0001824884

false

00-0000000

0001824884

2023-12-04

2023-12-04

0001824884

ADOC:ClassOrdinaryShares.0001ParValuePerShareMember

2023-12-04

2023-12-04

0001824884

ADOC:RightsExchangeableIntoOnetenthOfOneClassOrdinaryShareMember

2023-12-04

2023-12-04

0001824884

ADOC:WarrantsEachExercisableForOnehalfOfOneClassOrdinaryShareEachWholeWarrantExercisableFor11.50PerShareMember

2023-12-04

2023-12-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 4, 2023

EDOC Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-39689 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7612 Main Street Fishers

Suite 200

Victor, NY 14564

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (585) 678-1198

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Ordinary Shares, $.0001 par value per share |

|

ADOC |

|

The Nasdaq Stock Market LLC |

| Rights, exchangeable into one-tenth of one Class A Ordinary Share |

|

ADOCR |

|

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one-half of one Class A Ordinary Share, each whole Warrant exercisable for $11.50 per share |

|

ADOCW |

|

The Nasdaq Stock Market LLC |

Item 1.01 Entry into a Material Definitive

Agreement.

Second Amendment to Agreement and Plan

of Merger

As

previously disclosed by Edoc Acquisition Corp., a special purpose acquisition company formed as a Cayman Islands exempted company

(together with its successors, “Edoc” or “Company”), Edoc entered into a Business Combination

Agreement (as amended on March 31, 2023, and as may be further amended or supplemented from time to time, the “Business

Combination Agreement”) with Australian Oilseeds Investments Pty Ltd., an Australian proprietary company (the

“AOI”), Australian Oilseeds Holdings Limited, a Cayman Islands exempted company (“Pubco”), AOI

Merger Sub, Cayman Islands exempted company and a wholly-owned subsidiary of Pubco (“Merger Sub”), American

Physicians LLC, a Delaware limited liability company (“Purchaser Representative”), in the capacity as the

Purchaser Representative thereunder, and Gary Seaton, in his capacity as the representative for the Sellers (as defined below) in

accordance with the terms and conditions of the Business Combination Agreement (the “Seller Representative”). Also as previously disclosed by Edoc, on March 31, 2023, the Company, AOI, Pubco, Merger Sub, and the Purchaser Representative entered

into that certain First Amendment to the Business Combination Agreement (the “First Amendment”), pursuant to which the Business

Combination Agreement was amended to add, as a closing condition, that upon the closing of the transactions contemplated by the Business

Combination Agreement, the Company shall have cash and cash equivalents, including funds remaining in the Company’s trust account

(after giving effect to the completion and payment of the redemption) and the proceeds of any PIPE Investment, prior to giving effect

to the payment of the Company’s unpaid expenses or liabilities, of at least equal to $10,000,000.

On

December 7, 2023, Edoc, AOI, Pubco, Merger Sub, the Purchaser Representative and the Seller Representative entered into that certain Second

Amendment to the Business Combination Agreement (the “Second Amendment”), pursuant to which the Business Combination

Agreement was amended to extend the Outside Date (as defined in the Business Combination) to March 31, 2024.

The

foregoing description of the Second Amendment does not purport to be complete and is subject to and qualified in its entirety by reference

to the Second Amendment, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The

Business Combination Agreement provides investors with information regarding its terms and is not intended to provide any other factual

information about the parties. In particular, the assertions embodied in the representations and warranties contained in the Business

Combination Agreement were made as of the execution date of the Business Combination Agreement only and are qualified by information in

confidential disclosure schedules provided by the parties in connection with the signing of the Business Combination Agreement. These

disclosure schedules contain information that modifies, qualifies, and creates exceptions to the representations and warranties set forth

in the Business Combination Agreement, which, while they may be material to the parties to the Business Combination Agreement, Edoc believes

are not material to investors’ understanding of such representations and warranties. Moreover, certain representations and warranties

in the Business Combination Agreement may have been used for the purpose of allocating risk between the parties rather than establishing

matters of fact. Accordingly, you should not rely on the representations and warranties in the Business Combination Agreement as characterizations

of the actual statements of fact about the parties.

