Filed pursuant to Rule 424(b)(5)

Registration

No. 333-281999

PROSPECTUS SUPPLEMENT

(to Prospectus dated

September 23, 2024)

ACLARION, INC.

Up to $1,075,000

Common Stock

We have entered into an At-The-Market

Issuance Sales Agreement (the “Sales Agreement”) with Ascendiant Capital Markets, LLC (the “Sales Agent” or “ACM”)

relating to the sale of shares of our common stock, par value $0.00001 per share, offered by this prospectus supplement and the accompanying

prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock bearing an aggregate

offering price of up to $1,075,000 from time to time through or to ACM, acting as an agent or principal.

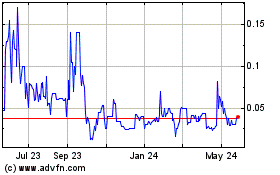

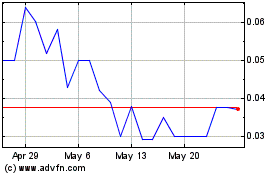

Our common stock is quoted

on the Nasdaq Capital Market under the symbol “ACON.” The last reported sale price of our common stock on the Nasdaq Capital

Market on September 23, 2024 was $0.1761 per share. Our warrants offered in connection with our initial public offering (the “IPO

Warrants”) are quoted on the Nasdaq Capital Market under the symbol “ACONW.” The last reported sale price of our IPO

Warrants on the Nasdaq Capital Market on September 23, 2024 was $0.038 per IPO Warrant.

As of the date of this prospectus

supplement, the aggregate market value of our outstanding shares of common stock held by non-affiliates, or public float, was determined

to be $3,247,370 based on 10,044,728 shares of common stock outstanding, of which 10,026,843 are held by non-affiliates, and the closing sale

price of our shares of common stock on the Nasdaq Capital Market of $0.3239 on July 26, 2024, which is within 60 days of the date of this

prospectus supplement. Upon any sale of shares of common stock under this prospectus supplement pursuant to General Instruction I.B.6

of Form S-3, in no event will the aggregate market value of securities sold by us or on our behalf pursuant to General Instruction I.B.6

of Form S-3 during the twelve calendar month period immediately prior to, and including, the date of any such sale exceed one-third of

the aggregate market value of our shares of common stock held by non-affiliates, calculated in accordance with General Instruction I.B.6

of Form S-3. During the prior 12 calendar month period that ends on, and includes, the date of this prospectus supplement (excluding this

offering), we have sold $0 of our securities pursuant to General Instruction I.B.6 of Form S-3.

Sales of our common stock,

if any, under this prospectus supplement will be made in sales deemed to be an “at the market offering” as defined in Rule

415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). ACM is not required to sell any

specific amount of securities but will be acting as our sales agent using commercially reasonable efforts consistent with its normal trading

and sales practices, on mutually agreed terms between ACM and us. There is no arrangement for funds to be received in an escrow, trust

or similar arrangement.

The compensation to ACM for

sales of common stock sold pursuant to the Sales Agreement will be up to 3% of the gross proceeds of any shares of common stock sold under

the Sales Agreement. In connection with the sale of the common stock on our behalf, ACM will be deemed to be an “underwriter”

within the meaning of the Securities Act and the compensation of ACM will be deemed to be underwriting commissions or discounts. We have

also agreed to provide indemnification and contribution to ACM with respect to certain liabilities, including liabilities under the Securities

Act or the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We have received deficiency

letters from The Nasdaq Stock Market LLC (“Nasdaq”) that we are not in compliance with Nasdaq’s (i) minimum bid price

requirement of at least $1.00 per share (the “Bid Price Requirement”) and (ii) requirement to have at least $2,500,000 in

stockholders’ equity (the “Stockholders’ Equity Requirement”).

On April 8, 2024, we received

a written notice from Nasdaq indicating that we were not in compliance with the Bid Price Requirement set forth in Nasdaq Listing Rule

5550(a)(2) for continued listing on the Nasdaq Capital Market (the “Bid Price Notice”). The Bid Price Notice did not result

in the immediate delisting of our common stock from the Nasdaq Capital Market. The Bid Price Notice indicated that we would be provided

180 calendar days (or until October 7, 2024) in which to regain compliance. If at any time during this 180 calendar day period the bid

price of our common stock closes at or above $1.00 per share for a minimum of ten consecutive business days, the Nasdaq staff (the “Staff”)

will provide us with written confirmation of compliance and the matter will be closed. In the event we do not regain compliance with Rule

5550(a)(2) prior to the expiration of the initial 180 calendar day period, and if it appears to the Staff that we will not be able to

cure the deficiency, or if we are not otherwise eligible, the Staff will provide us with written notification that our securities are

subject to delisting from the Nasdaq Capital Market. At that time, we may appeal the delisting determination to a Nasdaq hearings panel

(the “Panel”).

At the Company’s special

stockholders’ meeting on September 23, 2024, the Company’s stockholders approved a proposal to grant discretionary authority

to our board of directors to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser

number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five (1-for-5) to

a maximum of a one-for-fifty (1-for-50) split, with the exact ratio to be determined by our board of directors in its sole discretion;

and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders. The Company

intends to implement a reverse stock split in the near future in order to assist with the Company’s compliance with Nasdaq’s

Bid Price Requirement.

On August 22, 2024, we received

a written notice from Nasdaq indicating that we were not in compliance with the Stockholders’ Equity Requirement. In our quarterly

report on Form 10-Q for the period ended June 30, 2024, we reported stockholders’ equity of $1,642,177, and, as a result, did not

satisfy Listing Rule 5550(b)(1). Accordingly, the Staff had determined to delist our common stock from Nasdaq. Nasdaq’s letter provided

us until August 29, 2024 to request an appeal of this determination.

We have appealed these matters

to the Panel. The hearing request stays any suspension or delisting action pending the conclusion of the hearing process and the expiration

of any additional extension period granted by the Panel following the hearing. We have an appeal hearing scheduled on October 10, 2024

before the Panel to appeal the delisting notice from the Staff. While the appeal process is pending, the suspension of trading of our

common stock will be stayed. Our common stock will continue to trade on Nasdaq until the hearing process concludes and the Panel issues

a written decision.

We intend to take all reasonable

measures available to regain compliance under the Nasdaq Listing Rules and remain listed on Nasdaq. We are currently evaluating our available

options to resolve the deficiency and regain compliance with the Stockholders’ Equity Requirement.

Our receipt of these letters

from Nasdaq does not affect our business, operations or reporting requirements with the Securities and Exchange Commission.

