VGP Rights Offering: Start of Private Placement of Scrips –

Suspension of trading until publication of results of the Offering

PRESS RELEASE

REGULATED

INFORMATION –

INSIDE INFORMATION25 November

2022, Antwerp, Belgium – 10h30 a.m.

VGP rights offering (with non-statutory

preferential rights for existing shareholders) of a

maximum of 5,458,262

new shares,

amounting to a maximum of

EUR 302,933,541

94.43% of the New

Shares subscribed at closing of

the rights Subscription

Period for holders of

Preferential Rights

Start of Private Placement of Scrips on

25 November 2022

– Suspension of trading until publication of results of the

Offering1

An Investment in the New Shares involves

substantial risks and uncertainties. Prospective investors must be

able to bear the economic risk of an investment in the New Shares,

the Preferential Rights or the Scrips and should be able to sustain

a partial or total loss of their investment. Before making any

investment decision, the investors must read the prospectus,

approved by the FSMA on 15 November 2022 and available on the

website (www.vgpparks.eu), in its entirety (and, in particular, the

section on Risk factors starting on page 9). Investors should in

particular note that the Issuer’s solvability and liquidity depends

on the sustainability of its development activities, its ability to

execute new lease agreements and its sales cycles of completed

projects to the Second Joint Venture and the Fourth Joint Venture,

taking into account the postponement of the first closing with the

Fourth Joint Venture.

During the Subscription Period with Preferential

Rights, which closed on 24 November 2022 (16:00 CET), 5,153,976 New

Shares, or 94.43% of the maximum number of New Shares offered for

subscription, have been subscribed for at a subscription price of

EUR 55.50 per New Share, on the basis of 1 New Share for 4

Preferential Rights.

The 1,217,146 unexercised Preferential Rights

have automatically been converted into an equal number of Scrips.

These Scrips will be be sold in a private placement with qualified

investors in Belgium and by way of a private placement exempt from

prospectus requirements or similar formalities in such other

jurisdictions as will be determined by the Issuer in consultation

with the Global Coordinators. The Scrips Private Placement will be

conducted in reliance on Regulation S under the United States

Securities Act of 1933, as amended. The Scrips Private Placement

will be organised by way of an accelerated book-building procedure,

in order to determine a single market price per Scrip. The Private

Placement of Scrips will take place as from the publication of this

press release and is expected to end on the same day. Investors who

acquire Scrips enter into an irrevocable commitment to exercise the

Scrips and thus to subscribe for the corresponding number of New

Shares at the Issue Price and in accordance with the Ratio, i.e., 1

New Share (at EUR 55.50 per New Share) for 4 Preferential Rights in

the form of Scrips.

The net proceeds from the sale of Scrips

(rounded down to a whole eurocent per unexercised Preferential

Right) after deducting expenses, charges and all forms of

expenditure which the Issuer has to incur for the sale of the

Scrips (the “Net Scrips Proceeds”), if any, will be distributed

proportionally between all holders of unexercised Preferential

Rights and will be paid to the holders of such unexercised

Preferential Rights upon presentation of coupon n° 11, as from 30

November 2022. If the Net Scrips Proceeds are less than EUR 0.01

per unexercised Preferential Right, the holders of such unexercised

Preferential Rights are not entitled to receive any payment and,

instead, the Net Scrips Proceeds will be transferred to the

Issuer.

The results of the subscriptions for New Shares

resulting from the exercise of the Scrips and the Net Scrips

Proceeds due to the holders of unexercised Preferential Rights,

will be published in a press release on the Company’s website, in

principle later today, 25 November 2022.

The payment and delivery of the New Shares is

expected to be carried out with a value date as per 29 November

2022 and the subscribers’ account will be debited on the same date

(subject to the relevant financial intermediary procedures) (except

for subscriptions with Preferential Rights attached to registered

Existing Shares, for which the payment had to reach the Company by

24 November 2022 at 16:00 CET).

The New Shares will in principle be tradable on

the regulated market of Euronext Brussels as from 29 November

2022.

The trading of the shares of the Company on the

regulated market of Euronext Brussels was, at the Company’s

request, suspended as from the opening of the markets earlier

today, 25 November 2022, until the publication of the press release

relating to the results of the Offering (after completion of the

Private Placement of Scrips).

Any decision to invest in securities in the

framework of the Offering must be based on all information provided

in the Prospectus, and any supplements thereto, as the case may be.

