AbCellera (Nasdaq: ABCL) today announced financial results for

the first quarter of 2024. All financial information in this press

release is reported in U.S. dollars, unless otherwise

indicated.

“We continue to execute on advancing our internal pipeline,

completing capital investments in forward integration, and

expanding strategic partnerships,” said Carl Hansen, Ph.D., founder

and CEO of AbCellera. “This quarter, presentations on our T-cell

engager platform, which includes our highly differentiated CD3

panel, demonstrated how we can repeatedly generate TCEs that

maximize tumor-cell killing without inducing excessive cytokine

release. With our TCE platform in place, we are moving programs

towards in vivo studies.”

Q1 2024 Business Summary

- Announced a new collaboration with Biogen Inc. to discover

antibodies for neurological conditions.

- Announced a new collaboration with Viking Global Investors and

ArrowMark Partners to launch new biotech companies.

- Presented new data on its T-cell engager (TCE) programs at the

American Association for Cancer ResearchⓇ Annual Meeting 2024 that

demonstrate how AbCellera's TCE platform is able to generate TCEs

that achieve potent cell killing with low toxicity associated with

cytokine release.

- Reported the start of three additional partner-initiated

programs with downstreams to reach a cumulative total of 90

partner-initiated program starts with downstreams.

- Maintained a cumulative total of 13 molecules advanced to the

clinic.

Key Business Metrics

Cumulative Metrics

March 31, 2023

March 31, 2024

Change %

Partner-initiated program starts with

downstreams

75

90

20

%

Molecules in the clinic

9

13

44

%

AbCellera started discovery on an additional three

partner-initiated programs with downstreams to reach a cumulative

total of 90 partner-initiated program starts with downstreams in Q1

2024 (up from 75 on March 31, 2023). AbCellera’s partners have

advanced a cumulative total of 13 molecules into the clinic (up

from nine on March 31, 2023).

Discussion of Q1 2024 Financial Results

- Revenue – Total revenue was $10.0 million, compared to

$12.2 million in Q1 2023. Partnerships generated research fees of

$9.8 million, compared to $10.6 million in Q1 2023. Licensing

revenue was $0.2 million.

- Research & Development (R&D) Expenses – R&D

expenses were $39.3 million, compared to $52.6 million in Q1 2023,

reflecting underlying continued growth in program execution,

platform development, and investments in internal programs,

partially offset by the non-recurrence of specific one-time

investments in co-development and internal programs.

- Sales & Marketing (S&M) Expenses – S&M

expenses were $3.4 million, compared to $3.8 million in Q1

2023.

- General & Administrative (G&A) Expenses –

G&A expenses were $17.4 million, compared to $15.1 million in

Q1 2023.

- Net Loss – Net loss of $40.6 million, or $(0.14) per

share on a basic and diluted basis, compared to net loss of $40.1

million, or $(0.14) per share on a basic and diluted basis in Q1

2023.

- Liquidity – $725.3 million of total cash, cash

equivalents, and marketable securities and with approximately $240

million in available non-dilutive government funding to execute on

our strategy, bringing our total available liquidity to just under

$1 billion.

Conference Call and Webcast

AbCellera will host a conference call and live webcast to

discuss these results today at 2:00 p.m. Pacific Time (5:00 p.m.

Eastern Time).

The live webcast of the earnings conference call can be accessed

on the Events and Presentations section of AbCellera’s Investor

Relations website. A replay of the webcast will be available

through the same link following the conference call.

About AbCellera Biologics Inc.

AbCellera (Nasdaq: ABCL) discovers and develops antibody

medicines for indications across therapeutic areas including

cancer, metabolic and endocrine conditions, and autoimmune

disorders. AbCellera’s engine integrates technology, data science,

infrastructure, and interdisciplinary teams to solve the most

challenging antibody discovery problems. AbCellera is focused on

advancing an internal pipeline of first-in-class and best-in-class

programs and collaborating on innovative drug development programs

with partners. For more information, please visit

www.abcellera.com.

Definition of Key Business Metrics

We regularly review the following key business metrics to

evaluate our business, measure our performance, identify trends

affecting our business, formulate financial projections, and make

strategic decisions. We believe that the following metrics are

important to understand our current business. These metrics may

change or may be substituted for additional or different metrics as

our business develops. Information on changes is set forth in our

Annual Report on Form 10-K for the year ended December 31,

2023.