Amendments to Arena Securities Purchase

Agreement

As

previously disclosed by Edoc, on August 23, 2023, Pubco executed a Securities Purchase Agreement (the “Securities Purchase Agreement”)

with AOI, Edoc Acquisition Corp. and Arena Investors, LP, a Delaware limited partnership

(the “Purchaser”).

On October 31, 2023, the

parties entered into Amendment No. 1 to Securities Purchase Agreement, which extended the exclusivity date under the Securities Purchase

Agreement until December 31, 2023.

On December 4, 2023, the

parties entered into Amendment No. 2 to Securities Purchase Agreement, which extended the exclusivity date under the Securities Purchase

Agreement until February 29, 2024 and extending the date upon which each of Pubco or Purchaser may terminate the Securities Purchase Agreement

to February 29, 2024.

Forward-Looking Statements

The information in this

report includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United

States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,”

“plan,” “project,” “forecast,” “intend,” “may,” “will,” “expect,”

“continue,” “should,” “would,” “anticipate,” “believe,” “seek,”

“target,” “predict,” “potential,” “seem,” “future,” “outlook”

or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the

absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited

to, (1) statements regarding estimates and forecasts of financial and performance metrics and projections of market opportunity and market

share; (2) references with respect to the anticipated benefits of the proposed Business Combination and the projected future financial

performance of Edoc and AOI’s operating companies following the proposed Business Combination; (3) changes in the market for AOI’s

products and services and expansion plans and opportunities; (4) AOI’s unit economics; (5) the sources and uses of cash of the proposed

Business Combination; (6) the anticipated capitalization and enterprise value of the combined company following the consummation of the

proposed Business Combination; (7) the projected technological developments of AOI and its competitors; (8) anticipated short- and long-term

customer benefits; (9) current and future potential commercial and customer relationships; (10) the ability to manufacture efficiently

at scale; (11) anticipated investments in research and development and the effect of these investments and timing related to commercial

product launches; and (12) expectations related to the terms and timing of the proposed Business Combination. These statements are based

on various assumptions, whether or not identified in this report, and on the current expectations of AOI’s and Edoc’s management

and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many

actual events and circumstances are beyond the control of AOI and Edoc. These forward-looking statements are subject to a number of risks

and uncertainties, including the occurrence of any event, change or other circumstances that could give rise to the termination of the

Business Combination Agreement; the risk that the Business Combination disrupts current plans and operations as a result of the announcement

and consummation of the transactions described herein; the inability to recognize the anticipated benefits of the Business Combination;

the ability to obtain or maintain the listing of the Pubco’s securities on The Nasdaq Stock Market, following the Business Combination,

including having the requisite number of shareholders; costs related to the Business Combination; changes in domestic and foreign business,

market, financial, political and legal conditions; risks relating to the uncertainty of the projected financial information with respect

to AOI; AOI’s ability to successfully and timely develop, manufacture, sell and expand its technology and products, including implement

its growth strategy; AOI’s ability to adequately manage any supply chain risks, including the purchase of a sufficient supply of

critical components incorporated into its product offerings; risks relating to AOI’s operations and business, including information

technology and cybersecurity risks, failure to adequately forecast supply and demand, loss of key customers and deterioration in relationships

between AOI and its employees; AOI’s ability to successfully collaborate with business partners; demand for AOI’s current

and future offerings; risks that orders that have been placed for AOI’s products are cancelled or modified; risks related to increased

competition; risks relating to potential disruption in the transportation and shipping infrastructure, including trade policies and export

controls; risks that AOI is unable to secure or protect its intellectual property; risks of product liability or regulatory lawsuits relating

to AOI’s products and services; risks that the post-combination company experiences difficulties managing its growth and expanding

operations; the uncertain effects of the COVID-19 pandemic and certain geopolitical developments; the inability of the parties to successfully

or timely consummate the proposed Business Combination, including the risk that any required shareholder or regulatory approvals are not

obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits

of the proposed Business Combination; the outcome of any legal proceedings that may be instituted against AOI, Edoc or Pubco or other

