Hermès International: 2024 Half-year Results

Half-year information report as at the end of

June 2024

Robust sales and results in the first

half

Revenue amounted to €7.5 billion

(Revenue increased by 15% at constant rates and by 12% at current

rates)

Recurring operating income reached €3.1 billion (i.e. 42% of

sales)

Paris, 25 July 2024

The group’s consolidated revenue in the first

half of 2024 amounted to €7.5 billion, up 15% at constant exchange

rates and 12% at current exchange rates compared to the same period

in 2023. All the geographical areas recorded double-digit growth.

Recurring operating income was €3.1 billion (42% of sales) and net

profit (group share) reached €2.4 billion (32% of sales).

In the second quarter, sales reached €3.7

billion, up 13% at constant exchange rates. In a more challenging

context, all the regions continued to show remarkable momentum,

with the exception of Asia due to an inflection in traffic in

Greater China. This growth relies on the loyalty of our customers

all over the world.

Axel Dumas, Executive Chairman of Hermès, said:

“The solid first-half results, in a more complex economic and

geopolitical context, reflect the strength of Hermès’ model. The

group is confident in the future and is continuing to invest, to

pursue its vertical integration projects and to create new jobs,

while remaining true to its values.”

Sales by geographical area at the end of

June

(at constant exchange rates, unless otherwise

indicated)

At the end of June 2024, all the geographical

areas posted solid growth, despite a particularly high comparison

basis in the second quarter in Asia. The exclusive distribution

network continued to develop, with store openings and

expansions.

- Asia excluding Japan (+10%) posted

growth in all the countries of the region. As a reminder,

performance in the second quarter of 2023 was exceptional,

following the lifting of health measures in China. The house’s

value strategy supported activity, despite a downturn in traffic in

Greater China observed after the Chinese New Year in the first

quarter. In June, the Lee Gardens store in Hong Kong reopened after

expansion, after the reopening in May of the renovated Beijing SKP

store in China. In April, the Mumbai Jio World Plaza store opened

its doors, the house’s third address in India.

- Japan (+22%) continued its strong

growth, thanks to its local clients. A new store was inaugurated in

the Ginza district of Tokyo in June, following the Azabudai Hills

store in February.

- The Americas (+13%) confirmed their

sustained growth, thanks to the continued solid momentum in the

United States. A new store was inaugurated in Princeton, New

Jersey, in April. The second chapter of the women’s fall-winter

2024 collection was unveiled in June in New York with the

Manhattan Rocabar event.

- Sales in Europe excluding France

(+18%) and France (+15%) were particularly robust, thanks to the

loyalty of local customers and dynamic tourist flows. In France,

the Nantes store reopened in June after being renovated and

expanded.

Sales by sector at the end of

June

(at constant exchange rates, unless otherwise

indicated)

At the end of June 2024, the métiers showed

solid growth, despite a more complex context.

The Leather Goods and Saddlery métier (+19%)

posted a remarkable performance, thanks to the increase in

production capacities and particularly sustained demand. The

collections have been enriched with new formats, including the

Della Cavalleria Élan and the Kelly Mini clouté

models in particular. The travel universe unfolds around an

R.M.S. Cargo suitcase and weekend bags. The increase in

production capacities continues with the opening of the Riom

(Puy-de-Dôme) leather goods production site in September 2024 and

the laying of the first stone for two new leather goods production

sites: Isle-d'Espagnac (Charente) in April and Loupes (Gironde) in

May, which will open in 2025 and 2026 respectively. They will

reinforce the nine centres of expertise located across the national

territory. Hermès is developing employment and training and

continues to strengthen its anchoring in France.

The Ready-to-wear and Accessories sector (+15%)

pursued its strong momentum. The men’s spring-summer 2025 fashion

show held at Palais d’Iéna in June was very well received. The

shoes and fashion accessories displayed designs combining the

house’s extensive expertise with boundless creativity.

The Silk and Textiles sector (+1%) posted growth

despite a high comparison basis in the second quarter, thanks to

the diversity of creations, materials and formats in both the

women’s and men’s collections.

The Perfume and Beauty sector (+5%) continued

its development. The new creation Oud Alezan joined the

Hermessence collection in February, and the H24 men’s line

was enriched with Herbes Vives in April, two refillable

creations. In June, the Bain Hermès celebrated 10 years

with the renewal of the whole collection, Cologne and

Parfum-Jardin, around a sustainable range now made of glass.

