AngioDynamics, Inc. (NASDAQ: ANGO):

Fiscal Year 2024 Third Quarter Highlights

- Completed the sale of its PICC and Midline product

portfolios to Spectrum Vascular on February 15, 2024

- Discontinued its Uniblate and Starburst RadioFrequency

products, as well as its Syntrax support catheter products, to

further streamline its product portfolio

GAAP As Reported

Pro Forma*

Net Sales:

$75.2 million

$66.0 million

Growth:

N/A

8.0%

Gross Margin

47.7%

51.1%

GAAP Loss per Share**

$(4.73)

N/A

Adj. Loss per Share

N/A

$(0.16)

*“Pro forma” results exclude the Dialysis

and BioSentry businesses divested in June 2023 and the PICC and

Midline product portfolios divested in February 2024, as well as

the discontinued Uniblate, Starburst, and Syntrax products. “As

Reported” results include sales of the divested assets through

February 14, 2024

**GAAP Loss per share includes a $159.5

million goodwill impairment and $22.0 million related to the

previously announced settlement of IP litigation. The total value

of the goodwill impairment is preliminary, is undergoing further

evaluation and will be adjusted, if necessary, prior to the filing

of the Company’s quarterly report on Form 10-Q

- Pro forma Med Tech net sales of $25.7 million increased

12.6%

- Pro forma Med Device net sales of $40.3 million increased

5.2%

- Subsequent to quarter end, the Company entered into a

settlement agreement with Becton, Dickinson and Company (“BD”) to

resolve all patent litigation with C.R. Bard, Inc., an affiliate of

BD

- Subsequent to quarter end, the Company received 510(k)

clearance for the use of AlphaVac to treat pulmonary

embolism

AngioDynamics, Inc. (NASDAQ: ANGO), a leading and transformative

medical technology company focused on restoring healthy blood flow

in the body’s vascular system, expanding cancer treatment options

and improving quality of life for patients, today announced

financial results for the third quarter of fiscal year 2024, which

ended February 29, 2024.

“During our fiscal third quarter, we took another significant

step in our transformation with the divestiture of our PICC and

Midline product portfolios, further strengthening our balance sheet

and providing us with an opportunity to enhance our focus on the

growth of our Med Tech portfolio,” commented Jim Clemmer, President

and Chief Executive Officer of AngioDynamics, Inc. “We saw a strong

pick up in growth from both our Med Tech and Med Device portfolios

during the quarter and continue to drive toward meaningful margin

expansion and profitability.”

Mr. Clemmer continued, “Subsequent to the end of our fiscal

third quarter, we reached a settlement agreement with BD/Bard that

provides us with clarity and certainty going forward. This allows

us to avoid continued litigation and keep the team focused on

further developing our key growth platforms. I am also very pleased

to announce that earlier this week we received FDA 510(k) clearance

for AlphaVac in the treatment of pulmonary embolism. This approval

came in ahead of even our expectations and is a testament to the

strong submission compiled by our team and the compelling data

generated by our APEX trial. This expanded indication is a

significant piece of our long-term strategy and validates the

effectiveness of the product, opening up another large,

fast-growing market for us to serve with this innovative

platform.”

Third Quarter 2024 Financial Results

Unless otherwise noted, all financial results below are

presented on a pro forma basis excluding the Dialysis and BioSentry

businesses divested in June 2023, the PICC and Midline product

portfolios divested in February 2024, and the recently discontinued

Uniblate and Starburst RadioFrequency products and Syntrax support

catheter products.

Net sales for the third quarter of fiscal year 2024 were $66.0

million, an increase of 8.0% compared to the prior-year quarter.

Foreign currency translation did not have a significant impact on

the Company’s net sales in the quarter.

Med Tech net sales were $25.7 million, a 12.6% increase from

$22.8 million in the prior-year period. Med Tech includes the

Auryon peripheral atherectomy platform, the thrombus management

platform and the NanoKnife irreversible electroporation platform.

Year-over-year growth was driven by Auryon sales during the quarter

of $11.8 million, which increased 14.7%, and NanoKnife sales of

$6.0 million, which increased 46.7% compared to the third quarter

of fiscal 2023. NanoKnife disposable sales were $4.2 million, which

increased 19.8% compared to the third quarter of fiscal 2023.

AngioVac sales were $5.5 million, similar to the prior-year

quarter, while AlphaVac sales were $1.1 million, down from $2.0

million in the third quarter of fiscal 2023.

Med Device net sales were $40.3 million, an increase of 5.2%

compared to the prior-year period.

U.S. net sales in the third quarter of fiscal 2024 were $55.8

million, an increase of 5.9% from sales of $52.7 million a year

ago. International net sales were $10.1 million, an increase of

20.8% from sales of $8.4 million in the prior-year period.