following announcement of the proposed Business Combination and transactions contemplated thereby; the ability of AOI to execute its business

model, including market acceptance of its planned products and services and achieving sufficient production volumes at acceptable quality

levels and prices; technological improvements by AOI’s peers and competitors; and those risk factors discussed in documents of Pubco

and Edoc filed, or to be filed, with the Securities and Exchange Commission (the “SEC”). If any of these risks materialize

or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

There may be additional risks that neither Edoc nor AOI presently know or that Edoc and AOI currently believe are immaterial that could

also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect

Edoc’s and AOI’s expectations, plans or forecasts of future events and views as of the date of this report. Edoc and AOI anticipate

that subsequent events and developments will cause Edoc’s and AOI’s assessments to change. However, while Edoc and AOI may

elect to update these forward-looking statements at some point in the future, Edoc and AOI specifically disclaim any obligation to do

so. Readers are referred to the most recent reports filed with the SEC by Edoc. Readers are cautioned not to place undue reliance upon

any forward-looking statements, which speak only as of the date made, and we undertake no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events or otherwise.

Additional Information

Pubco has filed with the

SEC, a Registration Statement on Form F-4 (as may be amended, the “Registration Statement”), which includes a preliminary

proxy statement of Edoc and a prospectus in connection with the proposed Business Combination involving Edoc, Pubco, American Physicians

LLC, AOI Merger Sub, Gary Seaton, and the holders of AOI’s outstanding capital shares named on Annex I of the Business Combination

Agreement. The definitive proxy statement and other relevant documents will be mailed to shareholders of Edoc as of a record date to be

established for voting on Edoc’s proposed Business Combination with AOI. SHAREHOLDERS OF EDOC AND OTHER INTERESTED PARTIES ARE URGED

TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT IN CONNECTION WITH

EDOC’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION BECAUSE

THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT EDOC, AOI, PUBCO AND THE BUSINESS COMBINATION. Shareholders will also be able

to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s

website at www.sec.gov or by directing a request to: Edoc Acquisition Corp., 7612 Main Street Fishers, Suite 200, Victor, NY 14564, Attention:

Kevin Chen.

Participants in the Business Combination

Pubco, Edoc and their

respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Edoc

in connection with the Business Combination. Information regarding the officers and directors of Edoc is set forth in Edoc’s annual

report on Form 10-K, which was filed with the SEC on January 24, 2023. Additional information regarding the interests of such potential

participants are included in the Registration Statement on Form F-4 (and will be included in the definitive proxy statement/prospectus

for the Business Combination) and other relevant documents filed with the SEC.

Disclaimer

This communication shall

not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any

jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities

laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section

10 of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 7, 2023 |

EDOC Acquisition Corp. |

| |

|

| |

By: |

/s/ Kevin Chen |

| |

|

Name: |

Kevin Chen |

| |

|

Title: |

Chief Executive Officer |

4

Exhibit 2.1

Execution Version

SECOND AMENDMENT TO BUSINESS COMBINATION AGREEMENT

This Second Amendment (“Second

Amendment”) to the Business Combination Agreement (as defined below) is made and entered into as of December 7, 2023, by

and among (i) Edoc Acquisition Corp, a Cayman Islands exempted company (together with its successors, the “Purchaser”),

(ii) American Physicians LLC, a Delaware limited liability company, in the capacity as the Purchaser Representative thereunder

(the “Purchaser Representative”), (iii) Australian Oilseeds Holdings Limited, a Cayman Islands exempted

company (“Pubco”), (iv) AOI Merger Sub, a Cayman Islands exempted company and a wholly-owned subsidiary

of Pubco (“Merger Sub”), (v) Australian Oilseeds Investments Pty Ltd., an Australian proprietary

company (the “Company”), and (vi) Gary Seaton, in his capacity as the Seller Representative thereunder

(the “Seller Representative”). Capitalized terms used but not defined herein shall have the meanings ascribed

to them in the Business Combination Agreement.

