false

0001860657

0001860657

2024-03-08

2024-03-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): March 8, 2024

ALLARITY THERAPEUTICS,

INC.

(Exact name of registrant

as specified in our charter)

| Delaware |

|

001-41160 |

|

87-2147982 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

24 School Street, 2nd Floor

Boston, MA |

|

02108 |

| (Address of principal executive offices) |

|

(Zip Code) |

(401) 426-4664

(Registrant’s telephone

number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ALLR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition.

On

March 8, 2024, Allarity Therapeutics, Inc. (the “Company”) issued a press release announcing,

among other things, certain financial and operational information for its fiscal year ended December 31, 2023 and provided a business

update. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item

7.01 Regulation FD Disclosure.

The

information included in Item 2.02 above is incorporated herein by reference. A copy of the press release is furnished as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

This

information is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, unless we specifically incorporate

it by reference in a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934. By furnishing this information

on this Current Report on Form 8-K, we make no admission as to the materiality of any information in this report that is required to be

disclosed solely by reason of Regulation FD.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on our behalf by the

undersigned hereunto duly authorized.

| |

Allarity Therapeutics, Inc. |

|

|

|

| Date: March 8, 2024 |

By: |

/s/ Thomas Jensen |

| |

|

Thomas Jensen |

| |

|

Chief Executive Officer |

2

Exhibit

99.1

Allarity

Therapeutics Reports Full Year 2023

Financial Results and Provides a Business Update

| | - Leadership

Changes Led by Appointment of Co-Founder Thomas Jensen as Interim CEO and Jeremy Graff, Ph.D.,

former Eli Lilly Executive, as Executive Advisor |

| | - Reduced

Net Loss from Operations by 50% and Reduced Net Loss by 26% |

| | - Announced Data in

December 2023 from Advanced Ovarian Cancer Phase 2 Stenoparib Study Showing Significant Clinical

Benefit |

Boston

(March 8, 2024) — Allarity Therapeutics, Inc. (“Company”) (NASDAQ: ALLR), a clinical-stage pharmaceutical company

dedicated to developing personalized cancer treatments, today reported financial results for the year ended December 31, 2023, and provided

a general business update.

The

Company’s Interim Chief Executive Officer, Thomas Jensen, stated, “2023 was a year of remarkable achievements for Allarity

Therapeutics as we made significant strides in advancing our DRP®-guided drug development. Our clinical research has shown strong

indications that we can address a significant unmet medical need in oncology. In particular, our lead asset, stenoparib, has demonstrated

exceptional promise in advanced ovarian cancer trials. As we continue through 2024, our focus remains on continuing to generate and report

on additional pivotal clinical trial data for stenoparib, which we expect will further strengthen interest in our work from a broad group

of stakeholders, including leading oncologists, potential partner companies, and the biotech investor community.”

2023

Highlights and Recent Developments

Stenoparib

(2X-121): An orally available, small molecule dual-targeted inhibitor of poly-ADP ribose polymerase (PARP1/2) and telomerase maintenance

enzymes (Tankyrase 1 and 2) in development for advanced ovarian cancer.

| ● | Early

data announced in December 2023 from the Phase 2 monotherapy study of stenoparib for advanced

ovarian cancer showed significant clinical benefit in evaluable patients following a protocol

change to twice-daily dosing earlier in the year. Using the DRP®-Stenoparib

companion diagnostic (CDx), which includes 414 mRNA biomarkers, patients were selected based

on a DRP score above 50%. Of 22 screened, 17 were DRP positive, with 11 treated, of which

five were evaluable before the data evaluation cut-off. One trial participant showed a complete

response in December 2023, and the other four evaluable patients had stable diseases, all

were previously treated with PARP inhibitors and chemotherapy. |

Allarity

Therapeutics, Inc. | 210 Broadway, #201 | Cambridge, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

Announced

leadership changes and strategic advisory engagement:

| ● | Appointment

of co-founder Thomas H. Jensen as Interim Chief Executive Officer in December 2023. With

nearly two decades at Allarity Therapeutics, Jensen brings extensive experience and a deep

understanding of the company’s DRP® to his new role. Mr. Jensen has

been instrumental in developing molecular biological techniques essential for the DRP platform

and played a key role in building investor relations and securing financing. |

| | | |

| ● | Engaged

Jeremy R. Graff, Ph.D., as an Executive Advisor. Dr. Graff, with over 25 years of experience

in biotech and pharma, is a specialist in both developing clinical strategy and successful

execution of numerous clinical development programs of cancer therapeutics. His notable career

includes C-level positions and a significant tenure at Eli Lilly, where he led the translational

oncology group. |

Anticipated

Clinical Milestones in 2024

The

focus of the Company remains on generating and disclosing pivotal clinical data to demonstrate the clinical benefit of our DRP guided

therapies. Accordingly, we expect to announce interim data from the DRP®-guided Phase 2 clinical trial of stenoparib in advanced

ovarian cancer during the second quarter of 2024. We believe that this milestone is particularly significant as it will provide further

insights into stenoparib’s potential to meet the unmet needs in the treatment of advanced ovarian cancer.

