UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

September 2024

Commission File Number: 001-39179

Addex Therapeutics Ltd

(Exact Name of Registrant as Specified in Its

Charter)

Chemin des Mines 9,

CH-1202 Geneva,

Switzerland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F o

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 to this Report on Form 6-K shall be deemed

to be incorporated by reference into the registration statement on Form F-3 (Registration No. 333-255089) of Addex Therapeutics

Ltd and the registration statement on Form S-8 (Registration No. 333-255124 and No. 333-272515) of Addex Therapeutics

Ltd (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date on which this

report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

RISK FACTORS

Our business faces significant risks. You should carefully consider

all of the information set forth in this Report on Form 6-K and in our other filings with the United States Securities and Exchange

Commission, or the SEC, including the risk factors related to our business set forth in our Annual Report on Form 20-F for

the year ended December 31, 2023 filed with the Securities and Exchange Commission on April 18, 2024 and updated in our prospectus

(No.333-271611) amended on April 24, 2024. Our business, financial condition, results of operations and growth prospects could be

materially adversely affected by any of these risks. This report also contains forward-looking statements that involve risks and uncertainties.

Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including

the risks described in our Annual Report and our other SEC filings.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Addex

Therapeutics Ltd |

| |

|

| |

By: |

/s/

Tim Dyer |

| |

|

Name: |

Tim

Dyer |

| Date:

September 30, 2024 |

|

Title: |

Chief

Executive Officer |

EXHIBIT INDEX

Exhibit 99.1

ADDEX THERAPEUTICS LTD

INDEX TO UNAUDITED INTERIM CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

| Unaudited

Interim Condensed Consolidated Financial Statements |

|

| Unaudited

Interim Condensed Consolidated Balance Sheets as of June 30, 2024 and December 31, 2023 |

2 |

| Unaudited

Interim Condensed Consolidated Statements of Profit or Loss for the three-month and six-month periods ended June 30, 2024 and

2023 |

3

|

| Unaudited

Interim Condensed Consolidated Statements of Comprehensive Income or Loss for the three-month and six-month periods ended June 30,

2024 and 2023 |

4 |

| Unaudited

Interim Condensed Consolidated Statements of Changes in Equity for the six-month periods ended June 30, 2024 and 2023 |

5 |

| Unaudited

Interim Condensed Consolidated Statements of Changes in Equity for the three-month period ended June 30, 2023 |

6 |

| Unaudited

Interim Condensed Consolidated Statements of Changes in Equity for the three-month period ended June 30, 2024 |

7 |

| Unaudited

Interim Condensed Consolidated Statements of Cash Flows for the six-month periods ended June 30, 2024 and 2023 |

8 |

| Unaudited

Notes to the Interim Condensed Consolidated Financial Statements for the six-month period ended June 30, 2024 |

9 |

Addex

Therapeutics │ Unaudited Interim Condensed Consolidated Financial Statements

Unaudited Interim Condensed Consolidated Balance

Sheets

as of June 30, 2024, and December 31,

2023

| | |

Notes | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

| |

| | |

| |

| | |

| |

Amounts in Swiss francs | |

| ASSETS | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Current assets | |

| |

| | | |

| | |

| Cash and cash equivalents | |

6 | |

| 3,787,780 | | |

| 3,865,481 | |

| Other financial assets | |

7/13 | |

| 2,796 | | |

| 848 | |

| Trade and other receivables | |

7 | |

| 585,908 | | |

| 110,361 | |

| Contract asset | |

7 | |

| 30,520 | | |

| 40,907 | |

| Prepayments | |

7 | |

| 278,186 | | |

| 217,008 | |

| Other current assets | |

7 | |

| 5,000 | | |

| - | |

| Total current assets | |

| |

| 4,690,190 | | |

| 4,234,605 | |

| | |

| |

| | | |

| | |

| Non-current assets | |

| |

| | | |

| | |

| Right-of-use assets | |

8 | |

| 29,379 | | |

| 330,332 | |

| Other intangible assets | |

10 | |

| 72,904 | | |

| - | |

| Property, plant and equipment | |

9 | |

| - | | |

| 22,604 | |

| Non-current financial assets | |

11 | |

| 7,069 | | |

| 54,344 | |

| Investment accounted for using the equity method | |

22 | |

| 8,897,651 | | |

| - | |

| Total non-current assets | |

| |

| 9,007,003 | | |

| 407,280 | |

| | |

| |

| | | |

| | |

| Total assets | |

| |

| 13,697,193 | | |

| 4,641,885 | |

| | |

| |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| Current liabilities | |

| |

| | | |

| | |

| Current lease liabilities | |

| |

| 12,392 | | |

| 273,956 | |

| Payables and accruals | |

12 | |

| 930,598 | | |

| 2,384,350 | |

| Deferred income | |

| |

| - | | |

| 234,978 | |

| Total current liabilities | |

| |

| 942,990 | | |

| 2,893,284 | |

| | |

| |

| | | |

| | |

| Non-current liabilities | |

| |

| | | |

| | |

| Non-current lease liabilities | |

| |

| 19,790 | | |

| 70,380 | |

| Retirement benefits obligations | |

15 | |

| 83,113 | | |

| 443,524 | |

| Deferred income | |

| |

| - | | |

| 89,232 | |

| Total non-current liabilities | |

| |

| 102,903 | | |

| 603,136 | |

| | |

| |

| | | |

| | |

| Equity | |

| |

| | | |

| | |

| Share capital | |

13 | |

| 1,843,545 | | |

| 1,843,545 | |

| Share premium | |

13 | |

| 266,384,119 | | |

| 266,194,689 | |

| Other equity | |

13 | |

| 64,620,223 | | |

| 64,620,223 | |

| Treasury shares reserve | |

13 | |

| (874,859 | ) | |

| (909,566 | ) |

| Other reserves | |

| |

| 31,305,021 | | |

| 29,814,816 | |

| Accumulated deficit | |

| |

| (350,626,749 | ) | |

| (360,418,242 | ) |

| Total equity | |

| |

| 12,651,300 | | |

| 1,145,465 | |

| | |

| |

| | | |

| | |

| Total liabilities and equity | |

| |

| 13,697,193 | | |

| 4,641,885 | |

The accompanying notes form an integral part of

these consolidated financial statements.

Addex Therapeutics │

Unaudited Interim Condensed Consolidated Financial Statements

Unaudited Interim Condensed Consolidated Statements

of Profit or Loss

for the three-month and six-month periods ended

June 30, 2024 and 2023

| | |

| |

For the

three months ended June 30, | | |

For the

six months ended June 30, | |

| | |

Notes | |

2024 | | |

2023* | | |

2024 | | |

2023* | |

| | |

| |

| | |

| | |

| | |

| |

| | |

| |

| | |

Amounts in Swiss francs | | |

| |

| Revenue

from contract with customer | |

16 | |

| 115,277 | | |

| 630,877 | | |

| 348,757 | | |

| 1,131,769 | |

| Other income | |

17 | |

| - | | |

| 1,100 | | |

| 1,430 | | |

| 2,255 | |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Operating costs | |

| |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| |

| (339,317 | ) | |

| (291,574 | ) | |

| (584,442 | ) | |

| (546,942 | ) |

| General

and administration | |

| |

| (675,276 | ) | |

| (736,585 | ) | |

| (1,453,153 | ) | |

| (1,350,920 | ) |

| Total

operating costs | |

18 | |

| (1,014,593 | ) | |

| (1,028,159 | ) | |

| (2,037,595 | ) | |

| (1,897,862 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Operating

loss | |

| |

| (899,316 | ) | |

| (396,182 | ) | |

| (1,687,408 | ) | |

| (763,838 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Finance income | |

| |

| (25,832 | ) | |

| 13,349 | | |

| 27,693 | | |

| 37,175 | |

| Finance expense | |

| |

| (864 | ) | |

| (138,563 | ) | |

| (1,475 | ) | |

| (164,742 | ) |

| Finance result | |

20 | |

| (26,696 | ) | |

| (125,214 | ) | |

| 26,218 | | |

| (127,567 | ) |

| Share of net loss

of investments accounted for using the equity method | |

22 | |

| (530,749 | ) | |

| - | | |

| (530,749 | ) | |

| - | |

| Net loss before

tax | |

| |

| (1,456,761 | ) | |

| (521,396 | ) | |

| (2,191,939 | ) | |

| (891,405 | ) |

| Income tax expense | |

| |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss from

continuing operations | |

| |

| (1,456,761 | ) | |

| (521,396 | ) | |

| (2,191,939 | ) | |

| (891,405 | ) |

| Net

profit / (loss) from discontinued operations (attributable to equity holders of the Group) | |