We are an “emerging

growth company” and a “smaller reporting company” as defined under the federal securities laws and, as such, have elected

to be subject to reduced public company reporting requirements.

Investing in our securities

involves risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning

on page S-11 of this prospectus supplement and under similar headings in the other documents that are incorporated by reference in this

prospectus supplement and the accompanying prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

ASCENDIANT CAPITAL MARKETS, LLC

The date of this prospectus supplement is September

24, 2024.

PROSPECTUS SUPPLEMENT

TABLE OF CONTENTS

PROSPECTUS

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of

two parts. The first part is this prospectus supplement, including the information incorporated by reference, which describes the specific

terms of this offering and other matters relating to us. The second part is the accompanying prospectus, which provides more general information

about us and the securities we may offer from time to time, some of which may not apply to this offering. This prospectus supplement and

the accompanying prospectus are part of the registration statement on Form S-3 (Registration No. 333-281999) that we filed with the Securities

and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this “shelf” registration

process, we may, from time to time, sell or issue any of the combination of securities described in the accompanying prospectus in one

or more offerings with a maximum aggregate offering price of up to $50,000,000. Each time we sell securities, we provide a prospectus

supplement that contains specific information about the terms of that offering. A prospectus supplement may also add, update, or change

information contained in the accompanying prospectus. You should read both this prospectus supplement and the accompanying prospectus,

together with the documents incorporated by reference and the additional information described under the heading “Where You Can Find More Information” in this prospectus supplement and the accompanying prospectus before making an investment decision.

To the extent there is a conflict

between the information contained in this prospectus supplement and the accompanying prospectus, you should rely on the information in

this prospectus supplement. This prospectus supplement, the accompanying prospectus, and the documents we incorporate by reference herein

and therein include important information about us, this offering and our securities and other information you should know before investing.

If any statement in this prospectus supplement conflicts with any statement in a document that has been incorporated herein by reference,

then you should consider only the statement in the more recent document.

The distribution of this prospectus

supplement and the accompanying prospectus and the offering of our securities in certain jurisdictions may be restricted by law. We are

not, and ACM is not, making an offer of these securities in any jurisdiction where the offer is not permitted. Persons who come into possession

of this prospectus supplement and the accompanying prospectus should inform themselves about and observe any such restrictions. This prospectus

supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer or solicitation by anyone

in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is

not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

You should rely only on the

information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus, and any free writing

prospectus prepared by or on behalf of us or to which we have referred you. We have not, and ACM has not, authorized any person to provide

you with any information or to make any representation other than as contained in this prospectus supplement or in the accompanying prospectus

and the information incorporated by reference herein and therein. We and ACM do not take any responsibility for, and can provide no assurance

as to the reliability of, any information that others may provide you. The information appearing or incorporated by reference in this

prospectus supplement and the accompanying prospectus is accurate only as of the date of this prospectus supplement or the date of the

document in which incorporated information appears unless otherwise noted in such documents. Our business, financial condition, results

of operations and prospects may have changed since those dates. You should assume that the information appearing in this prospectus supplement,

the accompanying prospectus, and the documents incorporated by reference herein and therein is accurate only as of the date of those respective

documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should carefully

read this entire prospectus supplement and the accompanying prospectus, including the information included and referred to under “Risk Factors” below, the information incorporated by reference in this prospectus supplement and in the accompanying prospectus,

and the financial statements and the other information incorporated by reference in the accompanying prospectus, before making an investment

decision.

Unless the context indicates

otherwise, as used in this prospectus supplement, unless the context otherwise requires, references to “we,” “us,”

“our,” “the Company” and “Aclarion” refer to Aclarion, Inc.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus supplement

and the accompanying prospectus and the documents incorporated by reference herein and therein may contain forward looking statements

that involve significant risks and uncertainties. All statements other than statements of historical fact contained in this prospectus

supplement and the accompanying prospectus and the documents incorporated by reference herein and therein, including statements regarding

future events, our future financial performance, business strategy, and plans and objectives of management for future operations, are

forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts,” “should,”

or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements

unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and

involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere

in this prospectus supplement and the documents incorporated by reference herein, which may cause our or our industry’s actual results,

levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a highly

regulated, very competitive, and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict

all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors,

may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking

statements largely on our current expectations and assumptions about future events and financial trends that we believe may affect our

financial condition, results of operations, business strategy, short term and long term business operations, and financial needs. These

forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from

those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited

to, those discussed in this prospectus supplement, and in particular, the risks discussed below and under the heading “Risk Factors”

and those discussed in other documents we file with the SEC which are incorporated by reference herein. This prospectus supplement and

the accompanying prospectus should be read in conjunction with the consolidated financial statements for the fiscal years ended December 31,

2023 and 2022 and related notes, as well as our annual and quarterly financial statements filed thereafter, each of which are or will

be incorporated by reference herein.

We undertake no obligation

to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. In light of

the significant risks, uncertainties and assumptions that accompany forward-looking statements, the forward-looking events and circumstances

discussed in this prospectus supplement and the accompanying prospectus may not occur and actual results could differ materially and adversely

from those anticipated or implied in the forward-looking statement.

You should not place undue

reliance on any forward-looking statement, each of which applies only as of the date of this prospectus supplement. Except as required

by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this prospectus

supplement to conform our statements to actual results or changed expectations.

Any forward-looking statement

you read in this prospectus supplement or accompanying prospectus or any document incorporated by reference reflects our current views

with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our operations, operating

results, growth strategy and liquidity. You should not place undue reliance on these forward-looking statements because such statements

speak only as to the date when made. We assume no obligation to publicly update or revise these forward-looking statements for any reason,

or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new

information becomes available in the future, except as otherwise required by applicable law. All subsequent forward-looking statements

attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained

or referred to in this section. You are advised, however, to consult any further disclosures we make on related subjects in our reports

on Forms 10-Q, 8-K and 10-K filed with the SEC. You should understand that it is not possible to predict or identify all risk factors.

Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information about us and this offering appearing in this prospectus supplement, the accompanying prospectus and the documents

incorporated or deemed incorporated by reference herein and therein. This summary may not contain all of the information that you should

consider before making an investment decision. You should read carefully the more detailed information included or referred to under the

heading “Risk Factors” of this prospectus supplement and the other information included in this prospectus supplement, the

accompanying prospectus, the documents incorporated or deemed incorporated by reference herein and therein, including our Annual Report

on Form 10-K for the year ended December 31, 2023, before deciding to invest in our common stock.

