VGP and Deka Immobilien Announce € 1.1 Billion Logistics Portfolio Joint Venture

July 24 2023 - 12:00AM

VGP and Deka Immobilien Announce € 1.1 Billion Logistics Portfolio

Joint Venture

PRESS RELEASE Regulated Information – Inside

information

Antwerp, Belgium 24 July 2023 (7.00 a.m.

CET)

VGP NV ('VGP') and Deka Immobilien, one of the

largest globally active real estate investment companies in Europe,

today announced the set up of a 50:50 joint venture, which is set

to acquire over time a defined portfolio of 5 Parks with 20

buildings of German semi-industrial and logistics assets developed

by VGP.

The total value of the joint venture is €1.1

billion which will be accomplished through a number of closings and

with a first closing anticipated to materialize in Q3 2023.

Dr. Malte-Maria Münchow, head of

acquisitions and sales (Logistics, Hotel, Retail) of Deka,

said: “We are very pleased with the setup of this

partnership in the German logistics market. This is our first

European real estate joint venture and it reflects our groups’

shared ambition to create a stable and long-term portfolio of prime

semi-industrial and logistics assets. This joint venture, the

largest European logistics transaction of 2023 so far, is expected

to contribute substantially to our European portfolio and fits

within our aim to continue our growth as a real estate manager

using an approach that focuses on quality and contributes to our

sustainable business strategy – in economic, environmental and

social terms.”

Jan Van Geet, CEO of VGP, said:

“With DEKA, one of the leading European real estate investors, we

have found a partner with a shared vision, focusing on creating

sustainable value. Our joint venture marks an important milestone

in our strategy to further diversify our cash recycling model and

it speaks for the quality of our platform that we have been able to

come to this partnership notwithstanding the adverse investment

market conditions. We will share further details with our H1

update, but we are well on track to deliver on our targets for 2023

and beyond.”

The joint venture will form an addition to VGP’s

group of existing joint ventures and will be operated in a similar

way, in which VGP will continue to be the asset-, property-,

and development manager of the assets.

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Investor Relations |

Tel: +32 (0)3 289 1433investor.relations@vgpparks.eu |

|

Karen Huybrechts (Head of Marketing) |

Tel: +32 (0)3 289 1432 |

Forward-looking statements:

This press release may contain forward-looking statements.

Such statements reflect the current views of management regarding

future events, and involve known and unknown risks, uncertainties

and other factors that may cause actual results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. VGP is

providing the information in this press release as of this date and

does not undertake any obligation to update any forward-looking

statements contained in this press release considering new

information, future events or otherwise. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in VGP or an invitation or inducement to engage

in any other investment activities. VGP disclaims any liability for

statements made or published by third parties and does not

undertake any obligation to correct inaccurate data, information,

conclusions or opinions published by third parties in relation to

this or any other press release issued by VGP.

ABOUT VGP

VGP is a pan-European owner, manager and

developer of high-quality logistics and semi-industrial real

estate. VGP operates a fully integrated business model with

capabilities and longstanding expertise across the value chain.

Founded in 1998 as a Belgian family-owned real estate developer in

the Czech Republic, VGP with a staff of circa 383 FTE’s today is

active in 17 European countries directly and through several 50:50

joint ventures. As of December 2022, the Gross Asset Value of VGP,

including the joint ventures at 100%, amounted to € 6.44 billion

and the company had a Net Asset Value (EPRA NTA) of € 2.30 billion.

VGP is listed on Euronext Brussels (ISIN: BE0003878957). For more

information please visit:

http://www.vgpparks.eu/en

- VGP Deka 24 Juli 2023 - Press release ENG

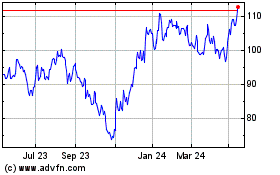

VGP NV (EU:VGP)

Historical Stock Chart

From Dec 2024 to Jan 2025

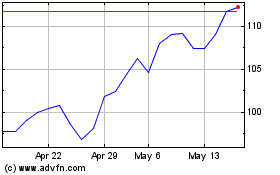

VGP NV (EU:VGP)

Historical Stock Chart

From Jan 2024 to Jan 2025