The Watches métier was stable and successfully

unveiled at the Geneva Watches & Wonders exhibition

held in mid-April Hermès Cut, a new line with a sporty

spirit featuring a manufacture movement.

The Other Hermès sectors (+19%) which include

Jewellery and the Home universe, pursued their strong growth,

illustrating the singularity and creativity of the house, in

particular with the launch of the eighth Haute Bijouterie

collection Les formes de la couleur in June, at the Musée

des Arts Décoratifs in Paris. The Home universe collections,

presented at the Milan Design Week, were very well

received, highlighting the singularity of the exceptional

savoir-faire of the house.

Robust results in the first half of

2024

Recurring operating income increased by 7% to

€3.1 billion compared to €2.9 billion in the first half of 2023.

Despite the negative impact of currency hedging, recurring

operating profitability reached 42% compared to 44% at the end of

June 2023, an exceptionally high level.

Consolidated net profit group share amounted to

€2.4 billion compared to €2.2 billion in the first half of 2023,

representing a net profitability of 32% compared to 33% last

year.

The cash flow from operating activities amounted

to €2.2 billion and increased by 7%, at the same rate as the

operating income. After operational investments (€0.3 billion) and

repayment of lease liabilities, the adjusted free cash flow reached

€1.8 billion.

After distribution of the ordinary and

extraordinary dividend of €2.6 billion, the restated net cash

position amounted to €10 billion at the end of June 2024 compared

to €11.2 billion at the end of December 2023.

A sustainable and responsible

model

In line with its commitments as a responsible

employer, the Hermès group continued its creation of jobs and

increased its workforce by 1,205 people in the first half,

including close to 600 in France. At the end of June 2024, the

Group employed 23,242 people, including 14,320 in France. The House

paid in February a bonus of €4,000 to all its employees worldwide

in respect of 2023, consistent with its policy of sharing the

fruits of growth with all those who contribute to it on a daily

basis.

In line with its ambitions to promote diversity,

Hermès is pursuing its commitment to the inclusion of people with

disabilities: the direct employment rate reached 7.12% in France

since 2023, doubling in five years.

In July 2024, employees acquired the remaining

12 shares under the July 2019 free share plan. As a reminder, a new

free share plan for all employees was announced in June 2023.

Hermès continued to take concrete actions and initiatives in

response to climate change and is pursuing its work to preserve

natural resources. After identifying its priorities on its direct

operations and across the value chain, the group has launched the

third step of the Science Based Targets for Nature (SBTN)

process, to set scientific targets for nature, in particular for

biodiversity, fresh water, forests and soils.

The sustainable and responsible dimension of the

house’s artisanal model was rewarded in July with the “Grand Prix

toutes categories” Transparency Award, and by a 5-point improvement

in Moody’s ESG rating. These results bear witness to the

commitments and values of the house.

Other highlights

At the end of June 2024, currency fluctuations

represented a negative impact of €207 million on revenue.

Hermès International did not redeem any shares,

excluding transactions completed within the framework of the

liquidity contract.

As announced during the annual results, Hermès

became a majority shareholder in January alongside its partner in

the Middle East in the retail activities located in the United Arab

Emirates. As a reminder, the impact resulting from this acquisition

of a majority stake will not be significant on the 2024

consolidated financial statements.

Outlook

In a more complex economic and geopolitical

context, the group continues its development with confidence,

thanks to the highly integrated artisanal model, the balanced

distribution network, the creativity of collections and the loyalty

of clients.

In the medium-term, despite the economic,

geopolitical and monetary uncertainties around the world, the group

confirms an ambitious goal for revenue growth at constant exchange

rates.

Thanks to its unique business model, Hermès is

pursuing its long-term development strategy based on creativity,

maintaining control over know-how and singular communication.

In the Spirit of the Faubourg

is the theme of the year. This place, the fruit of Émile Hermès’

dream, is the beating heart of the house. It accompanies Hermès

everywhere and inspires the effervescence and joyful spirit so dear

to the house.

Limited review procedures have been carried

out on the condensed interim consolidated financial statements by

the Statutory Auditors in accordance with applicable

regulations.