Overview

We are a healthcare technology

company that leverages Magnetic Resonance Spectroscopy (“MRS”), and a proprietary biomarker to optimize clinical treatments.

Our technology addresses the $134.5B U.S. low back and neck pain market, which according to a 2020 JAMA (Journal of the American Medical

Association) article is now the most costly healthcare condition in the United States. We are currently utilizing Artificial Intelligence

(“AI”) to assist in quality control processes that flag spectroscopy data indicative of a poor MRS study. The use of AI in

this application is early in its development cycle and is expected to evolve with further research and development. We are also researching

the application of AI and machine learning platforms to analyze both the raw spectroscopy data and the post-processed signal to evaluate

whether AI platforms can more efficiently and more effectively associate MRS data with clinical outcomes. The use of AI in this application

is aspirational and we intend this type of AI research and development to be an ongoing process applied not only to the various treatment

paths associated with back pain, such as conservative therapies, regenerative and cell therapies and surgical intervention, but also to

potentially expand into other clinical explorations involving the diagnosis of brain, breast and prostate tumors.

We are addressing this market

by initially focusing on improving the outcomes of surgical interventions to treat low back pain and have limited sales to date. In this

initial application, our technology is intended to assist surgeons in determining the optimal surgical procedure for a patient undergoing

surgery for pain isolated to their lumbar spine (the “lumbar spine” is comprised of the five (5) lower vertebrae, L-1 to L-5).

We then intend to add additional applications of our technology targeting the management of large segments of low back pain patients from

the point of initial Magnetic Resonance Imaging (“MRI”) through to episode resolution. We believe this will expand the use

of our technology to low back pain patients undergoing conservative therapies such as physical therapy or biologic and cell therapies

aimed at regenerating the lumbar discs. We plan to expand the application of our technology beyond the lumbar spine to address neck pain

populations in addition to low back pain populations. To expand the application of our technology for use in neck pain populations, we

will need to overcome technical changes associated with securing adequate MRS data from the cervical disc, which is significantly smaller

than the lumbar disc, and there can be no assurance we will be able to overcome these challenges.

The core technology we employ

is MRS. The patient experience when undergoing an MRS exam is exactly like that of a standard MRI, with the exception of an additional

3-5 minutes for each disc undergoing a spectroscopy exam. Whereas a standard MRI produces a signal that is converted into anatomical images,

an MRS produces a signal that is converted into a waveform that identifies the chemical composition of tissues. Just like with standard

MRI’s, the data from spectroscopy is useless without technologies that can process the data. We have developed proprietary signal

processing software that transforms spectroscopy data into clear biomarkers. These biomarkers, which are exclusively licensed from the

Regents of University of California, San Francisco, are the key data inputs for our proprietary algorithms that, when applied, determine

if an intervertebral disc is consistent with pain. Our patent portfolio includes 22 U.S. Patents, 17 Foreign Patents, 6 pending U.S. patent

applications, and 7 pending Foreign patent applications, including patents and patent applications exclusively licensed from Regents of

the University of California.

We believe one of the biggest

issues driving the cost of treating low back and neck pain patients to the top of the list for healthcare spending is that there is no

objective, cost effective and noninvasive diagnostics to reliably identify the source of a patient’s pain. We believe the poor

surgical outcomes for Discogenic Low Back Pain (“DLBP”) are largely due to difficulties in reliably and accurately diagnosing

the specific spinal discs that are causing pain. The current primary diagnostic standard is the MRI, which is useful for showing abnormal

structures and tissue dehydration, but, we believe, cannot reliably identify specific discs that are causing pain. To diagnose specific

discs that are causing pain, a needle-based Provocation Discogram test (“PD Test”) has been developed. PD Tests have been

shown to be highly accurate when performed properly. However, a PD Test is invasive, subjective and unpleasant for the patient as the

patient needs to be awake in order to tell the physician if the pain the physician is purposefully causing in the disc is the same as

the pain the patient feels when they are experiencing a back pain episode. In addition, recent evidence has shown that the action of

inserting a needle into a normal disc during a discogram procedure leads to an increased rate of degeneration in these previously normal

discs. Based on the limitations and concerns of the PD Test, we believe there is a significant need for an objective, accurate, personalized

and noninvasive diagnostic test that can reliably determine if an individual disc is a pain generator. By providing physicians information

about whether a disc has the chemical and structural makeup consistent with pain or not, we believe the treatment plan for each patient

will lead to more efficient and targeted care that, will in turn, result in lower costs and healthier patient outcomes.

We have taken the first steps

to demonstrate the potential use of our technology in helping to improve the outcome of surgical intervention for DLBP patients by publishing

a clinical study (Gornet et al) in the European Spine Journal in April 2019. The study illustrated that when all discs identified as consistent

with pain by our technology were included in a surgical treatment, 97% of the patients met the criteria for “clinical improvement”.

This compared to only 54% of patients meeting the criteria for clinical improvement if a disc that our technology identified as consistent

with pain, was not included in the surgical treatment.

The results of this clinical

study led the CPT committee to approve four Category III codes for our technology in January 2021. The NIH also included our technology

as one of the handful of technologies selected to participate in their $150 million Back Pain Consortium (BACPAC) Research Program, an

NIH translational, patient-centered effort to address the need for effective and personalized therapies for chronic low back pain.

In April 2023, we have advanced

the evidence of our technology with a peer-reviewed journal article detailing the Gornet 2-year outcomes, published in the European Spine

Journal. The 2-year outcomes were durable with 1-year outcomes previously published in 2019. At 2-years follow-up, 85% of patients improved

when disc(s) identified as consistent with pain by our technology were included in a surgical treatment, compared to only 63% of patients

when disc(s) identified as consistent with pain were not treated or disc(s) identified as consistent without pain were treated.

Emerging Growth Company under the JOBS

Act

As a company with less than

$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our

Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting

requirements and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As

an emerging growth company:

| · | We may present only two years of audited financial statements and only two years of related Management’s

Discussion and Analysis of Financial Condition and Results of Operations; |

| · | We are exempt from the requirement to obtain an attestation and report from our auditors on whether we

maintained effective internal control over financial reporting under the Sarbanes-Oxley Act; |

| · | We are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| · | We are not required to give our stockholders non-binding advisory votes on executive compensation or golden

parachute arrangements. |

We may take advantage of these

provisions until December 31, 2026 (the last day of the fiscal year following the fifth anniversary of our initial public offering) if

we continue to be an emerging growth company. We would cease to be an emerging growth company if we have more than $1.235 billion in annual

revenue, have more than $700 million in market value of our shares held by non-affiliates or issue more than $1.0 billion of non-convertible

debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have elected to provide

two years of audited financial statements. Additionally, we have elected to take advantage of the extended transition period provided

in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards

that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth

company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act. Accordingly, the information contained herein may be different from the information you receive from other public companies that

are not emerging growth companies.