The approval of the Prospectus by the FSMA should not be understood

as an endorsement of the new shares offered.

*****

Belfius Bank NV in cooperation with Kepler

Cheuvreux S.A., BNP Paribas Fortis SA/NV, J.P. Morgan SE and KBC

Securities NV are actingas Joint Global Coordinators in this

transaction.

About VGP

VGP is a pan-European owner, manager and

developer of high-quality logistics and semi-industrial real

estate. VGP operates a fully integrated business model with

capabilities and longstanding expertise across the value chain.

Founded in 1998 as a Belgian family-owned real estate developer in

the Czech Republic, VGP with a staff of circa 380 FTEs today and

operates in 19 European countries directly and through several

50:50 joint ventures. As of June 2022, the Gross Asset Value of

VGP, including the joint ventures at 100%, amounted to EUR 6.53

billion. VGP is listed on Euronext Brussels. (ISIN:

BE0003878957).

For more information, please visit: http://www.vgpparks.eu

Contact details

for investors

and media

enquiries

Martijn Vlutters(VP – Business Development & Investor

Relations)

Tel: +32 (0)3 289 1433

IMPORTANT INFORMATION

THIS DOCUMENT IS BEING FURNISHED TO YOU SOLELY

FOR YOUR INFORMATION AND MAY NOT BE REPRODUCED OR REDISTRIBUTED, IN

WHOLE OR IN PART, TO ANY OTHER PERSON.

THIS DOCUMENT IS NOT AN OFFER TO SELL OR A

SOLICITATION OF AN OFFER TO BUY THE ORDINARY SHARES, OR RIGHTS IN

RESPECT THEREOF, OF VGP NV (THE "COMPANY", AND SUCH ORDINARY SHARES

AND RIGHTS TOGETHER, THE "SECURITIES"). ANY OFFER TO ACQUIRE

SECURITIES WILL BE MADE, AND ANY INVESTOR SHOULD MAKE HIS

INVESTMENT DECISION, SOLELY ON THE BASIS OF THE INFORMATION

CONTAINED IN THE PROSPECTUS TO BE MADE GENERALLY AVAILABLE IN

CONNECTION WITH THE PROPOSED OFFERING. WHEN MADE GENERALLY

AVAILABLE, COPIES OF THE PROSPECTUS MAY BE OBTAINED AT NO COST FROM

THE WEBSITE OF THE COMPANY. THIS DOCUMENT IS NOT A PROSPECTUS

WITHIN THE MEANING OF THE PROSPECTUS REGULATION IN RELATION TO THE

OFFERING.

THIS DOCUMENT DOES NOT CONSTITUTE OR FORM A PART

OF ANY OFFER OR SOLICITATION TO PURCHASE OR SUBSCRIBE FOR ANY

SECURITIES IN THE UNITED STATES. THE SECURITIES REFERRED TO HEREIN

HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES

ACT OF 1933, AS AMENDED FROM TIME TO TIME (THE "SECURITIES ACT"),

AND THE SECURITIES MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES

(AS DEFINED IN REGULATION S UNDER THE U.S. SECURITIES ACT) ABSENT

REGISTRATION OR AN EXEMPTION FROM REGISTRATION OR IN A TRANSACTION

NOT SUBJECT TO THE REGISTRATION REQUIREMENTS UNDER THE SECURITIES

ACT. THE COMPANY AND ITS AFFILIATES HAVE NOT REGISTERED, AND DO NOT

INTEND TO REGISTER, ANY PORTION OF THE OFFERING OF THE SECURITIES

CONCERNED IN THE UNITED STATES, AND DO NOT INTEND TO CONDUCT A

PUBLIC OFFERING OF SECURITIES IN THE UNITED STATES.

ANY OFFER OF SECURITIES TO WHICH THIS

ANNOUNCEMENT RELATES IS ONLY ADDRESSED TO AND DIRECTED AT PERSONS

IN MEMBER STATES OF THE EUROPEAN ECONOMIC AREA ("EEA"), OTHER THAN

BELGIUM, WHO ARE "QUALIFIED INVESTORS" WITHIN THE MEANING OF

ARTICLE 2(E) OF REGULATION 2017/1129 OF THE EUROPEAN PARLIAMENT AND

OF THE COUNCIL OF 14 JUNE 2017 ON THE PROSPECTUS TO BE PUBLISHED

WHEN SECURITIES ARE OFFERED TO THE PUBLIC OR ADMITTED TO TRADING ON

A REGULATED MARKET, AND REPEALING DIRECTIVE 2003/71/EC (THE

"PROSPECTUS REGULATION") ("QUALIFIED INVESTORS"), OR SUCH OTHER

INVESTORS AS SHALL NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE

MEANING OF ARTICLE 3.1 OF THE PROSPECTUS REGULATION.

