0001781174false00017811742024-08-132024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 13, 2024 |

Acrivon Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41551 |

82-5125532 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

480 Arsenal Way Suite 100 |

|

Watertown, Massachusetts |

|

02472 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 207-8979 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

ACRV |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 13, 2024, Acrivon Therapeutics, Inc., or the Company, issued a press release announcing its financial results for the quarter ended June 30, 2024 and providing business updates. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, regardless of any general incorporation language in such filings.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Acrivon Therapeutics, Inc. |

|

|

|

|

Date: |

August 13, 2024 |

By: |

/s/ Peter Blume-Jensen |

|

|

|

Name: Peter Blume-Jensen, M.D., Ph.D.

Title: President and Chief Executive Office |

Acrivon Therapeutics Reports Second Quarter 2024 Financial Results and Business Highlights

WATERTOWN, Massachusetts, August 13, 2024 – Acrivon Therapeutics, Inc. (“Acrivon” or “Acrivon Therapeutics”) (Nasdaq: ACRV), a clinical stage precision medicine company utilizing its Acrivon Precision Predictive Proteomics (AP3) platform for the discovery, design, and development of drug candidates through a mechanistic match to patients whose disease is predicted sensitive to the specific treatment, today reported financial results for the second quarter ended June 30, 2024 and reviewed business highlights.

“We continue to make significant progress on our mission to deliver on the unique and actionable capabilities of our AP3 platform by rapidly advancing a pipeline of differentiated therapies that address high unmet need cancers,” said Peter Blume-Jensen, M.D., Ph.D., chief executive officer, president, and founder of Acrivon. “We are planning to hold a webcast in September 2024 during the upcoming ESMO conference to update broadly on both clinical lead and pipeline programs as well as on our AP3 platform progress. For our lead asset ACR-368, we expect to share additional clinical data from our ongoing registrational-intent Phase 2b trial at ESMO, building on the initial positive clinical data that we reported in April of this year which showed an overall response rate of 50% in patients with gynecological cancers prospectively predicted sensitive to ACR-368 with our ACR-368 OncoSignature test. We also remain on track to initiate a Phase 1 clinical study with ACR-2316, our potent, selective WEE1/PKMYT1 inhibitor. ACR-2316 has been rationally designed, uniquely enabled by our AP3 platform, for superior single agent activity through robust activation of CDK1, CDK2, and PLK1, resulting in potent, apoptotic tumor cell death as demonstrated in our preclinical studies. Our AP3 platform, which leverages internally generated data and generative AI to deliver unique insights, is broadly applicable across disease areas and modalities and is already being applied to a new cell cycle program with an undisclosed target.”

Recent Highlights

•Presented data from the ongoing, registrational-intent, multicenter Phase 2 trial of ACR-368 in patients with locally advanced or metastatic, recurrent platinum-resistant ovarian cancer or endometrial adenocarcinoma (n=26; 10 OncoSignature-positive and 16 OncoSignature-negative; data as of April 1, 2024)

-Reported a confirmed overall response rate (ORR), per RECIST 1.1, of 50% observed in the prospective cohort of OncoSignature-positive patients with gynecological cancer who were efficacy evaluable, including 60% ORR in endometrial cancer, a new tumor type predicted to be sensitive to ACR-368 by AP3-enabled indication screening

-Demonstrated the ability of the AP3-based ACR-368 OncoSignature assay to prospectively predict ovarian and endometrial patients sensitive to ACR-368 monotherapy based on initial data that showed a clear segregation of RECIST

responders in the OncoSignature-positive versus OncoSignature-negative arms (p-value = 0.0038)

-In the OncoSignature-negative arm, initial clinical activity was observed in response to ACR-368 combined with ultra-low dose gemcitabine (ULDG), with 8 out of 16 patients achieving stable disease. ULDG was identified through AP3 profiling as a way to sensitize resistant ovarian cancer cells to ACR-368.