We are also a “smaller

reporting company” meaning that the market value of our stock held by non-affiliates is less than $700 million and our annual revenue

was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company if either

(i) the market value of our stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million

during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. If

we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain

disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose

to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar

to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

Corporate Information

We were formed under the

name Nocimed, LLC, a limited liability company in January 2008, under the laws of the State of Delaware. In February 2015, Nocimed, LLC

was converted into Nocimed, Inc. a Delaware corporation. On December 3, 2021, we changed our name to Aclarion, Inc. Our principal executive

offices are located at 8181 Arista Place, Suite 100, Broomfield, Colorado 80021. Our main telephone number is (833) 275-2266. Our internet

website is www.aclarion.com. The information contained in, or that can be accessed through, our website is not incorporated by reference

and is not a part of this prospectus supplement.

THE OFFERING

| Common stock offered by us |

|

Shares of common stock having an aggregate offering price up to $1,075,000. |

| |

|

|

| Common stock to be outstanding after this offering |

|

Up to 16,149,214 shares, assuming sales of 6,104,486 shares of our common

stock in this offering at an offering price of $0.1761 per share, which was the last reported sale price of our common stock on the Nasdaq

Capital Market on September 23, 2024. The actual number of shares issued will vary depending on the sales price under this offering. |

| |

|

|

| Plan of Distribution |

|

“At the market offering” that may be made from time to time through or to ACM, as our sales agent or principal. See “Plan of Distribution” in this prospectus supplement. |

| |

|

|

| Use of Proceeds |

|

We intend to use the net proceeds from this offering to fund market

development and clinical evidence, product development and quality, and general and administration support, and other general corporate

purposes. See “Use of Proceeds” for further information. |

| |

|

|

| Risk Factors |

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-11 of this prospectus supplement and in our accompanying prospectus and the Annual Report on Form 10-K incorporated by reference herein for a discussion of factors you should consider carefully before deciding to invest in our shares of our common stock. |

| |

|

|

| Nasdaq Capital Market Symbols |

|

Common Stock “ACON”. IPO Warrants

“ACONW”. |

The number of shares outstanding

after this offering is based on 10,044,728 shares of our common stock outstanding as of September 23, 2024, and excludes as of such date:

| · | 136,123 shares of our common stock issuable upon the exercise of outstanding stock options granted under

our 2015 Stock Plan, |

| · | 33,334 shares of our common stock issuable upon the exercise of outstanding stock options granted under

our 2022 Stock Plan, |

| · | 10,350,000 shares of our common stock issuable upon the exercise of our outstanding

February 2024 public offering warrants, |

| · | 130,093 shares of our common stock reserved for future grant under our 2022 Stock Plan, |

| · | 155,610 shares of common stock issuable upon the exercise of our outstanding IPO Warrants, |

| · | 551,815 shares of common stock issuable upon the exercise of outstanding privately placed warrants, |

| · | 10,825 shares of common stock reserved for issuance upon the exercise of an outstanding IPO underwriter

representative common stock warrant, |

| · | approximately 3,974,580 shares of common stock which may be issued upon conversion of our outstanding Series B Convertible Preferred

Stock at the current conversion price of $0.234, and |

| | · | up to $6.8 million worth of common stock that may be sold in the future

by us to White Lion from time to time pursuant to the Equity Line Purchase Agreement. |

RISK FACTORS

An investment in our shares

of common stock involves a high degree of risk. Before investing in our shares of common stock, you should carefully consider the risk

factors set forth below and those described under “Risk Factors” in the documents incorporated by reference herein,

including in our most recent Annual Report on Form 10-K filed with the SEC, together with the other information included in this prospectus

supplement and incorporated by reference herein from our filings with the SEC. If any of such risks or uncertainties occurs, our business,

financial condition, and operating results could be materially and adversely affected. Additional risks and uncertainties not currently

known to us or that we currently deem immaterial also may materially and adversely affect our business operations. As a result, the trading

price of our common stock could decline and you could lose all or a part of your investment.

Risks Related to Our Financial Position and

Need for Additional Capital

Our auditors have expressed substantial

doubt about our ability to continue as a going concern, which may hinder our ability to obtain further financing.

Our past working capital deficiency,

stockholders’ deficit and recurring losses from operations raised substantial doubt about our ability to continue as a going concern.

As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements

for the year ended December 31, 2023, with respect to this uncertainty. As of June 30, 2024, we had cash of approximately $1.2 million.

Subsequent to June 30, 2024, we raised capital using an offering pursuant to Tier 2 of Regulation A promulgated under the Securities Act.

We believe our current cash will fund our operating expenses and capital expenditure requirements into the fourth quarter of 2024. If

we are unable to raise capital when needed or on acceptable terms, we would be forced to delay, reduce, or eliminate our technology development

and commercialization efforts.

We are not currently in compliance

with the minimum bid price requirement and minimum stockholders’ equity rule of the Nasdaq Capital Market and a delisting

could limit the liquidity of our stock, increase its volatility and hinder our ability to raise capital.

We have received deficiency letters from The Nasdaq

Stock Market LLC (“Nasdaq”) that we are not in compliance with Nasdaq’s (i) minimum bid price requirement of at least

$1.00 per share (the “Bid Price Requirement”) and (ii) the requirement to have at least $2,500,000 in stockholders’

equity (the “Stockholders’ Equity Requirement”).

On April 8, 2024, we received a written notice

(the “Bid Price Notice”) from Nasdaq indicating that we were not in compliance with the Bid Price Requirement set forth in

Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq Capital Market. The Bid Price Notice did not result in the immediate

delisting of our common stock from the Nasdaq Capital Market.

The Notice indicated that we would be provided

180 calendar days (or until October 7, 2024) in which to regain compliance. If at any time during this 180 calendar day period the bid

price of our common stock closes at or above $1.00 per share for a minimum of ten consecutive business days, the Nasdaq staff (the “Staff”)

will provide us with a written confirmation of compliance and the matter will be closed. In the event we do not regain compliance with

Rule 5550(a)(2) prior to the expiration of the initial 180 calendar day period, and if it appears to the Staff that we will not be able

to cure the deficiency, or if we are not otherwise eligible, the Staff will provide us with written notification that our securities are

subject to delisting from the Nasdaq Capital Market. At that time, we may appeal the delisting determination to a Nasdaq hearings panel

(the “Panel”).

