ALX Oncology Reports Fourth Quarter and Full Year 2023 Financial Results and Provides Corporate Update

March 07 2024 - 3:03PM

ALX Oncology Holdings Inc., (“ALX Oncology” or “the Company”)

(Nasdaq: ALXO), an immuno-oncology company developing therapies

that block the CD47 immune checkpoint pathway, today reported

financial results for the fourth quarter and full year ended

December 31, 2023, and provided a corporate update.

“This past year proved to be a profound growth period for ALX

Oncology highlighted by evorpacept’s positive results in the

prespecified randomized interim analysis of the ASPEN-06 Phase 2

clinical trial in advanced HER2-positive gastric/GEJ cancer,” said

Jason Lettmann, Chief Executive Officer (“CEO”) of ALX Oncology.

“Notably, this outcome is particularly important as it represents

the first promising activity in a randomized trial in solid tumors

in the CD47 space and further underscores evorpacept’s

differentiation. Over the next 12-18 months, we expect to report

multiple value inflection datapoints, with the goal of advancing

evorpacept’s potential beyond anti-cancer antibodies through

ongoing combination studies with ADCs and checkpoint inhibitors.

With nine ongoing trials, our goal is to expand evorpacept’s value

to other tumor types including breast, NHL, multiple myeloma and

urothelial cancers as well as accelerate our efforts to identify

new indications around this highly differentiated asset.”

Fourth Quarter 2023 Highlights

- Appointed long-standing board member,

Jason Lettmann to CEO, while co-founder and previous CEO, Jaume

Pons, Ph.D., transitioned to Chief Scientific Officer in

September.

- Reported positive results from a

prespecified interim analysis of the Phase 2 randomized

multi-center international clinical trial of ASPEN-06 for the

treatment of advanced HER2-positive gastric/gastroesophageal

junction (“GEJ”) cancer in October.

- Key findings from

the 54 randomized subjects, which included those previously treated

with ENHERTU® (fam-trastuzumab deruxtecan-nxki) and/or immune

checkpoint inhibitors, reported a confirmed overall response rate

(“ORR”) of 52 percent in the evorpacept combination treatment arm

compared to 22 percent for the control group of trastuzumab +

CYRAMZA® (ramucirumab) + paclitaxel (“TRP”).

- Median duration of

response (“mDOR”) was not reached for the evorpacept TRP

combination treatment arm compared to 7.4 months for the control

group of TRP.

- The safety profile

of evorpacept was consistent with the Company’s previous clinical

trials and remained well-tolerated in this reported treatment

combination.

- The interim results

compared favorably to the efficacy results reported for CYRAMZA +

paclitaxel in the RAINBOW study (ORR of 28 percent and mDOR of 4.4

months), which currently serves as the regulatory benchmark and

global standard-of-care for second-line gastric/GEJ cancer.

- Executed an

oversubscribed underwritten public offering that generated gross

proceeds of approximately $63.2 million during October, which helps

to extend the Company’s expected cash runway into early 2026. The

follow-on offering closely followed the report of the positive

interim analysis of the Phase 2 ASPEN-06 clinical trial in advanced

HER2-positive gastric/GEJ cancer.

- ALX Oncology sold

8,663,793 shares of common stock, which included 1,293,103 shares

of common stock pursuant to the full exercise of the underwriters’

option to purchase additional shares and, in lieu of common stock

to certain investors, pre-funded warrants to purchase 1,250,000

shares of common stock in the offering. The shares of common stock

were sold at a public offering price of $6.38 per share (the

closing price on October 4, 2023), and the pre-funded warrants were

sold at a public offering price of $6.379 per pre-funded

warrant.

Anticipated 2024 Clinical Milestones for

Evorpacept’s Maturing Pipeline Development

- Non-Hodgkin

Lymphoma – Data from a Phase 1b IST with rituximab + lenalidomide

will be presented in an oral presentation in a Clinical Trials

Minisymposium session at the AACR Annual Meeting 2024 on Tuesday,

April 9, 2024, from 2:30 pm – 4:30 pm PT.

