false

0000715579

0000715579

2025-02-01

2025-02-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): February 1, 2025

ACNB Corporation

(Exact name of Registrant

as specified in its charter)

| Pennsylvania |

|

1-35015 |

|

23-2233457 |

(State

or other

jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 16

Lincoln Square, Gettysburg,

PA |

|

17325 |

| (Address of principal executive offices) |

|

(Zip Code) |

717.334.3161

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the Registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title

Of Each Class |

Trading

Symbol(s) |

Name

Of Each Exchange On Which Registered |

| Common Stock, $2.50 par value per share |

ACNB |

The NASDAQ Stock Market, LLC |

CURRENT REPORT ON FORM 8-K

| ITEM 2.01 | Completion of Acquisition or Disposition of Assets |

Effective February 1, 2025, ACNB Corporation (“ACNB”)

completed its previously-announced acquisition of Traditions Bancorp, Inc. (“Traditions”) pursuant to the Agreement and

Plan of Reorganization, dated as of July 23, 2024, by and among ACNB, ACNB South Acquisition Subsidiary, LLC (“Acquisition

Subsidiary”), ACNB Bank, Traditions, and Traditions Bank (the “Reorganization Agreement”). At the effective time of

the acquisition, Traditions merged with and into Acquisition Subsidiary, with Acquisition Subsidiary surviving the merger. In addition,

immediately thereafter, Traditions Bank, a Pennsylvania state-chartered bank and Traditions’ wholly-owned subsidiary, merged with

and into ACNB Bank, a Pennsylvania state-chartered bank and trust company and ACNB’s wholly-owned subsidiary, with ACNB Bank as

the surviving bank.

Subject to the terms and conditions of the Reorganization Agreement,

at the effective time of the merger, each share of Traditions common stock was converted into the right to receive 0.7300 shares of ACNB

common stock, with an amount in cash, without interest, to be paid in lieu of fractional shares. As a result of the merger, ACNB expects

to issue approximately 2,035,359 shares of its common stock, and cash in exchange for fractional shares based upon $39.09 per whole share

of ACNB common stock, the determined market share price in accordance with the Reorganization Agreement. In addition, all unexercised

options to purchase shares of Traditions common stock were redeemed for cash.

The foregoing description of the Reorganization Agreement does

not purport to be complete and is qualified in its entirety by reference to the full text of the Reorganization Agreement, which is attached

hereto as Exhibit 2.1 and is incorporated herein by reference.

| ITEM 5.02 | Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Board

Appointments

Effective February 1,

2025, in connection with the merger and pursuant to the terms of the Reorganization Agreement, three former Traditions directors were

appointed to ACNB’s Board of Directors as follows:

Elizabeth F. Carson,

former Lead Independent Director of Traditions and Traditions Bank, was appointed as a Class 2 director of ACNB. Ms. Carson

was also appointed as a Director of ACNB Bank’s Board of Directors. In connection with her appointment to the Boards of ACNB and

ACNB Bank, Ms. Carson was appointed to ACNB Bank’s Board Loan Committee and Board Trust Committee.

Eugene J. Draganosky,

former Director, Chair of the Board, and CEO of Traditions and Traditions Bank, was appointed as a Class 1 director of ACNB and a

Vice Chair of the Board of Directors. Mr. Draganosky was also appointed as a Director and Vice Chair of ACNB Bank’s Board of

Directors and as a member of the Board of Directors of ACNB Insurance Services, Inc., the wholly owned insurance agency subsidiary

of ACNB. In connection with his appointment to the Boards of ACNB and ACNB Bank, Mr. Draganosky was appointed to ACNB Bank’s

Board Loan Committee.

John M. Polli, former

Director of Traditions and Traditions Bank, was appointed as a Class 3 director of ACNB. Mr. Polli was also appointed as a Director

of ACNB Bank’s Board of Directors. In connection with his appointment to the Boards of ACNB and ACNB Bank, Mr. Carson was appointed

to ACNB and ACNB Bank’s Board Audit Committee and ACNB Bank’s Board Trust Committee.

Other than pursuant to the

terms of the Reorganization Agreement and those fees and benefits available to all nonemployee Directors of ACNB and ACNB Bank, and except

as disclosed below regarding Mr. Draganosky, none of the foregoing individuals was appointed to these positions pursuant to any arrangement

or understanding with any other person, nor do any of the foregoing individual individuals have reportable transactions under Item 404(a) of

Regulation S-K.