At the Company’s special

stockholders’ meeting on September 23, 2024, the Company’s stockholders approved a proposal to grant discretionary authority

to our board of directors to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser

number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five (1-for-5) to

a maximum of a one-for-fifty (1-for-50) split, with the exact ratio to be determined by our board of directors in its sole discretion;

and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders. The Company

intends to implement a reverse stock split in the near future in order to assist with the Company’s compliance with Nasdaq’s

Bid Price Requirement.

On August 22, 2024, we received a letter from

Nasdaq indicating that we were not in compliance with the Stockholders’ Equity Requirement. In our quarterly report on Form 10-Q

for the period ended June 30, 2024, we reported stockholders’ equity of $1,642,177, and, as a result, did not satisfy Listing Rule

5550(b)(1). Accordingly, the Staff had determined to delist our common stock from Nasdaq. Nasdaq’s letter provided us until August

29, 2024 to request an appeal of this determination.

We have appealed these matters to the Panel. The

hearing request stays any suspension or delisting action pending the conclusion of the hearing process and the expiration of any additional

extension period granted by the Panel following the hearing. We have an appeal hearing scheduled on October 10, 2024, before the Panel

to appeal the delisting notice from the Staff. While the appeal process is pending, the suspension of trading of our common stock will

be stayed. Our common stock will continue to trade on Nasdaq until the hearing process concludes and the Panel issues a written decision.

We intend to take all reasonable measures available

to regain compliance under the Nasdaq Listing Rules and remain listed on Nasdaq. We are currently evaluating our available options to

resolve the deficiency and regain compliance with the Stockholders’ Equity Requirement.

If our common stock is delisted by Nasdaq, our

common stock may be eligible for quotation on an over-the-counter quotation system or on the pink sheets. Upon any such delisting, our

common stock would become subject to the regulations of the SEC relating to the market for penny stocks. A penny stock is any equity security

not traded on a national securities exchange that has a market price of less than $5.00 per share. The regulations applicable to penny

stocks may severely affect the market liquidity for our common stock and could limit the ability of stockholders to sell securities in

the secondary market. In such a case, an investor may find it more difficult to dispose of or obtain accurate quotations as to the market

value of our common stock, and there can be no assurance that our common stock will be eligible for trading or quotation on any alternative

exchanges or markets.

Delisting from Nasdaq could adversely affect our

ability to raise additional financing through public or private sales of equity securities, would significantly affect the ability of

investors to trade our securities and would negatively affect the value and liquidity of our common stock. Delisting could also have other

negative results, including the potential loss of confidence by employees, the loss of institutional investor interest and fewer business

development opportunities.

Risks Related to this Offering

You may experience immediate and substantial

dilution in the net tangible book value per share of the common stock you purchase.

Since the price per share of our common stock being offered may be

higher than the net tangible book value per share of our common stock prior to this offering, you will suffer immediate dilution in the

net tangible book value of the shares of common stock you purchase in this offering. As of June 30, 2024, our historical net tangible

book value was approximately $0.4 million, or $0.049 per share. Assuming that an aggregate of 6,104,486 shares are sold at a price of $0.1761

per share, the last reported sale price of our common stock on the Nasdaq Capital Market on September 23, 2024, for aggregate gross proceeds

of approximately $1,075,000 in this offering, and after deducting commissions and estimated aggregate offering expenses payable by us,

you will suffer immediate dilution of $0.002 per share, representing the difference between our pro forma as adjusted net tangible book

value per share as of June 30, 2024 and the assumed offering price.

Please see the section entitled “Dilution” on page S-14 of this prospectus supplement for a more detailed illustration

of the dilution you would incur if you participate in this offering.

We will have broad discretion in using the

proceeds of this offering, and we may not effectively spend the proceeds.

We will use the net proceeds

of this offering to fund market development and clinical evidence, product development and quality, and general and administration support, and other general corporate purposes. We have not allocated any specific portion of the net proceeds to any

particular purpose, and our management will have the discretion to allocate the proceeds as it determines and could use them for purposes

other than those contemplated at the time of the offering. We will have significant flexibility and broad discretion in applying the

net proceeds of this offering, and we may not apply these proceeds effectively, and you will not have the opportunity as part of your

investment decision to assess whether our management is using the proceeds appropriately. The failure by our management to apply these

funds effectively could result in financial losses that could have a material adverse effect on our business and cause the price of our

common stock to decline. Pending their use, we may invest the net proceeds in short-term, investment-grade, interest-bearing securities.

These investments may not yield a favorable return to our stockholders. Please see the section entitled “Use

of Proceeds” on page S-12 of this prospectus supplement for further information.

The actual number of shares we will issue

under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations

in the Sales Agreement and compliance with applicable law, we have the discretion to deliver instructions to ACM to sell shares of our

common stock at any time throughout the term of the Sales Agreement. The number of shares that are sold through ACM after our instruction

will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set

with ACM in any instruction to sell shares, and the demand for our common stock during the sales period. Because the price per share of

each share sold will fluctuate during this offering, it is not currently possible to predict the number of shares that will be sold or

the gross proceeds to be raised in connection with those sales.

The common stock offered hereby will be sold in “at the

market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares

in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different

outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares

sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales

made at prices lower than the prices they paid.

A substantial number of shares may be sold

in the market following this offering, which may depress the market price for our common stock.

Sales of a substantial number

of shares of our common stock in the public market following this offering could cause the market price of our common stock to decline.

A substantial majority of the outstanding shares of our common stock are, and all of the shares sold in this offering upon issuance will

be, freely tradable without restriction or further registration under the Securities Act, unless these shares are owned or purchased by

“affiliates” as that term is defined in Rule 144 under the Securities Act. In addition, we have also registered the shares

of common stock that we may issue under our equity incentive plans. As a result, these shares can be freely sold in the public market

upon issuance, subject to restrictions under securities laws.

Our share price may be subject to substantial

volatility, and stockholders may lose all or a substantial part of their investment.

