U.K. Service Sector Growth Eases Slightly In December

January 06 2016 - 1:25AM

RTTF2

Although the British service sector expanded at a solid pace in

December, underpinned by a sharp rise in new business, the pace of

growth eased slightly from November as expectations fell to a near

three-year low.

The Purchasing Managers' Index dropped slightly to 55.5 from

55.9 in November, survey data from Markit and the Chartered

Institute of Procurement & Supply revealed Wednesday. The

reading was forecast to drop to 55.6.

Nonetheless, the PMI remained above the long-run survey trend of

55.2. Also, the current period of rise in output was extended to

three years, as the measure remained above the 50-neutral mark.

The headline figure averaged 55.4 in both third and fourth

quarters, representing a weaker growth outcome in the second half

of 2015.

"The surveys point to the economy having grown 0.5 percent in

the fourth quarter, a solid but perhaps unexciting pace that means

GDP would have risen 2.2 percent in 2015," Chris Williamson, chief

economist at Markit, said.

Elsewhere, Capital Economics economist Vicky Redwood said there

was clearly no reason for the central bank to raise interest rates

soon with the recovery having lost some of its shine in 2015 and

the further fall in oil prices having weakened the near-term

outlook for inflation even more.

Data showed that the service sector growth was underpinned by a

further strong increase in new business as firms reported

successful marketing campaigns. On the other hand, the volume of

outstanding business increased at the sharpest rate since

August.

The current sequence of employment growth in the service sector

was extended to three years in December, but the pace of job

creation was the weakest since July.

Firms' expectations for activity over the forthcoming twelve

months were the weakest since February 2013. Solid overall growth

in activity is expected for 2016, but the strength of sentiment

remained weaker than the long-run survey average.

Due to higher wages, average input prices registered the

strongest growth in five months.

That said, input price inflation remained historically muted. At

the same time, prices charged by service providers rose only

marginally in December.

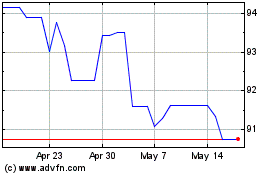

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Jul 2023 to Jul 2024