RECITALS:

WHEREAS, the Purchaser,

the Purchaser Representative, Pubco, Merger Sub, the Company, the Seller Representative and certain Sellers entered into that certain

Business Combination Agreement, dated as of December 5, 2022 (the “Original Agreement”);

WHEREAS, the Original

Agreement was amended by the Amendment to Business Combination Agreement, dated as of March 31, 2023 (the “First Amendment”),

to add a $10,000,000 minimum cash closing condition (the Original Agreement, as amended by the First Amendment, is referred to herein

as, the “Amended Agreement”, and as further amended, including by this Second Amendment, the “Business

Combination Agreement”); and

WHEREAS, the Parties

now desire to further amend the Amended Agreement on the terms and conditions set forth herein, to, among other matters, extend the Outside

Date of the Business Combination Agreement to March 31, 2024.

NOW, THEREFORE, in

consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

and in accordance with the terms of the Business Combination Agreement, the Parties hereto, intending to be legally bound, do hereby acknowledge

and agree as follows:

1. Amendments

to Business Combination Agreement. The Amended Agreement is hereby further amended as follows:

A. Section

11.1(b) of the Amended Agreement is hereby amended by deleting it in its entirety and replacing it with the following:

(b) by written notice

by Purchaser or the Company if any of the conditions to the Closing set forth in Article X have not been satisfied or waived

by March 31, 2024 (the “Outside Date”); provided, however, that the right to terminate this

Agreement under this Section 11.1(b) shall not be available to a Party if the breach or violation by such Party or its

Affiliates (or with respect to the Company, the Sellers, the Seller Representative, Pubco or Merger Sub) of any representation,

warranty, covenant or obligation under this Agreement was the primary cause of, or directly resulted in, the failure of the Closing

to occur on or before the Outside Date;

2. Miscellaneous.

Except as expressly provided in this Amendment, all of the terms and provisions in the Amended Agreement and the Ancillary Documents are

and shall remain unchanged and in full force and effect, on the terms and subject to the conditions set forth therein. This Second Amendment

does not constitute, directly or by implication, an amendment or waiver of any provision of the Amended Agreement or any Ancillary Document,

or any other right, remedy, power or privilege of any party, except as expressly set forth herein. Any reference to the Business Combination

Agreement in the Business Combination Agreement or any other agreement, document, instrument or certificate entered into or issued in

connection therewith shall hereinafter mean the Amended Agreement, as further amended by this Second Amendment (or as the Business Combination

Agreement may be further amended or modified after the date hereof in accordance with the terms thereof). The Amended Agreement, as amended

by this Second Amendment, and the documents or instruments attached hereto or thereto or referenced herein or therein, constitute the

entire agreement between the parties with respect to the subject matter of the Business Combination Agreement, and supersedes all prior

agreements and understandings, both oral and written, between the parties with respect to its subject matter. If any provision of the

Amended Agreement is materially different from or inconsistent with any provision of this Second Amendment, the provision of this Second

Amendment shall control, and the provision of the Amended Agreement shall, to the extent of such difference or inconsistency, be disregarded.

Sections 13.1 through 13.10, and 13.12 through 13.16 of the Amended Agreement are hereby incorporated herein by reference as if fully

set forth herein, and such provisions apply to this Amendment as if all references to the “Agreement” contained therein were

instead references to this Amendment.

[Remainder of Page Intentionally Left Blank;

Signature Pages Follow]

IN WITNESS WHEREOF, each Party

hereto has caused this Amendment to be signed and delivered as of the date first written above.

| |

The Purchaser: |

| |

|

|

| |

EDOC ACQUISITION CORP. |

| |

|

|

|

| |

By: |

/s/ Kevin Chen |

| |

|

Name: |

Kevin Chen |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

The Purchaser Representative: |

| |

|

|

|

| |

AMERICAN PHYSICIANS LLC, solely in the capacity as the Purchaser Representative hereunder |