21 | |

| 14,335,393 | | |

| (2,153,756 | ) | |

| 11,983,432 | | |

| (4,190,916 | ) |

| Net profit

/ (loss) for the period | |

| |

| 12,878,632 | | |

| (2,675,152 | ) | |

| 9,791,493 | | |

| (5,082,321 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Basic

profit / (loss) per share for profit/(loss) attributable to the ordinary equity holders of the Company | |

23 | |

| 0.13 | | |

| (0.04 | ) | |

| 0.10 | | |

| (0.08 | ) |

| From continuing operations | |

| |

| (0.01 | ) | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.02 | ) |

| From discontinued operations | |

| |

| 0.14 | | |

| (0.03 | ) | |

| 0.12 | | |

| (0.06 | ) |

| | |

| |

| | | |

| | | |

| | | |

| | |

| Diluted

profit / (loss) per share for profit/ (loss) attributable to the ordinary equity holders of the Company | |

23 | |

| (0.08 | ) | |

| (0.04 | ) | |

| 0.06 | | |

| (0.08 | ) |

| From continuing operations | |

| |

| (0.01 | ) | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.02 | ) |

| From discontinued operations | |

| |

| 0.09 | | |

| (0.03 | ) | |

| 0.07 | | |

| (0.06 | ) |

*

The comparative information has been re-presented due to discontinued operations that have been reclassed to the financial

line called “Net profit or loss from discontinued operations” (note 21). In the other sections of these unaudited interim

condensed consolidated financial statements an asterisk will indicate where comparative information has been re-presented.

The accompanying notes form an integral part of

these consolidated financial statements.

Addex

Therapeutics │ Unaudited Interim Condensed Consolidated Financial Statements

Unaudited Interim Condensed

Consolidated Statements of Comprehensive Income or Loss

for the three-month and six-month periods ended

June 30, 2024 and 2023

| | |

For the

three months ended June 30, | | |

For the

six months ended June 30, | |

| | |

2024 | | |

2023* | | |

2024 | | |

2023* | |

| | |

| | |

| | |

| | |

| |

| | |

Amounts in Swiss francs | |

| Net

profit / (loss) for the period | |

| 12,878,632 | | |

| (2,675,152 | ) | |

| 9,791,493 | | |

| (5,082,321 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive

income / (loss) | |

| | | |

| | | |

| | | |

| | |

| Items that will never

be reclassified to profit and loss: | |

| | | |

| | | |

| | | |

| | |

| Remeasurements of retirement

benefits obligation related to continuing operations | |

| (2,618 | ) | |

| (6,763 | ) | |

| (5,115 | ) | |

| (8,298 | ) |

| Remeasurements of retirement benefits

obligation related to discontinued operations | |

| (49,640 | ) | |

| (128,249 | ) | |

| (96,988 | ) | |

| (157,355 | ) |

| Items that may be classified

subsequently to profit and loss: | |

| | | |

| | | |

| | | |

| | |

| Exchange

difference on translation of foreign operations | |

| (143 | ) | |

| (979 | ) | |

| 985 | | |

| (898 | ) |

| Other

comprehensive income / (loss) for the period, net of tax | |

| (52,401 | ) | |

| (135,991 | ) | |

| (101,118 | ) | |

| (166,551 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total

comprehensive income / (loss) for the period | |

| 12,826,231 | | |

| (2,811,143 | ) | |

| 9,690,375 | | |

| (5,248,872 | ) |

| From continuing operations | |

| (1,459,522 | ) | |

| (529,138 | ) | |

| (2,196,069 | ) | |

| (900,601 | ) |

| From discontinued operations | |

| 14,285,753 | | |

| (2,282,005 | ) | |

| 11,886,444 | | |

| (4,348,271 | ) |

The accompanying notes form an integral part of

these consolidated financial statements.

Addex

Therapeutics │ Unaudited Interim Condensed Consolidated Financial Statements

Unaudited Interim Condensed Consolidated Statements

of Changes in Equity

for the six-month periods ended June 30,

2024 and 2023

| | |

Notes | | |

Share

Capital | | |

Share

Premium | | |

Other

Equity | | |

Treasury

Shares

Reserve | | |

Foreign

Currency

Translation

Reserve | | |

Other

Reserves | | |

Accumulated

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Amounts

in Swiss francs |

Balance

as of January 1, 2023 | |

| | | |

| 1,153,483 | | |

| 269,511,610 | | |

| 64,620,223 | | |

| (6,278,763 | ) | |

| (657,870 | ) | |

| 26,426,243 | | |

| (349,862,015 | ) | |

| 4,912,911 | |

| Net

loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (5,082,321 | ) | |

| (5,082,321 | ) |

| Other

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (898 | ) | |

| (165,653 | ) | |

| - | | |

| (166,551 | ) |

Total

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (898 | ) | |

| (165,653 | ) | |

| (5,082,321 | ) | |

| (5,248,872 | ) |

| Issue

of treasury shares | |

| 13 | | |

| 176,000 | | |

| - | | |

| - | | |

| (176,000 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Cost

of treasury shares issuance | |

| | | |

| - | | |

| (16,823 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (16,823 | ) |

| Sales

under shelf registration | |

| 13 | | |

| - | | |

| (920,069 | ) | |

| - | | |

| 2,079,828 | | |

| - | | |

| - | | |

| - | | |

| 1,159,759 | |

| Related

costs of sales shelf-registration | |

| | | |

| - | | |

| (34,106 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (34,106 | ) |

| Sale

of pre-funded warrants | |

| 13 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,382,259 | | |

| - | | |

| 3,382,259 | |

| Cost

of pre-funded warrants sold | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (118,117 | ) | |

| - | | |

| (118,117 | ) |

| Exercise

of pre-funded warrants | |

| 13 | | |

| 35,030 | | |

| 449,939 | | |

| - | | |

| - | | |

| - | | |

| (484,930 | ) | |

| - | | |

| 39 | |

| Value

of warrants and pre-funded warrants | |

| 13 | | |

| - | | |

| (2,760,143 | ) | |

| - | | |

| - | | |

| - | | |

| 2,760,143 | | |

| - | | |

| - | |

| Value

of share-based services | |

| 14 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 921,797 | | |

| - | | |

| 921,797 | |

| Movement

in treasury shares: | |

| 13 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

purchases under liquidity agreement | |

| | | |

| - | | |

| 2,183 | | |

| - | | |

| (2,882 | ) | |

| - | | |

| - | | |

| - | | |

| (699 | ) |

| Sales

agency agreement | |

| | | |

| - | | |

| (2,565,725 | ) | |

| - | | |

| 3,742,506 | | |

| - | | |

| - | | |

| - | | |

| 1,176,781 | |

| Costs

under sale agency agreement | |

| | | |

| - | | |

| (8,826 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (8,826 | ) |

Balance

as of June 30, 2023 | |

| | | |

| 1,364,513 | | |

| 263,658,040 | | |

| 64,620,223 | | |

| (635,311 | ) | |

| (658,768 | ) | |

| 32,721,742 | | |

| (354,944,336 | ) | |

| 6,126,103 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Balance

as of January 1, 2024 | |

| | | |

| 1,843,545 | | |

| 266,194,689 | | |

| 64,620,223 | | |

| (909,566 | ) | |

| (659,870 | ) | |

| 30,474,686 | | |

| (360,418,242 | ) | |

| 1,145,465 | |

| Net

profit for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 9,791,493 | | |

| 9,791,493 | |

| Other

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 985 | | |

| (102,103 | ) | |

| - | | |

| (101,118 | ) |

Total

comprehensive profit for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 985 | | |

