Advantage Solutions Inc. (NASDAQ: ADV) (“Advantage,” “Advantage

Solutions,” the “company,” “we” or “our”), a leading provider of

sales and marketing services to consumer goods manufacturers and

retailers, today reported financial results for its fourth quarter

and fiscal full year ended December 31, 2023. The results continue

to reflect a trendline of improving financial performance and

progress executing its transformation strategy.

“Our ongoing efforts to strengthen our culture, simplify our

operations, improve our financial discipline and enhance our

processes as a unified company resulted in a solid fourth-quarter

performance,” said Advantage Solutions CEO Dave Peacock. “I am

incredibly proud of our team’s success as we delivered full-year

revenue growth and Adjusted EBITDA results ahead of expectations.

We are committed to continuing to evolve our position in the

marketplace and deliver long-term, profitable growth by enhancing

our service level with clients and customers.”

The company also continues to evaluate its service offerings,

consistent with its stated strategy, to ensure more focus on its

mission of converting shoppers into buyers for consumer goods

companies and retailers. To that end, Advantage Solutions completed

additional actions to advance its transformation. Those

include:

- Divesture of foodservice businesses: The company divested its

foodservice businesses, most notably Waypoint, to Prospect Hill

Growth Partners LP on Jan. 31, 2024. As part of the sale, the

foodservice businesses were combined with KeyImpact Sales &

Systems Inc. to form Acxion Foodservice. The resulting firm creates

an innovative go-to-market model to offer clients next-generation

services powered by analytics. Advantage received total proceeds of

approximately $100 million in mostly cash and an ongoing 7.5% stake

in the combined entity.

- Deconsolidation of the European joint venture: Advantage

Solutions reduced its stake in Advantage Smollan Limited, a joint

venture with the Smollan Group in Europe, from a majority stake

under 60% to a minority position of 49.6% in exchange for cash and

other considerations. The transaction restructures the European

operation by reducing back-office complexities and expenses and

simplifies the company’s overall financial reporting.

- Administrative and technology agreements: Advantage Solutions

entered into an agreement with Genpact to build an innovative,

proprietary digital solution designed to streamline and automate

processes behind Advantage BPO and administrative services.

Additionally, the company announced a collaboration with Tata

Consultancy Services to provide certain IT services.

“We believe the path to unlock Advantage Solutions’ potential

lies in our core capabilities,” Peacock said. “The actions we have

taken to date and potential future actions under consideration are

designed to make us more nimble, insights-driven, and efficient to

provide unmatched service to our clients and customers.”

In 2023, the company reduced the face value of its debt by

$168.2 million in voluntary open-market repurchases of its term

loan and senior secured notes while executing $6.4 million in share

repurchases. Advantage’s capital allocation philosophy focuses on

maximizing returns for equity holders, including deleveraging its

balance sheet and investing behind core business offerings to fuel

future growth.

“We believe having a healthy balance sheet and a sound

infrastructure are crucial to providing clients and customers with

best-in-class service,” Peacock said. “Advantage is committed to

quickly implementing the right plans to generate more cash to

invest in the business and position the company for long-term

success.”

Fiscal Year 2023 Highlights Compared to

2022

Revenues

| |

|

Year Ended December 31, |

|

Change |

| |

|

2023 |

|

2022 |

|

$ |

|

% |

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

2,445,015 |

|

|

$ |

2,507,017 |

|

|

$ |

(62,002 |

) |

|

|

(2.5 |

%) |

| Marketing |

|

|

1,779,831 |

|

|

|

1,542,725 |

|

|

|

237,106 |

|

|

|

15.4 |

% |

|

Total Revenues |

|

$ |

4,224,846 |

|

|

$ |

4,049,742 |

|

|

$ |

175,104 |

|

|

|

4.3 |

% |

|

|

Adjusted EBITDA and Adjusted EBITDA by

Segment

| |

|

Year Ended December 31, |

|

Change |

| |

|

2023 |

|

2022 |

|

$ |

|

% |

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

265,255 |

|

|

$ |

294,234 |

|

|

$ |

(28,979 |

) |

|

|

(9.8 |

%) |

| Marketing |

|

|

159,092 |

|

|

|

141,761 |

|

|

|

17,331 |

|

|

|

12.2 |

% |

|

Total Adjusted EBITDA |

|

$ |

424,347 |

|

|

$ |

435,995 |

|

|

$ |

(11,648 |

) |

|

|

(2.7 |

%) |

|

|

Consolidated revenues grew 4.3% to $4.2 billion and increased

6.8% excluding the impact of foreign exchange and divestitures

(including the deconsolidation of the European joint venture).

Revenue growth in the marketing segment was driven primarily by the

continued recovery of in-store sampling and demonstration services

and pricing realization. The decline in the sales segment was

driven by completed divestitures and an intentional client exit in

late 2022, partially offset by price and volume realization.

Operating income was $76.2 million, an increase of $1.5 billion

due to a non-cash goodwill impairment and intangible asset

impairment charge in the fourth quarter of 2022. Inflationary cost

pressures related to wage and incentive compensation and internal

reorganization activities negatively impacted operating income in

2023 but were largely in line with expectations. The Company

recorded a non-cash intangible asset impairment expense and a

non-cash gain on the deconsolidation of subsidiaries related to the

European deconsolidation in the fourth quarter of 2023.

Adjusted EBITDA declined 2.7% to $424.3 million. Price increases

and increased in-store sampling and demonstration activity drove

improved performance in the marketing segment. This was offset by a

decline in revenues in the sales segment, inflationary cost

pressure, incentive compensation, and higher technology

expenses.