Separation and

Non-Competition Agreement

In connection with the merger and as of the effective date

of the merger, ACNB and ACNB Bank entered into a Separation and Non-competition Agreement with Mr. Draganosky relating to the termination

of his employment as Chief Executive Officer of Traditions and Traditions Bank and his related employment agreement with Traditions and

Traditions Bank (the “Draganosky Agreement”). Under the terms of the Draganosky Agreement, Mr. Draganosky will receive

a lump some separation payment of $1,373,500 and maintenance of at least $800,000 in split dollar bank owned life insurance for at least

3 years following the effective date. In exchange, Mr. Draganosky agrees such payment satisfies all obligations under his employment

agreement and that he will be subject to certain non-competition and non-solicitation restrictions for a period of 18 months as delineated

in the Draganosky Agreement.

The description above is only a summary of the material terms

of the Draganosky Agreement and is not intended to be a full description of the agreement. The Draganosky Agreement is attached hereto

as Exhibit 10.1 and is incorporated herein by reference.

ACNB issued a press release on February 3, 2025, announcing

completion of the acquisition. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

| ITEM 9.01 | Financial Statements and Exhibits |

(a) Financial

Statements of Business Acquired

The financial

statements required to be filed under this Item 9.01(a) shall be filed by an amendment to this Form 8-K not later than 71 days

after the date this Current Report on Form 8-K is required to be filed.

(b) Pro

Forma Financial Information

The pro forma

financial information required to be filed under this Item 9.01(b) shall be filed by an amendment to this Form 8-K not later

than 71 days after the date this Current Report on Form 8-K is required to be filed.

(d) Exhibits.

| |

Exhibit Number |

Description |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its

behalf by the undersigned, thereunto duly authorized.

| |

ACNB CORPORATION |

| |

(Registrant) |

| |

|

| Dated: February 3, 2025 |

/s/ Kevin J.

Hayes |

| |

Kevin J. Hayes |

| |

Senior Vice President/ |

| |

General Counsel, Secretary & Chief Governance

Officer |

Exhibit 10.1

Execution Version

SEPARATION AND NON-COMPETITION AGREEMENT

THIS SEPARATION AND NON-COMPETITION

AGREEMENT (the “Agreement”) is made this 23rd day of January 2025, by and among ACNB Corporation (“ACNB”),

ACNB Bank, Traditions Bancorp, Inc. (“TBI”), Traditions Bank (“Traditions Bank”), and Eugene J. Draganosky

(the “Executive”) on the terms and conditions set forth below:

WHEREAS, the Executive has

been employed by Traditions Bank and will remain an employee of Traditions Bank until the Effective Time of the merger ( the “Merger”)

and the other transactions contemplated by the Agreement and Plan of Reorganization by and among ACNB, ACNB South Acquisition Subsidiary,

LLC, ACNB Bank, Traditions Bank and Traditions Bank' s parent holding company, TBI, dated July 23, 2024 (the “Reorganization

Agreement”);

WHEREAS, Traditions Bank,

ACNB Bank and their respective affiliates are engaged in the community banking business (the “Business”);

WHEREAS, the Executive is the Chief Executive Officer of

TBI and Traditions Bank;

WHEREAS, the Executive has

been a fundamental and elemental contributor to the systems, policies, procedures, processes, success, growth and leadership of Traditions

Bank;

WHEREAS, the Executive will

terminate his employment with TBI and Traditions Bank and their affiliates and subsidiaries effective and contingent upon the Effective

Time of the Merger as defined in and provided for in the Reorganization Agreement (the “Termination Date”);

WHEREAS, the Executive, TBI,

Traditions Bank, ACNB and ACNB Bank wish to settle, compromise and resolve any and all claims that the Executive may have against TBI,

Traditions Bank, ACNB, ACNB Bank or any of the affiliates or subsidiaries of such entities, including claims under the Executive's Employment

Agreement with TBI and Traditions Bank dated January 1, 2023 (the “Traditions Employment Agreement”), in order to facilitate

completion of the Merger;

WHEREAS, Employee is not

a party nor subject to any employment, change in control, noncompete, non-solicitation or restrictive covenant agreements, or any other

restrictions or agreements except the Traditions Employment Agreement; and

WHEREAS, ACNB has, as part

of this agreement, agreed to provide the Executive with certain special benefits that it was not otherwise obligated to provide, including

that ACNB will not dispute the Executive's claim that “Good Reason” as defined in the Traditions Employment Agreement has

occurred to Executive as of the Effective Time as defined in the Reorganization Agreement.