Full

Year 2023 Operating Results

R&D

Expenses: Research and Development (R&D) expenses were $7.1 million for 2023, compared to $6.9 million for 2022.

G&A

Expenses: General and Administrative (G&A) expenses were $10.0 million for 2023, compared to $10.0 million for 2022.

Net

Loss from Operations: Net Loss from Operations was $17.1 million for 2023, compared to $34 million for 2022.

Net

Loss: Net loss was $11.9 million for 2023, compared to $16.1 million for 2022.

About

the Drug Response Predictor – DRP® Companion Diagnostic

Allarity

uses its drug-specific DRP® to select those patients who, by the expression signature of their cancer, are found to have a high likelihood

of benefiting from a specific drug. By screening patients before treatment, and only treating those patients with a sufficiently high,

drug-specific DRP score, the therapeutic benefit rate may be significantly increased. The DRP method builds on the comparison of sensitive

vs. resistant human cancer cell lines, including transcriptomic information from cell lines combined with clinical tumor biology filters

and prior clinical trial outcomes. DRP is based on messenger RNA expression profiles from patient biopsies. The DRP® platform has

proven its ability to provide a statistically significant prediction of the clinical outcome from drug treatment in cancer patients in

37 out of 47 clinical studies that were examined (both retrospective and prospective). The DRP platform, which can be used in all cancer

types and is patented for more than 70 anti-cancer drugs, has been extensively published in the peer-reviewed literature.

About

Allarity Therapeutics

Allarity

Therapeutics, Inc. (NASDAQ: ALLR) is a clinical-stage biopharmaceutical company dedicated to developing personalized cancer treatments.

The Company is focused on development of stenoparib, a novel PARP/Tankyrase inhibitor for advanced ovarian cancer patients, using its

DRP® companion diagnostic for patient selection in the ongoing phase 2 clinical trial, NCT03878849. Allarity is headquartered in

the U.S., with a research facility in Denmark, and is committed to addressing significant unmet medical needs in cancer treatment. For

more information, visit www.allarity.com.

Allarity

Therapeutics, Inc. | 24 School Street, 2nd Floor | Boston, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

Follow

Allarity on Social Media

LinkedIn:

https://www.linkedin.com/company/allaritytx/

X:

https://twitter.com/allaritytx

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements provide the Company’s current expectations or forecasts of future events. The words “anticipates,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predicts,”

“project,” “should,” “would” and similar expressions may identify forward-looking statements, but

the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not

limited to, statements related to release of the clinical trial data in 2024 and its impact on strengthening interest in our work, the

availability of interim/final data readout from the DRP guided Phase 2 clinical trial of stenoparib for advanced ovarian cancer, the

possibility of a financing in Q1 2024 and expected availability of capital to fund its anticipated clinical trials, any statements related

to ongoing clinical trials for stenoparib as a monotherapy or in combination with another therapeutic candidate for the treatment of

advanced ovarian cancer, or ongoing clinical trials (in Europe) for IXEMPRA® for the treatment of metastatic breast cancer, statements

relating to the effectiveness of the Company’s DRP® companion diagnostics platform in predicting whether a particular patient

is likely to respond to a specific drug and statements related to the Company’s ability to regain compliance with the Nasdaq Listing

Rule. Any forward-looking statements in this press release are based on management’s current expectations of future events and

are subject to multiple risks and uncertainties that could cause actual results to differ materially and adversely from those set forth

in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that the Company

is not able to raise sufficient capital to support its current and anticipated clinical trials, the risk that early results of a clinical

study do not necessarily predict final results and that one or more of the clinical outcomes may materially change following more comprehensive

reviews of the data, and as more patient data become available, the risk that results of a clinical study are subject to interpretation

and additional analyses may be needed and/or may contradict such results, the receipt of regulatory approval for stenoparib or any of

our other therapeutic candidates and companion diagnostics or, if approved, the successful commercialization of such products, the risk

of cessation or delay of any of the ongoing or planned clinical trials and/or our development of our product candidates, the risk that

the results of previously conducted studies will not be repeated or observed in ongoing or future studies involving our therapeutic candidates,

and the risk that the current COVID-19 pandemic will impact the Company’s current and future clinical trials and the timing of

the Company’s preclinical studies and other operations. For a discussion of other risks and uncertainties, and other important

factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section

entitled “Risk Factors” in our Form S-1 registration statement filed on October 30, 2023, as amended and our Form 10-K annual

report on file with the Securities and Exchange Commission (the “SEC”), available at the SEC’s website at www.sec.gov,

and as well as discussions of potential risks, uncertainties and other important factors in the Company’s subsequent filings with

the SEC. All information in this press release is as of the date of the release, and the Company undertakes no duty to update this information

unless required by law.

