Euro Mixed After Eurozone Flash PMI Data

August 22 2024 - 3:28AM

RTTF2

The euro showed mixed trading against its major rivals in the

European session on Thursday, after the release of the euro area

private sector growth data for August.

Data from the flash survey compiled by S&P Global showed

that the HCOB composite output index improved to a three-month high

of 51.2 in August from 50.2 in July. The reading was forecast to

fall to 50.1.

The services Purchasing Managers' Index improved to a four-month

high of 53.3 from 51.9 in July. The expected reading was 51.9.

Meanwhile, the factory PMI slid to an eight-month low of 45.6,

while the score was forecast to remain unchanged at 45.8.

At 51.4, the services PMI hit the lowest in five months and was

down from 52.5 in July. The reading was below forecast of 52.3.

Germany's private sector activity shrank further in August as

manufacturing output declined sharply and service sector growth

softened for the third consecutive month.

The headline HCOB flash composite output index fell unexpectedly

to 48.5 in August from 49.1 in July. The score was seen at

49.2.

At 51.4, the services PMI hit the lowest in five months and was

down from 52.5 in July. The reading was below forecast of 52.3.

The manufacturing PMI also dropped to a five-month low of 42.1,

down from 43.2 in the prior month. Economists had forecast the

index to climb to 43.5.

By contrast, France's private sector expanded in August for the

first time since April as the Olympic Games boosted services

activity. The composite output index rose to 52.7 in August from

49.1 in July. The score was forecast to remain unchanged at

49.1.

The uplift in private sector output was exclusively driven by

services. The services PMI hit a 27-month high of 55.0 compared to

50.1 in July. The reading was seen at 50.2.

On the other hand, the manufacturing PMI declined unexpectedly

to an eight-month low of 42.1 from 44.0 a month ago. The score was

forecast to rise to 44.4.

The European currency rose against its major rivals after the

France PMI data and then retreated after the German PMI data.

Thereafter, the euro showed mixed trading against its major

rivals.

In the European trading now, the euro retreated to near 3-week

low of 0.8484 against the pound, from an early high of 0.8520. The

euro is likely to find support around the 0.83 region.

Data from the flash survey results published by S&P Global

showed that the manufacturing Purchasing Managers' Index climbed to

52.5 in August from 52.1 in July. The flash composite output index

rose to a 4-month high of 53.4 in August from 52.8 in July. The

score was forecast to rise to 52.9.

The services business activity index stood at 53.3 versus 52.5

in July, above the expected score of 52.8.

Against the Swiss franc, the euro rose to 0.9500 from an early

9-day low of 0.9462. If the euro extends its uptrend, it is likely

to find resistance around the 0.97 region.

The euro slipped to 1.1128 against the U.S. dollar, from an

early high of 1.1166 and held steady thereafter.

Against the yen, the euro edged up to 162.72 from an early low

of 161.47. The next possible upside target for the euro is seen

around the 168.00 region.

Looking ahead, U.S. weekly jobless claims data, U.S. S&P

Global flash PMI data for August and U.S. existing home sales data

for July are slated for release in the New York session.

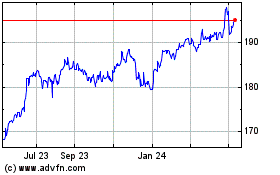

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Oct 2024 to Nov 2024

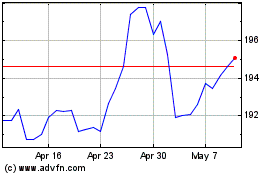

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Nov 2023 to Nov 2024