NOW THEREFORE, the Executive,

TBI, Traditions Bank, ACNB and ACNB Bank hereby agree to the following:

1. Effective

Date and Contingency. This Agreement shall be effective upon the Effective Time of the Merger as defined in and provided for in the Reorganization

Agreement.

None of the parties to this Agreement shall have

any rights or obligations set forth in this Agreement before the Effective Time. This Agreement shall be null and void if, and at such

time as, the Reorganization Agreement is terminated and the Merger is abandoned for any reason prior to the Effective Time of the Merger

(as defined in the Reorganization Agreement).

2. Separation

from Employment. The Executive's employment with TBI and Traditions Bank and its affiliates and subsidiaries shall terminate as of the

Termination Date. Traditions Bank will pay the Executive all salary and vacation benefits, payable through the Termination Date, subject

to standard withholdings and deductions, in accordance with its normal payroll processes.

3. Compensation

and Benefits.

(a) ACNB

agrees to pay (or cause its wholly owned subsidiary ACNB Bank to pay) the Executive a lump sum payment in the aggregate amount of $1,373,500,

subject to deductions and withholdings as required by law (the “Separation Payment”), in connection with the Executive's

termination of employment and in exchange for the promises and releases made by the Executive within this Agreement and specifically

in exchange for the Non Compete and Non Solicitation provisions of Section 6 below. The Separation Payment will be made as soon

as practicable, but in no event later than ten (10) business days after the Effective Time of Merger as defined in the Reorganization

Agreement, assuming such release is executed on the Termination Date and is not thereafter revoked.

(b) Subject

to the relevant plan and/or policy terms, provisions, conditions and/or requirements, as may be in effect from time to time, for a period

of three years following the Effective Time of the Merger, and for so long thereafter as the Executive serves on the ACNB and ACNB Bank

Boards of Directors, ACNB agrees to maintain for the benefit of Executive (or his named beneficiaries) one or more life insurance policies

having an aggregate death benefit of not less than $800,000.

(c) The

Executive agrees that the lump sum payment set forth in Section 3(a) and the performance of the obligations provided in Section 3(b) above

shall satisfy ALL of the obligations of TBI, Traditions Bank and their successors, ACNB and ACNB Bank under the Employment Agreement.

The Executive further acknowledges and agrees that there are no equity awards under the Employment Agreement and that he is waiving any

and all rights to continued life insurance, accident, health, and disability insurances, health and welfare benefits pursuant to and

as provided in the Employment Agreement.

(d) TBI,

Traditions Bank, ACNB and ACNB Bank shall not be responsible for any fees, taxes, penalties, costs or fines associated or in connection

with Internal Revenue Code Section 409A (or any successor provision thereto).

4. No

Other Obligations. Except as set forth in the preceding paragraphs and except as required under any “Traditions Benefits Plan”

(as defined in the Reorganization Agreement), neither ACNB, ACNB Bank or any ACNB subsidiaries or affiliates nor TBI or Traditions Bank

or any of their affiliates shall have any obligation to make any further payments to or for the Executive's benefit with respect to his

services on or before the Termination Date or in connection with or with respect to the Traditions Employment Agreement.

5. Release.

The Executive agrees to sign a release substantially in the form attached as Exhibit A to this Agreement on the Termination Date.

6. Non-Compete

and Non-Solicitation Provisions.

(a) The

Executive hereby covenants and agrees that for eighteen (18) months following the Termination Date that Executive shall not, except as

otherwise permitted in writing by ACNB:

(i) be

engaged, directly or indirectly, either for his own account or as agent, consultant, employee, partner, officer, director, proprietor,

investor (except as an investor owning less than 5% of the stock of a publicly owned company) or otherwise of any person, firm, corporation

or enterprise engaged in (1) the banking (including bank holding company) or financial services industry, or (2) any other

activity in which ACNB or ACNB Bank or any of their subsidiaries are engaged, in any county in which ACNB Bank has or operates a bank

branch or loan production office (including branches or offices operating under a trade name) as well as all counties or independent

cities contiguous to such county as of the business day after the Effective Time of the Reorganization Agreement (the “Non- Competition