Our shares currently trade

on Nasdaq. Trading volume historically has been low and sporadic. As a result, the market price for our shares may not necessarily be

a reliable indicator of our fair market value. The price at which our shares trade may fluctuate or decline substantially as a result

of a variety of factors, some of which are beyond our control or are related in complex ways, including:

| · | Actual or anticipated fluctuations in our financial condition and results of operations; |

| · | Variance in our financial performance from expectations of securities analysts or investors; |

| · | Changes in the coverage decisions, reimbursement or pricing of our technology; |

| · | Changes in our projected operating and financial results; |

| · | Changes in laws or regulations applicable to our technology; |

| · | Announcements by us or our competitors of significant business developments, acquisitions, or new offerings; |

| · | Publicity associated with issues related to our technology; |

| · | Our involvement in regulatory investigations or litigation; |

| · | Future sales of our common stock or other securities, by us or our stockholders, as well as the anticipation

of lock-up releases; |

| · | Changes in senior management or key personnel; |

| · | The trading volume of our common stock; |

| · | Changes in the anticipated future size and growth rate of our market; |

| · | General economic, regulatory, and market conditions, including economic recessions or slowdowns; |

| · | Changes in the structure of healthcare payment systems; and |

| · | Developments or disputes concerning our intellectual property or other proprietary rights. |

Broad market and industry

fluctuations, as well as general economic, political, regulatory, and market conditions, may negatively impact the market price of our

common stock. In addition, given the relatively small expected public float of shares of our common stock on the Nasdaq Capital Market,

the trading market for our shares may be subject to increased volatility. In the past, securities class action litigation has often been

brought against a company following a decline in the market price of its securities. This risk is especially relevant for us, because

medical device companies have experienced significant stock price volatility in recent years. If we face such litigation, it could result

in substantial costs and a diversion of management’s attention and resources, which could harm our reputation and our business.

We do not currently intend to pay dividends

on our common stock, and, consequently, investors’ ability to achieve a return on their investment will depend on appreciation in

the price of our common stock.

We have never declared or

paid cash dividends on our capital stock. We currently intend to retain future earnings, if any, to finance the expansion of our business.

As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at

the discretion of our Board of Directors after taking into account various factors, including but not limited to our financial condition,

operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly,

investors seeking cash dividends should not purchase our shares. There is no guarantee that our common stock will appreciate or even maintain

the price at which investors have purchased it.

USE OF PROCEEDS

We may issue and sell shares

of our common stock having aggregate sales proceeds of up to $1,075,000 from time to time. Because there is no minimum offering

amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any,

are not determinable at this time.

We intend to use the net proceeds

from this offering to fund market development and clinical evidence, product development and quality, and general and administration support, and other general corporate purposes.

The foregoing represents our

current intentions based upon our present plans and business conditions to use and allocate the net proceeds of this offering. Our management,

however, will have significant flexibility and discretion to apply the net proceeds of this offering. If an unforeseen event occurs or

business conditions change, we may use the proceeds of this offering differently than as described in this prospectus supplement. Unforeseen

events or changed business conditions may result in application of the proceeds of this offering in a manner other than as described in

this prospectus supplement.

To the extent that the net

proceeds we receive from this offering are not immediately applied for the above purposes, we plan to invest the net proceeds in bank

deposits.

DIVIDEND POLICY

We have never paid or declared

any cash dividends on our common stock, and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Any future determination

to pay dividends will be at the discretion of our board of directors and will depend upon a number of factors, including our results of

operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors

our board of directors deems relevant. Our future ability to pay cash dividends on our stock may also be limited by the terms of any future

debt or preferred securities or future credit facility.

DILUTION

If you invest in our shares

of common stock in this offering, your ownership interest will be diluted to the extent of the difference between the public offering

price per share of our common stock in this offering and the as adjusted net tangible book value per share of our common stock immediately

after the closing of this offering.

As of June 30, 2024, our historical

net tangible book value was $0.4 million, or $0.049 per share of common stock. Our historical net tangible book value per share is equal

to our total tangible assets, less total liabilities, divided by the number of outstanding shares of common stock as of June 30, 2024.

After giving effect to the

issuance of (i) 1,825,000 shares of common stock under that certain Subscription Agreement, dated August 27, 2024, with certain accredited

investors and (ii) the exchange of $930,052 of outstanding debt for shares of newly issued Series B Convertible Preferred Stock on August

14, 2024, our pro forma net tangible book value as of June 30, 2024, would have been approximately $1.9 million, or $0.19 per share of

common stock.

After giving effect to the

assumed sale of shares of our common stock in the aggregate amount of $1,075,000 in this offering at an assumed offering price of $0.1761

per share, the last reported sale price of our common stock on the Nasdaq Capital Market on September 23, 2024, and after deducting commissions

and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2024 would have been $2.8 million,

or $0.174 per share of common stock. This amount represents an immediate increase in as adjusted net tangible book value of $0.125 per

share to our existing stockholders and an immediate dilution of $0.002 per share to investors participating in this offering. We determine

dilution per share to investors participating in this offering by subtracting as adjusted net tangible book value per share after this

offering from the assumed public offering price per share paid by investors participating in this offering.

| Public offering price per share |

|

$ |

0.176 |

|

| Net tangible book value per share as of June 30, 2024 |

|

$ |

0.049 |

|

| Increase in net tangible book value per share attributable to the Pro Forma Adjustments |

|

$ |

0.137 |

|

| Pro forma net tangible book value per share |

|

$ |

0.186 |

|

| Increase (decrease) in net tangible book value per share attributable to this offering |

|

$ |

(0.012 |

) |

| Pro forma net tangible book value per share after giving effect to this offering |

|

$ |

0.174 |

|

| Net dilution per share to new investors in this offering |

|

$ |

0.002 |

|

To the extent that outstanding

options, restricted stock units or warrants are exercised or shares of preferred stock are converted, or any additional options, restricted

stock units, warrants or other equity awards are granted and exercised or become vested or other issuances of shares of our common stock

are made, you will experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic

considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital

is raised through the sale of common stock or securities exercisable, convertible or exchangeable into common stock, such issuance could

result in further dilution to our stockholders.