•Discovered ACR-2316 using biological structure-activity relationship (SAR) enabled by AP3 to overcome the limitations of single-target WEE1 and PKMYT1 inhibitors

-ACR-2316 was designed by AP3 to have optimal properties including strong WEE1 inhibition and balanced PKMYT1 inhibition to elicit potent activation of CDK1, CDK2 and PLK1, resulting in powerful pro-apoptotic mitotic catastrophe and tumor cell death

-The Phase 1 clinical study of ACR-2316 is on track to be initiated in 4Q 2024

•Executed an oversubscribed $130 million private placement financing at a premium, with support from high caliber new and key existing investors

Anticipated Upcoming Milestones

•Provide pipeline (ACR-368 and ACR-2316), AP3 platform, and corporate updates in 2H 2024, including updated ACR-368 clinical data at the upcoming ESMO conference, where the company will present on September 14, 2024 in the Gynecological Cancers poster session (presentation number P744). The poster will be accessible on our website the same day. The company plans on hosting a live webcast during ESMO to discuss and review the clinical data and provide other pipeline and platform updates.

•Initiate a Phase 1 clinical study of ACR-2316 in 4Q 2024 enriched for tumor types predicted to be sensitive to monotherapy through AP3-based indication finding

•Advance a new potential first-in-class drug discovery program for an undisclosed target towards development candidate nomination in 2025

Second Quarter 2024 Financial Results

Net loss for the quarter ended June 30, 2024 was $18.8 million compared to a net loss of $13.9 million for the same period in 2023.

Research and development expenses were $15.0 million for the quarter ended June 30, 2024 compared to $10.5 million for the same period in 2023. The difference was primarily due to the continued development of ACR-368, inclusive of progression of the ongoing clinical trial and achieved Akoya milestones, as well as increased personnel costs to support these development activities.

General and administrative expenses were $6.4 million for the quarter ended June 30, 2024 compared to $5.0 million for the same period in 2023. The difference was primarily due to increased personnel costs, inclusive of non-cash stock compensation expense.

As of June 30, 2024, the company had cash, cash equivalents and marketable securities of $220.4 million, which is expected to fund our operating expenses and capital expenditure requirements into the second half of 2026.

About Acrivon Therapeutics

Acrivon is a clinical stage biopharmaceutical company developing precision oncology medicines that it matches to patients whose tumors are predicted to be sensitive to each specific medicine by utilizing Acrivon’s proprietary proteomics-based patient responder identification platform, Acrivon Predictive Precision Proteomics, or AP3. The AP3 platform is engineered to measure compound-specific effects on the entire tumor cell protein signaling network and drug-induced resistance mechanisms in an unbiased manner. These distinctive capabilities enable AP3’s direct application for drug design optimization for monotherapy activity, the identification of rational drug combinations, and the creation of drug-specific proprietary OncoSignature companion diagnostics that are used to identify the patients most likely to benefit from Acrivon’s drug candidates. Acrivon is currently advancing its lead candidate, ACR-368 (also known as prexasertib), a selective small molecule inhibitor targeting CHK1 and CHK2 in a potentially registrational Phase 2 trial across multiple tumor types. The company has received Fast Track designation from the Food and Drug Administration, or FDA, for the investigation of ACR-368 as monotherapy based on OncoSignature-predicted sensitivity in patients with platinum-resistant ovarian or endometrial cancer. Acrivon’s ACR-368 OncoSignature test, which has not yet obtained regulatory approval, has been extensively evaluated in preclinical studies, including in two separate, blinded, prospectively-designed studies on pretreatment tumor biopsies collected from past third-party Phase 2 trials in patients treated with ACR-368.

The FDA has granted Breakthrough Device designation for the ACR-368 OncoSignature assay for the identification of ovarian cancer patients who may benefit from ACR-368 treatment. In addition to ACR-368, Acrivon is also leveraging its proprietary AP3 precision medicine platform for developing its co-crystallography-driven, internally-discovered preclinical stage pipeline programs. These include ACR-2316, a potent, selective WEE1/PKMYT1 inhibitor designed for superior single-agent activity as demonstrated in preclinical studies against benchmark inhibitors, and a cell cycle program with an undisclosed target.