NO ANNOUNCEMENT OR INFORMATION REGARDING THE

OFFERING, LISTING OR SECURITIES OF THE ISSUER REFERRED TO ABOVE MAY

BE DISSEMINATED TO THE PUBLIC IN JURISDICTIONS OTHER THAN BELGIUM

WHERE A PRIOR REGISTRATION OR APPROVAL IS REQUIRED FOR SUCH

PURPOSE. NO STEPS HAVE BEEN TAKEN, OR WILL BE TAKEN, FOR THE

OFFERING OR LISTING OF SECURITIES OF THE ISSUER IN ANY JURISDICTION

OUTSIDE OF BELGIUM WHERE SUCH STEPS WOULD BE REQUIRED. THE ISSUE,

EXERCISE OR SALE OF SECURITIES, AND THE SUBSCRIPTION FOR OR

PURCHASE OF SECURITIES, ARE SUBJECT TO SPECIAL LEGAL OR STATUTORY

RESTRICTIONS IN CERTAIN JURISDICTIONS. THE ISSUER IS NOT LIABLE IF

THESE RESTRICTIONS ARE NOT COMPLIED WITH BY ANY PERSON.

IN ADDITION, THIS DOCUMENT IS BEING DISTRIBUTED

TO AND IS ONLY DIRECTED AT (I) PERSONS WHO ARE OUTSIDE THE UNITED

KINGDOM, AND (II) TO PERSONS WITHIN THE UNITED KINGDOM WHO ARE (A)

"QUALIFIED INVESTORS" WITHIN THE MEANING OF ARTICLE 2 OF THE

PROSPECTUS REGULATION (REGULATION (EU) 2017/1129) AS IT FORMS PART

OF RETAINED EU LAW AS DEFINED IN THE EU (WITHDRAWAL) ACT 2018 AND

(B) EITHER (A) INVESTMENT PROFESSIONALS FALLING WITHIN ARTICLE

19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL

PROMOTION) ORDER 2005 AS AMENDED (THE "ORDER"), (B) HIGH NET WORTH

COMPANIES, (C) OTHER PERSONS TO WHOM IT MAY LAWFULLY BE

COMMUNICATED, FALLING WITHIN ARTICLE 49(2)(A) TO (D) OF THE ORDER,

OR PERSONS TO WHOM AN INVITATION OR INDUCEMENT TO ENGAGE IN

INVESTMENT ACTIVITY (WITHIN THE MEANING OF SECTION 21 OF FINANCIAL

SERVICES AND MARKETS ACT 2000, AS AMENDED ("FSMA")) MAY OTHERWISE

BE LAWFULLY COMMUNICATED OR CAUSED TO BE COMMUNICATED (ALL SUCH

PERSONS IN(A) TO (D) ABOVE TOGETHER BEING REFERRED TO AS "RELEVANT

PERSONS"). THE OFFERING OF SECURITIES TO WHICH THIS DOCUMENT

RELATES WILL ONLY BE AVAILABLE TO, AND ANY INVITATION, OFFER OR

AGREEMENT TO SUBSCRIBE FOR, PURCHASE, OR OTHERWISE ACQUIRE

SECURITIES WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. ANY

PERSON WHO IS NOT A RELEVANT PERSON SHOULD NOT ACT OR RELY ON THIS

DOCUMENT OR ANY OF ITS CONTENTS.

THIS DOCUMENT HAS NOT BEEN PREPARED IN THE

CONTEXT OF A PUBLIC OFFERING OF SECURITIES IN FRANCE WITHIN THE

MEANING OF ARTICLE L.411-1 OF THE FRENCH MONETARY AND FINANCIAL

CODE (CODE MONÉTAIRE ET FINANCIER) AND ARTICLES 211-1 ET SEQ. OF

THE GENERAL REGULATIONS OF THE AUTORITÉ DES MARCHÉS FINANCIERS.