- Urothelial

Carcinoma – Data from a Phase 1b ASPEN-07 clinical trial with

PADCEV® (enfortumab vedotin-ejfv) (Q2 2024)

- Gastric/GEJ Cancer

– Top line results from all 122 subjects in a Phase 2 randomized

clinical trial of ASPEN-06 (June-July 2024)

- Breast Cancer – Top

line results from a Phase 1b I-SPY TRIAL with ENHERTU (Q4

2024)

- Head and Neck

Squamous Cell Carcinoma – Top line results from a Phase 2

randomized clinical trial of ASPEN-03 with KEYTRUDA®

(pembrolizumab) (Q4 2024/Q1 2025)

- Head and Neck

Squamous Cell Carcinoma – Top line results from a Phase 2

randomized clinical trial of ASPEN-04 with KEYTRUDA and

chemotherapy (Q4 2024/Q1 2025)

- Gastric/GEJ Cancer

– Initiation of Phase 3 registrational randomized clinical trial

for evorpacept (Q4 2024)

2023 Full Year and Fourth Quarter Financial

Results:

- Cash, Cash Equivalents and

Investments: Cash, cash equivalents and investments as of

December 31, 2023, were $218.1 million. The Company believes its

cash, cash equivalents, and investments along with the ability to

draw down an additional $40 million of its term loan are sufficient

to fund planned operations into early 2026.

- Research and Development

(“R&D”) Expenses: R&D expenses consist primarily

of pre-clinical, clinical and manufacturing expenses related to the

development of the Company’s current lead product candidate,

evorpacept, and R&D employee-related expenses. These expenses

for the three months ended December 31, 2023, were $41.8 million,

compared to $25.2 million for the prior-year period. The increase

was primarily attributable to an increase of $13.6 million in

clinical costs from an increase in the number of active trials and

patient enrollment as well as manufacturing of clinical trial

materials to support a higher number of active clinical trials and

future expected patient enrollment related to the advancement of

evorpacept. R&D expenses for the year ended December 31, 2023

were $141.8 million, compared to $98.4 million for the prior-year

period.

- General and Administrative

(“G&A”) Expenses: G&A expenses consist primarily

of administrative employee-related expenses, legal and other

professional fees, patent filing and maintenance fees, and

insurance. These expenses for the three months ended December 31,

2023, were $6.2 million, compared to $7.0 million for the prior

year period. G&A expenses for the year ended December 31, 2023

were $28.5 million, compared to $29.0 million for the prior-year

period.

- Net loss: GAAP net

loss was $45.5 million for the fourth quarter ended December 31,

2023, or ($0.93) per basic and diluted share, as compared to a GAAP

net loss of $30.7 million for the fourth quarter ended December 31,

2022, or ($0.75) per basic and diluted share. GAAP net loss was

$160.8 million for the year ended December 31, 2023, or ($3.74) per

basic and diluted share, as compared to a GAAP net loss of $123.5

million for the year ended December 31, 2022, or ($3.03) per basic

and diluted share. Non-GAAP net loss was $38.7 million for the

fourth quarter ended December 31, 2023, as compared to a non-GAAP

net loss of $24.4 million for the fourth quarter ended December 31,

2022. Non-GAAP net loss was $134.3 million for the year ended

December 31, 2023, as compared to a non-GAAP net loss of $99.6

million for the year ended December 31, 2022. A reconciliation of

GAAP to non-GAAP financial results can be found at the end of this

news release.