The half-year financial report, the press

release and the presentation of the 2024 half-year results are

available on the group's website:

https://finance.hermes.com

Upcoming events:

- 24 October 2024: Q3 2024 revenue

publication

- 14 February 2025: 2024 full-year

results publication

- 17 April 2025: Q1 2025 revenue

publication

- 30 April 2025: General Meeting of

shareholders

FIRST HALF 2024 KEY

FIGURES

|

In millions of euros |

H1 2024 |

2023 |

H1 2023 |

| |

|

|

|

|

Revenue |

7,504 |

13,427 |

6,698 |

|

Growth at current exchange rates vs. n-1 |

12.0% |

15.7 % |

22.3% |

|

Growth at constant exchange rates vs. n-1

(1) |

15.1% |

20.6 % |

25.2% |

|

|

|

|

|

|

Recurring operating income (2) |

3,148 |

5,650 |

2,947 |

|

As a % of revenue |

42.0% |

42.1% |

44.0% |

|

|

|

|

|

|

Operating income |

3,148 |

5,650 |

2,947 |

|

As a % of revenue |

42.0% |

42.1% |

44.0% |

|

|

|

|

|

|

Net profit – Group share |

2,368 |

4,311 |

2,226 |

|

As a % of revenue |

31.6% |

32.1% |

33.2% |

|

|

|

|

|

|

Operating cash flows |

2,829 |

5,123 |

2,615 |

|

|

|

|

|

|

Operating investments |

319 |

859 |

249 |

|

|

|

|

|

|

Adjusted free cash flows (3) |

1,776 |

3,192 |

1,720 |

|

|

|

|

|

|

Equity – Group share |

15,052 |

15,201 |

13,249 |

|

|

|

|

|

|

Net cash position (4) |

9,477 |

10,625 |

9,326 |

|

|

|

|

|

|

Restated net cash position (5) |

10,033 |

11,164 |

9,848 |

|

|

|

|

|

|

Workforce (number of employees)

(6) |

23,242 |

22,037 |

20,607 |

(1) Growth at

constant exchange rates is calculated by applying, for each

currency, the average exchange rates of the previous period to the

revenue for the period.

(2) Recurring

operating income is one of the main performance indicators

monitored by Group Management. It corresponds to operating income

excluding non‑recurring items having a significant impact that may

affect understanding of the Group’s economic performance.

(3) Adjusted

free cash flows are the sum of cash flows related to operating

activities, less operating investments and the repayment of lease

liabilities recognised in accordance with IFRS 16 (aggregates in

the consolidated statement of cash flows).

(4) Net

cash position includes cash and cash equivalents presented under

balance sheet assets, less bank overdrafts which appear under

short‑term borrowings and financial liabilities on the liabilities

side. Net cash position does not include lease liabilities

recognised in accordance with IFRS 16.

(5) The

restated net cash position corresponds to net cash plus cash

investments that do not meet the IFRS criteria for cash equivalents

due in particular to their original maturity of more than three

months, less borrowings and financial liabilities.

(6) The

headcount relates to employees on permanent contracts and those on

fixed-term contracts lasting more than 9 months.

REVENUE BY GEOGRAPHICAL

AREA

(a)

|

|

|

First half |

Evolution /2023 |

| In

millions of Euros |

|

2024 |

2023 |

Published |

At constant exchange rates |

| France |

|

680 |

593 |

14.7% |

14.7% |

| Europe (excl.

France) |

|

970 |

836 |

16.1% |

17.7% |

|

Total Europe |

|

1,651 |

1,428 |

15.6% |

16.4% |

| Japan |

|

693 |

636 |

9.0% |

22.4% |

| Asia-Pacific

(excl. Japan) |

|

3,521 |

3,297 |

6.8% |

9.9% |

|

Total Asia |

|

4,213 |

3,932 |

7.1% |

11.9% |

| Americas |

|

1,329 |

1,185 |

12.1% |

12.6% |

| Other (Middle

East) |

|

311 |

151 |

105.4% |

105.3% |

|

TOTAL |

|

7,504 |

6,698 |

12.0% |

15.1% |

|

|

|

2nd

quarter |

Evolution /2023 |

| In

millions of Euros |

|

2024 |

2023 |

Published |

At constant exchange rates |

| France |

|

368 |

320 |

15.1% |

15.1% |

| Europe (excl.