Net loss was $60.3 million compared with net loss of $1.4

billion in 2022 due to the one-time impairment charges. Net loss in

the current period was also impacted by an unfavorable interest

expense due to higher interest rates, partially offset by lower

debt balances.

Fourth Quarter 2023 Highlights Compared to Fourth

Quarter 2022

Revenues

| |

|

Three Months Ended December 31, |

|

|

Change |

| |

|

2023 |

|

2022 |

|

$ |

|

% |

| (in

thousands) |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

Sales |

|

$ |

603,297 |

|

|

$ |

664,670 |

|

|

$ |

(61,373 |

) |

|

|

(9.2 |

%) |

| Marketing |

|

|

476,452 |

|

|

|

438,093 |

|

|

|

38,359 |

|

|

|

8.8 |

% |

|

Total Revenues |

|

$ |

1,079,749 |

|

|

$ |

1,102,763 |

|

|

$ |

(23,014 |

) |

|

|

(2.1 |

%) |

|

|

Adjusted EBITDA and Adjusted EBITDA by

Segment

|

|

|

Three Months Ended December 31, |

|

Change |

| |

|

2023 |

|

2022 |

|

$ |

|

% |

| (in

thousands) |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

Sales |

|

$ |

68,811 |

|

|

$ |

78,076 |

|

|

$ |

(9,265 |

) |

|

|

(11.9 |

%) |

| Marketing |

|

|

46,105 |

|

|

|

34,590 |

|

|

|

11,515 |

|

|

|

33.3 |

% |

|

Total Adjusted EBITDA |

|

$ |

114,916 |

|

|

$ |

112,666 |

|

|

$ |

2,250 |

|

|

|

2.0 |

% |

|

|

Consolidated revenues declined 2.1% to $1.1 billion and

increased 3.4%, excluding the impact of foreign exchange,

acquisitions and divestitures. The drivers of top-line performance

were similar to what drove the full-year results.

Operating income in the quarter was $46.2 million, an increase

of $1.6 billion due to a non-cash goodwill impairment and

intangible asset impairment charge in the prior year period. Price

actions in the quarter helped to mostly offset inflationary cost

pressures related to wages and benefits. Additional costs related

to various internal reorganization activities were recognized in

the quarter. The Company recorded a non-cash intangible asset

impairment charge and a gain on deconsolidation of subsidiaries

related to the European deconsolidation in the current period.

The continuing trend for improved performance led to an Adjusted

EBITDA of $114.9 million, which resulted in modest year-over-year

growth and margin expansion.

Net income was $17.8 million compared with a net loss of $1.4

billion in the prior year, which was impacted by the one-time

impairment charges. Net income in the current period was consistent

with expectations for operating performance and the net effects of

the current interest rate environment and reduction in debt

balances.

Balance Sheet Highlights

As of December 31, 2023, the company’s cash and cash equivalents

were $126.5 million, including the reduction in cash from the

deconsolidation of the European joint venture and the use of cash

for debt and share repurchases in the fourth quarter. Total Debt

was $1,897.5 million, and Net Debt was $1,771.0 million. The debt

capitalization consists primarily of the $1,149.1 million First

Lien Term Loan and $743.0 million of senior secured notes.

During the quarter, Advantage voluntarily repurchased

approximately $25.0 million of its First Lien Term Loan and

approximately $32.0 million of its senior secured notes at

attractive discounts, resulting in a net leverage ratio of

approximately 4.2x Adjusted EBITDA as of December 31, 2023,

compared to 4.5x at the end of 2022. Approximately 89% of the

company’s debt is hedged or at a fixed interest rate.

Fiscal Year 2024 Outlook

In light of growing business momentum and improving market

dynamics, management expects 2024 revenue and Adjusted EBITDA

growth in the range of low single digits, excluding the in-year

impact of the completed divestitures on the 2023 results. The

company plans to execute additional simplification objectives in

2024, including activities related to improving operating

efficiencies and investments behind the business from a talent and

technology perspective. As a result, capital expenditures are

expected to be $90 million to $110 million with a tapering in the

spending planned for 2025 and a return to historical spending

levels in 2026. The company also establishes a long-term net

leverage target below 3.5x LTM Adjusted EBITDA. Additional guidance

metrics can be found in the company’s supplemental earnings

presentation.

Conference Call Details

Advantage will host a conference call at 8:30 am ET on February

29, 2024 to discuss its fourth quarter and full year 2023 financial

performance and business outlook. To participate, please dial

877-407-4018 within the United States or +1-201-689-8471 outside

the United States approximately 10 minutes before the scheduled

start of the call. The conference ID for the call is 13742873. The

conference call will also be accessible live via audio broadcast on

the Investor Relations section of the Advantage website at

ir.advantagesolutions.net.

A replay of the conference call will be available online on the

investor section of the Advantage website. In addition, an audio

replay of the call will be available for one week following the

call and can be accessed by dialing 844-512-2921 within the United

States or +1-412-317-6671 outside the United States. The replay ID

is 13742873.

About Advantage Solutions

Advantage Solutions is a leading provider of outsourced sales

and marketing solutions uniquely positioned at the intersection of

brands and retailers. Our data- and technology-driven services —

which include headquarter sales, retail merchandising, in-store and

online sampling, digital commerce, omnichannel marketing, retail

media and others — help brands and retailers of all sizes get

products into the hands of consumers, wherever they shop. As a

trusted partner and problem solver, we help our clients sell more

while spending less. Advantage has offices throughout North America

and strategic investments in select markets throughout Africa,

Asia, Australia, Latin America and Europe through which the company

serves the global needs of multinational, regional and local

manufacturers. For more information, please visit

advantagesolutions.net.

