Avalon GloboCare Reports Laboratory Services MSO Revenue of $14.7 Million and Net Income of $6.3 Million in 2022

April 27 2023 - 8:00AM

Avalon GloboCare Corp. (“Avalon” or the “Company”) (NASDAQ:

ALBT), a developer of innovative cell-based technology,

cellular therapy and precision diagnostics, today reported

financial results for Laboratory Services MSO, LLC (“LSM”) for the

twelve months ended December 31, 2022. In February 2023, Avalon

acquired a 40% interest in LSM, a premier clinical diagnostics and

reference laboratory.

LSM 2022 Financial

Highlights

- Revenue was $14.7 million

- Gross profit was $8.1 million

- Total operating expense was $2.4

million

- Net income was $6.3 million

“We are pleased to report strong financial

results and profitability for LSM in 2022, which we believe is

further validation of our strategic investment,” stated David Jin,

M.D., Ph.D., President and Chief Executive Officer of Avalon

GloboCare. “LSM offers an extensive test menu, from general

bloodwork to anatomic pathology, urine toxicology, pharmacogenomics

(PGx) testing and more, with quick turnaround times. Our goal is to

continue to grow LSM’s top and bottom line by taking advantage of a

unique roll-up opportunity within the highly fragmented market for

laboratory testing and services. By targeting laboratories with

exceptional performance, a positive revenue track record and

niche-market advantage, we believe we can effectively leverage

LSM’s experience and infrastructure to achieve significant

synergies.”

Headquartered in Costa Mesa, California, LSM

provides a broad portfolio of diagnostic tests including drug

testing, toxicology, pharmacogenetics, and a broad array of test

services, from general bloodwork to anatomic pathology. Specific

capabilities include STAT blood testing, qualitative drug

screening, genetic testing, urinary testing, sexually transmitted

disease testing and more. LSM has a sophisticated and

state-of-the-art facility for clinical diagnostics and reference

laboratory. It has also developed a premier reputation for customer

service satisfaction and fast turnaround time in the industry. LSM

has completed over 600,000 tests since inception and currently has

two operational locations in California.

About Avalon GloboCare Corp.

Avalon GloboCare Corp. (NASDAQ: ALBT) is a

clinical-stage biotechnology company dedicated to developing and

delivering innovative, transformative cellular therapeutics,

precision diagnostics, and clinical laboratory services. Avalon

also provides strategic advisory and outsourcing services to

facilitate and enhance its clients’ growth and development, as well

as competitiveness in healthcare and CellTech industry markets.

Through its subsidiary structure with unique integration of

verticals from innovative R&D to automated bioproduction and

accelerated clinical development, Avalon is establishing a leading

role in the fields of cellular immunotherapy (including CAR-T/NK),

exosome technology (ACTEX™), and regenerative therapeutics. For

more information about Avalon GloboCare, please visit

www.avalon-globocare.com.

For the latest updates on Avalon GloboCare’s

developments, please follow our twitter at @avalongc_avco

Forward-Looking Statements

Certain statements contained in this press

release may constitute “forward-looking statements.”

Forward-looking statements provide current expectations of future

events based on certain assumptions and include any statement that

does not directly relate to any historical or current fact,

including statements regarding LSM. Actual results may differ

materially from those indicated by such forward-looking statements

as a result of various important factors as disclosed in our

filings with the Securities and Exchange Commission located at

their website (http://www.sec.gov). In addition to these factors,

actual future performance, outcomes, and results may differ

materially because of more general factors including (without

limitation) general industry and market conditions and growth

rates, economic conditions, and governmental and public policy

changes. The forward-looking statements included in this press

release represent the Company's views as of the date of this press

release and these views could change. However, while the Company

may elect to update these forward-looking statements at some point

in the future, the Company specifically disclaims any obligation to

do so. These forward-looking statements should not be relied upon

as representing the Company's views as of any date subsequent to

the date of the press release.