Area”);

(ii) provide

financial or other assistance to any person, firm, corporation or enterprise engaged in (1) the banking (including bank holding

company) or financial services industry, or (2) any other activity in which ACNB or ACNB Bank or any of their subsidiaries are engaged

in the Non-Competition Area;

(iii) directly

or indirectly solicit (including advertising, social media or outreach) persons or entities who were customers, prospects or referral

sources of Traditions Bank, ACNB, ACNB Bank or their subsidiaries within one (1) year of Executive’s Termination Date, to

become a customer or referral source of a person or entity other than ACNB, ACNB Bank or their subsidiaries; or,

(iv) directly

or indirectly solicit employees of ACNB, ACNB Bank or their subsidiaries or Traditions Bank who were employed within two (2) years

of Executive’s Termination to leave the employ of ACNB, ACNB Bank or their subsidiaries or Traditions Bank or work for anyone other

than ACNB, ACNB Bank or their subsidiaries or Traditions Bank.

(b) It

is expressly understood and agreed that, although Executive and ACNB and ACNB Bank consider the restrictions contained in Section 6

hereof reasonable for the purpose of preserving for ACNB and ACNB Bank and their subsidiaries their goodwill and other proprietary rights,

if a final judicial determination is made by a court having jurisdiction that the time or territory or any other restriction contained

in Section 6 hereof is an unreasonable or otherwise unenforceable restriction against Executive, the provisions of Section 6

hereof shall not be rendered void but shall be deemed amended to apply as to such maximum time and territory and to such other extent

as such court may judicially determine or indicate to be reasonable.

7. Severability.

If any provision of this Agreement is illegal, invalid or unenforceable or is held to be illegal, invalid or unenforceable, the Executive

agrees that such provision shall be fully severable with respect to scope, time and geographic area, and this Agreement and its terms

in such lesser scope, time and geographic area shall be construed and enforced as if such unenforceable or invalid provision had never

been a part of this Agreement.

8. Confidentiality.

The Executive acknowledges that he has had access to trade secrets and other confidential information regarding Traditions Bank, ACNB,

ACNB Bank and their businesses that are unique and irreplaceable and that the use of such trade secrets and other confidential information

by a competitor, or certain other persons, would cause irreparable harm to ACNB, ACNB Bank and their predecessors and successors. Accordingly,

the Executive covenants that he will not disclose or use to the detriment of ACNB, ACNB Bank and their successors any such trade secrets

or other confidential information. Confidential information includes any information, whether or not reduced to written or other tangible

form, which (i) is not generally known to the public or within the industry; (ii) has been treated by Traditions Bank, ACNB

or ACNB Bank as confidential or proprietary; and (iii) is of competitive advantage to Traditions Bank, ACNB, ACNB Bank and their

successors. Nothing in this Agreement shall be interpreted or applied to prohibit the making of any good faith report to Traditions Bank's

or ACNB's auditors or any regulator, Governmental Agency or other governmental entity, participating in an investigation by any such

entity, or disclosure in compliance with a lawful subpoena, except that the entity or entities named by such subpoena must be informed

of the subpoena and be provided an opportunity to oppose disclosure pursuant to the subpoena.

9. Non-Disparagement.

The Executive covenants that, except to the extent required by law, he will not make to any person or entity any statement, whether written

or oral, that directly or indirectly impugns the integrity of, or reflects negatively on TBI, Traditions Bank, ACNB, ACNB Bank or any

of their employees, officers or directors, parent, subsidiaries, or affiliates or that denigrates, disparages or results in detriment

to any such entities or persons. This section does not prohibit any truthful statement made to any government agency in the context of

an official investigation.

10. No

Waiver. No waiver by any party of any breach of, or of compliance with, any condition or provision of this Agreement by another party

shall be considered a waiver of any other condition or provision or of the same condition or provision at another time.

11. Acknowledgments

and Affirmations. The Executive affirms that he has not filed, caused to be filed or presently is a party to any claim against TBI, Traditions

Bank, ACNB, ACNB Bank or any of their respective affiliates or subsidiaries.