| (102,103 | ) | |

| 9,791,493 | | |

| 9,690,375 | |

| Cost

of treasury shares issuance | |

| | | |

| - | | |

| (7,037 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,037 | ) |

| Cost

of pre-funded warrants exercised | |

| | | |

| - | | |

| (4,259 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,259 | ) |

| Value

of share-based services | |

| 14 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,591,323 | | |

| - | | |

| 1,591,323 | |

| Movement

in treasury shares: | |

| 13 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

sales under liquidity agreement | |

| | | |

| - | | |

| (2,260 | ) | |

| - | | |

| 4,200 | | |

| - | | |

| - | | |

| - | | |

| 1,940 | |

| Sales

agency agreement | |

| | | |

| - | | |

| 204,750 | | |

| - | | |

| 30,507 | | |

| - | | |

| - | | |

| - | | |

| 235,257 | |

| Costs

under sale agency agreement | |

| | | |

| - | | |

| (1,764 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,764 | ) |

Balance

as of June 30, 2024 | |

| | | |

| 1,843,545 | | |

| 266,384,119 | | |

| 64,620,223 | | |

| (874,859 | ) | |

| (658,885 | ) | |

| 31,963,906 | | |

| (350,626,749 | ) | |

| 12,651,300 | |

The accompanying notes form an integral part of

these consolidated financial statements.

Addex

Therapeutics │ Unaudited Interim Condensed Consolidated Financial Statements

Unaudited Interim Condensed Consolidated Statements

of Changes in Equity

for the three-month period ended June 30,

2023

| | |

Notes | | |

Share

Capital | | |

Share

Premium | | |

Other

Equity | | |

Treasury

Shares

Reserve | | |

Foreign

Currency

Translation

Reserve | | |

Other

Reserves | | |

Accumulated

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Amounts

in Swiss francs |

Balance

as of January 1, 2023 | |

| | | |

| 1,153,483 | | |

| 269,511,610 | | |

| 64,620,223 | | |

| (6,278,763 | ) | |

| (657,870 | ) | |

| 26,426,243 | | |

| (349,862,015 | ) | |

| 4,912,911 | |

| Net

loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,407,169 | ) | |

| (2,407,169 | ) |

| Other

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 81 | | |

| (30,641 | ) | |

| - | | |

| (30,560 | ) |

| Total

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 81 | | |

| (30,641 | ) | |

| (2,407,169 | ) | |

| (2,437,729 | ) |

| Cost

of shares issuance | |

| | | |

| - | | |

| (4,062 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,062 | ) |

| Value

of share-based services | |

| 14 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 431,196 | | |

| - | | |

| 431,196 | |

| Movement

in treasury shares: | |

| 13 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

purchases under liquidity agreement | |

| | | |

| - | | |

| 12,775 | | |

| - | | |

| (11,818 | ) | |

| - | | |

| - | | |

| - | | |

| 957 | |

| Sales

agency agreement | |

| | | |

| - | | |

| (2,565,725 | ) | |

| - | | |

| 3,742,506 | | |

| - | | |

| - | | |

| - | | |

| 1,176,781 | |

| Costs

under sale agency agreement | |

| | | |

| - | | |

| (8,826 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (8,826 | ) |

| Balance

as of March 31, 2023 | |

| | | |

| 1,153,483 | | |

| 266,945,772 | | |

| 64,620,223 | | |

| (2,548,075 | ) | |

| (657,789 | ) | |

| 26,826,798 | | |

| (352,269,184 | ) | |

| 4,071,228 | |

| Net

loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,675,152 | ) | |

| (2,675,152 | ) |

| Other

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (979 | ) | |

| (135,012 | ) | |

| - | | |

| (135,991 | ) |

Total

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (979 | ) | |

| (135,012 | ) | |

| (2,675,152 | ) | |

| (2,811,143 | ) |

| Issue

of treasury shares | |

| | | |

| 176,000 | | |

| - | | |

| - | | |

| (176,000 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Cost

of treasury shares issuance | |

| | | |

| - | | |

| (12,761 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (12,761 | ) |

| Sales

under shelf registration | |

| 13 | | |

| - | | |

| (920,069 | ) | |

| - | | |

| 2,079,828 | | |

| - | | |

| - | | |

| - | | |

| 1,159,759 | |

| Related

costs of sales shelf-registration | |

| | | |

| - | | |

| (34,106 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (34,106 | ) |

| Sale

of pre-funded warrants | |

| 13 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,382,259 | | |

| - | | |

| 3,382,259 | |

| Cost

of pre-funded warrants sold | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (118,117 | ) | |

| - | | |

| (118,117 | ) |

| Exercise

of pre-funded warrants | |

| 13 | | |

| 35,030 | | |

| 449,939 | | |

| - | | |

| - | | |

| - | | |

| (484,930 | ) | |

| - | | |

| 39 | |

| Value

of warrants and pre-funded warrants | |

| 13 | | |

| - | | |

| (2,760,143 | ) | |

| - | | |

| - | | |

| - | | |

| 2,760,143 | | |

| - | | |

| - | |

| Value

of share-based services | |

| 14 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 490,601 | | |

| - | | |

| 490,601 | |

| Movement

in treasury shares: | |

| 13 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

purchases under liquidity agreement | |

| | | |

| - | | |

| (10,592 | ) | |

| - | | |

| 8,936 | | |

| - | | |

| - | | |

| - | | |

| (1,656 | ) |

Balance

as of June 30, 2023 | |

| | | |

| 1,364,513 | | |

| 263,658,040 | | |

| 64,620,223 | | |

| (635,311 | ) | |

| (658,768 | ) | |

| 32,721,742 | | |

| (354,944,336 | ) | |

| 6,126,103 | |

The accompanying notes form an integral part of

these consolidated financial statements.

