false

0000882291

0000882291

2025-02-12

2025-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 12, 2025

Aethlon

Medical, Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

001-37487 |

13-3632859 |

|

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

11555

Sorrento Valley Road, Suite

203

San Diego, California |

92121 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (619) 941-0360

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, $0.001 par value per share |

AEMD |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

The information provided

below in “Item 7.01 - Regulation FD Disclosure” of this Current Report on Form 8-K (this “Current Report”) is

incorporated by reference into this Item 2.02.

Item 7.01 Regulation FD Disclosure.

On February 12, 2025,

Aethlon Medical, Inc. (the “Company”) issued a press release regarding its financial results for the quarter ended December

31, 2024. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information set forth

under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be incorporated

by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference

language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed

an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 12, 2025 |

Aethlon Medical, Inc. |

| |

|

|

| |

By: |

/s/ James B. Frakes |

| |

Name:

|

James B. Frakes

Chief Executive Officer and Chief Financial Officer |

Exhibit 99.1

Aethlon Medical

Announces Financial Results for the Fiscal Third Quarter Ended

December 31, 2024 and Provides Corporate Update

Key Milestone Achieved: First Patient treated

in Hemopurifier® Safety, Feasibility, and Dose

Finding Study for Solid Tumors Not Responding to Anti-PD-1 Antibodies

Patient Enrollment Open at Two Australian for

Hemopurifier® Cancer Trial

Operating Expenses Significantly Reduced

Conference Call to be Held Today at 4:30 p.m.

ET

SAN DIEGO, February 12, 2025 -- Aethlon

Medical, Inc. (Nasdaq: AEMD), a medical therapeutic company focused on developing products to treat cancer and life-threatening infectious

diseases, today reported financial results for its fiscal third quarter ended December 31, 2024 and provided an update on recent developments.

Company Updates

During the third quarter, and subsequently, the

company made significant progress in its oncology trial efforts in Australia while executing cost-cutting measures to enhance operational

efficiency. Management is pleased to highlight the following key developments:

Clinical Trials:

Steady progress in our Australian Oncology

trial of the Hemopurifier in patients with solid tumors was made. To date, three patients have been enrolled. Two patients did not advance

to the treatment phase due to pre-specified stopping criteria during the run-in period - one showed a clinical response to anti PD-1 therapy,

while the other experienced toxicity related to anti-PD-1 therapy. The third patient, who did not respond to anti-PD-1 therapy, successfully

underwent a single 4-hour Hemopurifier treatment at Royal Adelaide Hospital on January 29, 2025. The treatment was completed with no device-related

issues or complications. Samples collected before and after treatment will be analyzed to assess extracellular vesicle removal and changes

in anti-tumor T cell activity. This data will be available once all 3 patients in this patient cohort are treated.

Following the investigator meeting with

the three clinical sites, Aethlon received valuable feedback suggesting protocol modifications that could possibly improve enrollment

speed, reduce screen failures, and shorten the time to Hemopurifier treatment and time to data. In response, the Aethlon team swiftly

developed a protocol amendment incorporating these recommendations.

Key changes include enrolling patients

only after they have been confirmed not to be responding to anti-PD-1 therapy. This adjustment eliminates the need to identify patients

within the first 2 weeks of starting anti-PD-1 therapy and removes the two-month run-in period previously required to assess response

to therapy. Additionally, restrictions on commonly prescribed concomitant medications that do not impact patient safety have been lifted.

The amended protocol also broadens eligibility to include patients receiving all approved dosing regimens of Pembrolizumab and Nivolumab,

rather than limiting enrollment to specific schedules.

The company is pleased to announce that

the Human Research Ethics Committees (HREC) and Research Governance Offices (RGO) have approved this amendment at all three clinical sites.

The two currently active clinical sites, Royal Adelaide Hospital and Pindara Private Hospital, can enroll under the amended protocol.