12. Complete

Agreement. Except as provided herein, this Agreement supersedes any and all prior agreements between the Executive and, TBI, Traditions

Bank or ACNB and ACNB Bank, whether written or oral, including the Traditions Employment Agreement. This Agreement sets forth the entire

understanding of the parties as to the subject matter contained herein and may be amended only in writing by the parties hereto. Notwithstanding

the foregoing, the terms of the Supplemental Executive Retirement Plan Agreement, dated May 7, 2021, shall remain in full force

and effect.

13. Governing

Law. This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania (without regard

to conflict of laws principles) and any dispute pertaining to or arising out of this Agreement shall be brought only in the state or

federal courts located within the Commonwealth of Pennsylvania. Both parties irrevocably consent to the personal jurisdiction of the

state and federal courts located within the Commonwealth of Pennsylvania.

14. Survival.

The provisions set forth in Sections 6, 7, 8 and 9 shall survive termination of this Agreement for any reason.

15. Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which taken together shall constitute

one and the same instrument.

16. Assignment.

The Executive represents and warrants that he has not assigned or in any other manner conveyed any right or claim that he has or may

have to any third party, and he shall not assign or convey to any assignee for any reason any right or claim covered by this Agreement,

or the consideration, monetary or other, to be received by him hereunder. Traditions Bank or ACNB may assign their rights and obligations

under this Agreement to any third party at their discretion.

17. Payment

in the Event of Executive’s Death. This Agreement shall inure to the benefit of and be enforceable by Executive’s personal

or legal representatives, executors, administrators, heirs, distributees, devisees or legatees. If Executive should die after the Effective

Time of the Merger and any amounts would be payable to Executive under this Agreement if Executive had continued to live, all such amounts

shall be paid in accordance with the terms of this Agreement to Executive’s devisee, legatee, or other designee, or, if there is

no such designee, to Executive’s estate.

18. Executive

agrees and by this provision does hereby resign from the ACNB and ACNB Bank Boards of Directors when he is employed by or serves as a

director of a financial institution within the Non-Competition Area.

Signature Page Follows

IN Witness WHEREOF TBI, Traditions Bank, ACNB,

and ACNB Bank and the Executive have signed this Agreement on the date set forth above:

| ATTEST: |

|

TRADITIONS BANCORP, INC. |

| |

|

|

| /s/ Suzanne M. Becker |

|

By |

/s/ John D. Blecher |

| |

|

|

| ATTEST: |

|

TRADITIONS BANK |

| |

|

|

| /s/ Suzanne M.

Becker |

|

By |

/s/ John D. Blecher |

| |

|

|

| ATTEST: |

|

ACNB CORPORATION |

| |

|

|

| /s/ Kevin J.

Hayes |

|

By |

/s/ James

P. Helt |

| |

|

|

James P. Helt |

| |

|

|

President and Chief Executive Officer |

| |

|

|

| ATTEST: |

|

ACNB BANK |

| |

|

|

| /s/ Kevin J.

Hayes |

|

By |

/s/ James P. Helt |

| |

|

|

James P. Helt |

| |

|

|

President and Chief Executive Officer |

| |

|

|

| WITNESS: |

|

EXECUTIVE |

| |

|

|

| /s/ Suzanne M.

Becker |

|

/s/

Eugene J. Draganosky |

| |

|

Eugene J. Draganosky |

EXHIBIT A

RELEASE

I, Eugene

J. Draganosky, in consideration for the compensation, benefits and other items of consideration extended to me under the Agreement to

which this Release is attached as Exhibit A, on behalf of myself and my heirs, executors, administrators and assigns, hereby release,

waive and forever discharge Traditions Bancorp, Inc. (“TBI”), Traditions Bank (“Traditions Bank”), ACNB

Corporation (“ACNB”), and ACNB Bank, and their subsidiaries, affiliates, predecessors, successors, parent companies or assigns,

and their respective directors, officers, trustees, employees, representatives, attorneys and agents (individually and collectively the

“Releasees”) from any and all claims, demands, losses, liabilities, and causes of action of any nature or kind whatsoever

related to any past or present duties or responsibilities of any of the Releasees, known or unknown, suspected or unsuspected, which

arose or accrued on or before the effective date of this Release, including, but not limited to: claims in tort or contract; breach of

fiduciary duty; defamation; emotional distress; wrongful or unlawful discharge; claims for bonuses, severance pay, vacation leave, employee

or fringe benefits, or other compensation; and claims based on any state or federal wage, employment or common laws, statutes or amendments

thereto, including, but not limited to: (a) age discrimination claims under the Age Discrimination in Employment Act (“ADEA''),