Allarity

Therapeutics, Inc. | 24 School Street, 2nd Floor | Boston, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

ALLARITY

THERAPEUTICS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

For the years ended December 31, 2023 and 2022

(U.S. dollars in thousands, except for share and per share data)

| | |

2023 | | |

2022 | |

| Operating

expenses: | |

| | | |

| | |

| Research

and development | |

$ | 7,103 | | |

$ | 6,930 | |

| Impairment

of intangible assets | |

| — | | |

| 17,571 | |

| General

and administrative | |

| 10,026 | | |

| 9,962 | |

| Total

operating expenses | |

| 17,129 | | |

| 34,463 | |

| Loss

from operations | |

| (17,129 | ) | |

| (34,463 | ) |

| Other

income (expenses) | |

| | | |

| | |

| Income

from the sale of IP | |

| — | | |

| 1,780 | |

| Interest

income | |

| 22 | | |

| 30 | |

| Interest

expenses | |

| (498 | ) | |

| (223 | ) |

| Loss

on investment | |

| — | | |

| (115 | ) |

| Foreign

exchange gains (losses) | |

| 133 | | |

| (913 | ) |

| Fair

value of inducement warrants | |

| (4,189 | ) | |

| — | |

| Loss

on modification of warrants | |

| (591 | ) | |

| — | |

| Change

in fair value adjustment of warrant derivative liabilities | |

| 10,434 | | |

| 17,125 | |

| Penalty

on Series A Preferred stock liability | |

| — | | |

| (800 | ) |

| Net

other income, net | |

| 5,311 | | |

| 16,884 | |

| Net

loss before tax recovery (expense) | |

| (11,818 | ) | |

| (17,579 | ) |

| Deferred

income tax (expense) benefit | |

| (83 | ) | |

| 1,521 | |

| Net

loss | |

| (11,901 | ) | |

| (16,058 | ) |

| Cash

payable on converted Series A Preferred Stock | |

| — | | |

| (3,421 | ) |

| Deemed

dividends on Series A Preferred Stock | |

| (8,392 | ) | |

| — | |

| Deemed

dividend of on Series C Preferred Stock | |

| (123 | ) | |

| (1,572 | ) |

| Net

loss attributable to common stockholders | |

$ | (20,416 | ) | |

$ | (21,051 | ) |

| | |

| | | |

| | |

| Basic

and diluted net loss per common stock | |

$ | (10.26 | ) | |

$ | (3,093.42 | ) |

| Weighted

average number of common stock outstanding, basic and diluted | |

| 1,990,748 | | |

| 6,805 | |

| Other

comprehensive loss, net of tax: | |

| | | |

| | |

| Net

loss | |

$ | (11,901 | ) | |

$ | (16,058 | ) |

| Change

in cumulative translation adjustment | |

| 310 | | |

| (121 | ) |

| Comprehensive

loss attributable to common stockholders | |

$ | (11,591 | ) | |

$ | (16,179 | ) |

| All

common share data has been retroactively adjusted to effect reverse stock splits in 2023. |

Allarity

Therapeutics, Inc. | 24 School Street, 2nd Floor | Boston, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

ALLARITY

THERAPEUTICS, INC.

CONSOLIDATED BALANCE SHEETS

As of December 31, 2023 and 2022

(U.S. dollars in thousands, except for share and per share data)

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| ASSETS |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