Included with this press release are the company’s consolidated

and condensed financial statements as of and for the three and

twelve months ended December 31, 2023. These financial statements

should be read in conjunction with the information

contained in the company’s Annual Report on Form 10-K, to be filed

with the Securities and Exchange Commission on or about March 1,

2024.

Forward-Looking Statements

Certain statements in this press release may be considered

forward-looking statements within the meaning of the federal

securities laws, including statements regarding the expected future

performance of Advantage's business and projected financial

results. Forward-looking statements generally relate to future

events or Advantage’s future financial or operating performance.

These forward-looking statements generally are identified by the

words “may”, “should”, “expect”, “intend”, “will”, “would”,

“could”, “estimate”, “anticipate”, “believe”, “predict”,

“confident”, “potential” or “continue”, or the negatives of these

terms or variations of them or similar terminology. Such

forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to

risks, uncertainties and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Advantage and its

management at the time of such statements, are inherently

uncertain. Factors that may cause actual results to differ

materially from current expectations include, but are not limited

to, market-driven wage changes or changes to labor laws or wage or

job classification regulations, including minimum wage; the

COVID-19 pandemic and other future potential pandemics or health

epidemics; Advantage’s ability to continue to generate significant

operating cash flow; client procurement strategies and

consolidation of Advantage’s clients’ industries creating pressure

on the nature and pricing of its services; consumer goods

manufacturers and retailers reviewing and changing their sales,

retail, marketing and technology programs and relationships;

Advantage’s ability to successfully develop and maintain relevant

omni-channel services for our clients in an evolving industry and

to otherwise adapt to significant technological change; Advantage’s

ability to maintain proper and effective internal control over

financial reporting in the future; potential and actual harms to

Advantage’s business arising from the Take 5 Matter; Advantage’s

substantial indebtedness and our ability to refinance at favorable

rates; and other risks and uncertainties set forth in the section

titled “Risk Factors” in the Annual Report on Form 10-K to be filed

by the company with the Securities and Exchange Commission (the

“SEC”) on or about March 1, 2024, and in its other filings made

from time to time with the SEC. These filings identify and address

other important risks and uncertainties that could cause actual

events and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Advantage assumes

no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Non-GAAP Financial Measures and Related

Information

This press release includes certain financial measures not

presented in accordance with generally accepted accounting

principles (“GAAP”), including Adjusted EBITDA, Adjusted EBITDA by

Segment and Net Debt. These are not measures of financial

performance calculated in accordance with GAAP and may exclude

items that are significant in understanding and assessing

Advantage’s financial results. Therefore, the measures are in

addition to, and not a substitute for or superior to, measures of

financial performance prepared in accordance with GAAP, and should

not be considered in isolation or as an alternative to net income,

cash flows from operations or other measures of profitability,

liquidity or performance under GAAP. You should be aware that

Advantage’s presentation of these measures may not be comparable to

similarly titled measures used by other companies. Reconciliations

of historical non-GAAP measures to their most directly comparable

GAAP counterparts are included below.

Advantage believes these non-GAAP measures provide useful

information to management and investors regarding certain financial

and business trends relating to Advantage’s financial condition and

results of operations. Advantage believes that the use of Adjusted

EBITDA, Adjusted EBITDA by Segment and Net Debt provides an

additional tool for investors to use in evaluating ongoing

operating results and trends and in comparing Advantage’s financial

measures with other similar companies, many of which present

similar non-GAAP financial measures to investors. Non-GAAP

financial measures are subject to inherent limitations as they

reflect the exercise of judgments by management about which expense

and income are excluded or included in determining these non-GAAP

financial measures. Additionally, other companies may calculate

non-GAAP measures differently, or may use other measures to

calculate their financial performance, and therefore Advantage’s

non-GAAP measures may not be directly comparable to similarly

titled measures of other companies.

Adjusted EBITDA and Adjusted EBITDA by Segment mean net (loss)

income before (i) interest expense, net, (ii) provision for

(benefit from) income taxes, (iii) depreciation, (iv) impairment of

goodwill and indefinite-lived assets, (v) amortization of

intangible assets, (vi) gain on deconsolidation of subsidiaries,

(vii) loss on divestitures, (viii) equity-based compensation of

Karman Topco L.P., (ix) changes in fair value of warrant liability,

(x) stock based compensation expense, (xi) fair value adjustments

of contingent consideration related to acquisitions, (xii)

acquisition and divestiture related expenses, (xiii) costs

associated with COVID-19, net of benefits received, (xiv) EBITDA

for economic interests in investments, (xv) reorganization

expenses, (xvi) litigation expenses, (xvii) recovery from and costs

associated with the Take 5 Matter and (xviii) other adjustments

that management believes are helpful in evaluating our operating

performance.

Net Debt represents the sum of current portion of long-term debt

and long-term debt, less cash and cash equivalents and debt

issuance costs. With respect to Net Debt, cash and cash equivalents

are subtracted from the GAAP measure, total debt, because they

could be used to reduce the debt obligations. We present Net Debt

because we believe this non-GAAP measure provides useful

information to management and investors regarding certain financial

and business trends relating to the company’s financial condition

and to evaluate changes to the company's capital structure and

credit quality assessment.

Due to rounding, numbers presented throughout this document may

not add up precisely to the totals provided and percentages may not

precisely reflect the absolute figures.