Forward-Looking Statements

This press release includes certain disclosures that contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this press release, including statements regarding our future results of operations or financial condition, preclinical and clinical results, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. Forward-looking statements are based on Acrivon’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Factors that could cause actual results to differ include, but are not limited to, risks and uncertainties that are described more fully in the section titled “Risk Factors” in our reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this press release are made as of this date, and Acrivon undertakes no duty to update such information except as required under applicable law.

Investor and Media Contacts:

Adam D. Levy, Ph.D., M.B.A.

alevy@acrivon.com

Alexandra Santos

asantos@wheelhouselsa.com

|

|

|

|

|

|

|

|

|

Acrivon Therapeutics, Inc.

Condensed Consolidated Balance Sheets

(unaudited, in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

46,006 |

|

|

$ |

36,015 |

|

Investments |

|

|

174,426 |

|

|

|

91,443 |

|

Other assets |

|

|

10,153 |

|

|

|

10,807 |

|

Total assets |

|

$ |

230,585 |

|

|

$ |

138,265 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Liabilities |

|

|

14,527 |

|

|

|

17,070 |

|

Stockholders' Equity |

|

|

216,058 |

|

|

|

121,195 |

|

Total Liabilities and Stockholders' Equity |

|

$ |

230,585 |

|

|

$ |

138,265 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acrivon Therapeutics, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(unaudited, in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

15,025 |

|

|

$ |

10,521 |

|

|

$ |

26,498 |

|

|

$ |

20,279 |

|

General and administrative |

|

|

6,412 |

|

|

|

4,999 |

|

|

|

12,607 |

|

|

|

9,634 |

|

Total operating expenses |

|

|

21,437 |

|

|

|

15,520 |

|

|

|

39,105 |

|

|

|

29,913 |

|

Loss from operations |

|

|

(21,437 |

) |

|

|

(15,520 |

) |

|

|

(39,105 |

) |

|

|

(29,913 |

) |

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

2,694 |

|

|

|

1,770 |

|

|

|

4,140 |

|

|

|

3,577 |

|

Other expense, net |

|

|

(55 |

) |

|

|

(164 |

) |

|

|

(319 |

) |

|

|

(334 |

) |

Total other income, net |

|

|

2,639 |

|

|

|

1,606 |

|

|

|

3,821 |

|

|

|

3,243 |

|

Net loss |

|

$ |

(18,798 |

) |

|

$ |

(13,914 |

) |

|

$ |

(35,284 |

) |

|

$ |

(26,670 |

) |

Net loss per share - basic and diluted |

|

$ |

(0.52 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.20 |

) |

|

$ |

(1.22 |

) |

Weighted-average common stock outstanding - basic and diluted |

|

|

36,132,616 |

|

|

|

21,971,032 |

|

|

|

29,361,710 |

|

|

|

21,945,940 |

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(18,798 |

) |

|

$ |

(13,914 |

) |

|

$ |

(35,284 |

) |

|

$ |

(26,670 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on available-for-sale investments, net of tax |

|

|

51 |

|

|

|

(436 |

) |

|

|

64 |

|

|

|

(332 |

) |

Comprehensive loss |

|

$ |

(18,747 |

) |

|

$ |

(14,350 |

) |

|

$ |

(35,220 |

) |

|

$ |

(27,002 |

) |

v3.24.2.u1

Document And Entity Information

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity Registrant Name |

Acrivon Therapeutics, Inc.

|

| Entity Central Index Key |

0001781174

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-41551

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-5125532

|

| Entity Address, Address Line One |

480 Arsenal Way

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

(617)

|

| Local Phone Number |

207-8979

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ACRV

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

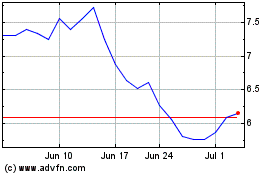

Acrivon Therapeutics (NASDAQ:ACRV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Acrivon Therapeutics (NASDAQ:ACRV)

Historical Stock Chart

From Nov 2023 to Nov 2024