| |

|

|

|

| |

By: |

/s/ Xiaoping Becky Zhang |

| |

|

Name: |

Xiaoping Becky Zhang |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

Pubco: |

| |

|

|

|

| |

AUSTRALIAN OILSEEDS HOLDINGS LIMITED |

| |

|

|

|

| |

By: |

/s/ Gary Seaton |

| |

|

Name: |

Gary Seaton |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

Merger Sub: |

| |

|

|

|

| |

AOI MERGER SUB |

| |

|

|

|

| |

By: |

/s/ Gary Seaton |

| |

|

Name: |

Gary Seaton |

| |

|

Title: |

Authorized Representative |

[Signature Page to Second Amendment to Business

Combination Agreement]

| |

The Company: |

| |

|

|

|

| |

AUSTRALIAN OILSEEDS INVESTMENTS PTY LTD. |

| |

|

|

|

| |

By: |

/s/ Gary Seaton |

| |

|

Name: |

Gary Seaton |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

The Seller Representative: |

| |

|

|

|

| |

Gary Seaton, an individual, solely in the capacity as the Seller Representative |

| |

|

|

|

| |

/s/ Gary Seaton |

| |

Gary Seaton, individually |

[Signature Page to Second Amendment to Business

Combination Agreement]

Exhibit 10.1

AMENDMENT NO. 1 TO SECURITIES PURCHASE AGREEMENT

This Amendment No. 1 to Securities

Purchase Agreement (this “Amendment”) is made and entered into as of October 31, 2023 (the “Effective Date”),

by and among Australian Oilseeds Holdings Limited, an exempted company incorporated in the Cayman Islands (the “Company”),

EDOC Acquisition Corp., an exempted company incorporated in the Cayman Islands (“EDOC”), Australian Oilseeds Investments

Pty Ltd., an Australian proprietary company (“AOI”), and Arena Investors, LP, a Delaware limited partnership, in its

capacity as the purchaser (the “Purchaser”), and amends that certain Securities Purchase Agreement (the “Agreement”),

dated as of August 23, 2023, by and among the Company, AOI, EDOC and the Purchaser. Each of the Company, AOI, EDOC and the Purchaser shall

individually be referred to herein as a “Party” and, collectively, as the “Parties.” Capitalized terms used in

this Amendment but not defined herein shall have the meanings set forth in the Agreement.

RECITALS

WHEREAS, the Parties

desire to amend the Agreement as set forth in this Amendment;

WHEREAS, Section 6.5

of the Agreement provides that the Agreement may be amended with the written consent of each Party.

NOW, THEREFORE, in

consideration of the mutual agreements contained in this Amendment, and intending to be legally bound by the terms and conditions of this

Amendment, the Parties hereby agree as follows:

1. Amendment

to the Agreement. Section 5.22 of the Agreement is amended and restated in its entirety to read as follows:

“5.22 Exclusivity. The Company,

AOI and EDOC agreed to refrain from soliciting, accepting or encouraging any other financing proposal similar to the transactions contemplated

hereunder until at least December 31, 2023.”

2.

General Provisions.

2.1 Effectiveness;

No Other Amendments; Entire Agreement. Upon the effectiveness of this Amendment, on and after the Effective Date, each reference

in the Agreement to “hereunder,” “hereof,” “herein” or words of like import, and each reference in

the other documents entered into in connection with such Agreement shall mean and be a reference to such Agreement, as amended by this

Amendment. No term or provision of the Agreement shall be affected by this Amendment unless specifically set forth herein and any term

or provision of the Agreement not affected by this Amendment shall remain in full force and effect following the Effective Date. The Agreement,

the exhibits and schedules thereto and this Amendment constitute the full and entire understanding and agreement between the parties with

regard to the subject matter hereof and thereof. In the event of a conflict between the terms of the Agreement and the terms of this Amendment,

the terms of this Amendment shall control.

2.2 Severability.

In the event one or more of the provisions of this Amendment should, for any reason, be held to be invalid, illegal or unenforceable in

any respect, such invalidity, illegality or unenforceability shall not affect any other provisions of this Amendment, and this Amendment

shall be construed as if such invalid, illegal or unenforceable provision had never been contained herein.

2.3 Governing

Law. This Amendment and any controversy arising out or relating to this Amendment shall be governed by the internal law of the

State of New York, without regard to conflict of law principles that would result in the application of any law other than the law of

the State of New York.