This press release also includes certain estimates and

projections of Adjusted EBITDA, including with respect to expected

fiscal 2024 results. Due to the high variability and difficulty in

making accurate estimates and projections of some of the

information excluded from Adjusted EBITDA, together with some of

the excluded information not being ascertainable or accessible,

Advantage is unable to quantify certain amounts that would be

required to be included in the most directly comparable GAAP

financial measures without unreasonable effort. Consequently, no

disclosure of estimated or projected comparable GAAP measures is

included and no reconciliation of such forward-looking non-GAAP

financial measures is included.

|

Advantage Solutions Inc.Consolidated

Balance Sheets |

|

|

|

|

|

December 31, |

|

| (in thousands, except

share data) |

|

2023 |

|

|

2022 |

|

|

ASSETS |

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

126,479 |

|

|

$ |

120,715 |

|

|

Restricted cash |

|

|

16,363 |

|

|

|

17,817 |

|

|

Accounts receivable, net of allowance for expected credit

losses of $34,807 and $22,752,

respectively |

|

|

703,252 |

|

|

|

869,000 |

|

|

Prepaid expenses and other current assets |

|

|

165,940 |

|

|

|

149,476 |

|

|

Total current assets |

|

|

1,012,034 |

|

|

|

1,157,008 |

|

| Property and equipment,

net |

|

|

73,910 |

|

|

|

70,898 |

|

| Goodwill |

|

|

855,391 |

|

|

|

887,949 |

|

| Other intangible assets,

net |

|

|

1,580,134 |

|

|

|

1,897,503 |

|

| Investments in unconsolidated

affiliates |

|

|

211,393 |

|

|

|

129,491 |

|

| Other assets |

|

|

46,461 |

|

|

|

119,522 |

|

|

Total assets |

|

$ |

3,779,323 |

|

|

$ |

4,262,371 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

13,580 |

|

|

$ |

13,991 |

|

|

Accounts payable |

|

|

181,076 |

|

|

|

261,464 |

|

|

Accrued compensation and benefits |

|

|

165,701 |

|

|

|

154,744 |

|

|

Other accrued expenses |

|

|

153,015 |

|

|

|

133,173 |

|

|

Deferred revenues |

|

|

27,925 |

|

|

|

37,329 |

|

|

Total current liabilities |

|

|

541,297 |

|

|

|

600,701 |

|

| Long-term debt, net of current

portion |

|

|

1,852,784 |

|

|

|

2,022,819 |

|

| Deferred income tax

liabilities |

|

|

204,251 |

|

|

|

297,874 |

|

| Warrant liability |

|

|

667 |

|

|

|

953 |

|

| Other long-term

liabilities |

|

|

76,247 |

|

|

|

110,554 |

|

|

Total liabilities |

|

|

2,675,246 |

|

|

|

3,032,901 |

|

|

|

|

|

|

|

|

|

| Redeemable noncontrolling

interest |

|

|

— |

|

|

|

3,746 |

|

| |

|

|

|

|

|

|

| Equity

attributable to stockholders of Advantage Solutions Inc. |

|

|

Preferred stock, no par value, 10,000,000 shares

authorized; none issued and outstanding

as of December 31, 2023 and 2022,

respectively |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value, 3,290,000,000

shares authorized; 322,235,261 and

319,690,300 shares issued and outstanding

as of December 31, 2023 and 2022,

respectively |

|

|

32 |

|

|

|

32 |

|

|

Additional paid in capital |

|

|

3,449,261 |

|

|

|

3,408,836 |

|

|

Accumulated deficit |

|

|

(2,314,650 |

) |

|

|

(2,247,109 |

) |

|

Loans to Karman Topco L.P. |

|

|

(6,387 |

) |

|

|

(6,363 |

) |

|

Accumulated other comprehensive loss |

|

|

(3,945 |

) |

|

|

(18,849 |

) |

|

Treasury stock, at cost; 3,600,075 and 1,610,014 shares

as of December 31, 2023 and 2022,

respectively |

|

|

(18,949 |

) |

|

|

(12,567 |

) |

|

Total equity attributable to stockholders of Advantage

Solutions Inc. |

|

|

1,105,362 |

|

|

|

1,123,980 |

|

| Nonredeemable noncontrolling

interest |

|

|

(1,285 |

) |

|

|

101,744 |

|

|

Total stockholders’ equity |

|

|

1,104,077 |

|

|

|

1,225,724 |

|

|

Total liabilities, redeemable noncontrolling interest,

and stockholders’ equity |

|

$ |

3,779,323 |

|

|

$ |

4,262,371 |

|

|

|

|

Advantage Solutions Inc.Consolidated

Statements of Operations and Comprehensive (Loss)

Income |

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| (in thousands, except

share and per share data) |

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

Revenues |

$ |

1,079,749 |

|

|

$ |

1,102,763 |

|

|

$ |

4,224,846 |

|

|

$ |

4,049,742 |

|

| Cost of revenues |

|

915,985 |

|

|

|

956,927 |

|

|

|

3,660,464 |

|

|

|

3,493,183 |

|

| Selling, general, and

administrative expenses |

|

80,854 |

|

|

|

51,863 |

|

|

|

265,091 |

|

|

|

187,504 |

|

| Impairment of goodwill and

indefinite-lived assets |

|

43,500 |

|

|

|

1,572,523 |

|

|

|

43,500 |

|

|

|

1,572,523 |

|

| Depreciation and

amortization |

|

54,390 |

|

|

|

59,078 |

|

|

|

224,697 |

|

|

|

233,075 |

|

| Gain on deconsolidation of

subsidiaries |

|

(58,891 |

) |

|

|

— |

|

|

|

(58,891 |

) |

|

|

— |

|

| (Gain) loss on

divestitures |

|

(1,140 |

) |

|

|

(90 |

) |

|

|

19,068 |

|

|

|

2,863 |

|

| Income from unconsolidated

investments |

|

(1,141 |

) |

|

|

— |

|

|

|

(5,273 |

) |

|

|

— |

|

|

Total expenses |

|

1,033,557 |

|

|

|

2,640,301 |

|

|

|

4,148,656 |

|

|

|

5,489,148 |

|

| Operating income (loss) |

|

46,192 |

|

|

|

(1,537,538 |

) |

|

|

76,190 |

|

|

|

(1,439,406 |

) |

| Other (income) expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Change in fair value of

