Vallourec continues to implement its

strategic plan with the arrival of ArcelorMittal,

new reference shareholder

Meudon (France), March

12th, 2024, Vallourec, a

world leader in premium tubular solutions, announces today that

ArcelorMittal has reached an agreement to purchase Apollo’s stake

in Vallourec (65,243,206 shares) representing 28,4% of the voting

rights and 27,5% of the share capital, at a price of €14,64 per

share, for a total purchase price of €955 million. This marks the

final step of the financial restructuring of Vallourec that was

initiated in 2021, when Apollo became Vallourec’s reference

shareholder. This new investment by a world-class industrial player

speaks to the breadth of the operational turnaround executed since

that time, as well as the robust outlook for the premium seamless

tubes business over the coming years.

Vallourec welcomes the transition in reference

shareholder from Apollo, the leader of Vallourec’s successful

financial restructuring, to ArcelorMittal, a global steel industry

player. ArcelorMittal is a world leader in steelmaking and mining,

present in 60 countries and with primary steel production

facilities in 15 countries. We are pleased with ArcelorMittal’s

confidence in Vallourec's new trajectory and success in executing a

substantial strategic shift. It also represents a long-term

commitment, as ArcelorMittal shares with Vallourec a common

industrial vision and complementary, world-renowned expertise.

ArcelorMittal will hold 28,4% of the voting rights and 27,5% of the

share capital of the Company following the closing of the

transaction.

This transaction was made possible by the New

Vallourec plan, which was announced in May 2022 with the arrival of

Philippe Guillemot as CEO. The New Vallourec plan, endorsed by

Apollo since Philippe Guillemot’s arrival, has transformed the

Group into a focused, streamlined, and resilient company with a

promising future. Vallourec’s 2023 earnings were the best Group

results in nearly 15 years, and the Group has reduced its net debt

by more than €900 million versus third quarter 2022 peak. Vallourec

remains on track to reach zero net debt by the end of 2025 at the

latest and is undertaking several initiatives to continue to

deliver enhanced shareholder value over the coming years. Vallourec

further reiterates its outlook given in its Fourth Quarter and Full

Year 2023 Results press release. Based on current market conditions

and management’s assumptions, Vallourec expects that Group EBITDA

in the first half of 2024 will be broadly similar to second half

2023 EBITDA. For the full year, Vallourec anticipates strong EBITDA

generation due to robust Tubes pricing in backlog and operational

improvement. In keeping with prior years’ financial communication,

Vallourec has not provided a quantitative full-year EBITDA outlook

and expects it will provide such an outlook during the

communication of its first half results.

The completion of the acquisition is expected to

close in the second half of the year, after obtaining the relevant

regulatory approvals. Such acquisition will not entail a change of

control of Vallourec and ArcelorMittal does not intend to launch a

voluntary tender offer for Vallourec’s remaining shares over the

next six months. Vallourec and ArcelorMittal will enter into

discussions for a shareholders' agreement which will contain

customary provisions for such type of transaction, with 2 board

seats for ArcelorMittal upon closing of the acquisition (subject to

negotiations). In accordance with applicable law, the main terms of

the shareholders' agreement will be made publicly available in due

course.

Philippe Guillemot, Chairman of the

Board of Directors, and Chief Executive Officer,

declared:

“I would like to thank Apollo, for its decisive

action during Vallourec’s financial restructuring and its unfailing

support in Vallourec’s financial and industrial turnaround that I

initiated when I took over the helm of the Company two years ago.

With Apollo’s help, we have fundamentally changed the operational

and financial structure of Vallourec, and are now well-positioned

to carry this momentum into the future. ArcelorMittal is a natural

shareholder for Vallourec, and we are excited for the contributions

it will bring to our Company. We share a passion for the global

steel industry and share a common vision of its future. With this

transaction, we transition from a world-class financial partner to

a world-class industrial partner. I look forward to leading this

magnificent group and continuing to realize the full potential of

our premier industrial base.”

Information and Forward-Looking Statements

This press release

includes forward-looking statements. These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms as “believe”, “expect”,

“anticipate”, “may”, “assume”, “plan”, “intend”, “will”, “should”,

“estimate”, “risk” and or, in each case, their negative, or other

variations or comparable terminology. These forward-looking

statements include all matters that are not historical facts and

include statements regarding the Company’s intentions, beliefs or

current expectations concerning, among other things, Vallourec’s

results of operations, financial condition, liquidity, prospects,

growth, strategies and the industries in which they operate.

Readers are cautioned that forward-looking statements are not

guarantees of future performance and that Vallourec’s or any of its

affiliates’ actual results of operations, financial condition and

liquidity, and the development of the industries in which they

operate may differ materially from those made in or suggested by

the forward-looking statements contained in this presentation. In

addition, even if Vallourec’s or any of its affiliates’ results of

operations, financial condition and liquidity, and the development

of the industries in which they operate are consistent with the

forward-looking statements contained in this presentation, those

results or developments may not be indicative of results or

developments in subsequent periods. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future. These risks include those developed or

identified in the public documents filed by Vallourec with the

French Financial Markets Authority (Autorité des marches

financiers, or “AMF”), including those listed in the “Risk Factors”

section of the Universal Registration Document filed with the AMF

on April 17, 2023, under filing number n° D.23-0293.Accordingly,

readers of this document are cautioned against relying on these

forward-looking statements. These forward-looking statements are

made as of the date of this document. Vallourec disclaims any

intention or obligation to complete, update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable laws

and regulations. This press release does not constitute any offer

to purchase or exchange, nor any solicitation of an offer to sell

or exchange securities of Vallourec. or further information, please

refer to the website https://www.vallourec.com/en

About Vallourec

Vallourec is a world

leader in premium tubular solutions for the energy markets and for

demanding industrial applications such as oil & gas wells in

harsh environments, new generation power plants, challenging

architectural projects, and high-performance mechanical equipment.

Vallourec’s pioneering spirit and cutting edge R&D open new

technological frontiers. With close to 15,000 dedicated and

passionate employees in more than 20 countries, Vallourec works

hand-in-hand with its customers to offer more than just tubes:

Vallourec delivers innovative, safe, competitive and smart tubular

solutions, to make every project possible.

Listed on Euronext in

Paris (ISIN code: FR0013506730, Ticker VK), Vallourec is part of

the CAC Mid 60, SBF 120 and Next 150 indices and is eligible for

Deferred Settlement Service.

In the United States,

Vallourec has established a sponsored Level 1 American Depositary

Receipt (ADR) program (ISIN code: US92023R4074, Ticker: VLOWY).

Parity between ADR and a Vallourec ordinary share has been set at

5:1.

For further information, please contact:

|

Investor relations Connor LynaghTel: +1 (713)

409-7842connor.lynagh@vallourec.com |

Press relations Taddeo – Romain GrièreTel: +33

(0)7 86 53 17 29 romain.griere@taddeo.fr

|

|

Individual shareholdersToll Free Number (from

France): 0 805 65 10 10 actionnaires@vallourec.com |

|

- Vallourec_Press release_New reference shareholder

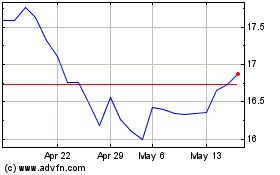

Vallourec (EU:VK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vallourec (EU:VK)

Historical Stock Chart

From Dec 2023 to Dec 2024