2.4 Counterparts.

This Amendment may be executed in two (2) or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart

so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

2.5 Further

Assurances. The Parties hereto agree to execute such further documents and instruments and to take such further actions as may

be reasonably necessary to carry out the purposes and intent of this Amendment.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have executed

this Amendment as of the day and year first above written.

| |

AUSTRALIAN OILSEEDS HOLDINGS LIMITED |

| |

|

| |

By: |

/s/ Gary Seaton |

| |

|

Name: |

Gary Seaton |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

AUSTRALIAN OILSEEDS INVESTMENTS PTY LTD. |

| |

|

| |

By: |

/s/ Gary Seaton |

| |

|

Name: |

Gary Seaton |

| |

|

Title: |

Director |

| |

EDOC ACQUISITION CORP. |

| |

|

| |

By: |

/s/ Kevin Chen |

| |

|

Name: |

Kevin Chen |

| |

|

Title: |

Chief Executive Officer |

| |

ARENA INVESTORS, LP |

| |

|

| |

By: |

/s/ Lawrence Cutler |

| |

|

Name: |

Lawrence Cutler |

| |

|

Title: |

Authorized Signatory |

Exhibit 10.2

AMENDMENT NO. 2 TO SECURITIES PURCHASE AGREEMENT

This Amendment No. 2 to Securities

Purchase Agreement (this “Amendment”) is made and entered into as of December 4, 2023 (the “Effective Date”),

by and among Australian Oilseeds Holdings Limited, an exempted company incorporated in the Cayman Islands (the “Company”),

EDOC Acquisition Corp., an exempted company incorporated in the Cayman Islands (“EDOC”), Australian Oilseeds Investments

Pty Ltd., an Australian proprietary company (“AOI”), and Arena Investors, LP, a Delaware limited partnership, in its

capacity as the purchaser (the “Purchaser”), and amends that certain Securities Purchase Agreement, dated as of August

23, 2023, as amended by Amendment No. 1 to Securities Purchase Agreement, dated as of October 31, 2023, by and among the Company, AOI,

EDOC and the Purchaser (collectively, the “Agreement”). Each of the Company, AOI, EDOC and the Purchaser shall individually

be referred to herein as a “Party” and, collectively, as the “Parties.” Capitalized terms used in this Amendment

but not defined herein shall have the meanings set forth in the Agreement.

RECITALS

WHEREAS, the Parties

desire to amend the Agreement as set forth in this Amendment;

WHEREAS, Section 6.5

of the Agreement provides that the Agreement may be amended with the written consent of each Party.

NOW, THEREFORE, in

consideration of the mutual agreements contained in this Amendment, and intending to be legally bound by the terms and conditions of this

Amendment, the Parties hereby agree as follows:

1. Amendments

to the Agreement.

1.1 Section

5.22. Section 5.22 of the Agreement is amended and restated in its entirety to read as follows:

“5.22 Exclusivity. The

Company, AOI and EDOC agreed to refrain from soliciting, accepting or encouraging any other financing proposal similar to the transactions

contemplated hereunder until at least February 29, 2024.”

1.2 Section

6.1(a). Section 6.1(a) of the Agreement is amended and restated in its entirety to read as follows:

“6.1 Termination.

| (a) | This Agreement shall terminate and be void and of no further force and effect, and

all rights and obligations of the Parties hereunder shall terminate without any further liability on the part of any Party in respect

thereof, upon the earlier to occur of: (a) the mutual written agreement of each of the Parties hereto to terminate this Agreement; (b)

such date and time as the Business Combination Agreement is terminated in accordance with Section 11.1 thereof; and (c) written notice

by the Company to the Purchaser or by the Purchaser to the Company if the first Closing has not been consummated on or prior to February

29, 2024.” |

2.

General Provisions.