France) |

|

526 |

444 |

18.4% |

20.5% |

|

Total Europe |

|

894 |

764 |

17.0% |

18.2% |

| Japan |

|

336 |

314 |

7.0% |

19.5% |

| Asia-Pacific

(excl. Japan) |

|

1,601 |

1,534 |

4.4% |

5.5% |

|

Total Asia |

|

1,937 |

1,848 |

4.8% |

7.9% |

| Americas |

|

715 |

629 |

13.7% |

13.3% |

| Other (Middle

East) |

|

153 |

77 |

100.0% |

99.4% |

|

TOTAL |

|

3,699 |

3,317 |

11.5% |

13.3% |

(a) Sales by destination.

REVENUE BY SECTOR

|

|

|

First half |

Evolution /2023 |

| In

millions of Euros |

|

2024 |

2023 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

3,215 |

2,780 |

15.7% |

19.1% |

| Ready-to-wear

and Accessories (2) |

|

2,162 |

1,922 |

12.5% |

15.5% |

| Silk and

Textiles |

|

436 |

444 |

(1.7)% |

1.5% |

| Other Hermès

sectors (3) |

|

967 |

836 |

15.7% |

18.7% |

| Perfume and

Beauty |

|

259 |

249 |

3.9% |

4.9% |

| Watches |

|

308 |

317 |

(2.9)% |

(0.2)% |

| Other products

(4) |

|

157 |

150 |

4.9% |

6.6% |

|

TOTAL |

|

7,504 |

6,698 |

12.0% |

15.1% |

|

|

|

2nd

quarter |

Evolution /2023 |

| In

millions of Euros |

|

2024 |

2023 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

1,587 |

1,371 |

15.8% |

17.9% |

| Ready-to-wear

and Accessories (2) |

|

1,101 |

972 |

13.3% |

15.1% |

| Silk and

Textiles |

|

194 |

209 |

(7.3)% |

(5.6)% |

| Other Hermès

sectors (3) |

|

462 |

415 |

11.3% |

13.0% |

| Perfume and

Beauty |

|

129 |

123 |

4.8% |

5.6% |

| Watches |

|

142 |

152 |

(6.2)% |

(4.9)% |

| Other products

(4) |

|

83 |

75 |

10.6% |

11.8% |

|

TOTAL |

|

3,699 |

3,317 |

11.5% |

13.3% |

(1) The “Leather Goods and Saddlery”

business line includes women's and men's bags, travel items, small

leather goods and accessories, saddles, bridles and all equestrian

objects and clothing.

(2) The “Ready-to-wear and Accessories” business line

includes Hermès Ready-to-wear for men and women, belts, costume

jewellery, gloves, hats and shoes.

(3) The “Other Hermès business lines” include Jewellery

and Hermès home products (Art of Living and Hermès Tableware).

(4) The “Other products” include the production

activities carried out on behalf of non-group brands (textile

printing, tanning…), as well as John Lobb, Saint-Louis and

Puiforcat.

REMINDER –

1ST

QUARTER 2024

REVENUE BY GEOGRAPHICAL ZONE

(a)

|

|

|

1st

quarter |

Evolution /2023 |

| In

millions of Euros |

|

2024 |

2023 |

Published |

At constant exchange rates |

| France |

|

312 |

273 |

14.3% |

14.3% |

| Europe (excl.

France) |

|

444 |

391 |

13.5% |

14.6% |

|

Total Europe |

|

757 |

664 |

13.9% |

14.5% |

| Japan |

|

357 |

322 |

10.8% |

25.2% |

| Asia-Pacific

(excl. Japan) |

|

1,920 |

1,763 |

8.9% |

13.9% |

|

Total Asia |

|

2,277 |

2,084 |

9.2% |

15.7% |

| Americas |

|

614 |

556 |

10.3% |

11.8% |

| Other (Middle

East) |

|

158 |

75 |

111.0% |

112.6% |

|

TOTAL |

|

3,805 |

3,380 |

12.6% |

17.0% |

(a) Sales by destination.

REVENUE BY SECTOR

|

|

|

1st

quarter |

Evolution /2023 |

| In

millions of Euros |

|

2024 |

2023 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

1,628 |

1,409 |

15.5% |

20.3% |

| Ready-to-wear

and Accessories (2) |

|

1,061 |

950 |

11.7% |

15.9% |

| Silk and

Textiles |

|

242 |

234 |

3.4% |

7.9% |

| Other Hermès

sectors (3) |

|

505 |

421 |

20.0% |

24.5% |

| Perfume and

Beauty |

|

130 |

126 |

3.0% |

4.3% |

| Watches |

|

166 |

166 |

0.1% |

4.3% |

| Other products

(4) |

|

74 |

74 |

(0.8)% |

1.4% |

|

TOTAL |

|

3,805 |

3,380 |

12.6% |

17.0% |

(1) The “Leather Goods and Saddlery”

business line includes women's and men's bags, travel items, small

leather goods and accessories, saddles, bridles and all equestrian

objects and clothing.