About ALX Oncology

ALX Oncology is a publicly traded, clinical-stage

immuno-oncology company focused on helping patients fight cancer by

developing therapies that block the CD47 immune checkpoint

inhibitor and bridge the innate and adaptive immune system. ALX

Oncology’s lead product candidate, evorpacept, is a next generation

CD47 blocking therapeutic that combines a high-affinity CD47

binding domain with an inactivated, proprietary Fc domain. To date,

evorpacept has been dosed in over 500 subjects and has demonstrated

promising activity and a favorable tolerability profile across a

range of hematologic and solid malignancies in combination with

various leading anti-cancer antibodies. ALX Oncology is currently

focusing on combining evorpacept with anti-cancer antibodies, ADCs,

and PD-1/PD-L1 immune checkpoint inhibitors.

Evorpacept’s Unique Profile: Anchored by a Rational

Design and Dual Development Pillars

Rationally engineered with an inactive Fc effector function,

evorpacept’s clinical data to date has demonstrated a substantially

improved safety profile over other anti-CD47 molecules in the

clinic with an active Fc (i.e., binding the Fc gamma receptor on

macrophages). This best-in-class safety profile allows for higher

dosage with minimal overlapping toxicity in the combination

treatment setting. CD47 expressed on cancer cells binds to its

receptor SIRP alpha, which is predominantly expressed on two cell

types: macrophages and dendritic cells. The Company’s pipeline of

therapeutic candidates with standard-of-care agents include:

- Anti-cancer antibodies (the “don’t eat

me” signal): evorpacept enables

Fc-mediated antibody-dependent phagocytosis by macrophages in

combination with anti-cancer antibodies (e.g., Herceptin®) with an

active Fc domain, which is otherwise impaired by CD47 expression on

cancer cells binding to SIRP alpha on macrophages. This same

mechanism of action applies to ADCs.

- PD-1/PD-L1 immune checkpoint inhibitors (the

“don’t activate T-cells”

signal): evorpacept enables T-cell activation by dendritic

cells that are constitutively inhibited by CD47 expression on

cancer cells binding to SIRP alpha on dendritic cells. Activated

dendritic cells present neoantigens to T-cells that once activated

will kill cancer cells when the PD-1/PD-L1 inhibitory interaction

is blocked by T-cell checkpoint inhibitors.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. Forward-looking

statements include statements regarding future results of

operations and financial position, business strategy, product

candidates, planned preclinical studies and clinical trials,

results of clinical trials, research and development costs,

regulatory approvals, timing and likelihood of success, plans and

objects of management for future operations, as well as statements

regarding industry trends. Such forward-looking statements are

based on ALX Oncology’s beliefs and assumptions and on information

currently available to it on the date of this press release.

Forward-looking statements may involve known and unknown risks,

uncertainties and other factors that may cause ALX Oncology’s

actual results, performance or achievements to be materially

different from those expressed or implied by the forward-looking

statements. These and other risks are described more fully in ALX

Oncology’s filings with the Securities and Exchange Commission

(“SEC”), including ALX Oncology’s Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and other documents ALX Oncology

files with the SEC from time to time. Except to the extent required

by law, ALX Oncology undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date on which they were made.