The above discussion and table

are based on 8,210,671 shares of our common stock outstanding as of June 30, 2024, and excludes the following items (which are calculated

as of September 23, 2024):

| · | 136,123 shares of our common stock issuable upon the exercise of outstanding stock options granted under

our 2015 Stock Plan, |

| · | 33,334 shares of our common stock issuable upon the exercise of outstanding stock options granted under

our 2022 Stock Plan, |

| · | 10,350,000 shares of our common stock issuable upon the issuable upon the exercise of our outstanding

February 2024 public offering warrants, |

| · | 130,093 shares of our common stock reserved for future grant under our 2022 Stock Plan, |

| · | 155,610 shares of common stock issuable upon the exercise of our outstanding IPO Warrants, |

| · | 551,815 shares of common stock issuable upon the exercise of outstanding privately placed warrants, |

| · | 10,825 shares of common stock reserved for issuance upon the exercise of an outstanding IPO underwriter

representative common stock warrant, |

| · | approximately 3,974,580 shares of common stock which may be issued upon conversion of our outstanding

Series B Convertible Preferred Stock at the current conversion price of $0.234, and |

| | · | up to $6.8 million worth of common stock that may be sold in the future

by us to White Lion from time to time pursuant to the Equity Line Purchase Agreement. |

DESCRIPTION OF CAPITAL STOCK

The following description

is intended as a summary of our certificate of incorporation (which we refer to as our “charter”) and our bylaws, each of

which is filed as an exhibit to the registration statement of which this prospectus supplement forms a part, and to the applicable provisions

of the Delaware General Corporation Law. Because the following is only a summary, it does not contain all of the information that may

be important to you. For a complete description, you should refer to our charter and bylaws.

We have two classes of securities

registered under Section 12 of the Exchange Act. Our shares of common stock are listed on The Nasdaq Stock Market under the trading symbol

“ACON.” Our IPO Warrants are listed on the Nasdaq Stock Market under the trading symbol “ACONW.”

Authorized Capital Stock

Our authorized capital stock consists of 200,000,000

shares of common stock, par value $0.00001 per share, and 20,000,000 shares of preferred stock, par value $0.00001 per share.

Common Stock

The holders of our common stock are entitled to

one vote for each share held on all matters submitted to a vote of the stockholders. The holders of our common stock do not have any cumulative

voting rights. Holders of our common stock are entitled to receive ratably any dividends declared by our board of directors out of funds

legally available for that purpose, subject to any preferential dividend rights of any outstanding preferred stock. Our common stock has

no preemptive rights, conversion rights or other subscription rights or redemption or sinking fund provisions.

In the event of our liquidation, dissolution or

winding up, holders of our common stock will be entitled to share ratably in all assets remaining after payment of all debts and other

liabilities and any liquidation preference of any outstanding preferred stock. Each outstanding share of common stock is duly and validly

issued, fully paid and non-assessable.

Preferred Stock

Our board will have the authority, without further

action by our stockholders, to issue up to 20,000,000 shares of preferred stock in one or more series and to fix the rights, preferences,

privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights, voting

rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting, or the designation of,

such series, any or all of which may be greater than the rights of common stock. The issuance of our preferred stock could adversely affect

the voting power of holders of common stock and the likelihood that such holders will receive dividend payments and payments upon our

liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change in control

of our company or other corporate action.

We issued 930 shares of newly issued Series B

convertible preferred stock on August 14, 2024. The Series B Preferred Stock is convertible into common stock at an initial conversion

price of $0.234 per share of common stock.

Anti-Takeover Effects of Delaware Law and Provisions

of Our Charter and Our Bylaws

Certain provisions of the DGCL and of our charter

and our bylaws could have the effect of delaying, deferring or preventing another party from acquiring control of us and encouraging persons

considering unsolicited tender offers or other unilateral takeover proposals to negotiate with our board of directors rather than pursue

non-negotiated takeover attempts. These provisions include the items described below.

Delaware Anti-Takeover

Statute

We are subject to the

provisions of Section 203 of the DGCL. In general, Section 203 prohibits a publicly held Delaware corporation from engaging in a “business

combination” with an “interested stockholder” for a three-year period following the time that this stockholder becomes

an interested stockholder, unless the business combination is approved in a prescribed manner. Under Section 203, a business combination

between a corporation and an interested stockholder is prohibited unless it satisfies one of the following conditions:

| · | before the stockholder became interested, our Board approved either the business combination or the transaction

which resulted in the stockholder becoming an interested stockholder; |

| · | upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced,

excluding for purposes of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee

stock plans, in some instances, but not the outstanding voting stock owned by the interested stockholder; or |

| · | at or after the time the stockholder became interested, the business combination was approved by our Board

and authorized at an annual or special meeting of the stockholders by the affirmative vote of at least two-thirds of the outstanding voting

stock which is not owned by the interested stockholder. |

Section 203 defines

a business combination to include:

| · | any merger or consolidation involving the corporation and the interested stockholder; |

| · | any sale, transfer, lease, pledge, exchange, mortgage or other disposition involving the interested stockholder

of 10% or more of the assets of the corporation; |

| · | subject to exceptions, any transaction that results in the issuance or transfer by the corporation of

any stock of the corporation to the interested stockholder; or |

| · | the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or

other financial benefits provided by or through the corporation. |

In general, Section 203

defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation

and any entity or person affiliated with or controlling or controlled by the entity or person.

Board Composition

and Filling Vacancies

Our charter provides

that stockholders may remove directors only for cause and only by the affirmative vote of the holders of at least two-thirds of our outstanding

common stock. Our charter and bylaws authorize only our board of directors to fill vacant directorships, including newly created seats.

In addition, the number of directors constituting our board of directors may only be set by a resolution adopted by a majority vote of

our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of directors and then

gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change

the composition of our board of directors but promotes continuity of management.

No Written Consent

of Stockholders

Our charter and bylaws

provide that all stockholder actions are required to be taken by a vote of the stockholders at an annual or special meeting, and that

stockholders may not take any action by written consent in lieu of a meeting. This limit may lengthen the amount of time required to take

stockholder actions and would prevent the amendment of our bylaws or removal of directors by our stockholders without holding a meeting

of stockholders.

Meetings of Stockholders

Our charter and bylaws

provide that only a majority of the members of our Board then in office, our Executive Chairman or our Chief Executive Officer may call

special meetings of stockholders and only those matters set forth in the notice of the special meeting may be considered or acted upon

at a special meeting of stockholders.

Advance Notice Requirements

Our bylaws provide advance

notice procedures for stockholders seeking to bring matters before our annual meeting of stockholders or to nominate candidates for election

as directors at our annual meeting of stockholders. Our bylaws also specify certain requirements regarding the form and content of a stockholder’s

notice. These provisions might preclude our stockholders from bringing matters before our annual meeting of stockholders or from making

nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions

might also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate

of directors or otherwise attempting to obtain control of our company.

Amendment to Our Charter

and Bylaws

The DGCL, provides, generally,

that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate

of incorporation or bylaws, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater

percentage. Our bylaws may be amended or repealed by a majority vote of our board of directors or the affirmative vote of the holders

of at least two-thirds of the votes that all our stockholders would be entitled to cast in an annual election of directors. In addition,

the affirmative vote of the holders of at least two-thirds of the votes that all our stockholders would be entitled to cast in an election

of directors is required to amend or repeal or to adopt certain provisions of our charter.