warrant liability |

|

(873 |

) |

|

|

220 |

|

|

|

(286 |

) |

|

|

(21,236 |

) |

| Interest expense, net |

|

45,850 |

|

|

|

40,831 |

|

|

|

165,802 |

|

|

|

104,459 |

|

|

Total other expenses |

|

44,977 |

|

|

|

41,051 |

|

|

|

165,516 |

|

|

|

83,223 |

|

| Income (loss) before income

taxes |

|

1,215 |

|

|

|

(1,578,589 |

) |

|

|

(89,326 |

) |

|

|

(1,522,629 |

) |

| (Benefit from) provision for

income taxes |

|

(16,573 |

) |

|

|

(156,860 |

) |

|

|

(29,008 |

) |

|

|

(145,337 |

) |

| Net income (loss) |

|

17,788 |

|

|

|

(1,421,729 |

) |

|

|

(60,318 |

) |

|

|

(1,377,292 |

) |

|

Less: net income attributable to noncontrolling interest |

|

359 |

|

|

|

2,168 |

|

|

|

2,940 |

|

|

|

3,210 |

|

| Net income (loss) attributable

to stockholders of Advantage Solutions

Inc. |

|

17,429 |

|

|

|

(1,423,897 |

) |

|

|

(63,258 |

) |

|

|

(1,380,502 |

) |

| Other comprehensive loss, net

of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

6,280 |

|

|

|

11,129 |

|

|

|

5,817 |

|

|

|

(14,370 |

) |

| Total comprehensive (loss)

income attributable to stockholders of

Advantage Solutions Inc. |

$ |

23,709 |

|

|

$ |

(1,412,768 |

) |

|

$ |

(57,441 |

) |

|

$ |

(1,394,872 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) earnings per common share |