2.1 Effectiveness;

No Other Amendments; Entire Agreement. Upon the effectiveness of this Amendment, on and after the Effective Date, each reference

in the Agreement to “hereunder,” “hereof,” “herein” or words of like import, and each reference in

the other documents entered into in connection with such Agreement shall mean and be a reference to such Agreement, as amended by this

Amendment. No term or provision of the Agreement shall be affected by this Amendment unless specifically set forth herein and any term

or provision of the Agreement not affected by this Amendment shall remain in full force and effect following the Effective Date. The Agreement,

the exhibits and schedules thereto and this Amendment constitute the full and entire understanding and agreement between the parties with

regard to the subject matter hereof and thereof. In the event of a conflict between the terms of the Agreement and the terms of this Amendment,

the terms of this Amendment shall control.

2.2 Severability.

In the event one or more of the provisions of this Amendment should, for any reason, be held to be invalid, illegal or unenforceable in

any respect, such invalidity, illegality or unenforceability shall not affect any other provisions of this Amendment, and this Amendment

shall be construed as if such invalid, illegal or unenforceable provision had never been contained herein.

2.3 Governing

Law. This Amendment and any controversy arising out or relating to this Amendment shall be governed by the internal law of the

State of New York, without regard to conflict of law principles that would result in the application of any law other than the law of

the State of New York.

2.4 Counterparts.

This Amendment may be executed in two (2) or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart

so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

2.5 Further

Assurances. The Parties hereto agree to execute such further documents and instruments and to take such further actions as may

be reasonably necessary to carry out the purposes and intent of this Amendment.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties

hereto have executed this Amendment as of the day and year first above written.

| |

AUSTRALIAN OILSEEDS HOLDINGS LIMITED |

| |

|

| |

By: |

/s/ Gary Seaton |

| |

|

Name: |

Gary Seaton |

| |

|

Title: |

Chairman and Chief Executive Officer |

| |

AUSTRALIAN OILSEEDS INVESTMENTS PTY LTD. |

| |

|

| |

By: |

/s/ Gary Seaton |

| |

|

Name: |

Gary Seaton |

| |

|

Title: |

Director |

| |

EDOC ACQUISITION CORP. |

| |

|

| |

By: |

/s/ Kevin Chen |

| |

|

Name: |

Kevin Chen |

| |

|

Title: |

Chief Executive Officer |

| |

ARENA INVESTORS, LP |

| |

|

| |

By: |

/s/ Lawrence Cutler |

| |

|

Name: |

Lawrence Cutler |

| |

|

Title: |

Authorized Signatory |

v3.23.3

Cover

|

Dec. 04, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 04, 2023

|

| Entity File Number |

001-39689

|

| Entity Registrant Name |

EDOC Acquisition Corp.

|

| Entity Central Index Key |

0001824884

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

7612 Main Street Fishers

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Victor

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

14564

|

| City Area Code |

585

|

| Local Phone Number |

678-1198

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A Ordinary Shares, $.0001 par value per share |

|

| Title of 12(b) Security |

Class A Ordinary Shares, $.0001 par value per share

|

| Trading Symbol |

ADOC

|

| Security Exchange Name |

NASDAQ

|

| Rights, exchangeable into one-tenth of one Class A Ordinary Share |

|

| Title of 12(b) Security |

Rights, exchangeable into one-tenth of one Class A Ordinary Share

|

| Trading Symbol |

ADOCR

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one-half of one Class A Ordinary Share, each whole Warrant exercisable for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each exercisable for one-half of one Class A Ordinary Share, each whole Warrant exercisable for $11.50 per share

|

| Trading Symbol |

ADOCW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADOC_ClassOrdinaryShares.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADOC_RightsExchangeableIntoOnetenthOfOneClassOrdinaryShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADOC_WarrantsEachExercisableForOnehalfOfOneClassOrdinaryShareEachWholeWarrantExercisableFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

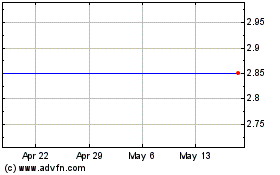

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From Apr 2024 to May 2024

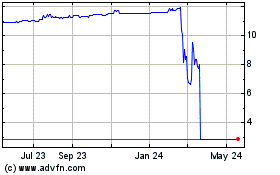

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From May 2023 to May 2024