Undesignated Preferred

Stock

Our charter provides for 20,000,000 authorized shares of preferred

stock. The existence of authorized but unissued shares of preferred stock may enable our board to discourage an attempt to obtain control

of us by means of a merger, tender offer, proxy contest or otherwise. For example, if in the due exercise of its fiduciary obligations,

our board of directors were to determine that a takeover proposal is not in the best interests of our stockholders, our board could cause

shares of convertible preferred stock to be issued without stockholder approval in one or more private offerings or other transactions

that might dilute the voting or other rights of the proposed acquirer or insurgent stockholder or stockholder group. In this regard, our

charter grants our board broad power to establish the rights and preferences of authorized and unissued shares of preferred stock. The

issuance of shares of preferred stock could decrease the amount of earnings and assets available for distribution to holders of shares

of common stock. The issuance may also adversely affect the rights and powers, including voting rights, of these holders and may have

the effect of delaying, deterring or preventing a change in control of us.

Choice of Forum

Our charter provides

that the Court of Chancery of the State of Delaware is the exclusive forum for the following types of actions or proceedings: any derivative

action or proceeding brought on behalf of the Company, any action asserting a claim of breach of a fiduciary duty owed by any director,

officer or other employee of the Company to the Company or the Company’s stockholders, any action asserting a claim against the

Company arising pursuant to any provision of the DGCL or the Company’s certificate of incorporation or bylaws, or any action asserting

a claim against the Company governed by the internal affairs doctrine. Our charter also provides that unless the Company consents in writing

to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive forum for

the resolution of any complaint asserting a cause of action arising under the Securities Act. Despite the fact that the certificate of

incorporation provides for this exclusive forum provision to be applicable to the fullest extent permitted by applicable law, Section

27 of the Exchange Act, creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the

Exchange Act or the rules and regulations thereunder and Section 22 of the Securities Act, creates concurrent jurisdiction for federal

and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder.

As a result, this provision of the Company’s certificate of incorporation would not apply to claims brought to enforce a duty or

liability created by the Exchange Act, or any other claim for which the federal courts have exclusive jurisdiction. However, there is

uncertainty as to whether a Delaware court would enforce the exclusive federal forum provisions for Securities Act claims and that investors

cannot waive compliance with the federal securities laws and rules and regulations thereunder.

Unless the Company consents

in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive

forum for the resolution of any complaint asserting a cause of action arising under the Securities Act.

Nasdaq-Listed IPO

Warrants

The Company has 155,610 IPO

Warrants outstanding. Each IPO Warrant represents the right to purchase one share of common stock at an exercise price of $4.35 (pre-split),

or $69.60 (after giving effect to our January 3, 2024 reverse stock split). The IPO Warrants are exercisable beginning April 21, 2022,

will terminate on the 5th anniversary date the IPO Warrants are first exercisable. The exercise price and number of shares for which each

IPO Warrant may be exercised is subject to adjustment in the event of stock dividends, stock splits, reorganizations or similar events

affecting our common stock.

Holders of the IPO Warrants

may exercise their IPO Warrants to purchase shares of our common stock on or before the termination date by delivering an exercise notice,

appropriately completed and duly signed. Payment of the exercise price for the number of shares for which the IPO Warrants is being exercised

must be made within two trading days following such exercise. In the event that the registration statement relating to the IPO Warrant

shares (the “IPO Warrant Shares”) is not effective, a holder of IPO Warrants may only exercise its IPO Warrants for a net

number of IPO Warrant Shares pursuant to the cashless exercise procedures specified in the IPO Warrants. IPO Warrants may be exercised

in whole or in part, and any portion of an IPO Warrant not exercised prior to the termination date shall be and become void and of no

value. The absence of an effective registration statement or applicable exemption from registration does not alleviate our obligation

to deliver common stock issuable upon exercise of an IPO Warrant.

Upon the holder’s

exercise of an IPO Warrant, we will issue the shares of common stock issuable upon exercise of the IPO Warrant within three trading days

of our receipt of notice of exercise, subject to timely payment of the aggregate exercise price therefor.

The shares of common

stock issuable on exercise of the IPO Warrants will be, when issued in accordance with the IPO Warrants, duly and validly authorized,

issued and fully paid and non-assessable. We will authorize and reserve at least that number of shares of common stock equal to the number

of shares of common stock issuable upon exercise of all outstanding warrants.

If, at any time an IPO

Warrant is outstanding, we consummate any fundamental transaction, as described in the IPO Warrants and generally including any consolidation

or merger into another corporation, the consummation of a transaction whereby another entity acquires more than 50% of our outstanding

common stock, or the sale of all or substantially all of our assets, or other transaction in which our common stock is converted into

or exchanged for other securities or other consideration, the holder of any IPO Warrants will thereafter receive upon exercise of the

IPO Warrants, the securities or other consideration to which a holder of the number of shares of common stock then deliverable upon the

exercise or conversion of such IPO Warrants would have been entitled upon such consolidation or merger or other transaction.

The IPO Warrants are

not exercisable by their holder to the extent (but only to the extent) that such holder or any of its affiliates would beneficially own

in excess of 4.99% of our common stock.

Amendments and waivers

of the terms of the IPO Warrants require the written consent of the holder of such IPO Warrants and us. The IPO Warrants were issued in

book-entry form under a warrant agent agreement between V-Stock Transfer Company, Inc. as warrant agent, and us, and shall initially be

represented by one or more book-entry certificates deposited with The Depository Trust Company, or DTC, and registered in the name of

Cede & Co., a nominee of DTC, or as otherwise directed by DTC.

You should review a copy of the warrant agent

agreement and the form of the IPO Warrants, each of which are included as exhibits to the registration statement of which this prospectus

supplement is a part.

Transfer Agent, Registrar, Warrant Agent

The transfer agent and

registrar for our common stock and the warrant agent for our IPO Warrants is VStock Transfer LLC, 18 Lafayette Place, Woodmere, NY 11598.

As of September 23,

2024, there were 10,044,728 shares of our common stock outstanding, 930 shares of our Series B Convertible Preferred Stock, and

approximately 137 stockholders of record.

Other Outstanding Warrants

As of September 23, 2024, after giving effect

to our January 3, 2024 reverse stock split, we had 10,901,815 other outstanding common stock warrants (in addition to our IPO Warrants

described above). The terms of these warrants are (i) 123,566 warrants with a per share exercise price of $0.29 and expiring 2028, (ii)