29 U.S.C. § 621 et seq.; as amended by the Older Workers Benefit Protection Act; (b) any race, color, religion, sex or national

origin discrimination claims under Title VII of the 1964 Civil Rights Act, 42 U.S.C. § 2000(e) et seq.; (c) any

claim under the Americans with Disabilities Act (“ADA”), 42 U.S.C. § 12101 et seq.; (d) claims under the

Employee Retirement Income Security Act of 1974, as amended (“ERISA”), 29 U.S.C. § 1001 et seq.; (excluding claims

for vested benefits); (e) any claim under the National Labor Relations Act (“NLRA”), 29 U.S.C. § 151 et seq.;

(f) claims under the Worker Adjustment and Retraining Notification Act (“WARN”), 20 U.S.C. § 2101 et seq.;

(g) claims under any state discrimination in employment statute; (h) any claims related to or arising out of my entering into

this Agreement; (i) any claims related to or arising out of my former employment with and the termination of my employment and separation

from TBI, Traditions Bank or ACNB and ACNB Bank, including but not limited to a claim for wrongful discharge in violation of public policy;

or (j) any claims for damages due to personal injury or for compensatory or punitive damages.

Notwithstanding any provision

of this Release to the contrary, nothing contained herein shall be deemed to modify, waive, release, terminate or amend any right or

benefit I may possess under the terms of the Separation and Non-Competition Agreement to which this Release is attached as Exhibit A

(the “Agreement”), and I do not waive or release any right that I may have related to (i) vested benefits under any

TBI or Traditions Bank Compensation and Benefit Plan other than the Employment Agreement, (ii) any breach of the Agreement, (iii) any

claim or right that may arise after I sign this Release, (iv) any accrued but unused vacation leave as of the Termination Date,

(v) my rights as a shareholder, depositor or borrower of Traditions Bank or ACNB, or (vi) any right or benefit that cannot

be waived as a matter of law.

I specifically acknowledge

and represent that: (a) I have had a reasonable time, that is, up to twenty-one (21) days, within which to consider whether to provide

this Release, and that I am free to provide this Release prior to expiration of the twenty-one (21) days if I so desire; (b) the

terms of this Release are clear and understandable to me; (c) the compensation and benefits that ACNB and ACNB Bank and TBI and

Traditions Bank are providing to me under the Agreement to which this Release is attached exceed the compensation and benefits that I

was otherwise entitled to receive as an employee of Traditions Bank or ACNB; (d) I have been advised to consult with an attorney

of my choice prior to signing this Release; (e) I have been advised that I have the right to revoke this Release at any time during

the seven (7) day period following the date on which I sign the Release; (f) by providing this Release, I give up any

right to sue any of the Releasees for any violation of the Age Discrimination in Employment Act, or any other statute, law or common

law; and (g) I have the legal capacity to provide this Release and I have signed this Release and the Agreement knowingly and voluntarily.

All capitalized terms which

are defined in the Agreement and which are not otherwise defined herein shall have the meaning set forth in the Agreement.

The Agreement shall not become

effective or enforceable until the expiration of the seven (7) day revocation period following the execution of this release.

EXECUTIVE

| /s/

Eugene J. Draganosky |

|

| Eugene J. Draganosky |

|

| |

|

| DATED: |

1/31/25 |

|

Exhibit 99.1

|

Press Release |

FOR IMMEDIATE RELEASE

| |

Contact: |

Kevin Hayes |

| |

|

SVP/ General Counsel, |

| |

|

Secretary, and Chief |

| |

|

Governance Officer |

| |

|

717.339.5161 |

| |

|

khayes@acnb.com |

ACNB

Corporation announceS Completion

of

Traditions BANCORP, inc. Acquisition

GETTYSBURG,

PA, February 3, 2025 --- ACNB Corporation (NASDAQ: ACNB), the parent financial holding company of ACNB Bank, a Pennsylvania state-chartered,

FDIC-insured community bank, headquartered in Gettysburg, PA, announced the completion of the acquisition of Traditions Bancorp, Inc.

(“Traditions”) and its wholly-owned subsidiary, Traditions Bank, headquartered in York, PA, effective February 1, 2025.