Addex

Therapeutics │ Unaudited Interim Condensed Consolidated Financial Statements

Unaudited Interim Condensed Consolidated Statements

of Changes in Equity

for the three-month period ended June 30,

2024

| | |

Notes | | |

Share

Capital | | |

Share

Premium | | |

Other Equity | | |

Treasury

Shares Reserve | | |

Foreign

Currency Translation Reserve | | |

Other

Reserves | | |

Accumulated

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Amounts

in Swiss francs |

Balance

as of January 1, 2024 | |

| | | |

| 1,843,545 | | |

| 266,194,689 | | |

| 64,620,223 | | |

| (909,566 | ) | |

| (659,870 | ) | |

| 30,474,686 | | |

| (360,418,242 | ) | |

| 1,145,465 | |

| Net

loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,087,139 | ) | |

| (3,087,139 | ) |

| Other

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,128 | | |

| (49,845 | ) | |

| - | | |

| (48,717 | ) |

Total

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,128 | | |

| (49,845 | ) | |

| (3,087,139 | ) | |

| (3,135,856 | ) |

| Cost

of pre-funded warrants exercised | |

| | | |

| - | | |

| (3,647 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,647 | ) |

| Value

of share-based services | |

| 14 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 386,028 | | |

| - | | |

| 386,028 | |

| Movement

in treasury shares: | |

| 13 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

sales under liquidity agreement | |

| | | |

| - | | |

| (2,417 | ) | |

| - | | |

| 3,947 | | |

| . | | |

| - | | |

| - | | |

| 1,530 | |

| Sales

agency agreement | |

| | | |

| - | | |

| 204,750 | | |

| - | | |

| 30,507 | | |

| - | | |

| - | | |

| - | | |

| 235,257 | |

| Costs

under sale agency agreement | |

| | | |

| - | | |

| (1,764 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,764 | ) |

Balance

as of March 31, 2024 | |

| | | |

| 1,843,545 | | |

| 266,391,611 | | |

| 64,620,223 | | |

| (875,112 | ) | |

| (658,742 | ) | |

| 30,810,869 | | |

| (363,505,381 | ) | |

| (1,372,987 | ) |

| Net

profit for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 12,878,632 | | |

| 12,878,632 | |

| Other

comprehensive loss for the period | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (143 | ) | |

| (52,258 | ) | |

| - | | |

| (52,401 | ) |

Total

comprehensive profit for the period. | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (143 | ) | |

| (52,258 | ) | |

| 12,878,632 | | |

| 12,826,231 | |

| Cost

of treasury shares issuance | |

| | | |

| - | | |

| (7,037 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,037 | ) |

| Cost

of pre-funded warrants exercised | |

| | | |

| - | | |

| (612 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (612 | ) |

| Value

of share-based services | |

| 14 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,205,295 | | |

| - | | |

| 1,205,295 | |

| Movement

in treasury shares: | |

| 13 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

sales under liquidity agreement | |

| | | |

| - | | |

| 157 | | |

| - | | |

| 253 | | |

| - | | |

| - | | |

| - | | |

| 410 | |

Balance

as of June 30, 2024 | |

| | | |

| 1,843,545 | | |

| 266,384,119 | | |

| 64,620,223 | | |

| (874,859 | ) | |

| (658,885 | ) | |

| 31,963,906 | | |

| (350,626,749 | ) | |

| 12,651,300 | |

The accompanying notes form an integral part of

these consolidated financial statements.

Addex

Therapeutics │ Unaudited Interim Condensed Consolidated Financial Statements

Unaudited Interim Condensed Consolidated Statements

of Cash Flows

for the six-month periods ended June 30,

2024 and 2023

| | |

| |

For the

six months ended

June 30, | |

| | |

Notes | |

2024 | | |

2023 | |

| | |

| |

| | |

| |

| | |

Amounts

in Swiss francs

| |

| Net profit / (loss) for the period | |

| |

| 9,791,493 | | |

| (5,082,321 | ) |

| Adjustments for: | |

| |

| | | |

| | |

| Net gain on Neurosterix Transaction | |

21 | |

| (13,961,900 | ) | |

| - | |

| Value of share-based services | |

14/21 | |

| 433,254 | | |

| 921,797 | |

| Post-employment benefits | |

15/21 | |

| (28,723 | ) | |

| (39,790 | ) |

| Share of net loss of associates | |

22 | |

| 530,749 | | |

| - | |

| Depreciation | |

8/21 | |

| 182,742 | | |

| 151,186 | |

| Finance cost net | |

| |

| (100,577 | ) | |

| 149,386 | |

| Increase in other financial assets | |

7/21 | |

| (1,948 | ) | |

| (13,579 | ) |

| Decrease / (increase) in trade and other receivables | |

7/21 | |

| (477,288 | ) | |

| 161,220 | |

| Decrease / (increase) in contract asset | |

7/21 | |

| 10,387 | | |

| (65,185 | ) |

| Increase in prepayments | |

7/21 | |

| (272,821 | ) | |

| (733,097 | ) |

| Increase in other current assets | |

7/21 | |

| (5,000 | ) | |

| - | |

| Decrease in payables and accruals | |

12/21 | |

| (1,013,382 | ) | |

| (566,878 | ) |

| Decrease in deferred income | |

| |

| (38,401 | ) | |

| - | |

| Net cash used in operating activities | |

| |

| (4,951,415 | ) | |

| (5,117,261 | ) |

| | |

| |

| | | |

| | |

| Cash flows from / (used in) investing activities | |

| |

| | | |

| | |

| Cash received from Neurosterix Transaction | |

21 | |

| 5,119,754 | | |

| - | |

| Legal fees paid for Neurosterix Transaction | |

21 | |

| (452,798 | ) | |

| - | |

| Purchase of property, plant and equipment | |

9 | |

| - | | |

| (4,959 | ) |

| Net cash from / (used in) investing

activities | |

| |

| 4,666,956 | | |

| (4,959 | ) |

| | |

| |

| | | |

| | |

| Cash flows from / (used in) financing activities | |

| |

| | | |

| | |

| Proceeds from the sale of treasury shares – shelf registration | |

13 | |

| - | | |

| 1,159,759 | |

| Costs paid on sale of treasury shares – shelf registration | |

| |

| (24,018 | ) | |

| (17,588 | ) |

| Proceeds from the sale or exercise of pre-funded warrants | |

13 | |

| - | | |

| 3,387,604 | |

| Costs paid on sale or exercise of pre-funded warrants | |

| |

| (36,457 | ) | |

| (26,333 | ) |

| Sales under sale agency agreement & liquidity agreement

movements | |

13 | |

| 237,197 | | |

| 1,176,082 | |

| Costs paid on sale of treasury shares under sale agency agreement | |

| |

| (1,764 | ) | |

| (8,826 | ) |

| Cost paid on issue of treasury shares | |

13 | |

| - | | |

| (45,599 | ) |

| Principal element of lease payment | |

| |

| (69,738 | ) | |

| (140,616 | ) |

| Interest received | |

20 | |

| 9,063 | | |

| 37,175 | |

| Interest paid | |

20 | |

| (7,147 | ) | |

| (9,748 | ) |

| Net cash from financing activities | |

| |

| 107,136 | | |

| 5,511,910 | |

| | |

| |

| | | |

| | |

| Increase / (decrease) in cash and

cash equivalents | |

| |

| (177,323 | ) | |

| 389,690 | |

| | |

| |

| | | |

| | |

| Cash and cash equivalents at the beginning of the period | |

6 | |

| 3,865,481 | | |

| 6,957,086 | |

| Exchange difference on cash and cash equivalents | |

| |

| 99,622 | | |

| (177,707 | ) |

| | |

| |

| | | |

| | |

| Cash and cash equivalents at the

end of the period | |

6 | |

| 3,787,780 | | |

| 7,169,069 | |

The Group reports a net gain of CHF 13.96 million

of which CHF 8.83 million relates to non-cash items including CHF 9.43 million for the fair value of its 20 % participation in Neurosterix

US Holdings LLC and CHF 0.2 million for the fair value of the service agreement provided at zero cost partially offset by the accelerated

vesting of equity incentive units of employees transferred to Neurosterix Pharma Sàrl amounting to CHF 1.2 million (note 21).

Other non-cash items mainly relate to share-based service costs.

The accompanying notes form an integral part of

these consolidated financial statements.

Addex Therapeutics │ Unaudited Interim

Condensed Consolidated Financial Statements │Notes

Unaudited Notes to the Interim Condensed Consolidated

Financial Statements

for the six-month period ended June 30,

2024

(Amounts in Swiss francs)

1. General information

Addex Therapeutics Ltd (the “Company”)

and its subsidiaries (together, the “Group”) are a clinical stage biopharmaceutical company focused on developing a portfolio

of novel small molecule allosteric modulators for neurological disorders.