$ |

0.05 |

|

|

$ |

(4.45 |

) |

|

$ |

(0.20 |

) |

|

$ |

(4.33 |

) |

|

Diluted (loss) earnings per common share |

$ |

0.05 |

|

|

$ |

(4.45 |

) |

|

$ |

(0.20 |

) |

|

$ |

(4.33 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of common shares: |

|

324,639,562 |

|

|

|

319,682,507 |

|

|

|

323,677,515 |

|

|

|

318,682,548 |

|

|

Weighted-average number of common shares,

assuming dilution |

|

340,320,151 |

|

|

|

319,682,507 |

|

|

|

323,677,515 |

|

|

|

318,682,548 |

|

|

|

|

Advantage Solutions Inc.Consolidated

Statement of Cash Flows |

| |

| |

|

Year Ended December 31, |

|

| (in

thousands) |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(60,318 |

) |

|

$ |

(1,377,292 |

) |

|

$ |

57,549 |

|

| Adjustments to reconcile net

(loss) income to net cash provided by operating

activities |

|

|

|

|

|

|

|

|

|

|

Noncash interest income |

|

|

(7,660 |

) |

|

|

(43,785 |

) |

|

|

(8,315 |

) |

|

Amortization of deferred financing fees |

|

|

8,292 |

|

|

|

8,860 |

|

|

|

9,250 |

|

|

Impairment of goodwill and indefinite-lived assets |

|

|

43,500 |

|

|

|

1,572,523 |

|

|

|

— |

|

|

Extinguishment costs related to repayment and repricing of

long-term debt |

|

|

— |

|

|

|

— |

|

|

|

1,569 |

|

|

Depreciation and amortization |

|

|

224,697 |

|

|

|

233,075 |

|

|

|

240,041 |

|

|

Change in fair value of warrant liability |

|

|

(286 |

) |

|

|

(21,236 |

) |

|

|

955 |

|

|

Fair value adjustments related to contingent consideration |

|

|

10,362 |

|

|

|

4,774 |

|

|

|

5,763 |

|

|

Deferred income taxes |

|

|

(80,416 |

) |

|

|

(190,754 |

) |

|

|

(10,012 |

) |

|

Equity-based compensation of Karman Topco L.P. |

|

|

(2,524 |

) |

|

|

(6,934 |

) |

|

|

(15,030 |

) |

|

Stock-based compensation |

|

|

42,880 |

|

|

|

39,825 |

|

|

|

39,412 |

|

|

Equity in earnings of unconsolidated affiliates |

|

|

(5,511 |

) |

|

|

(10,609 |

) |

|

|

(10,298 |

) |

|

Distribution received from unconsolidated affiliates |

|

|

2,100 |

|

|

|

1,826 |

|

|

|

1,465 |

|

|

Loss on disposal of property and equipment |

|

|

3,318 |

|

|

|

644 |

|

|

|

7,162 |

|

|

Loss on divestitures |

|

|

19,068 |

|

|

|

2,863 |

|

|

|

— |

|

|

Gain on deconsolidation of subsidiaries |

|

|

(58,891 |

) |

|

|

— |

|

|

|

— |

|

|

Gain on repurchases from the Term Loan Facility and Senior Secured

Notes debt |

|

|

(8,665 |

) |

|

|

— |

|

|

|

— |

|

|

Changes in operating assets and liabilities, net of effects from

divestitures and purchases of businesses: |

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

45,601 |

|

|

|

(75,688 |

) |

|

|

(215,501 |

) |

|

Prepaid expenses and other assets |

|

|

50,626 |

|

|

|

(22,738 |

) |

|

|

(14,000 |

) |

|

Accounts payable |

|

|

(26,175 |

) |

|

|

(17,635 |

) |

|

|

46,000 |

|

|

Accrued compensation and benefits |

|

|

26,941 |

|

|

|

16,678 |

|

|

|

(2,363 |

) |

|

Deferred revenues |

|

|

6,974 |

|

|

|

(11,551 |

) |

|

|

(2,694 |

) |

|

Other accrued expenses and other liabilities |

|

|

5,082 |

|

|

|

18,412 |

|

|

|

(4,962 |

) |

|

Net cash provided by operating activities |

|

|

238,995 |

|

|

|

121,258 |

|

|

|

125,991 |

|

| CASH FLOWS FROM

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

| Purchase of businesses, net of

cash acquired |

|

|

— |

|

|

|

(74,206 |

) |

|

|

(42,668 |

) |

| Purchase of investment in

unconsolidated affiliates |

|

|

(3,023 |

) |

|

|

(775 |

) |

|

|

(2,000 |

) |

| Purchase of property and

equipment |

|

|

(46,271 |

) |

|

|

(40,455 |

) |

|

|

(31,175 |

) |

| Proceeds from

divestitures |

|

|

21,108 |

|

|

|

1,896 |

|

|

|

— |

|

| Deconsolidation of

subsidiaries cash and cash equivalents and

restricted cash, net of proceeds |

|

|

(31,465 |

) |

|

|

— |

|

|

|

— |

|

| Proceeds from sale of

investment in unconsolidated affiliates |

|

|

4,428 |

|

|

|

— |

|

|

|

— |

|

|

Net cash used in investing activities |

|

|

(55,223 |

) |

|

|

(113,540 |

) |

|

|

(75,843 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

| Borrowings under lines of

credit |

|

|

99,538 |

|

|

|

326,090 |

|

|

|

61,629 |

|

| Payments on lines of

credit |

|

|

(99,102 |

) |

|

|

(326,968 |

) |

|

|

(111,736 |

) |

| Proceeds from government loans

for COVID-19 relief |

|

|

1,339 |

|

|

|

— |

|

|

|

2,975 |

|

| Principal payments on

long-term debt |

|

|

(13,602 |

) |

|

|

(13,394 |

) |

|

|

(13,309 |

) |

| Repurchases of Term Loan

Facility and Senior Secured Notes debt |

|

|

(156,559 |

) |

|

|

— |

|

|

|

— |

|

| Proceeds from issuance of

common stock |

|

|

2,248 |

|

|

|

3,320 |

|

|

|

794 |

|

| Payments for taxes related to

net share settlement under 2020 Incentive

Award Plan |

|

|

(1,880 |

) |

|

|

— |

|

|

|

— |

|

| Contingent consideration

payments |

|

|

(4,898 |

) |

|

|

(23,164 |

) |

|

|

(9,814 |

) |

| Holdback payments |

|

|

(1,886 |

) |

|

|

(11,057 |

) |

|

|

(3,989 |

) |

| Purchase of treasury

stock |

|

|

(6,382 |

) |

|

|

— |

|

|

|

(12,567 |

) |

| Financing fees paid |

|

|

— |

|

|

|

(1,464 |

) |

|

|

(74 |

) |

| Contribution from

noncontrolling interest |

|

|

— |

|

|

|

5,217 |

|

|

|

— |

|

| Redemption of noncontrolling

interest |

|

|

(154 |

) |

|