|

ALX ONCOLOGY HOLDINGS INC.Consolidated

Statements of Operations(unaudited for the three months

ended December 31, 2023 and 2022)(in thousands, except share and

per share amounts) |

| |

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

41,784 |

|

|

$ |

25,197 |

|

|

$ |

141,795 |

|

|

$ |

98,400 |

|

|

General and administrative |

|

6,239 |

|

|

|

7,022 |

|

|

|

28,483 |

|

|

|

29,036 |

|

|

Total operating expenses |

|

48,023 |

|

|

|

32,219 |

|

|

|

170,278 |

|

|

|

127,436 |

|

| Loss

from operations |

|

(48,023 |

) |

|

|

(32,219 |

) |

|

|

(170,278 |

) |

|

|

(127,436 |

) |

|

Interest income |

|

2,995 |

|

|

|

1,807 |

|

|

|

10,649 |

|

|

|

4,278 |

|

|

Interest expense |

|

(415 |

) |

|

|

(231 |

) |

|

|

(1,565 |

) |

|

|

(238 |

) |

|

Other income (expense), net |

|

(29 |

) |

|

|

(2 |

) |

|

|

389 |

|

|

|

(22 |

) |

| Loss

before income taxes |

|

(45,472 |

) |

|

|

(30,645 |

) |

|

|

(160,805 |

) |

|

|

(123,418 |

) |

| Income

tax (provision) benefit |

|

— |

|

|

|

(64 |

) |

|

|

— |

|

|

|

(64 |

) |

| Net

loss |

$ |

(45,472 |

) |

|

$ |

(30,709 |

) |

|

$ |

(160,805 |

) |

|

$ |

(123,482 |

) |

| Net loss

per share, basic and diluted |

$ |

(0.93 |

) |

|

$ |

(0.75 |

) |

|

$ |

(3.74 |

) |

|

$ |

(3.03 |

) |

|

Weighted-average shares of common stock used to compute net

loss per shares, basic and diluted |

|

48,995,998 |

|

|

|

40,755,520 |

|

|

|

42,987,767 |

|

|

|

40,699,612 |

|

|

Consolidated Balance Sheet Data(in thousands) |

|

| |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

Cash, cash equivalents and investments |

$ |

218,147 |

|

|

$ |

282,906 |

|

| Total

assets |

$ |

242,553 |

|

|

$ |

306,489 |

|

| Total

liabilities |

$ |

52,841 |

|

|

$ |

43,025 |

|

|

Accumulated deficit |

$ |

(486,272 |

) |

|

$ |

(325,467 |

) |

| Total

stockholders’ equity |

$ |

189,712 |

|

|

$ |

263,464 |

|

GAAP to Non-GAAP Reconciliation

(unaudited) (in thousands)

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

GAAP net loss, as reported |

$ |

(45,472 |

) |

|

$ |

(30,709 |

) |

|

$ |

(160,805 |

) |

|

$ |

(123,482 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

6,721 |

|

|

|

6,295 |

|

|

|

26,273 |

|

|

|

23,839 |

|

|

Accretion of term loan discount and issuance costs |

|

64 |

|

|

|

44 |

|

|

|

250 |

|

|

|

44 |

|

|

Total adjustments |

|

6,785 |

|

|

|

6,339 |

|

|

|

26,523 |

|

|

|

23,883 |

|

| Non-GAAP

net loss |

$ |

(38,687 |

) |

|

$ |

(24,370 |

) |

|

$ |

(134,282 |

) |

|

$ |

(99,599 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use of Non-GAAP Financial Measures

We supplement our consolidated financial statements presented on

a GAAP basis by providing additional measures which may be

considered “non-GAAP” financial measures under applicable SEC

rules. We believe that the disclosure of these non-GAAP financial

measures provides our investors with additional information that

reflects the amounts and financial basis upon which our management

assesses and operates our business. These non-GAAP financial

measures are not in accordance with generally accepted accounting

principles and should not be viewed in isolation or as a substitute

for reported, or GAAP, net loss, and are not a substitute for, or

superior to, measures of financial performance performed in

conformity with GAAP.

“Non-GAAP net loss” is not based on any standardized methodology

prescribed by GAAP and represents GAAP net loss adjusted to exclude

stock-based compensation expense and accretion of term loan

discount and issuance costs. Non-GAAP financial measures used by

ALX Oncology may be calculated differently from, and therefore may

not be comparable to, non-GAAP measures used by other

companies.

Investor and Media Contact:

Caitlyn Doherty

Manager, Investor Relations and Corporate Communications, ALX Oncology

cdoherty@alxoncology.com

(650) 466-7125

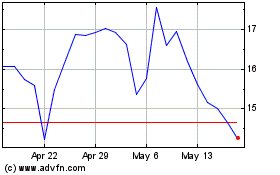

ALX Oncology (NASDAQ:ALXO)

Historical Stock Chart

From Dec 2024 to Jan 2025

ALX Oncology (NASDAQ:ALXO)

Historical Stock Chart

From Jan 2024 to Jan 2025