| Cash |

|

$ |

166 |

|

|

$ |

2,029 |

|

| Other

current assets |

|

|

209 |

|

|

|

1,559 |

|

| Prepaid

expenses |

|

|

781 |

|

|

|

591 |

|

| Tax

credit receivable |

|

|

815 |

|

|

|

789 |

|

| Total

current assets |

|

|

1,971 |

|

|

|

4,968 |

|

| Non-current

assets: |

|

|

|

|

|

|

|

|

| Property,

plant and equipment, net |

|

|

20 |

|

|

|

21 |

|

| Operating

lease right of use assets |

|

|

— |

|

|

|

6 |

|

| Intangible

assets |

|

|

9,871 |

|

|

|

9,549 |

|

| Total

assets |

|

$ |

11,862 |

|

|

$ |

14,544 |

|

| LIABILITIES

AND STOCKHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

8,416 |

|

|

$ |

6,251 |

|

| Accrued

liabilities |

|

|

1,309 |

|

|

|

1,904 |

|

| Warrant

derivative liability |

|

|

3,083 |

|

|

|

374 |

|

| Income

taxes payable |

|

|

59 |

|

|

|

41 |

|

| Convertible

promissory note and accrued interest, net of debt discount |

|

|

1,300 |

|

|

|

— |

|

| Secured

promissory notes |

|

|

— |

|

|

|

2,644 |

|

| Operating

lease liabilities, current |

|

|

— |

|

|

|

8 |

|

| Total

current liabilities |

|

|

14,167 |

|

|

|

11,222 |

|

| Non-current

liabilities: |

|

|

|

|

|

|

|

|

| Convertible

promissory note and accrued interest, net of debt discount |

|

|

— |

|

|

|

1,083 |

|

| Deferred

tax |

|

|

446 |

|

|

|

349 |

|

| Total

liabilities |

|

|

14,613 |

|

|

|

12,654 |

|

| Redeemable

preferred stock (500,000 shares authorized) |

|

|

|

|

|

|

|

|

| Series

A Preferred Stock $0.0001 par value (20,000 shares designated) shares issued and outstanding at December 31, 2023 and 2022, were

1,417 and 13,586, respectively (liquidation preference of $17.54 at December 31, 2023) |

|

|

— |

|

|

|

2,001 |

|

| Series

B Preferred Stock $0.0001 par value (200,000 shares designated); shares issued at December 31, 2023 and 2022, were 0 and 190,786,

respectively (liquidation preference of $0 at December 31, 2023) |

|

|

— |

|

|

|

2 |

|

| Series

C Convertible Preferred stock $0.0001 par value (50,000 and 0 shares designated at December 31, 2023 and 2022, respectively);

shares issued and outstanding at December 31, 2023 were 0 |

|

|

— |

|

|

|

— |

|

| Total

redeemable preferred stock |

|

|

— |

|

|

|

2,003 |

|

| Stockholders’

(deficit) equity |

|

|

|

|

|

|

|

|

| Series

A Preferred stock $0.0001 par value (20,000 shares designated) shares issued and outstanding at December 31, 2023 and 2022, were

1,417 and 13,586, respectively (liquidation preference of $17.54 at December 31, 2023) |

|

|

1,742 |

|

|

|

— |

|

| Common

Stock, $0.0001 par value (750,000,000 and 30,000,000 shares authorized, at December 31, 2023 and 2022, respectively); shares

issued and outstanding at December 31, 2023 and 2022, were 5,886,934 and 11,356, respectively |

|

|

— |

|

|

|

— |

|

| Additional

paid-in capital |

|

|

90,369 |

|

|

|

83,158 |

|

| Accumulated

other comprehensive loss |

|

|

(411 |

) |

|

|

(721 |

) |

| Accumulated

deficit |

|

|

(94,451 |

) |

|

|

(82,550 |

) |

| Total

stockholders’ deficit |

|

|

(2,751 |

) |

|

|

(113 |

) |

| Total

liabilities, preferred stock and stockholders’ (deficit) equity |

|

$ |

11,862 |

|

|

$ |

14,544 |

|

| All

common share data has been retroactively adjusted to effect reverse stock splits in 2023. |

###

Allarity

Therapeutics, Inc. | 24 School Street, 2nd Floor | Boston, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

Company

Contact:

investorrelations@allarity.com

Media

Contact:

Thomas

Pedersen

Carrotize

PR & Communications

+45

6062 9390

tsp@carrotize.com

Allarity

Therapeutics, Inc. | 24 School Street, 2nd Floor | Boston, MA | U.S.A. | NASDAQ: ALLR | www.allarity.com

v3.24.0.1

Cover

|

Mar. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 08, 2024

|

| Entity File Number |

001-41160

|

| Entity Registrant Name |

ALLARITY THERAPEUTICS,

INC.

|

| Entity Central Index Key |

0001860657

|

| Entity Tax Identification Number |

87-2147982

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

24 School Street

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02108

|

| City Area Code |

401

|

| Local Phone Number |

426-4664

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ALLR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

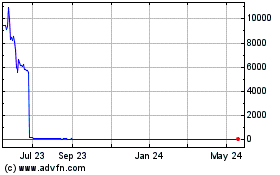

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Jan 2025 to Feb 2025

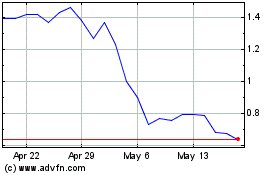

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

From Feb 2024 to Feb 2025