|

(224 |

) |

|

|

(209 |

) |

|

Net cash used in financing activities |

|

|

(181,338 |

) |

|

|

(41,644 |

) |

|

|

(86,300 |

) |

| Net effect of foreign currency

changes on cash |

|

|

1,876 |

|

|

|

(8,179 |

) |

|

|

(3,177 |

) |

| Net change in cash, cash

equivalents and restricted cash |

|

|

4,310 |

|

|

|

(42,105 |

) |

|

|

(39,329 |

) |

| Cash, cash equivalents and

restricted cash, beginning of period |

|

|

138,532 |

|

|

|

180,637 |

|

|

|

219,966 |

|

| Cash, cash equivalents and

restricted cash, end of period |

|

$ |

142,842 |

|

|

$ |

138,532 |

|

|

$ |

180,637 |

|

| SUPLLEMENTARY NON-CASH

INVESTING AND FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

| Exchange of ownership of SPV

for fair value of GSH |

|

$ |

15,854 |

|

|

$ |

— |

|

|

$ |

— |

|

| Non-cash proceeds from

divestitures |

|

$ |

4,283 |

|

|

$ |

— |

|

|

$ |

— |

|

| Purchase of property and

equipment recorded in accounts payable and accrued

expenses |

|

$ |

1,201 |

|

|

$ |

842 |

|

|

$ |

759 |

|

| SUPPLEMENTAL CASH FLOW

INFORMATION |

|

|

|

|

|

|

|

|

|

| Cash payments for

interest |

|

$ |

174,767 |

|

|

$ |

126,560 |

|

|

$ |

137,467 |

|

| Cash received from interest

rate derivatives |

|

$ |

28,808 |

|

|

$ |

6,527 |

|

|

$ |

— |

|

| Cash payments for income

taxes, net |

|

$ |

39,007 |

|

|

$ |

45,729 |

|

|

$ |

40,189 |

|

| |

|

Advantage Solutions Inc.Reconciliation of

Net Income (Loss) to Adjusted

EBITDA(Unaudited) |

| |

|

Consolidated |

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

17,788 |

|

|

$ |

(1,421,729 |

) |

|

$ |

(60,318 |

) |

|

$ |

(1,377,292 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

45,850 |

|

|

|

40,831 |

|

|

|

165,802 |

|

|

|

104,459 |

|

| (Benefit from) provision for

income taxes |

|

(16,573 |

) |

|

|

(156,860 |

) |

|

|

(29,008 |

) |

|

|

(145,337 |

) |

| Depreciation and

amortization |

|

54,390 |

|

|

|

59,078 |

|

|

|

224,697 |

|

|

|

233,075 |

|

| Impairment of goodwill and

indefinite-lived assets |

|

43,500 |

|

|

|

1,572,523 |

|

|

|

43,500 |

|

|

|

1,572,523 |

|

| Gain on deconsolidation of

subsidiaries |

|

(58,891 |

) |

|

|

— |

|

|

|

(58,891 |

) |

|

|

— |

|

| (Gain) loss on

divestitures |

|

(1,140 |

) |

|

|

(90 |

) |

|

|

19,068 |

|

|

|

2,863 |

|

| Equity-based compensation of

Karman Topco L.P.(a) |

|

754 |

|

|

|

208 |

|

|

|

(2,524 |

) |

|

|

(6,934 |

) |

| Change in fair value of

warrant liability |

|

(873 |

) |

|

|

220 |

|

|

|

(286 |

) |

|

|

(21,236 |

) |

| Fair value adjustments related

to contingent consideration related to

acquisitions(b) |

|

(1,229 |

) |

|

|

(674 |

) |

|

|

10,362 |

|

|

|

4,774 |

|

| Acquisition and divestiture

related expenses(c) |

|

2,503 |

|

|

|

4,149 |

|

|

|

7,024 |

|

|

|

21,039 |

|

| Reorganization

expenses(d) |

|

17,620 |

|

|

|

1,636 |

|

|

|

57,021 |

|

|

|

6,094 |

|

| Litigation expenses(e) |

|

855 |

|

|

|

6,157 |

|

|

|

9,519 |

|

|

|

5,357 |

|

| Costs associated with

COVID-19, net of benefits received(f) |

|

(2 |

) |

|

|

2,263 |

|

|

|

3,283 |

|

|

|

7,208 |

|

| Costs associated with

(recovery from) the Take 5 Matter(g) |

|

63 |

|

|

|

377 |

|

|

|

(1,380 |

) |

|

|

2,465 |

|

| Stock-based compensation

expense(h) |

|

10,370 |

|

|

|

9,919 |

|

|

|

42,880 |

|

|

|

39,825 |

|

| EBITDA for economic interests

in investments(i) |

|

(69 |

) |

|

|

(5,342 |

) |

|

|

(6,402 |

) |

|

|

(12,888 |

) |

| Adjusted EBITDA |

$ |

114,916 |

|

|

$ |

112,666 |

|

|

$ |

424,347 |

|

|

$ |

435,995 |

|

| Sales

Segment |

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

$ |

29,471 |

|

|

$ |

(1,389,107 |

) |

|

$ |

38,443 |

|

|

$ |

(1,323,192 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

36,791 |

|

|

|

40,075 |

|

|

|

154,891 |

|

|

|

161,385 |

|

| Impairment of goodwill and

indefinite-lived assets |

|

43,500 |

|

|

|

1,421,719 |

|

|

|

43,500 |

|

|

|

1,421,719 |

|

| Gain on deconsolidation of

subsidiaries |

|

(58,891 |

) |

|

|

— |

|

|

|

(58,891 |

) |

|

|

— |

|

| (Gain) loss on

divestitures |

|

(1,086 |

) |

|

|

(90 |

) |

|

|

14,911 |

|

|

|

2,863 |

|

| Equity-based compensation of

Karman Topco L.P.(a) |

|

552 |

|

|

|

283 |

|

|

|

(1,270 |

) |

|

|

(3,721 |

) |

| Fair value adjustments related

to contingent consideration related to

acquisitions(b) |

|

(1,464 |

) |

|

|

(4,442 |

) |

|

|

6,616 |

|

|

|

550 |

|

| Acquisition and divestiture

related expenses(c) |

|

1,817 |

|

|

|

898 |

|

|

|

4,887 |

|

|

|

11,679 |

|

| Reorganization

expenses(d) |

|

12,166 |

|

|

|

1,307 |

|

|

|

36,853 |

|

|

|

4,826 |

|

| Litigation expenses(e) |

|

223 |

|

|

|

6,157 |

|

|

|

6,860 |

|

|

|

6,057 |

|

| Costs associated with

COVID-19, net of benefits received(f) |

|

5 |

|

|

|

611 |

|

|

|

369 |

|

|

|

1,412 |

|

| Stock-based compensation

expense(h) |

|

5,439 |

|

|

|

6,016 |

|

|

|

23,850 |

|

|

|

24,025 |

|

| EBITDA for economic interests

in investments(i) |

|

288 |

|

|

|

(5,351 |

) |

|

|

(5,764 |

) |

|

|

(13,369 |

) |

| Sales Segment Adjusted

EBITDA |

$ |

68,811 |

|

|

$ |

78,076 |

|

|

$ |

265,255 |

|

|

$ |

294,234 |

|

| Marketing

Segment |

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