The third site, Genesis Care/ Royal North Shore Hospital, can begin enrollment under this amendment following a Site Initiation Visit

(SIV) on February 14, 2025.

The company continues to pursue approval

of a similar clinical trial in India. HREC approval has been obtained at Medanta Medicity Hospital, and we are currently awaiting approval

from the regulatory agency CDSCO in India. Recent regulatory changes in India have introduced additional documentation requirements that

were previously not necessary. Aethlon is actively responding to CDSCO’s queries through the company’s India CRO, Qualtran.

Operational Efficiency:

Aethlon has implemented strategic cost-cutting

measures to optimize company resources, enabling it to maintain a strong focus on the high-impact oncology trials in both Australia and

India. These initiatives are designed to improve resource allocation, reduce operational expenses, and support the continued advancement

of our clinical programs.

“During the third fiscal quarter and subsequent

period, we continued to advance our oncology trials, including treatment of the first patient at Royal Adelaide Hospital in late January.

We are pleased to report that the patient tolerated the procedure without complications, making a critical milestone for the safety, feasibility

and dose-finding trials of the Hemopurifier in patients with solid tumors who have not responded to anti-PD-1 antibodies” stated

James Frakes, Chief Executive Officer and Chief Financial Officer of Aethlon Medical. "We currently have two clinical sites activated

and open for enrollment in Australia, with a third site expected to be activated in February 2025. In addition, we have received ethics

committee approval from a site in India. We also anticipate continued enrollments in our Hemopurifier cancer trial as these sites progress.

While two previously recruited patients were withdrawn

from the study due to outcomes related to their anti-PD-1 therapies, we believe that the recent protocol amendment will shorten trial

timelines and support improved patient enrollment. As previously announced, we believe these studies will help inform future oncology

efficacy trials. Furthermore, we have implemented strategic cost-cutting measures to optimize company resources, enabling us to maintain

a strong focus on the high-impact oncology trials in both Australia and India.”

As a reminder, the primary endpoint of the approximate

nine to 18-patient, safety, feasibility and dose-finding trials, is safety. The trials will monitor any adverse events and clinically

significant changes in lab tests of Hemopurifier treated patients with solid tumors with stable or progressive disease at different treatment

intervals, after a two-month run in period of PD-1 antibody, Keytruda® or Opdivo® monotherapy. Patients who do not respond to

the PD-1 antibody therapy will be eligible to enter the Hemopurifier period of the study where sequential cohorts will receive 1, 2 or

3 Hemopurifier treatments during a one-week period. In addition to monitoring safety, the study is designed to examine the number of Hemopurifier

treatments needed to decrease the concentration of EVs and if these changes in EV concentrations improve the body’s own natural

ability to attack tumor cells. These exploratory central laboratory analyses are expected to inform the design of subsequent efficacy

and safety trials, including a Premarket Approval (PMA) study required by the FDA and other regulatory agencies.

Currently, only approximately 30% of patients

who receive pembrolizumab or nivolumab will have lasting clinical responses to these agents. Extracellular vesicles (EVs) produced by

tumors have been implicated in the spread of cancers as well as the resistance to anti-PD-1 therapies. The Aethlon Hemopurifier has been

designed to bind and remove these EVs from the bloodstream, which may improve therapeutic response rates to anti-PD-1 antibodies. In preclinical

studies, the Hemopurifier has been shown to reduce the number of EVs in cancer patient plasma samples.

The company is closely monitoring developments

related to Bird Flu in the United States, Marburg virus in Rwanda and Ebola virus in Uganda. Aethlon has direct experience with these

viruses, having previously generated in vitro viral binding data for all three viruses and treated an Ebola patient in Germany under Emergency

Use conditions. Aethlon will continue to monitor these situations carefully and be poised to respond if currently available treatment

strategies are deemed ineffective.