Traditions was merged with and into a wholly-owned subsidiary of ACNB Corporation immediately followed by the merger of Traditions Bank

with and into ACNB Bank. ACNB Bank will operate the former Traditions Bank branches as “Traditions Bank, A Division of ACNB Bank”.

In connection with the close of the acquisition, Traditions stockholders received 0.7300 shares of ACNB Corporation common stock for

each share of Traditions common stock that they owned as of the closing date, with cash paid in lieu of fractional shares.

In

addition, at the close of the acquisition, three former Traditions directors, Eugene J. Draganosky, Elizabeth F. Carson, and John M.

Polli, joined the Boards of Directors of ACNB Corporation and ACNB Bank. Mr. Draganosky has nearly 40 years of banking experience,

and is the former CEO and Chair of the Board of Traditions and Traditions Bank, having held those roles since 2017 and 2023, respectively.

Ms. Carson, Lead Independent Director of Traditions, joined the Traditions Bank Board in 2015, after over 30 years of banking experience

in a variety of leadership roles with community and regional banks. Mr. Polli was a member of the Traditions Bank board of directors

since its founding in 2002, and has nearly 40 years of diverse business expertise, from serving as a public accountant to owning, managing,

and advising businesses in the transportation, real estate, and insurance industries.

ACNB Corporation

Press Release/ACNB Corporation Announces

Completion of Traditions Bancorp, Inc. Acquisition

February 3,

2025

Page 2

of 4

With

the combination of the two organizations, and based on financial information for each organization as of December 31, 2024, ACNB

Corporation will have approximately $3.26 billion in assets, $2.04 billion in deposits, and $2.36 billion in loans, and will serve its

customers throughout 35 community banking offices in south central Pennsylvania and northern Maryland.

“We

are pleased to announce the completion of our strategic acquisition of Traditions Bancorp, and excited to unite our teams of dedicated

local bankers who are committed to their customers and communities,” stated ACNB Corporation President & Chief Executive

Officer James P. Helt. “This combination brings together organizations that are unified by a shared vision, values, and a customer-centric

approach to banking, to create an even stronger community bank. Importantly, our customers will benefit from expanded products and services

delivered by the familiar faces they have come to know and trust. This merger positions us well to continue to grow in the attractive

York and Lancaster County markets, and enhances ACNB Bank’s mortgage operations, which will now serve customers throughout our

footprint as ‘Traditions Mortgage, A Division of ACNB Bank.’ Together, we look forward to continuing to deliver on our vision

of being the financial services provider of choice in the communities we serve.”

Alan

J. Stock, Chair of the Board of ACNB, stated “We welcome Mr. Draganosky, Ms. Carson, and Mr. Polli to the ACNB Boards

of Directors, and are confident that their expertise, skills, and strong connections to the York and Lancaster market areas will enhance

and complement ACNB’s current Boards of Directors. We are committed to enhancing value for our shareholders and are poised to deliver

on that commitment with an experienced and knowledgeable board, a seasoned management group, and a team of bankers and professionals

dedicated to a successful integration and customer experience.”

ACNB Corporation

Press Release/ACNB Corporation Announces

Completion of Traditions Bancorp, Inc. Acquisition

February 3,

2025

Page 3

of 4

Bybel

Rutledge LLP served as legal counsel and Piper Sandler served as financial advisor to ACNB Corporation for the transaction. Pillar +

Aught served as legal counsel and Stephens Inc. served as financial advisor to Traditions Bancorp, Inc.

About ACNB Corporation

ACNB

Corporation, headquartered in Gettysburg, PA, is the $3.26 billion financial holding company for the wholly-owned subsidiaries of ACNB

Bank, Gettysburg, PA, and ACNB Insurance Services, Inc., Westminster, MD. Originally founded in 1857, ACNB Bank serves its marketplace

with banking and wealth management services, including trust and retail brokerage, via a network of 35 community banking offices and

two loan offices located in the Pennsylvania counties of Adams, Cumberland, Franklin, Lancaster and York and the Maryland counties of

Baltimore, Carroll and Frederick. ACNB Insurance Services, Inc. is a full-service insurance agency with licenses in 46 states. The

agency offers a broad range of property, casualty, health, life and disability insurance serving personal and commercial clients through

office locations in Westminster and Jarrettsville, MD, and Gettysburg, PA. For more information regarding ACNB Corporation and its subsidiaries,

please visit investor.acnb.com.