$ |

16,721 |

|

|

$ |

(148,431 |

) |

|

$ |

37,747 |

|

|

$ |

(116,214 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

17,599 |

|

|

|

19,003 |

|

|

|

69,806 |

|

|

|

71,690 |

|

| Impairment of goodwill and

indefinite-lived assets |

|

— |

|

|

|

150,804 |

|

|

|

— |

|

|

|

150,804 |

|

| (Gain) loss on

divestitures |

|

(54 |

) |

|

|

— |

|

|

|

4,157 |

|

|

|

— |

|

| Equity-based compensation of

Karman Topco L.P.(a) |

|

202 |

|

|

|

(75 |

) |

|

|

(1,254 |

) |

|

|

(3,213 |

) |

| Fair value adjustments related

to contingent consideration related to

acquisitions(b) |

|

235 |

|

|

|

3,768 |

|

|

|

3,746 |

|

|

|

4,224 |

|

| Acquisition and divestiture

related expenses(c) |

|

686 |

|

|

|

3,251 |

|

|

|

2,137 |

|

|

|

9,360 |

|

| Reorganization

expenses(d) |

|

5,454 |

|

|

|

329 |

|

|

|

20,168 |

|

|

|

1,268 |

|

| Litigation expenses

(recovery)(e) |

|

632 |

|

|

|

— |

|

|

|

2,659 |

|

|

|

(700 |

) |

| Costs associated with

COVID-19, net of benefits received(f) |

|

(7 |

) |

|

|

1,652 |

|

|

|

2,914 |

|

|

|

5,796 |

|

| Costs associated with

(recovery from) the Take 5 Matter(g) |

|

63 |

|

|

|

377 |

|

|

|

(1,380 |

) |

|

|

2,465 |

|

| Stock-based compensation

expense(h) |

|

4,931 |

|

|

|

3,903 |

|

|

|

19,030 |

|

|

|

15,800 |

|

| EBITDA for economic interests

in investments(i) |

|

(357 |

) |

|

|

9 |

|

|

|

(638 |

) |

|

|

481 |

|

| Marketing Segment Adjusted

EBITDA |

$ |

46,105 |

|

|

$ |

34,590 |

|

|

$ |

159,092 |

|

|

$ |

141,761 |

|

|

(a) |

Represents expenses related to (i) equity-based compensation

expense associated with grants of Common Series D Units of Karman

Topco L.P. ("Topco") made to one of the equity holders of Topco and

(ii) equity-based compensation expense associated with the Common

Series C Units of Topco. |

| (b) |

Represents adjustments to the

estimated fair value of our contingent consideration liabilities

related to our acquisitions. See Note 9—Fair Value of Financial

Instruments to our consolidated financial statements for the years

ended December 31, 2023 and 2022. |

| (c) |

Represents fees and costs

associated with activities related to our acquisitions,

divestitures, and related reorganization activities, including

professional fees, due diligence, and integration activities. |

| (d) |

Represents fees and costs

associated with various internal reorganization activities,

including professional fees, lease exit costs, severance, and

nonrecurring compensation costs. |

| (e) |

Represents legal settlements,

reserves, and expenses that are unusual or infrequent costs

associated with our operating activities. |

| (f) |

Represents (i) costs related to

implementation of strategies for workplace safety in response to

COVID-19, including additional sick pay for front-line associates

and personal protective equipment; and (ii) benefits received from

government grants for COVID-19 relief. |

| (g) |

Represents (i) cash receipts from

an insurance policy for claims related to the Take 5 Matter; and

(ii) costs associated with the Take 5 Matter, primarily,

professional fees and other related costs. |

| (h) |

Represents non-cash compensation

expense related to the 2020 Incentive Award Plan and the 2020

Employee Stock Purchase Plan. |

| (i) |

Represents additions to reflect

our proportional share of Adjusted EBITDA related to our equity

method investments and reductions to remove the Adjusted EBITDA

related to the minority ownership percentage of the entities that

we fully consolidate in our financial statements. |

| |

|

|

Advantage Solutions Inc.Disaggregated

revenues |

|

|

| |

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| (in

thousands) |

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

| Sales

brand-centric services |

$ |

328,983 |

|

|

$ |

358,966 |

|

|

$ |

1,362,612 |

|

|

$ |

1,364,673 |

|

| Sales retail-centric services |

|

274,314 |

|

|

|

305,704 |

|

|

|

1,082,403 |

|

|

|

1,142,344 |

|

|

Total sales revenues |

|

603,297 |

|

|

|

664,670 |

|

|

|

2,445,015 |

|

|

|

2,507,017 |

|

| Marketing brand-centric services |

|

149,473 |

|

|

|

166,063 |

|

|

|

545,243 |

|

|

|

559,218 |

|

| Marketing retail-centric services |

|

326,979 |

|

|

|

272,030 |

|

|

|

1,234,588 |

|

|

|

983,507 |

|

|

Total marketing revenues |

|

476,452 |

|

|

|

438,093 |

|

|

|

1,779,831 |

|

|

|

1,542,725 |

|

| Total Revenues |

$ |

1,079,749 |

|

|

$ |

1,102,763 |

|

|

$ |

4,224,846 |

|

|

$ |

4,049,742 |

|

| |

|

Advantage Solutions Inc.Reconciliation of

Total Debt to Net Debt(Unaudited) |

| |

| |

December 31, 2023 |

|

| (in millions) |

|

|

|

Current portion of long-term debt |

$ |

13.6 |

|

| Long-term debt, net of current

portion |

|

1,852.8 |

|

| Less: Debt issuance costs |

|

(31.1 |

) |

| Total Debt |

|

1,897.5 |

|

| Less: Cash and cash

equivalents |

|

126.5 |

|

|

Total Net Debt |

$ |

1,771.0 |

|

| |

|

|

| Adjusted EBITDA |

$ |

424.3 |

|

| Net Debt / Adjusted EBITDA

(Net Leverage) Ratio |

4.2x |

|

| |

|

|

Investor Contacts: Sean

Choksisean.choksi@advantagesolutions.net

Ruben

Mellaruben.mella@advantagesolutions.net

Media Contacts: Peter

Frostpeter.frost@advantagesolutions.net

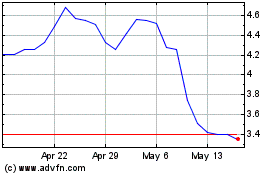

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Dec 2023 to Dec 2024