Financial Results for the Fiscal Third Quarter

Ended December 31, 2024

As of December 31, 2024, Aethlon had a cash balance

of approximately $4.8 million.

Consolidated operating expenses for the fiscal

quarter ended December 31, 2024, decreased by approximately $1.8 million, or approximately 50%, to $1.8 million compared to $3.6 million

for the fiscal quarter ended December 31, 2023. This reduction was driven by a $1.3 million decrease in payroll and related expenses,

a $300,000 decrease in professional fees, and a $200,000 decrease in general and administrative expenses.

The approximate $1.3 million decrease in payroll

and related expenses was primarily attributable to a reduction of $900,000 in separation expenses related to the Separation Agreement

with the former Chief Executive Officer that had been recorded in the December 2023 period, as well as a decrease of approximately $400,000

due to a reduction in headcount. Of the approximate $900,000 of separation expenses related to the departure of the former CEO, approximately

$400,000 related to the acceleration of vesting of stock options.

The approximate $300,000 decrease in professional

fees was primarily due to an approximate reduction of $200,000 in legal fees resulting from the transition to a new legal firm, and a

decrease of $200,000 in scientific and operational consulting fees largely attributable to completed projects. These decreases were partially

offset by an approximate $100,000 increase in investor relations and accounting fees.

The approximate $200,000 decrease in general and

administrative expenses was primarily driven by a $300,000 reduction in supplies, largely related to the raw materials and components

used in the manufacturing of the Hemopurifier, with no comparable purchases during the current period. Additionally, there was an approximate

$100,000 decrease in insurance expenses associated with a reduced headcount and various other operating expenses. These reductions were

partially offset by a $200,000 increase in expenses related clinical trial expenses related to our ongoing oncology clinical trials in

Australia and India.

As a result of the factors noted above, the company’s

net loss decreased to approximately $1.8 million in the fiscal quarter ended December 31, 2024, from approximately $3.5 million in the

fiscal quarter ended December 31, 2023.

The consolidated balance sheet for December 31,

2024, and the consolidated statements of operations for the three- and nine-month periods ended December 31, 2024 and 2023 follow at the

end of this release.

Conference Call

Management will host a conference call today,

Wednesday, February 12, 2025, at 4:30 p.m. ET to review the company’s financial results and recent corporate developments. Following

management’s formal remarks, there will be a question and answer session.

Interested parties can register for the conference

call by navigating to https://dpregister.com/sreg/10196811/fe7c419c9d.

Please note that registered participants will receive their dial-in number upon registration.

Interested parties without internet access or

unable to pre-register may dial in by calling:

PARTICIPANT DIAL IN (TOLL FREE): 1-844-836-8741

PARTICIPANT INTERNATIONAL DIAL IN: 1-412-317-5442

All callers should ask for the Aethlon Medical,

Inc. conference call.

A replay of the call will be available approximately

one hour after the end of the call through March 12, 2025. The replay can be accessed via Aethlon Medical’s website or by dialing

1-877-344-7529 (domestic) or 1-412-317-0088 (international) or Canada toll free at 1-855-669-9658. The replay conference ID number is

7828175.

About Aethlon and the Hemopurifier®

Aethlon Medical is a medical therapeutic company

focused on developing the Hemopurifier, a clinical stage immunotherapeutic device which is designed to combat cancer and life-threatening

viral infections and for use in organ transplantation. In human studies, the Hemopurifier has demonstrated the removal of life-threatening

viruses and in pre-clinical studies, the Hemopurifier has demonstrated the removal of harmful exosomes from biological fluids, utilizing

its proprietary lectin-based technology. This action has potential applications in cancer, where exosomes may promote immune suppression

and metastasis, and in life-threatening infectious diseases. The Hemopurifier is a U.S. Food and Drug Administration (FDA) designated

Breakthrough Device indicated for the treatment of individuals with advanced or metastatic cancer who are either unresponsive to or intolerant

of standard of care therapy, and with cancer types in which exosomes have been shown to participate in the development or severity of

the disease. The Hemopurifier also holds an FDA Breakthrough Device designation and an open Investigational Device Exemption (IDE) application

related to the treatment of life-threatening viruses that are not addressed with approved therapies.

