A-Mark Precious Metals, Inc.

(NASDAQ: AMRK) (A-Mark), a leading fully

integrated precious metals platform, today announced that its Board

of Directors has declared a quarterly cash dividend of $0.20 per

share, maintaining the company's current dividend program. The

dividend is payable on October 22, 2024, to stockholders of record

as of October 8, 2024.

About A-Mark Precious MetalsFounded in

1965, A-Mark Precious Metals, Inc. is a leading fully integrated

precious metals platform that offers an array of gold, silver,

platinum, palladium, and copper bullion, numismatic coins, and

related products to wholesale and retail customers via a portfolio

of channels. The company conducts its operations through three

complementary segments: Wholesale Sales & Ancillary Services,

Direct-to-Consumer, and Secured Lending. The company’s global

customer base spans sovereign and private mints, manufacturers and

fabricators, refiners, dealers, financial institutions, industrial

users, investors, collectors, e-commerce customers, and other

retail customers.

A-Mark’s Wholesale Sales & Ancillary

Services segment distributes and purchases precious metal products

from sovereign and private mints. As a U.S. Mint-authorized

purchaser of gold, silver, and platinum coins since 1986, A-Mark

purchases bullion products directly from the U.S. Mint for sale to

customers. A-Mark also has longstanding distributorships with other

sovereign mints, including Australia, Austria, Canada, China,

Mexico, South Africa, and the United Kingdom. The company sells

more than 200 different products to e-commerce retailers, coin and

bullion dealers, financial institutions, brokerages, and

collectors. In addition, A-Mark sells precious metal products to

industrial users, including metal refiners, manufacturers, and

electronic fabricators.

Located in the heart of Hong Kong’s Central

Financial District, A-Mark’s consolidated subsidiary, LPM Group

Limited (LPM), is one of Asia’s largest precious metals dealers.

LPM offers a wide selection of products to its wholesale customers,

through its showroom and 24/7 online trading platform, including

recently released silver coins, gold bullion, certified coins, and

the latest collectible numismatic issues.

Through its A-M Global Logistics subsidiary,

A-Mark provides its customers with a range of complementary

services, including managed storage options for precious metals as

well as receiving, handling, inventorying, processing, packaging,

and shipping of precious metals and coins on a secure basis.

A-Mark’s mint operations, which are conducted through its wholly

owned subsidiary Silver Towne Mint, enable the company to

offer customers a wide range of proprietary coin and bar offerings

and, during periods of market volatility when the availability of

silver bullion from sovereign mints is often product constrained,

preferred product access.

A-Mark’s Direct-to-Consumer segment operates as

an omni-channel retailer of precious metals, providing access to a

multitude of products through its wholly owned

subsidiaries, JM Bullion and Goldline. JMB owns and

operates numerous websites targeting specific niches within the

precious metals retail market, including JMBullion.com,

ProvidentMetals.com, Silver.com, CyberMetals.com, GoldPrice.org,

SilverPrice.org, BGASC.com, BullionMax.com, and Gold.com. Goldline

markets precious metals directly to the investor community through

various channels, including television, radio, and telephonic sales

efforts. A-Mark is the majority owner of Silver Gold Bull, a

leading online precious metals retailer in Canada, and also holds

minority ownership interests in three additional direct-to-consumer

brands.

The company operates its Secured Lending segment

through its wholly owned subsidiary, Collateral Finance Corporation

(CFC). Founded in 2005, CFC is a California licensed finance lender

that originates and acquires loans secured by bullion and

numismatic coins. Its customers include coin and precious metal

dealers, investors, and collectors.

A-Mark is headquartered in El Segundo, CA and

has additional offices and facilities in the neighboring Los

Angeles area as well as in Dallas, TX, Las Vegas, NV, Winchester,

IN, Vienna, Austria, and Hong Kong. For more information,

visit www.amark.com.

A-Mark periodically provides information for

investors on its corporate website, www.amark.com, and its investor

relations website, ir.amark.com. This includes press releases

and other information about financial performance, reports filed or

furnished with the SEC, information on corporate governance, and

investor presentations.

Important Cautions Regarding

Forward-Looking Statements

Statements in this press release that relate to

future plans, objectives, expectations, performance, events and the

like are "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995 and the Securities

Exchange Act of 1934. These include statements regarding

expectations with respect to future profitability and growth, the

dividend declaration, the amount or timing of any future dividends,

future macroeconomic conditions and demand for precious metal

products, and the Company’s ability to effectively respond to

changing economic conditions. Future events, risks and

uncertainties, individually or in the aggregate, could cause actual

results or circumstances to differ materially from those expressed

or implied in these statements. Factors that could cause actual

results to differ include the following: the failure to execute the

Company’s growth strategy, including the inability to identify

suitable or available acquisition or investment opportunities;

greater than anticipated costs incurred to execute this strategy;

government regulations that might impede growth, particularly in

Asia; the inability to successfully integrate recently acquired

businesses; changes in the current international political climate,

which historically has favorably contributed to demand and

volatility in the precious metals markets but also has posed

certain risks and uncertainties for the Company, particularly in

recent periods; potential adverse effects of the current problems

in the national and global supply chains; increased competition for

the Company’s higher margin services, which could depress pricing;

the failure of the Company’s business model to respond to changes

in the market environment as anticipated; changes in consumer

demand and preferences for precious metal products generally;

potential negative effects that inflationary pressure may have on

our business; the inability of the Company to expand capacity at

Silver Towne Mint; the failure of our investee companies to

maintain, or address the preferences of, their customer bases;

general risks of doing business in the commodity markets; and the

strategic, business, economic, financial, political and

governmental risks and other Risk Factors described in in the

Company’s public filings with the Securities and Exchange

Commission.

The Company undertakes no obligation to publicly

update or revise any forward-looking statements. Readers are

cautioned not to place undue reliance on these forward-looking

statements.

Company Contact:Steve Reiner,

Executive Vice President, Capital Markets & Investor

RelationsA-Mark Precious Metals, Inc.

1-310-587-1410sreiner@amark.com

Investor Relations Contact:Matt

Glover or Greg BradburyGateway Group, Inc.

1-949-574-3860AMRK@gatewayir.com

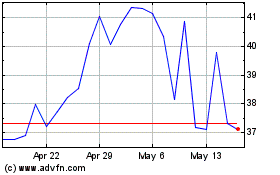

A Mark Precious Metals (NASDAQ:AMRK)

Historical Stock Chart

From Dec 2024 to Jan 2025

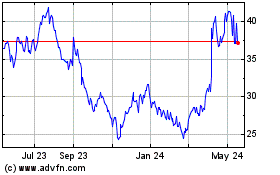

A Mark Precious Metals (NASDAQ:AMRK)

Historical Stock Chart

From Jan 2024 to Jan 2025