The Company is a Swiss stockholding corporation

domiciled c/o Addex Pharma SA, Chemin des Aulx 12, CH 1228 Plan-les-Ouates, Geneva, Switzerland and the parent company of Addex Pharma

SA, Addex Pharmaceuticals France SAS, Neurosterix SA and Addex Pharmaceuticals Inc. Addex Therapeutics also owns a 20% equity interest

in Neurosterix US Holdings LLC, USA. Neurosterix US Holdings LLC fully owns directly Neurosterix Swiss Holdings AG, Switzerland and indirectly

Neurosterix Pharma Sàrl whose principal place of business is Chemin des Mines 9, CH 1202 Geneva, Switzerland.

The Groups principal place of business is Chemin

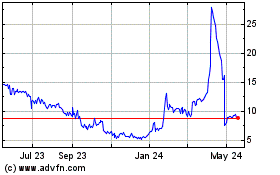

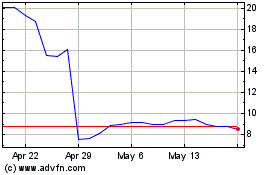

des Mines 9, CH 1202 Geneva, Switzerland. Its registered shares are traded at the SIX Swiss Exchange, under the ticker symbol ADXN and

its American Depositary Shares (ADSs) on the Nasdaq Stock Market under the symbol “ADXN”. ADSs represents shares that continue

to be admitted to trading on SIX Swiss Exchange.

These interim condensed consolidated financial

statements have been approved for issuance by the Board of Directors on September 27, 2024.

2. Basis of preparation

These interim condensed consolidated financial

statements for the six-month period ended June 30, 2024, have been prepared under the historic cost convention and in accordance

with IAS 34 “Interim Financial Reporting” and are presented in a format consistent with the consolidated financial statements

under IAS 1 “Presentation of Financial Statements”. However, they do not include all of the notes that would be required

in a complete set of financial statements. Thus, this interim financial report should be read in conjunction with the consolidated financial

statements for the year ended December 31, 2023.

Interim financial results are not necessarily

indicative of results anticipated for the full year. The preparation of these unaudited interim condensed consolidated financial statements

made in accordance with IAS 34 requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are based on management’s best knowledge of current events and actions,

actual results ultimately may differ from those estimates. The areas involving a higher degree of judgment which are significant to the

interim condensed consolidated financial statements are disclosed in note 4 to the consolidated financial statements for the year ended

December 31, 2023.

A number of new or amended standards and interpretations

became applicable for financial reporting periods beginning on or after January 1, 2024. Of the latter, the Group noted the publication

of IFRS S1 (General requirement for disclosure of sustainability-related financial information) and IFRS S2 (climate – related

Disclosures). The Group concluded that those new IFRS standards were not relevant as the Group did not opt for the publication of a sustainability

report in accordance with Six Swiss Exchange listing rules.

There are other new standards, amendments and

interpretations which have been deemed by the Group as currently not relevant, hence are not listed or discussed further here.

Due to rounding, numbers presented throughout

these interim condensed consolidated financial statements may not add up precisely to the totals provided. All ratios and variances are

calculated using the underlying amounts rather than the presented rounded amounts.

Where necessary, comparative figures have been

revised to conform with the current year 2024 presentation. In particular, we re-presented the unaudited interim condensed consolidated

statements of profit or loss and comprehensive income or loss for the three-month and six-month periods ended June 30, 2023, in

order to reclass discontinued operations in accordance with IFRS 5 (note 21). In addition, the ADS numbers previously disclosed have

been amended following the change in ADS ratio executed on October 23, 2023, from one ADS to six shares to a new ratio of one ADS

to one hundred and twenty shares. The ADS ratio change had the same effect as a one to twenty ADS reverse split and except as otherwise

indicated, all information in these consolidated financial statements gives retroactive effect to the ADS Ratio Change.

Addex Therapeutics │ Unaudited Interim

Condensed Consolidated Financial Statements │Notes

3. Material accounting estimates and judgments

The Group makes estimates and assumptions concerning

the future. These estimates and judgments are continually evaluated and are based on historical experience and other factors, including

expectations of future events that are believed to be reasonable under the circumstances. The resulting accounting estimates will, by

definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities or may have had a significant impact on the reported results are disclosed

below:

Going concern

The Group’s accounts are prepared on a

going concern basis. To date, the Group has financed its cash requirements primarily from share issuances, licensing certain of its research

and development stage products and selling its allosteric modulator drug discovery technology platform and a portfolio of preclinical

programs. The Group is a development - stage enterprise and is exposed to all the risks inherent in establishing a business. The Group

expects that its existing cash and cash equivalents, at the issuance date of these unaudited consolidated financial statements will be

sufficient to fund its operations and meet all of its obligations as they fall due, through 2026. The future viability of the Group is

dependent on its ability to raise additional capital through public or private financings or collaboration agreements to finance its

future operations, which may be delayed due to reasons outside of the Group’s control including health pandemics and geopolitical

risks. The sale of additional equity may dilute existing shareholders. The inability to obtain funding, as and when needed, would have

a negative impact on the Group’s financial condition and ability to pursue its business strategies. If the Group is unable to obtain

the required funding to run its operations and to develop and commercialize its product candidates, the Group could be forced to delay,

reduce or stop some or all of its research and development programs to ensure it remains solvent. Management continues to explore options

to obtain additional funding, including through collaborations with third parties related to the future potential development and/or

commercialization of its product candidates. However, there is no assurance that the Group will be successful in raising funds, closing

collaboration agreements, obtaining sufficient funding on terms acceptable to the Group, or if at all, which could have a material adverse

effect on the Group’s business, results of operations and financial condition.

The Business of the Group could be adversely

affected by health pandemics and geopolitical risks

The

business of the Group could be adversely affected by health epidemics and geopolitical risks in regions where the Group or partners

have concentrations of clinical trial sites or other business operations and could cause significant disruption in the operations of

third-party manufacturers and CROs upon whom the Group or partners rely. Health pandemics may pose the risk that the Group, employees,

contractors, collaborators, and partners may be prevented from conducting certain pre-clinical tests, clinical trials or other business

activities for an indefinite period of time, including due to travel restrictions, quarantines, “stay-at-home” and “shelter-in-place”

orders or shutdowns that have been or may in the future be requested or mandated by governmental authorities. For example, the COVID-19

pandemic has impacted and could in the future impact the business of the Group and ongoing and planning clinical trials led by the Group

or partners, including as a result of delays or difficulties in clinical site initiation, difficulties in recruiting and retaining clinical

site investigators and clinical site staff and interruption of the clinical supply chain or key clinical trial activities, such as clinical

trial site monitoring, and supply chain interruptions caused by restrictions for the supply of materials for drug candidates or other

materials necessary to manufacture product to conduct clinical and preclinical tests. Geopolitical risks such as Russia-Ukraine war or

Middle East conflict may create global security concerns including the possibility of an expanded regional or global conflict and potential

ramifications such as disruption of the supply chain including research and development activities being conducted by the Group and its

strategic partners. The Group and partners rely on global networks of contract research organizations to engage clinical study sites

and enroll patients, certain of which are in Russia and Ukraine. Delays in research and development activities of the Group and its partners

could increase associated costs and, depending upon the duration of any delays, require the Group and its partners to find alternative

suppliers at additional expense. In addition, Russia-Ukraine war has had significant ramifications on global financial markets, which

may adversely impact the ability of the Group to raise capital on favorable terms or at all.

