Swiss Franc Falls As Traders Await U.S. PCE Data

August 30 2024 - 12:09AM

RTTF2

The Swiss franc weakened against most major currencies in the

European session on Friday, as traders now cautiously look ahead to

the release of closely watched readings on U.S. consumer price

inflation later in the day.

The data is not likely to impact forecasts for an interest rate

cut by the U.S. Fed next month but could impact expectations

regarding how quickly the central bank will lower rates.

The July Personal Consumption Expenditures report along with

separate reports on Chicago-area business activity and consumer

sentiment will be in the spotlight later today, heading into the

long Labour Day weekend and the release of key employment data next

week.

The U.S. Fed's favored PCE inflation gauge may reinforce views

that a September rate cut is imminent.

In economic news, data from the KOF Swiss Economic Institute

showed that the Switzerland KOF Leading Indicator came in at 101.6

in August, up from 101.0 in July. Economists expect the leading

indicator to be at 100.6.

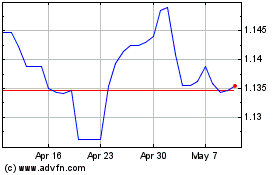

In the European trading today, the Swiss franc fell to a 2-day

low of 0.9405 against the euro and a 3-day low of 1.1181 against

the pound, from early highs of 0.9380 and 1.1149, respectively. If

the franc extends its downtrend, it is likely to find support

around 0.95 against the euro and 1.13 against the pound.

Against the U.S. dollar, the franc edged down to 0.8487 from an

early high of 0.8467. On the downside, 0.86 is seen as the next

support level for the franc.

Meanwhile, the Swiss franc rose to 171.07 against yen, from an

early 3-day low of 170.76. The franc is likely to find resistance

around the 172.00 region.

Looking ahead, Eurozone flash CPI data for August and

unemployment rate for July are due to be released at 5:00 am ET in

the European session.

In the New York session, Canada GDP for the second quarter, U.S.

PCE index for July, U.S. personal income and spending data for

July, U.S. Chicago PMI data for August, U.S. University of

Michigan's consumer sentiment for August, Canada budget balance for

June and U.S. Baker Hughes oil rig count data are slated for

release.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Oct 2024 to Nov 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Nov 2023 to Nov 2024