Pound Slides On Weak UK GDP Data

March 14 2025 - 2:07AM

RTTF2

The British pound weakened against most major currencies in the

European session on Friday, after U.K. economy logged an unexpected

contraction at the start of the year on a sharp fall in

production.

Data from the Office for National Statistics showed that the

U.K. Gross domestic product shrank 0.1 percent on a monthly basis

in January, following a growth of 0.4 percent in December. GDP was

expected to grow 0.1 percent.

The largest contributor to the fall was industrial production,

which fell 0.9 percent reversing a 0.5 percent gain in December. A

similar sharp fall was last reported in April 2024.

Manufacturing output slid 1.1 percent, in contrast to the 0.7

percent increase in the previous month. At the same time,

construction output was down 0.2 percent.

Partially offsetting these falls, services output edged up 0.1

percent. But this was weaker than the 0.4 percent expansion seen in

December.

In the three months to January, real GDP moved up 0.2 percent

from the three months to October. Compared to last year, GDP growth

was 1.2 percent.

On a yearly basis, GDP grew 1.0 percent in January, weaker than

the forecast of 1.2 percent. Markets remain cautious on heightened

trade tensions and growing concerns about an economic slowdown.

With most officials guiding a "gradual and cautious"

policy-easing strategy, the Bank of England (BoE) is anticipated to

keep interest rates unchanged at the next meeting of the Monetary

Policy Committee coming next week. The base rate of 4.5% would

remain constant as a result. Amid worries about growth forecasts,

the U.K. central bank opted to lower interest rates by 25 basis

points (bps) at its February meeting.

In the European trading today, the pound fell to a 2-day low of

1.2918 against the U.S. dollar, from an early high of 1.2959. The

next possible downside target for the pound is seen around the 1.25

region.

Against the euro and the Swiss franc, the pound edged down to

0.8394 and 1.1420 from early highs of 0.8375 and 1.1446,

respectively. If the pound extends its downtrend, it is likely to

find support around 0.81 against the euro and 1.12 against the

franc.

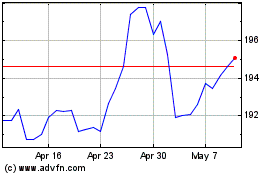

Meanwhile, the pound rose to 2-day high of 192.68 against the

yen, from an early low of 191.56. The pound may test resistance

around the 188.00 region.

Looking ahead, U.S. Michigan consumer sentiment for March and

U.S. Baker Hughes oil rig count data are slated for release in the

New York session.

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Feb 2025 to Mar 2025

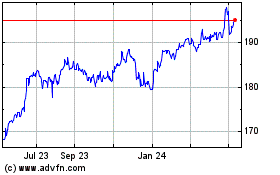

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Mar 2025