Discontinued operations, assets and liabilities

held for sale related to the Neurosterix Transaction

On

April 2, 2024, the Group sold a part of its business constituting its allosteric modulator drug discovery technology platform

and a portfolio of preclinical programs (note 21). As a consequence, the Group recognized discontinued operations in the statements of

profit or loss under “net profit or loss from discontinued operations” for the six month-period ended June 30, 2024

and 2023 respectively, in accordance with IFRS 5. The Group identified as well, cash flows from discontinued operations for the six-month

period ended June 30, 2024 and 2023, respectively (note 21). The identification of discontinued operations may require some degree

of judgement.

Addex Therapeutics │ Unaudited Interim

Condensed Consolidated Financial Statements │Notes

Investments accounted for using the equity method

The

Group received an equity interest of 20% in Neurosterix US Holdings LLC as part of the Neurosterix Transaction. The initial recognition

of the investment has been accounted at a fair value based on a financial valuation of Neurosterix’s Group. This carrying

amount is going to be increased or decreased to recognize the share of profit or loss of Neurosterix’s Group.

Revenue recognition

Revenue is primarily from fees related to licenses,

milestones and research services. Given the complexity of the relevant agreements, judgements are required to identify distinct performance

obligations, allocate the transaction price to these performance obligations and determine when the performance obligations are met.

In particular, the Group’s judgement over the estimated stand-alone selling price which is used to allocate the transaction price

to the performance obligations is disclosed in note 16.

Grants

Grants are recorded at their fair value when

there is reasonable assurance that they will be received and recognized as income when the Group has satisfied the underlying grant conditions.

In certain circumstances, grant income may be recognized before explicit grantor acknowledgement that the conditions have been met.

Accrued research and development costs

The Group records accrued expenses for estimated

costs of research and development activities conducted by third party service providers. The Group records accrued expenses for estimated

costs of research and development activities based upon the estimated amount of services provided, but not yet invoiced, and these costs

are included in accrued expenses on the balance sheets and within research and development expenses in the statements of profit or loss.

These costs are a significant component of research and development expenses. Accrued expenses for these costs are recorded based on

the estimated amount of work completed in accordance with agreements established with these third parties. Due to the nature of estimates,

the Group may be required to make changes to the estimates after a reporting period as it becomes aware of additional information about

the status or conduct of its research activities.

Research and development costs

The Group recognizes expenditure incurred in

carrying out its research and development activities, including development supplies, until it becomes probable that future economic

benefits will flow to the Group, which results in recognizing such costs as intangible assets, involving a certain degree of judgement.

Currently, such development supplies are associated with preclinical and clinical trials of specific products that have not demonstrated

technical feasibility.

Share-based compensation

The Group recognizes an expense for share-based

compensation based on the valuation of equity incentive units using the Black-Scholes valuation model. A number of assumptions related

to the volatility of the underlying shares and to the risk-free rate are made in this model. Should the assumptions and estimates underlying

the fair value of these instruments vary significantly from management’s estimates, then the share-based compensation expense would

be materially different from the amounts recognized.

Equity instruments

The Group records the prefunded warrants sold

to investors and the warrants granted to investors at fair value calculated using the Black-Scholes valuation model.

Pension obligations

The present value of the pension obligations

is calculated by an independent actuary and depends on a number of assumptions that are determined on an actuarial basis such as discount

rates, future salary and pension increases, and mortality rates. Any changes in these assumptions will impact the carrying amount of

pension obligations. The Group determines the appropriate discount rate at the end of each period. This is the interest rate that should

be used to determine the present value of estimated future cash outflows expected to be required to settle the pension obligations. In

determining the appropriate discount rate, the Group considers the interest rates of high-quality corporate bonds that are denominated

in the currency in which the benefits will be paid, and that have terms to maturity approximating the terms of the related pension liability.

Other key assumptions for pension obligations are based in part on current market conditions.

4.

Interim measurement note

Seasonality

of the business: The business is not subject to any seasonality, but expenses and corresponding revenue are largely determined

by the phase of the respective projects, particularly with regard to external research and development expenditures.

Costs:

Costs that incur unevenly during the financial year are anticipated or deferred in the interim report only if it would also

be appropriate to anticipate or defer such costs at the end of the financial year.

Addex Therapeutics │ Unaudited Interim

Condensed Consolidated Financial Statements │Notes

5. Segment reporting

Management has identified one single operating

segment, related to the discovery, development and commercialization of small-molecule pharmaceutical products.

Information about products, services and major

customers

External income of the Group for the three-month

and six-month periods ended June 30, 2024 and 2023 is derived from the business of discovery, development and commercialization

of pharmaceutical products. Income was earned from rendering of research services to a pharmaceutical company.

Information about geographical areas

External income is exclusively recorded in the

Swiss operating company.

Analysis of revenue from contract with customer

and other income by nature is detailed as follows:

| | |

For

the three months ended

June 30, | | |

For

the six months ended

June 30, | |

| | |

| 2024 | | |

| 2023* | | |

| 2024 | | |

| 2023* | |

| Collaborative research funding | |

| 115,277 | | |

| 630,877 | | |

| 348,757 | | |

| 1,131,769 | |

| Other service income | |

| - | | |

| 1,100 | | |

| 1,430 | | |

| 2,255 | |

| Total | |

| 115,277 | | |

| 631,977 | | |

| 350,187 | | |

| 1,134,024 | |

Analysis of revenue from contract with customer

and other income by major counterparties is detailed as follows:

| | |

For

the three months ended

June 30, | | |

For

the six months ended

June 30, | |

| | |

| 2024 | | |

| 2023* | | |

| 2024 | | |

| 2023* | |

| Indivior PLC | |

| 115,277 | | |

| 630,877 | | |

| 348,757 | | |

| 1,131,769 | |

| Other counterparties | |

| - | | |

| 1,100 | | |

| 1,430 | | |

| 2,255 | |

| Total | |

| 115,277 | | |

| 631,977 | | |

| 350,187 | | |

| 1,134,024 | |

For

more detail, refer to note 16, “Revenue from contract with customer” and note 17 “Other income”.

The geographical allocation of long-lived assets

is detailed as follows:

| | |

June 30,

2024 | |

December 31,

2023 | |

| Switzerland | |

| 9,006,654 | |

| 406,946 | |

| France | |

| 349 | |

| 334 | |

| Total | |

| 9,007,003 | |

| 407,280 | |

The geographical analysis of operating costs

is as follows:

| | |

For

the three months ended

June 30, | | |

For

the six months ended

June 30, | |

| | |

| 2024 | | |

| 2023* | | |

| 2024 | | |

| 2023* | |

| Switzerland | |

| 1,010,390 | | |

| 1,039,058 | | |

| 2,031,464 | | |

| 1,890,517 | |

| United States of America | |

| 2,371 | | |

| (11,863 | ) | |

| 4,017 | | |

| 5,274 | |

| France | |

| 1,832 | | |

| 964 | | |

| 2,114 | | |

| 2,071 | |

| Total operating costs (note 18) | |

| 1,014,593 | | |

| 1,028,159 | | |

| 2,037,595 | | |

| 1,897,862 | |

The capital expenditure during the three-month

and six-month periods ended June 30, 2024 is nil (CHF 2,469 for the three-month and CHF 4,959 for the six-month periods ended June 30,

2023).

6.

Cash and cash equivalents

| | |

June 30,

2024 | |

December 31,

2023 | |

| Cash at bank and on hand | |

| 3,787,780 | |

| 3,865,481 | |

| Total cash and cash equivalents | |

| 3,787,780 | |

| 3,865,481 | |

Addex Therapeutics │

Unaudited Interim Condensed Consolidated Financial Statements │Notes

Split by currency:

| | |

June 30, 2024 | | |

December 31, 2023 | |

| CHF | |

| 79.13 | % | |

| 39.88 | % |

| USD | |

| 13.50 | % | |

| 56.22 | % |

| EUR | |

| 4.35 | % | |

| 3.03 | % |

| GBP | |

| 3.02 | % | |

| 0.87 | % |

| Total | |

| 100.00 | % | |

| 100.00 | % |

The Group invests its cash balances into a variety

of current and deposit accounts mainly with one Swiss bank whose external credit rating is P-1/A-1.