Additional information can be found at www.AethlonMedical.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that

involve risks and uncertainties. Statements containing words such as "may," "believe," "anticipate," "expect,"

"intend," "plan," "project," "will," "projections," "estimate," "potentially"

or similar expressions constitute forward-looking statements. Such forward-looking statements are subject to significant risks and uncertainties

and actual results may differ materially from the results anticipated in the forward-looking statements. These forward-looking statements

are based upon Aethlon's current expectations and involve assumptions that may never materialize or may prove to be incorrect. Factors

that may contribute to such differences include, without limitation, the Company's ability to raise additional capital on terms favorable

to the Company, or at all; the Company’s ability to successfully complete development of the Hemopurifier; the Company’s ability

to successfully demonstrate the utility and safety of the Hemopurifier in cancer and infectious diseases and in the transplant setting;

the Company’s ability to achieve and realize the anticipated benefits from potential milestones; the Company’s ability to

obtain approval from the Ethics Committee of its third location in Australia, including on the timeline expected by the Company; the Company’s

ability to enroll additional patients in its oncology clinical trials in Australia and India, including on the timeline expected by the

Company; the Company’s ability to manage and successfully complete its clinical trials; the Company’s ability to successfully

manufacture the Hemopurifier in sufficient quantities for its clinical trials; unforeseen changes in regulatory requirements; the Company’s

ability to cure deficiencies and continue to maintain its Nasdaq listing; and other potential risks. The foregoing list of risks and uncertainties

is illustrative, but is not exhaustive. Additional factors that could cause results to differ materially from those anticipated in forward-looking

statements can be found under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended March

31, 2024, and in the Company's other filings with the Securities and Exchange Commission, including its quarterly Reports on Form 10-Q.

All forward-looking statements contained in this press release speak only as of the date on which they were made. Except as may be required

by law, the Company does not intend, nor does it undertake any duty, to update this information to reflect future events or circumstances.

Company Contact:

Jim Frakes

Chief Executive Officer and Chief Financial Officer

Aethlon Medical, Inc.

Jfrakes@aethlonmedical.com

Investor Contact:

Susan Noonan

S.A. Noonan Communications, LLC

susan@sanoonan.com

AETHLON MEDICAL, INC. AND SUBSIDIARY

Condensed Consolidated

Balance Sheets

Unaudited

| | |

December 31,

2024 | | |

March 31,

2024 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,825,387 | | |

$ | 5,441,978 | |

| Deferred offering costs | |

| 54,750 | | |

| 277,827 | |

| Prepaid expenses and other current assets | |

| 88,270 | | |

| 505,983 | |

| | |

| | | |

| | |

| TOTAL CURRENT ASSETS | |

| 4,968,407 | | |

| 6,225,788 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 762,138 | | |

| 1,015,229 | |

| Operating lease right-of-use lease asset | |

| 673,315 | | |

| 883,054 | |

| Patents, net | |

| 688 | | |

| 1,100 | |

| Restricted cash | |

| 87,506 | | |

| 87,506 | |

| Deposits | |

| 33,305 | | |

| 33,305 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 6,525,359 | | |

$ | 8,245,982 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 610,909 | | |

