U.S. Dollar Climbs On Trump Optimism

November 08 2024 - 7:23AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the New York session on Friday on hopes that policies under

incoming President Donald Trump would spur economic growth and

inflation.

Trump has proposed tax cuts and tariffs on imported goods in his

election campaign.

Trump's fiscal policies will elevate upside risks to inflation

and push rates higher.

The Fed cut the interest rate by 25 basis points as expected on

Thursday, and Chair Jerome Powell stressed that rates are not on

"any preset course" and that the central bank will make future

decisions "meeting by meeting" to deal with the risks to both sides

of the dual mandate.

However, market participants lowered expectations for further

interest rate reductions for 2025 following the victory of

Trump.

The greenback advanced to 1.0718 against the euro and 1.2911

against the pound, off its early lows of 1.0804 and 1.2988,

respectively. The next possible resistance for the currency is seen

around 1.06 against the euro and 1.26 against the pound.

The greenback recovered to 0.8752 against the franc and 152.85

against the yen, from its early 2-day lows of 0.8701 and 152.13,

respectively. The currency is poised to challenge resistance around

0.89 against the franc and 156.00 against the yen.

The greenback edged up to 0.6576 against the aussie, 0.5963

against the kiwi and 1.3920 against the loonie, reversing from its

early lows of 0.6680, 0.6027 and 1.3859, respectively. The currency

is likely to locate resistance around 0.64 against the aussie, 0.58

against the kiwi and 1.40 against the loonie.

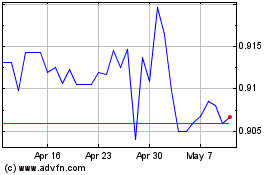

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Nov 2024 to Dec 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Dec 2023 to Dec 2024