Contact Information: Avalon GloboCare Corp.4400

Route 9, Suite 3100Freehold, NJ

07728PR@Avalon-GloboCare.com

Investor Relations:Crescendo Communications, LLCTel: (212)

671-1020 Ext. 304albt@crescendo-ir.com

(tables follow)

| LABORATORY SERVICES

MSO, LLC AND AFFILIATES |

| COMBINED BALANCE

SHEETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

| |

|

|

|

2022 |

|

2021 |

| ASSETS |

|

|

|

|

| |

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

| |

Cash |

$ |

439,778 |

$ |

607,982 |

| |

Accounts receivable |

|

4,088,069 |

|

3,086,966 |

| |

Other current assets |

|

86,277 |

|

- |

| |

|

|

|

|

|

|

| |

|

Total

Current Assets |

|

4,614,124 |

|

3,694,948 |

| |

|

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

| |

Operating lease right-of-use assets, net |

|

1,758,063 |

|

- |

| |

Finance lease right-of-use assets, net |

|

291,419 |

|

- |

| |

Property and equipment, net |

|

14,667 |

|

18,667 |

| |

|

|

|

|

|

|

| |

|

Total

Non-current Assets |

|

2,064,149 |

|

18,667 |

| |

|

|

|

|

|

|

| |

|

Total

Assets |

$ |

6,678,273 |

$ |

3,713,615 |

| |

|

|

|

|

|

|

| LIABILITIES AND

MEMBER'S EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

| |

Accounts payable |

$ |

573,395 |

$ |

184,139 |

| |

Accrued payroll liability |

|

38,589 |

|

42,077 |

| |

Operating lease obligation |

|

229,874 |

|

- |

| |

Finance lease obligation |

|

112,457 |

|

- |

| |

|

|

|

|

|

|

| |

|

Total

Current Liabilities |

|

954,315 |

|

226,216 |

| |

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES: |

|

|

|

|

| |

Operating lease obligation - noncurrent portion |

|

1,680,017 |

|

- |

| |

Finance lease obligation - noncurrent portion |

|

178,962 |

|

- |

| |

|

|

|

|

|

|

| |

|

Total

Non-current Liabilities |

|

1,858,979 |

|

- |

| |

|

|

|

|

|

|

| |

|

Total

Liabilities |

|

2,813,294 |

|

226,216 |

| |

|

|

|

|

|

|

| |

Commitments and Contingencies |

|

|

|

|

| |

|

|

|

|

|

|

|

MEMBER'S EQUITY |

|

3,864,979 |

|

3,487,399 |

| |

|

|

|

|

|

|

| |

|

Total

Liabilities and Member's Equity |

$ |

6,678,273 |

$ |

3,713,615 |

| |

|

|

|

|

|

|

| LABORATORY SERVICES

MSO, LLC AND AFFILIATES |

| COMBINED STATEMENTS

OF INCOME |

|

|

|

|

|

|

|

|

| |

|

|

|

For the

Year Ended |

|

For the

Year Ended |

| |

|

|

|

December 31, 2022 |

|

December 31, 2021 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

REVENUE |

$ |

14,689,747 |

$ |

18,278,430 |

| |

|

|

|

|

|

|

|

COST OF REVENUE |

|

6,612,268 |

|

5,002,674 |

| |

|

|

|

|

|

|

|

GROSS PROFIT |

|

8,077,479 |

|

13,275,756 |

| |

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

| |

Selling and marketing expense |

|

1,344,552 |

|

480,269 |

| |

Professional fees |

|

714,662 |

|

375,667 |

| |

Other general and administrative expenses |

|

296,704 |

|

281,128 |

| |

|

|

|

|

|

|

| |

|

Total

Operating Expenses |

|

2,355,918 |

|

1,137,064 |

| |

|

|

|

|

|

|

|

OPERATING INCOME |

|

5,721,561 |

|

12,138,692 |

| |

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

| |

Forgiveness of Paycheck Protection Program loan |

|

- |

|

95,000 |

| |

Employee Retention Tax Credit |

|

609,634 |

|

- |

| |

Other income |

|

11,938 |

|

24,330 |

| |

|

|

|

|

|

|

| |

|

Total Other

Income, net |

|

621,572 |

|

119,330 |

| |

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAXES |

|

6,343,133 |

|

12,258,022 |

| |

|

|

|

|

|

|

|

INCOME TAXES |

|

- |

|

- |

| |

|

|

|

|

|

|

|

NET INCOME |

$ |

6,343,133 |

$ |

12,258,022 |

| |

|

|

|

|

|

|

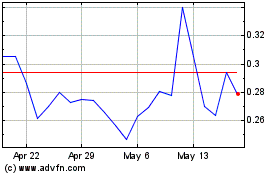

Avalon GloboCare (NASDAQ:ALBT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Avalon GloboCare (NASDAQ:ALBT)

Historical Stock Chart

From Feb 2024 to Feb 2025