$ | 777,862 | |

| Due to related parties | |

| 781,899 | | |

| 546,434 | |

| Operating lease liability, current portion | |

| 307,326 | | |

| 290,565 | |

| Accrued professional fees | |

| 73,537 | | |

| 215,038 | |

| | |

| | | |

| | |

| TOTAL CURRENT LIABILITIES | |

| 1,773,671 | | |

| 1,829,899 | |

| | |

| | | |

| | |

| Operating lease liability, less current portion | |

| 417,522 | | |

| 649,751 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 2,191,193 | | |

| 2,479,650 | |

| | |

| | | |

| | |

| STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Common stock, par value of $0.001; 60,000,000 shares authorized as of December 31, 2024; 13,986,669 and 2,629,725 issued and outstanding as of December 31, 2024 and March 31, 2024, respectively | |

| 13,987 | | |

| 2,629 | |

| Additional paid-in capital | |

| 166,037,129 | | |

| 160,337,371 | |

| Accumulated other comprehensive loss | |

| (17,026 | ) | |

| (6,940 | ) |

| Accumulated deficit | |

| (161,699,924 | ) | |

| (154,566,728 | ) |

| | |

| | | |

| | |

| TOTAL STOCKHOLDERS' EQUITY | |

| 4,334,166 | | |

| 5,766,332 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | |

$ | 6,525,359 | | |

$ | 8,245,982 | |

AETHLON MEDICAL, INC. AND SUBSIDIARY

Consolidated Statements of Operations and Comprehensive Loss

For the three and nine month periods ended December 31, 2024 and 2023

Unaudited

| | |

Three Months | | |

Three Months | | |

Nine Months | | |

Nine Months | |

| | |

Ended 12/31/24 | | |

Ended 12/31/23 | | |

Ended 12/31/24 | | |

Ended 12/31/23 | |

| | |

| | |

| | |

| | |

| |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Professional fees | |

$ | 377,877 | | |

$ | 668,586 | | |

$ | 1,563,995 | | |

$ | 2,778,335 | |

| Payroll and related expenses | |

| 620,487 | | |

| 1,919,305 | | |

| 3,248,187 | | |

| 4,233,970 | |

| General and administrative | |

| 816,383 | | |

| 979,197 | | |

| 2,525,220 | | |

| 3,138,289 | |

| Total operating expenses | |

| 1,814,747 | | |

| 3,567,088 | | |

| 7,337,402 | | |

| 10,150,594 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING LOSS | |

| (1,814,747 | ) | |

| (3,567,088 | ) | |

| (7,337,402 | ) | |

| (10,150,594 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

| 59,964 | | |

| 100,967 | | |

| 204,206 | | |

| 367,838 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

| (1,754,783 | ) | |

| (3,466,121 | ) | |

| (7,133,196 | ) | |

| (9,782,756 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE INCOME/(LOSS) | |

| (13,057 | ) | |

| 7,951 | | |

| (10,085 | ) | |

| 4,522 | |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE LOSS | |

$ | (1,767,840 | ) | |

$ | (3,458,170 | ) | |

$ | (7,143,281 | ) | |

$ | (9,778,234 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Basic and diluted loss per share attributable to

common stockholders | |

$ | (0.13 | ) | |

$ | (1.37 | ) | |

$ | (0.61 | ) | |

$ | (3.95 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Weighted average number of common shares outstanding - basic

and diluted | |

| 13,962,266 | | |

| 2,516,511 | | |

| 11,801,655 | | |

| 2,477,282 | |

v3.25.0.1

Cover

|

Feb. 12, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 12, 2025

|

| Entity File Number |

001-37487

|

| Entity Registrant Name |

Aethlon

Medical, Inc.

|

| Entity Central Index Key |

0000882291

|

| Entity Tax Identification Number |

13-3632859

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

11555

Sorrento Valley Road

|

| Entity Address, Address Line Two |

Suite

203

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

619

|

| Local Phone Number |

941-0360

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

AEMD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

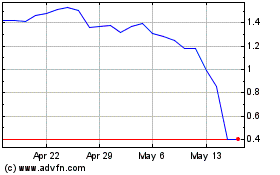

Aethlon Medical (NASDAQ:AEMD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aethlon Medical (NASDAQ:AEMD)

Historical Stock Chart

From Feb 2024 to Feb 2025