All cash and cash equivalents were held either

at banks or on hand as of June 30, 2024 and December 31, 2023.

7.

Other current assets

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Other financial assets | |

| 2,796 | | |

| 848 | |

| Trade and other receivables | |

| 585,908 | | |

| 110,361 | |

| Contract asset (Indivior PLC) | |

| 30,520 | | |

| 40,907 | |

| Prepayments | |

| 278,186 | | |

| 217,008 | |

| Other current assets | |

| 5,000 | | |

| - | |

| Total other current assets | |

| 902,410 | | |

| 369,124 | |

Total other current assets increased by CHF 0.5

million as of June 30, 2024 compared to December 31, 2023, primarily due to retirement benefits of employees transferred to

Neurosterix Pharma Sàrl which are expected to be recovered in the short term. The Group applies the IFRS 9 simplified approach

to measuring expected credit losses (“ECL”), which uses a lifetime expected loss allowance for all contract assets, trade

receivables and other receivables. The Group has considered that the contract asset, trade receivables and other receivables have a low

risk of default based on historic loss rates and forward-looking information on macroeconomic factors affecting the ability of the third

parties to settle invoices. As a result, expected loss allowance has been deemed as nil as of June 30, 2024 and December 31,

2023.

8.

Right-of-use assets

| Year ended December 31, 2023 |

|

Properties |

|

|

Equipment |

|

|

Total |

|

| Opening net book amount |

|

|

353,097 |

|

|

|

4,516 |

|

|

|

357,613 |

|

| Depreciation charge |

|

|

(277,885 |

) |

|

|

(2,708 |

) |

|

|

(280,593 |

) |

| Effect of lease modifications |

|

|

253,312 |

|

|

|

- |

|

|

|

253,312 |

|

| Closing net book amount |

|

|

328,524 |

|

|

|

1,808 |

|

|

|

330,332 |

|

| As of December 31, 2023 |

|

Properties |

|

|

Equipment |

|

|

Total |

|

| Cost |

|

|

1,725,162 |

|

|

|

13,542 |

|

|

|

1,738,704 |

|

| Accumulated depreciation |

|

|

(1,396,638 |

) |

|

|

(11,734 |

) |

|

|

(1,408,372 |

) |

| Net book value |

|

|

328,524 |

|

|

|

1,808 |

|

|

|

330,332 |

|

| Period ended June 30, 2024 |

|

Properties |

|

|

Equipment |

|

|

Total |

|

| Opening net book amount |

|

|

328,524 |

|

|

|

1,808 |

|

|

|

330,332 |

|

| Depreciation charge |

|

|

(69,004 |

) |

|

|

(677 |

) |

|

|

(69,681 |

) |

| Assets transferred to Neurosterix Pharma Sàrl |

|

|

(230,141 |

) |

|

|

(1,131 |

) |

|

|

(231,272 |

) |

| Closing net book amount |

|

|

29,379 |

|

|

|

- |

|

|

|

29,379 |

|

| As of June 30, 2024 |

|

Properties |

|

|

Equipment |

|

|

Total |

|

| Cost |

|

|

95,110 |

|

|

|

- |

|

|

|

95,110 |

|

| Accumulated depreciation |

|

|

(65,731 |

) |

|

|

- |

|

|

|

(65,731 |

) |

| Net book value |

|

|

29,379 |

|

|

|

- |

|

|

|

29,379 |

|

Addex Therapeutics │ Unaudited Interim

Condensed Consolidated Financial Statements │Notes

The gross value of the right of use assets decreased

by CHF 1,643,594 between the periods ended December 31, 2023, and June 30, 2024, primarily due to the transfer of assets to

Neurosterix Pharma Sàrl during the second quarter of 2024.

9.

Property, plant and equipment

| Year ended December 31, 2023 | |

Equipment | | |

Furniture &

fixtures | | |

Chemical library | | |

Total | |

| Opening net book amount | |

| 41,121 | | |

| - | | |

| - | | |

| 41,121 | |

| Additions | |

| 6,842 | | |

| - | | |

| - | | |

| 6,842 | |

| Depreciation charge | |

| (25,359 | ) | |

| - | | |

| - | | |

| (25,359 | ) |

| Closing net book amount | |

| 22,604 | | |

| - | | |

| - | | |

| 22,604 | |

| As of December 31, 2023 | |

Equipment | | |

Furniture &

fixtures | | |

Chemical library | | |

Total | |

| Cost | |

| 1,721,251 | | |

| 7,564 | | |

| 1,207,165 | | |

| 2,935,980 | |

| Accumulated depreciation | |

| (1,698,647 | ) | |

| (7,564 | ) | |

| (1,207,165 | ) | |

| (2,913,376 | ) |

| Net book value | |

| 22,604 | | |

| - | | |

| - | | |

| 22,604 | |

| Period ended June 30, 2024 | |

Equipment | | |

Furniture &

fixtures | | |

Chemical library | | |

Total | |

| Opening net book amount | |

| 22,604 | | |

| - | | |

| - | | |

| 22,604 | |

| Depreciation charge | |

| (3,617 | ) | |

| - | | |

| - | | |

| (3,617 | ) |

| Assets transferred to Neurosterix Pharma Sàrl | |

| (18,987 | ) | |

| - | | |

| - | | |

| (18,987 | ) |

| Closing net book amount | |

| - | | |

| - | | |

| - | | |

| - | |

| As of June 30, 2024 | |

Equipment | | |

Furniture &

fixtures | | |

Chemical library | | |

Total | |

| Cost | |

| 83,502 | | |

| - | | |

| - | | |

| 83,502 | |

| Accumulated depreciation | |

| (83,502 | ) | |

| - | | |

| - | | |

| (83,502 | ) |

| Net book value | |

| - | | |

| - | | |

| - | | |

| - | |

The gross value of property, plant and equipment

decreased by CHF 2,852,478 between the periods ended December 31, 2023, and June 30, 2024, primarily due to the transfer of

fixed assets to Neurosterix Pharma Sàrl for a gross amount of CHF 2,596,458 and disposals amounting to CHF 256,020.

10. Intangible assets

| Period ended June 30, 2024 | |

Service

agreement | | |

Total | |

| Opening net book amount | |

| - | | |

| - | |

| Additions | |

| 182,348 | | |

| 182,348 | |

| Depreciation charge | |

| (109,444 | ) | |

| (109,444 | ) |

| Closing net book amount | |

| 72,904 | | |

| 72,904 | |

| As of June 30, 2024 | |

Service

agreement | | |

Total | |

| Cost | |

| 182,348 | | |

| 182,348 | |

| Accumulated depreciation | |

| (109,444 | ) | |

| (109,444 | ) |

| Net book value | |

| 72,904 | | |

| 72,904 | |

The

service agreement relates to staff and infrastructure provided by Neurosterix Pharma Sàrl at zero cost in accordance with the

Neurosterix Transaction (note 21). The depreciation charge is recognized at the rate at which these services are provided.

11.

Non-current financial assets

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Security rental deposits | |

| 7,069 | | |

| 54,344 | |

| Total non-current financial assets | |

| 7,069 | | |

| 54,344 | |

Addex Therapeutics │ Unaudited Interim

Condensed Consolidated Financial Statements │Notes

12. Payables and accruals

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Trade payables | |

| 302,376 | | |

| 984,384 | |

| Social security and other taxes | |

| 7,521 | | |

| 164,609 | |

| Accrued expenses | |

| 620,701 | | |

| 1,235,357 | |

| Total payables and accruals | |

| 930,598 | | |

| 2,384,350 | |

All payables mature within 3 months. Accrued

expenses and trade payables primarily relate to R&D services from contract research organizations, consultants and professional fees.