CONSEQUENTLY, THIS DOCUMENT AND ANY OTHER MATERIAL RELATING TO THE

OFFERING HAVE NOT BEEN AND WILL NOT BE SUBMITTED TO THE AUTORITÉ

DES MARCHÉS FINANCIERS FOR REVIEW OR APPROVAL.

NO OFFER OF SECURITIES OR RIGHTS HAS BEEN OR

SHALL BE MADE TO THE PUBLIC IN SWITZERLAND, WITHIN THE MEANING OF

ARTICLE 652A PARA. II OF THE SWISS CODE OF OBLIGATIONS.

THE DISTRIBUTION OF THIS DOCUMENT IN OTHER

JURISDICTIONS MAY BE RESTRICTED BY LAW AND PERSONS INTO WHOSE

POSSESSION THIS DOCUMENT COMES SHOULD INFORM THEMSELVES ABOUT, AND

OBSERVE, ANY SUCH RESTRICTION. ANY FAILURE TO COMPLY WITH THESE

RESTRICTIONS MAY CONSTITUTE A VIOLATION OF THE LAWS OF ANY SUCH

OTHER JURISDICTION. BY ACCEPTING THIS DOCUMENT, YOU AGREE TO BE

BOUND BY THE FOREGOING LIMITATIONS.

THIS DOCUMENT IS NOT A PROSPECTUS FOR THE

PURPOSES OF THE PROSPECTUS REGULATION. THIS DOCUMENT CANNOT BE USED

AS BASIS FOR ANY INVESTMENT AGREEMENT OR DECISION. AN INVESTMENT IN

THE NEW SHARES INVOLVES SUBSTANTIAL RISKS AND UNCERTAINTIES.

PROSPECTIVE INVESTORS MUST BE ABLE TO BEAR THE ECONOMIC RISK OF AN

INVESTMENT IN THE NEW SHARES, THE PREFERENTIAL RIGHTS OR THE SCRIPS

AND SHOULD BE ABLE TO SUSTAIN A PARTIAL OR TOTAL LOSS OF THEIR

INVESTMENT. BEFORE MAKING ANY INVESTMENT DECISION, THE INVESTORS

MUST READ THE PROSPECTUS IN ITS ENTIRETY (AND, IN PARTICULAR, THE

SECTION ON RISK FACTORS STARTING ON PAGE 9). INVESTORS SHOULD IN

PARTICULAR HAVE REGARD TO THE KEY RISKS SUMMARIZED IN THIS PRESS

RELEASE. THIS DOCUMENT DOES NOT CONSTITUTE A RECOMMENDATION

CONCERNING THE SECURITIES REFERRED TO HEREIN.

THE CONTENTS OF THIS DOCUMENT MAY INCLUDE

STATEMENTS THAT ARE, OR MAY BE DEEMED TO BE, "FORWARD-LOOKING

STATEMENTS". IN SOME CASES, FORWARD-LOOKING STATEMENTS CAN BE

IDENTIFIED BY THE USE OF FORWARD-LOOKING TERMINOLOGY, INCLUDING THE

WORDS "BELIEVES", "ESTIMATES," "ANTICIPATES", "EXPECTS", "INTENDS",

"MAY", "WILL", "PLANS", "CONTINUE", "ONGOING", "POTENTIAL",

"PREDICT", "PROJECT", "TARGET", "SEEK" OR "SHOULD" OR, IN EACH

CASE, THEIR NEGATIVE OR OTHER VARIATIONS OR COMPARABLE TERMINOLOGY

OR BY DISCUSSIONS OF STRATEGIES, PLANS, OBJECTIVES,

TARGETS, GOALS, FUTURE EVENTS OR INTENTIONS.

FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS REGARDING THE

COMPANY'S INTENTIONS, BELIEFS OR CURRENT EXPECTATIONS

CONCERNING, AMONG OTHER THINGS, ITS RESULTS OF

OPERATIONS, PROSPECTS, GROWTH, STRATEGIES AND DIVIDEND POLICY AND

THE INDUSTRY IN WHICH THE COMPANY OPERATES. BY THEIR NATURE,

FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS AND

UNCERTAINTIES. NEW RISKS CAN EMERGE FROM TIME TO TIME, AND IT IS

NOT POSSIBLE FOR THE COMPANY TO PREDICT ALL SUCH RISKS, NOR CAN THE

COMPANY ASSESS THE IMPACT OF ALL SUCH RISKS ON ITS BUSINESS OR THE

EXTENT TO WHICH ANY RISKS, OR COMBINATION OF RISKS AND OTHER

FACTORS, MAY CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE

CONTAINED IN ANY FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING

STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE. GIVEN THESE

RISKS AND UNCERTAINTIES, THE READER SHOULD NOT RELY ON

FORWARD-LOOKING STATEMENTS AS A PREDICTION OF ACTUAL RESULTS.