(2) The “Ready-to-wear and Accessories” business line

includes Hermès Ready-to-wear for men and women, belts, costume

jewellery, gloves, hats and shoes.

(3) The “Other Hermès business lines” include Jewellery

and Hermès home products (Art of Living and Hermès Tableware).

(4) The “Other products” include the production

activities carried out on behalf of non-group brands (textile

printing, tanning…), as well as John Lobb, Saint-Louis and

Puiforcat.

APPENDIX – EXTRACT FROM FIRST HALF CONSOLIDATED

ACCOUNTS

CONSOLIDATED INCOME STATEMENT

|

In millions of euros |

H1 2024 |

H1 2023 |

|

Revenue |

7,504 |

6,698 |

|

Cost of sales |

(2,206) |

(1,863) |

|

Gross margin |

5,298 |

4,834 |

|

Sales and administrative expenses |

(1,682) |

(1,485) |

|

Other income and expenses |

(467) |

(403) |

|

Recurring operating income |

3,148 |

2,947 |

|

Other non-recurring income and expenses |

- |

- |

|

Operating income |

3,148 |

2,947 |

|

Net financial income |

141 |

75 |

|

Net income before tax |

3,289 |

3,021 |

|

Income tax |

(927) |

(831) |

|

Net income from associates |

16 |

43 |

|

CONSOLIDATED NET INCOME |

2,378 |

2,234 |

|

Non-controlling interests |

(10) |

(8) |

|

NET INCOME ATTRIBUTABLE TO OWNERS OF THE

PARENT |

2,368 |

2,226 |

|

Basic earnings per share (in euros) |

22.61 |

21.29 |

|

Diluted earnings per share (in euros) |

22.58 |

21.26 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

|

In millions of euros |

H1 2024 |

H1 2023 |

|

|

Consolidated net income |

2,378 |

2,234 |

|

|

Changes in foreign currency adjustments 1 |

42 |

(115) |

|

|

Hedges of future cash flows in foreign currencies 1

2 |

(17) |

72 |

|

|

|

34 |

123 |

|

- recycling through profit or

loss

|

(51) |

(51) |

|

|

Assets at fair value 2 |

30 |

- |

|

|

Employee benefit obligations: change in value linked to actuarial

gains and losses 2 |

(0) |

(1) |

|

|

Net comprehensive income |

2,433 |

2,189 |

|

- attributable to owners of the

parent

|

2,423 |

2,180 |

|

- attributable to non-controlling

interests

|

10 |

9 |

|

(1) Transferable through profit or loss.