# # #

ACNB Corporation

Press Release/ACNB Corporation Announces

Completion of Traditions Bancorp, Inc. Acquisition

February 3,

2025

Page 4

of 4

FORWARD-LOOKING

STATEMENTS - In addition to historical information, this press release may contain forward-looking statements. Examples of forward-looking

statements include, but are not limited to, (a) projections or statements regarding future earnings, expenses, net interest income,

other income, earnings or loss per share, asset mix and quality, growth prospects, capital structure, and other financial terms, (b) statements

of plans and objectives of Management or the Board of Directors, and (c) statements of assumptions, such as economic conditions

in the Corporation’s market areas. Such forward-looking statements can be identified by the use of forward-looking terminology

such as “believes”, “expects”, “may”, “intends”, “will”, “should”,

“anticipates”, or the negative of any of the foregoing or other variations thereon or comparable terminology, or by discussion

of strategy. Forward-looking statements are subject to certain risks and uncertainties such as national, regional and local economic

conditions, competitive factors, and regulatory limitations. Actual results may differ materially from those projected in the forward-looking

statements. Such risks, uncertainties, and other factors that could cause actual results and experience to differ from those projected

include, but are not limited to, the following: short-term and long-term effects of inflation and rising costs on the Corporation, customers

and economy; banking instability caused by bank failures and financial uncertainty of various banks which may adversely impact the Corporation

and its securities and loan values, deposit stability, capital adequacy, financial condition, operations, liquidity, and results of operations;

effects of governmental and fiscal policies, as well as legislative and regulatory changes; effects of new laws and regulations (including

laws and regulations concerning taxes, banking, securities and insurance) and their application with which the Corporation and its subsidiaries

must comply; impacts of the capital and liquidity requirements of the Basel III standards; effects of changes in accounting policies

and practices, as may be adopted by the regulatory agencies, as well as the Financial Accounting Standards Board and other accounting

standard setters; ineffectiveness of the business strategy due to changes in current or future market conditions; future actions or inactions

of the United States government, including the effects of short-term and long-term federal budget and tax negotiations and a failure

to increase the government debt limit or a prolonged shutdown of the federal government; effects of economic conditions particularly

with regard to the negative impact of any pandemic, epidemic or health-related crisis and the responses thereto on the operations of

the Corporation and current customers, specifically the effect of the economy on loan customers’ ability to repay loans; effects

of competition, and of changes in laws and regulations on competition, including industry consolidation and development of competing

financial products and services; inflation, securities market and monetary fluctuations; risks of changes in interest rates on the level

and composition of deposits, loan demand, and the values of loan collateral, securities, and interest rate protection agreements, as

well as interest rate risks; difficulties in acquisitions and integrating and operating acquired business operations, including information

technology difficulties; challenges in establishing and maintaining operations in new markets; effects of technology changes; effects

of general economic conditions and more specifically in the Corporation’s market areas; failure of assumptions underlying the establishment

of reserves for credit losses and estimations of values of collateral and various financial assets and liabilities; acts of war or terrorism

or geopolitical instability; disruption of credit and equity markets; ability to manage current levels of impaired assets; loss of certain

key officers; ability to maintain the value and image of the Corporation’s brand and protect the Corporation’s intellectual

property rights; continued relationships with major customers; and, potential impacts to the Corporation from continually evolving cybersecurity

and other technological risks and attacks, including additional costs, reputational damage, regulatory penalties, and financial losses;

and, the other factors detailed in ACNB’s publicly-filed documents, including its Annual Report on Form 10-K for the year

ended December 31, 2023, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and

September 30, 2024, and its other filings with the SEC. We caution readers not to place undue reliance on these forward-looking

statements. The forward-looking statements only speak as of the date hereof, and ACNB does assume any obligation to revise, update or

clarify forward-looking statements to reflect events or conditions after the date of this press release.

ACNB #2025-5

February 3,

2025

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

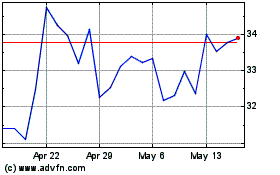

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Feb 2025 to Mar 2025

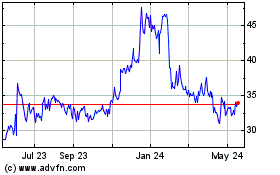

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Mar 2024 to Mar 2025