The total amount of payables and accruals decreased by CHF 1.5 million as of June 30, 2024 compared to December 31, 2023 mainly

due to the sale of a part of our business on April 2, 2024 (note 21). The carrying amounts of payables do not materially differ

from their fair values, due to their short-term nature.

13.

Share capital

| | |

Number of shares | |

| | |

Common shares | | |

Treasury shares | | |

Total | |

| Balance as of January 1, 2023 | |

| 115,348,311 | | |

| (38,214,291 | ) | |

| 77,134,020 | |

| Issue of shares – treasury shares | |

| 17,600,000 | | |

| (17,600,000 | ) | |

| - | |

| Sale of shares under shelf registration | |

| - | | |

| 7,999,998 | | |

| 7,999,998 | |

| Exercise of pre-funded warrants (1) | |

| 3,502,950 | | |

| - | | |

| 3,502,950 | |

| Sale of shares under sale agency agreement | |

| - | | |

| 3,742,506 | | |

| 3,742,506 | |

| Net purchase of shares under liquidity agreement | |

| - | | |

| (27,145 | ) | |

| (27,145 | ) |

| Acquisition of shares forfeited from DSPPP | |

| - | | |

| (7,311 | ) | |

| (7,311 | ) |

| Balance as of June 30, 2023 | |

| 136,451,261 | | |

| (44,106,243 | ) | |

| 92,345,018 | |

| Shares reclassed as treasury shares under IFRS 2 | |

| - | | |

| (17,431,572 | ) | |

| (17,431,572 | ) |

| Balance as of June 30, 2023 IFRS 2 | |

| 136,451,261 | | |

| (61,537,815 | ) | |

| 74,913,446 | |

(1) In accordance with Swiss corporate law,

the issuance of 3,502,950 new shares through the exercise of pre-funded warrants during the first half of 2023 has been registered in

the trade register on December 13, 2023. As of June 30, 2023, the amount of the share capital as registered in the trade register

is CHF 1,329,483.11 divided into 132,948,311 shares.

| | |

Number of shares | |

| | |

Common shares | | |

Treasury shares | | |

Total | |

| Balance

as of January 1, 2024 (1) | |

| 184,354,496 | | |

| (59,159,103 | ) | |

| 125,195,393 | |

| Sale of shares under sale agency agreement | |

| - | | |

| 3,050,665 | | |

| 3,050,665 | |

| Net sale of shares under liquidity agreement | |

| - | | |

| 10,500 | | |

| 10,500 | |

| Acquisition of shares forfeited from DSPPP | |

| - | | |

| (8,539 | ) | |

| (8,539 | ) |

| Balance as of June 30, 2024 | |

| 184,354,496 | | |

| (56,106,477 | ) | |

| 128,248,019 | |

| Shares reclassed as treasury shares under IFRS 2 | |

| - | | |

| (29,950,268 | ) | |

| (29,950,268 | ) |

| Balance as of June 30, 2024 IFRS 2 | |

| 184,354,496 | | |

| (86,056,745 | ) | |

| 98,297,751 | |

(1) In accordance with Swiss law, the issuance

of 6,120,000 new shares through the exercise of pre-funded warrants from December 12, 2023 to December 31, 2023, have been

registered in the commercial register on February 20, 2024. As of January 1, 2024, the amount of the share capital as registered

in the commercial register is CHF 1,782,344.96 divided into 178,234,496 shares.

As of June 30, 2024, 128,248,019 shares

were outstanding excluding 56,106,477 treasury shares directly held by Addex Pharma SA and including 29,950,268 outstanding shares benefiting

from our DSPPP, considered as treasury shares under IFRS 2 (note 14). As of June 30, 2023, 92,345,018 shares were outstanding excluding

44,106,243 treasury shares directly held by Addex Pharma SA and including 17,431,8572 outstanding shares benefiting from our DSPPP, considered

as treasury shares under IFRS 2. All shares have a nominal value of CHF 0.01.

The Group maintains a liquidity agreement with

Kepler Cheuvreux (“Kepler”). Under the agreement, the Group has provided Kepler with cash and shares to enable them to buy

and sell the Company’s shares. As of June 30, 2024, 161,572 (December 31, 2023: 172,072) treasury shares are recorded

under this agreement in the treasury share reserve and CHF 2,796 (December 31, 2023: CHF 848) is recorded in other financial assets.

During the six-month period ended June 30,

2024, the Group sold 3,050,665 treasury shares under the sale agency agreement with Kepler Cheuvreux at an average price of CHF 0.077

per share for gross proceeds of CHF 235,257 (during the six-month period ended June 30, 2023, the Group sold 3,742,506 treasury

shares at an average price of CHF 0.31 per share for gross proceeds of CHF 1,176,781).

Addex Therapeutics │ Unaudited Interim

Condensed Consolidated Financial Statements │Notes

On February 20, 2024, in accordance with

Swiss law, the company registered in the commercial register 6,120,000 new shares issued out of conditional capital from December 12,

2023 to December 31, 2023 following the exercise of pre-funded warrants granted to one institutional investor on April 3, 2023.

On June 14, 2023, the Company increased

its capital from CHF 1,153,483 to CHF 1,329,483 through the issuance of 17,600,000 new shares from its capital band to its 100% owned

subsidiary, Addex Pharma SA, at the nominal value of CHF 0.01. These shares are held as treasury shares; hence the operation does not

impact the outstanding share capital.

On April 3, 2023, the Group entered into

a securities purchase agreement with an institutional investor. The Group sold 7,999,998 treasury shares in the form of ADSs at a price

of USD 0.16 (CHF 0.14) per share equivalent to USD 19.00 per ADS (CHF 17.20 per ADS) and 23,578,950 pre-funded warrant shares in the

form of ADSs at a price of USD 0.16 (CHF 0.14 per share) equivalent to USD 18.80 (CHF 17.02) per ADS. During the second quarter of 2023,

the institutional investor exercised 3,502,950 pre-funded warrants in a form of ADSs allowed by the issuance of 3,502,950 new shares

through our listed conditional capital. The new issued shares have been registered in the trade register on December 13, 2023 in

accordance with Swiss corporate law. The remaining 20,076,000 pre-funded warrants in a form of ADSs have been exercised during the second

half of 2023. The total gross proceeds from the offering amounted to USD 5.0 million (CHF 4.5 million) and directly attributable share

offering costs of CHF 0.2 million were recorded as a deduction in equity. In addition, the Group granted the institutional investor,

31,578,948 warrant shares exercisable in the form of ADSs with an exercise price of USD 0.17 (CHF 0.15) per share equivalent to USD 20.00

(CHF 18.11) per ADS and an exercise period expiring on April 5, 2028. The fair value of the warrant shares amounts to CHF 1.78 million

and has been recorded in equity as a cost of the offering. The Group also reduced the price to USD 0.17 (CHF 0.15) per share equivalent

to USD 20.00 (CHF 18.11) per ADS and extended the exercise period to April 5, 2028 of 9,230,772 warrant shares exercisable in the

form of ADSs and 15,000,000 warrant shares exercisable in the form of ADSs granted in the securities purchase agreement signed on December 16,

2021 and July 22, 2022, respectively. The amendments to the exercise conditions resulted in an increase in the total fair value

of CHF 0.96 million that has been recorded in equity as a cost of the offering.

14.

Share-based compensation

The total share-based compensation expense for

equity incentive units recognized as continuing operating costs in the statement of profit or loss for the three-month and six-month