn United StatesFINN

Partners – Glenn Silverglenn.silver@finnpartners.com

In Belgium/FranceBackstage Communication –

Gunther De Backergunther@backstagecom.be

In International/GermanyMC Services – Anne

Henneckenyxoah@mc-services.eu

- ENGLISH_Q3 2024 Earnings PR

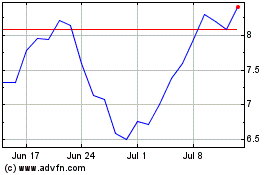

Nyxoah (EU:NYXH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nyxoah (EU:NYXH)

Historical Stock Chart

From Dec 2023 to Dec 2024