WITHOUT PREJUDICE TO THE COMPANY'S OBLIGATIONS UNDER APPLICABLE LAW

IN RELATION TO DISCLOSURE AND ONGOING INFORMATION, THE COMPANY DOES

NOT INTEND, AND DOES NOT ASSUME ANY OBLIGATION, TO UPDATE

FORWARD-LOOKING STATEMENTS.

BELFIUS BANK SA/NV, BNP PARIBAS, J.P. MORGAN AG

AND KBC BANK NV (THE "GLOBAL COORDINATORS") ARE ACTING FOR THE

COMPANY AND NO ONE ELSE IN RELATION TO THE INTENDED OFFERING, AND

WILL NOT BE RESPONSIBLE TO ANYONE OTHER THAN THE COMPANY FOR

PROVIDING THE PROTECTIONS OFFERED TO THEIR RESPECTIVE CLIENTS NOR

FOR PROVIDING ADVICE IN RELATION TO THE INTENDED OFFERING.

NONE OF THE GLOBAL COORDINATORS OR ANY OF THEIR

RESPECTIVE AFFILIATES OR ANY OF THEIR RESPECTIVE DIRECTORS,

OFFICERS, EMPLOYEES, ADVISERS OR AGENTS ACCEPTS ANY RESPONSIBILITY

OR LIABILITY WHATSOEVER FOR OR MAKES ANY REPRESENTATION OR

WARRANTY, EXPRESS OR IMPLIED, AS TO THE TRUTH, ACCURACY OR

COMPLETENESS OF THE INFORMATION IN THIS DOCUMENT (OR WHETHER ANY

INFORMATION HAS BEEN OMITTED FROM THE DOCUMENT) OR ANY OTHER

INFORMATION RELATING TO THE COMPANY, WHETHER WRITTEN, ORAL OR IN A

VISUAL OR ELECTRONIC FORM, AND HOWSOEVER TRANSMITTED OR MADE

AVAILABLE OR FOR ANY LOSS HOWSOEVER ARISING FROM ANY USE OF THIS

DOCUMENT OR ITS CONTENTS OR OTHERWISE ARISING IN CONNECTION

THEREWITH. EACH OF THE GLOBAL COORDINATORS AND EACH OF THEIR

RESPECTIVE AFFILIATES ACCORDINGLY DISCLAIM, TO THE FULLEST EXTENT

PERMITTED BY APPLICABLE LAW, ALL AND ANY LIABILITY WHETHER ARISING

IN TORT, CONTRACT OR OTHERWISE WHICH THEY MIGHT OTHERWISE BE FOUND

TO HAVE IN RESPECT OF THIS DOCUMENT OR ANY SUCH STATEMENT OR

INFORMATION. NO REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, IS

MADE BY ANY OF THE GLOBAL COORDINATORS OR ANY OF THEIR RESPECTIVE

AFFILIATES AS TO THE ACCURACY, COMPLETENESS, VERIFICATION OR

SUFFICIENCY OF THE INFORMATION SET OUT IN THIS DOCUMENT, AND

NOTHING IN THIS DOCUMENT CAN BE RELIED UPON AS A PROMISE OR

REPRESENTATION IN THIS RESPECT, WHETHER OR NOT TO THE PAST OR

FUTURE.

- VGP - Launch of scrips private placement press release 24112022

(EN)

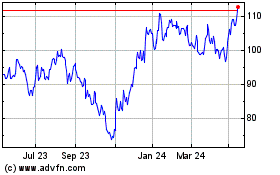

VGP NV (EU:VGP)

Historical Stock Chart

From Dec 2024 to Jan 2025

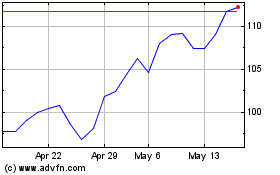

VGP NV (EU:VGP)

Historical Stock Chart

From Jan 2024 to Jan 2025