(2) Net of tax. |

CONSOLIDATED BALANCE SHEET

ASSETS

|

In millions of euros |

30/06/2024 |

31/12/2023 |

|

Goodwill |

241 |

72 |

|

Intangible assets |

228 |

225 |

|

Right-of-use assets |

1,821 |

1,716 |

|

Property, plant and equipment |

2,455 |

2,340 |

|

Investment property |

7 |

7 |

|

Financial assets |

1,205 |

1,141 |

|

Investments in associates |

211 |

200 |

|

Loans and deposits |

83 |

70 |

|

Deferred tax assets |

750 |

631 |

|

Other non-current assets |

45 |

37 |

|

Non-current assets |

7,046 |

6,438 |

|

Inventories and work-in-progress |

2,780 |

2,414 |

|

Trade and other receivables |

535 |

431 |

|

Current tax receivables |

52 |

51 |

|

Other current assets |

418 |

300 |

|

Financial derivatives |

199 |

188 |

|

Cash and cash equivalents |

9,478 |

10,625 |

|

Current assets |

13,462 |

14,008 |

|

TOTAL ASSETS |

20,507 |

20,447 |

LIABILITIES

|

In millions of euros |

30/06/2024 |

31/12/2023 |

|

Share capital |

54 |

54 |

|

Share premium |

50 |

50 |

|

Treasury shares |

(698) |

(698) |

|

Reserves |

12,482 |

10,744 |

|

Foreign currency adjustments |

231 |

189 |

|

Revaluation adjustments |

565 |

553 |

|

Net income attributable to owners of the parent |

2,368 |

4,311 |

|

Equity attributable to owners of the parent |

15,052 |

15,201 |

|

Non-controlling interests |

26 |

2 |

|

Equity |

15,078 |

15,203 |

|

Borrowings and financial liabilities due in more than one year |

49 |

50 |

|

Lease liabilities due in more than one year |

1,826 |

1,720 |

|

Non-current provisions |

33 |

31 |

|

Post-employment and other employee benefit obligations due in more

than one year |

159 |

151 |

|

Deferred tax liabilities |

3 |

2 |

|

Other non-current liabilities |

81 |

106 |

|

Non-current liabilities |

2,152 |

2,060 |

|

Borrowings and financial liabilities due in less than one year |

1 |

1 |

|

Lease liabilities due in less than one year |

305 |

289 |

|

Current provisions |

126 |

134 |

|

Post-employment and other employee benefit obligations due in less

than one year |

16 |

16 |

|

Trade and other payables |

798 |

880 |

|

Financial derivatives |

80 |

45 |

|

Current tax liabilities |

738 |

586 |

|

Other current liabilities |

1,213 |

1,233 |

|

Current liabilities |

3,277 |

3,183 |

|

TOTAL EQUITY AND LIABILITIES |

20,507 |

20,447 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

In millions of euros

|

Number of shares

|

Share capital

|

Share premium

|

Treasury shares

|

Consolidated reserves and net income attributable to owners

of the parent

|

Actuarial gains and losses

|

Foreign currency adjustments

|

Revaluation adjustments |

|

|

|

|

Financial investments |

Hedges of future cash flows in foreign

currencies |

Equity attributable to owners of the parent |

Non- controlling interests |

Equity |

|

As at 1 January 2023 |

105,569,412 |

54 |

50 |

(674) |

12,247 |

(85) |

303 |

521 |

25 |

12,440 |

16 |

12,457 |

|

Net income |

- |

- |

- |

- |

4,311 |

- |

- |

- |

- |

4,311 |

12 |

4,322 |

|

Other comprehensive income |

- |

- |

- |

- |

- |

10 |

(115) |

- |

7 |

(98) |

1 |

(97) |

|

Comprehensive income |

- |

- |

- |

- |

4,311 |

10 |

(115) |

- |

7 |

4,213 |

13 |

4,225 |

|

Change in share capital and share premiums |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase or sale of treasury shares |

- |

- |

- |

(24) |

(105) |

- |

- |

- |

- |

(129) |

- |

(129) |

|

Share-based payments |

- |

- |

- |

- |

104 |

- |

- |

- |

- |

104 |

- |

104 |

|

Dividends paid |

- |

- |

- |

- |

(1,376) |

- |

- |

- |

- |

(1,376) |

(10) |

(1,386) |

|

Other |

- |

- |

- |

- |

(51) |

- |

- |

- |

- |

(51) |

(17) |

(68) |

|

As at 31 December 2023 |

105,569,412 |

54 |

50 |

(698) |

15,130 |

(75) |

189 |

521 |

32 |

15,201 |

2 |

15,203 |

|

Net income for the first half of 2024 |

- |

- |

- |

- |

2,368 |

- |

- |

- |

- |

2,368 |

10 |

2,378 |

|

Other comprehensive income for the first half of 2024 |

- |

- |

- |

- |

- |

(0) |

42 |

30 |

(17) |

55 |

1 |

56 |

|

Comprehensive income for the first half of

2024 |

- |

- |

- |

- |

2,368 |

(0) |

42 |

30 |

(17) |

2,423 |

10 |

2,433 |

|

Change in share capital and share premiums |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase or sale of treasury shares |