Partner-initiated program starts with downstreams

represent the number of unique partner-initiated programs where we

stand to participate financially in downstream success for which we

have commenced the discovery effort. The discovery effort commences

on the later of (i) the day on which we receive sufficient reagents

to start discovery of antibodies against a target and (ii) the day

on which the kick-off meeting for the program is held. We view this

metric as an indication of the selection and initiation of projects

by our partners and the resulting potential for near-term payments.

Cumulatively, partner-initiated program starts with downstream

participation indicate our total opportunities to earn downstream

revenue from milestone fees and royalties (or royalty equivalents)

in the mid- to long-term.

Molecules in the clinic represent the count of unique

molecules for which an Investigational New Drug, or IND, New Animal

Drug, or equivalent under other regulatory regimes, application has

reached "open" status or has otherwise been approved based on an

antibody that was discovered either by us or by a partner using

licensed AbCellera technology. Where the date of such application

approval is not known to us, the date of the first public

announcement of a clinical trial will be used for the purpose of

this metric. We view this metric as an indication of our near- and

mid-term potential revenue from milestone fees and potential

royalty payments in the long term.

AbCellera Forward-Looking Statements

This press release contains forward-looking statements,

including statements made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995. The

forward-looking statements are based on management’s current

beliefs and assumptions and on information currently available to

management. All statements contained in this release other than

statements of historical fact are forward-looking statements,

including statements regarding our ability to develop,

commercialize and achieve market acceptance of our current and

planned products and services, our research and development

efforts, and other matters regarding our business strategies, use

of capital, results of operations and financial position, and plans

and objectives for future operations.

In some cases, you can identify forward-looking statements by

the words “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. These statements

involve risks, uncertainties and other factors that may cause

actual results, levels of activity, performance, or achievements to

be materially different from the information expressed or implied

by these forward-looking statements. These risks, uncertainties and

other factors are described under “Risk Factors,” “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” and elsewhere in the documents we file with the

Securities and Exchange Commission from time to time. We caution

you that forward-looking statements are based on a combination of

facts and factors currently known by us and our projections of the

future, about which we cannot be certain. As a result, the

forward-looking statements may not prove to be accurate. The

forward-looking statements in this press release represent our

views as of the date hereof. We undertake no obligation to update

any forward-looking statements for any reason, except as required

by law.

Source: AbCellera Biologics Inc.

AbCellera Biologics

Inc.

Condensed Consolidated

Statements of Loss and

Comprehensive Loss

(All figures in U.S. dollars.

Amounts are expressed in thousands except share and per share

data.)

(Unaudited)

Three months ended March

31,

2023

2024

Revenue:

Research fees

$

10,570

$

9,774

Licensing revenue

372

180

Milestone payments

1,250

-

Total revenue

12,192

9,954

Operating expenses:

Research and development(1)

52,647

39,287

Sales and marketing(1)

3,771

3,365

General and administrative(1)

15,134

17,352

Depreciation and amortization

5,514

4,844

Total operating expenses

77,066

64,848

Loss from operations

(64,874

)

(54,894

)

Other (income) expense

Interest income

(9,759

)

(10,401

)

Grants and incentives

(3,374

)

(3,275

)

Other

(3,593

)

1,529

Total other (income)

(16,726

)

(12,147

)

Net loss before income tax

(48,148

)

(42,747

)

Income tax recovery

(8,038

)

(2,137

)

Net loss

$

(40,110

)

$

(40,610

)

Foreign currency translation

adjustment

(630

)

(96

)

Comprehensive loss

$

(40,740

)

$

(40,706

)

Net loss per share

Basic

$

(0.14

)

$

(0.14

)

Diluted

$

(0.14

)

$

(0.14

)

Weighted-average common shares

outstanding

Basic

287,767,136

292,723,901

Diluted

287,767,136

292,723,901

(1) Exclusive of depreciation and amortization

AbCellera Biologics

Inc.

Condensed Consolidated Balance

Sheet

(All figures in U.S. dollars.

Amounts are expressed in thousands except share data.)

(Unaudited)

December 31, 2023

March 31, 2024

Assets

Current assets:

Cash and cash equivalents

$

133,320

$

123,572

Marketable securities

627,265

574,451

Total cash, cash equivalents, and

marketable securities

760,585

698,023

Accounts and accrued receivable

30,590

34,419

Restricted cash

25,000

25,000

Other current assets

55,810

56,506

Total current assets

871,985

813,948

Long-term assets:

Property and equipment, net

287,696

306,081

Intangible assets, net

120,425

118,736

Goodwill

47,806

47,806

Investments in equity accounted

investees

65,938

71,592

Other long-term assets

94,244

104,933

Total long-term assets

616,109

649,148

Total assets

$

1,488,094

$

1,463,096

Liabilities and shareholders'

equity

Current liabilities:

Accounts payable and other current

liabilities

$

49,580

$

42,887

Contingent consideration payable

50,475

51,431

Deferred revenue

18,958

10,565

Total current liabilities

119,013

104,883

Long-term liabilities:

Operating lease liability

71,222

68,079

Deferred revenue

8,195

8,570

Deferred government contributions

95,915

110,579

Contingent consideration payable

4,913

5,063

Deferred tax liability

30,612

30,274

Other long-term liabilities

5,906

5,735

Total long-term liabilities

216,763

228,300

Total liabilities

335,776

333,183

Commitments and contingencies

Shareholders' equity:

Common shares: no par value, unlimited

authorized shares at December 31, 2023 and March 31, 2024:

290,824,970 and 293,621,312 shares issued and outstanding at

December 31, 2023 and March 31, 2024, respectively

753,199

764,562

Additional paid-in capital

121,052

127,990

Accumulated other comprehensive loss

(1,720

)

(1,816

)

Accumulated earnings

279,787

239,177

Total shareholders' equity

1,152,318

1,129,913

Total liabilities and shareholders'

equity

$

1,488,094

$

1,463,096

AbCellera Biologics

Inc.

Condensed Consolidated

Statement of Cash Flows

(Expressed in thousands of

U.S. dollars.)

(Unaudited)

Three months ended March

31,

2023

2024

Cash flows from operating

activities:

Net loss

$

(40,110

)

$

(40,610

)

Cash flows from operating activities:

Depreciation of property and equipment

2,858

3,155

Amortization of intangible assets

2,656

1,689

Amortization of operating lease

right-of-use assets

1,606

1,922

Stock-based compensation

15,474

17,409

Other

(3,634

)

1,707

Changes in operating assets and

liabilities:

Research fees and grants receivable

7,915

(18,576

)

Accrued royalties receivable

9,260

—

Income taxes payable

(12,614

)

(3,182

)

Accounts payable and accrued

liabilities

(5,778

)

(4,878

)

Deferred revenue

(3,905

)

(8,017

)

Accrued royalties payable

(16,253

)

—

Deferred grant income

4,525

11,278

Other assets

(6,063

)

(3,605

)

Net cash used in operating activities

(44,063

)

(41,708

)

Cash flows from investing

activities:

Purchases of property and equipment

(14,984

)

(24,140

)

Purchase of marketable securities

(360,752

)

(249,371

)

Proceeds from marketable securities

262,638

306,545

Receipt of grant funding

2,693

7,168

Long-term investments and other assets

(34,735

)

(4,385

)

Investment in equity accounted

investees

(4,469

)

(5,907

)

Net cash provided by (used in) investing

activities

(149,609

)

29,910

Cash flows from financing

activities:

Payment of liability for in-licensing

agreement and other

(948

)

(185

)

Proceeds from long-term liabilities

—

2,124

Proceeds from exercise of stock

options

490

892

Net cash provided by (used in) financing

activities

(458

)

2,831

Effect of exchange rate changes on cash

and cash equivalents

(213

)

(781

)

Decrease in cash and cash equivalents

(194,343

)

(9,748

)

Cash and cash equivalents and restricted

cash, beginning of period

414,650

160,610

Cash and cash equivalents and restricted

cash, end of period

$

220,307

$

150,862

Restricted cash included in other

assets

2,290

2,290

Total cash, cash equivalents, and

restricted cash shown on the balance sheet

$

218,017

$

148,572

Supplemental disclosure of non-cash

investing and financing activities

Property and equipment in accounts

payable

8,918

18,654

Right-of-use assets obtained in exchange

for operating lease obligation

2,124

107

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507073711/en/

Inquiries Media: Kathleen Reid: media@abcellera.com,

+1(236)521-6774 Business Development: Murray McCutcheon, Ph.D.,

bd@abcellera.com, +1(604)559-9005 Investor Relations: Melanie

Solomon, ir@abcellera.com, +1(778)729-9116

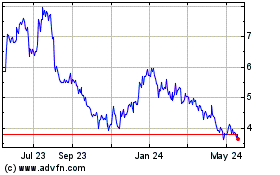

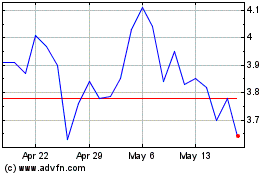

AbCellera Biologics (NASDAQ:ABCL)

Historical Stock Chart

From Nov 2024 to Dec 2024

AbCellera Biologics (NASDAQ:ABCL)

Historical Stock Chart

From Dec 2023 to Dec 2024