- |

- |

- |

(0) |

0 |

- |

- |

- |

- |

0 |

- |

0 |

|

Share-based payments |

- |

- |

- |

- |

69 |

- |

- |

- |

- |

69 |

- |

69 |

|

Dividends paid |

- |

- |

- |

- |

(2,641) |

- |

- |

- |

- |

(2,641) |

(9) |

(2,650) |

|

Other |

- |

- |

- |

- |

(0) |

- |

- |

- |

- |

(0) |

23 |

22 |

|

AS AT 30 JUNE 2024 |

105,569,412 |

54 |

50 |

(698) |

14,925 |

(75) |

231 |

551 |

14 |

15,052 |

26 |

15,078 |

|

As at 1 January 2023 |

105,569,412 |

54 |

50 |

(674) |

12,247 |

(85) |

303 |

521 |

25 |

12,440 |

16 |

12,457 |

|

Net income for the first half of 2023 |

- |

- |

- |

- |

2,226 |

- |

- |

- |

- |

2,226 |

8 |

2,234 |

|

Other comprehensive income for the first half of 2023 |

- |

- |

- |

- |

- |

(1) |

(116) |

- |

72 |

(45) |

1 |

(45) |

|

Comprehensive income for the first half of

2023 |

- |

- |

- |

- |

2,226 |

(1) |

(116) |

- |

72 |

2,180 |

9 |

2,189 |

|

Change in share capital and share premiums |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase or sale of treasury shares |

- |

- |

- |

4 |

1 |

- |

- |

- |

- |

5 |

- |

5 |

|

Share-based payments |

- |

- |

- |

- |

30 |

- |

- |

- |

- |

30 |

- |

30 |

|

Dividends paid |

- |

- |

- |

- |

(1,376) |

- |

- |

- |

- |

(1,376) |

(8) |

(1,384) |

|

Other |

- |

- |

- |

- |

(31) |

- |

- |

- |

- |

(31) |

(22) |

(53) |

|

AS AT 30 JUNE 2023 |

105,569,412 |

54 |

50 |

(670) |

13,097 |

(86) |

188 |

521 |

96 |

13,249 |

(5) |

13,244 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

In millions of euros |

H1 2024 |

H1 2023 |

|

Net income attributable to owners of the parent |

2,368 |

2,226 |

|

Depreciation and amortisation of fixed assets, right-of-use assets

and impairment losses |

383 |

344 |

|

Foreign exchange gains/(losses) on fair value adjustments |

(19) |

62 |

|

Change in provisions |

2 |

26 |

|

Net income from associates |

(16) |

(43) |

|

Net income attributable to non-controlling interests |

10 |

8 |

|

Capital gains or losses on disposals and impact of changes in scope

of consolidation |

52 |

0 |

|

Deferred tax expense |

(5) |

(25) |

|

Accrued expenses and income related to share-based payments |

69 |

30 |

|

Dividend income |

(16) |

(12) |

|

Other |

(0) |

(0) |

|

Operating cash flows |

2,829 |

2,615 |

|

Change in working capital requirements |

(584) |

(509) |

|

CASH FLOWS RELATED TO OPERATING ACTIVITIES

(A) |

2,244 |

2,106 |

|

Operating investments |

(319) |

(249) |

|

Acquisitions of consolidated shares |

(218) |

(73) |

|

Acquisitions of other financial assets |

(28) |

(24) |

|

Disposals of operating assets |

0 |

0 |

|

Disposals of consolidated shares and impact of losses of

control |

- |

- |

|

Disposals of other financial assets |

- |

- |

|

Change in payables and receivables related to investing

activities |

(80) |

(12) |

|

Dividends received |

19 |

26 |

|

CASH FLOWS RELATED TO INVESTING ACTIVITIES

(B) |

(626) |

(333) |

|

Dividends paid |

(2,650) |

(1,384) |

|

Repayment of lease liabilities |

(149) |

(137) |

|

Treasury share buybacks net of disposals |

(0) |

4 |

|

Borrowing subscriptions |

- |

0 |

|

Repayment of borrowings |

(1) |

(0) |

|

Other equity transactions |

2 |

0 |

|

CASH FLOWS RELATED TO FINANCING ACTIVITIES

(C) |

(2,799) |

(1,517) |

|

Foreign currency translation adjustment (D) |

33 |

(153) |

|

CHANGE IN NET CASH POSITION (A) + (B) + (C) +

(D) |

(1,147) |

103 |

|

Net cash position at the beginning of the period |

10,625 |

9,223 |

|

Net cash position at the end of the period |

9,477 |

9,326 |

- hermes_20240725_pr_2024firsthalfresults_va

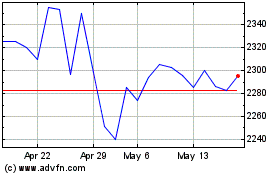

Hermes (EU:RMS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hermes (EU:RMS)

Historical Stock Chart

From Nov 2023 to Nov 2024