GAAP reported gross margin was 47.7%, a decrease of 250 basis

points compared to the third quarter of fiscal 2023. On a pro forma

basis, gross margin for the third quarter of fiscal 2024 was 51.1%,

a decline of 290 basis points from the third quarter of fiscal

2023. Gross margin for the Med Tech business was 61.5%, a decline

of 300 basis points from the third quarter of fiscal 2023. The

year-over-year decline in gross margin for the Med Tech business

was driven primarily by product and geographic mix. Gross margin

for the Med Device business was 44.4%, a decrease of 330 basis

points compared to the third quarter of fiscal 2023. The

year-over-year decline in gross margin for the Med Device business

was driven primarily by a supplier recall as well as costs

associated with the Company’s ongoing transition to outsourced

manufacturing.

The Company recorded a GAAP net loss of $190.4 million, or a

loss per share of $4.73, in the third quarter of fiscal 2024. The

GAAP net loss includes a goodwill impairment charge of $159.5

million, settlement charge of $22.0 million and asset impairment

charges totaling $6.7 million related to the transition to

outsourced manufacturing and discontinuation of Syntrax. The amount

of the goodwill impairment is preliminary, is undergoing further

evaluation and will be adjusted, if necessary, prior to the filing

of the Company’s quarterly report on Form 10-Q. Excluding the items

shown in the non-GAAP reconciliation table below, adjusted net loss

for the third quarter of fiscal 2024 was $6.5 million, and adjusted

loss per share was $0.16.

Adjusted EBITDA in the third quarter of fiscal 2024, excluding

the items shown in the reconciliation table below, was negative

$3.6 million, compared to adjusted EBITDA of negative $1.5 million

in the third quarter of fiscal 2023.

On February 29, 2024, the Company had $78.5 million in cash and

cash equivalents and no debt compared to $44.6 million in cash and

cash equivalents and $50.0 million of debt on May 31, 2023.

In the third quarter of fiscal 2024, the Company used $12.5

million in operating cash, had capital expenditures of $0.6 million

and had additions to Auryon placement and evaluation units of $1.2

million. Cash flow during the third quarter was significantly

impacted by a combination of timing and extraordinary items related

to both the divestiture transaction and manufacturing restructuring

as well as approximately $1.0 million related to a supplier

recall.

Nine Months Financial Results

Unless otherwise noted, all financial results below are

presented on a pro forma basis excluding the Dialysis and BioSentry

businesses divested in June 2023, the PICC and Midline product

portfolios divested in February 2024, and the recently discontinued

Uniblate and Starburst RadioFrequency products and Syntrax support

catheter products.

For the nine months ended February 29, 2024:

Net sales were $199.6 million, an increase of 6.5% compared to

$187.4 million for the same period a year ago.

Med Tech net sales were $76.6 million, a 9.6% increase from the

prior-year period. Med Device net sales were $123.0 million, an

increase of 4.6% from the prior-year period.

U.S. net sales were $167.6 million, a 3.6% increase from the

prior-year period. International net sales were $32.0 million, an

increase of 24.6% from the prior-year period.

GAAP reported gross margin was 49.9%, a decrease of 170 basis

points compared to the prior-year period. On a pro forma basis,

gross margin was 53.6%, a decline of 150 basis points from the

prior-year period. The year-over-year decline in gross margin was

driven primarily by a supplier recall as well as costs associated

with the Company’s ongoing transition to outsourced

manufacturing.

The Company’s GAAP net loss was $173.6 million, or a loss of

$4.33 per share, compared to a net loss of $31.0 million, or a loss

of $0.79 per share, a year ago. The GAAP net loss includes a

goodwill impairment charge of $159.5 million, settlement charge of

$22.0 million and asset impairment charges totaling $6.8 million

related to the transition to outsourced manufacturing and

discontinuation of Syntrax. The amount of the goodwill impairment

is preliminary, is undergoing further evaluation and will be

adjusted, if necessary, prior to the filing of the Company’s

quarterly report on Form 10-Q. Excluding the items shown in the

non-GAAP reconciliation table below, adjusted net loss was $16.1

million, with adjusted loss per share of $0.40, compared to

adjusted net loss and adjusted loss per share of $17.5 million and

$0.44, respectively, a year ago.

Adjusted EBITDA, excluding the items shown in the reconciliation

table below, was negative $4.7 million, compared to negative $4.3

million for the same period a year ago.

Fiscal Year 2024 Financial Guidance

The Company now expects its fiscal year 2024 net sales to be in

the range of $270 to $275 million, which reflects the recent

divestiture of the PICC and Midline businesses and discontinuance

of the RadioFrequency ablation and Syntrax businesses, which

accounted for approximately $50 million of the prior revenue

guidance of $320 to $325 million. The Company expects gross margin

to be approximately 52.0% to 54.0% and adjusted loss per share in

the range of $0.54 to $0.58.

For comparison, pro forma revenue, gross margin, and adjusted

loss per share for FY23 when excluding the discontinued assets and

the assets divested to Spectrum Vascular and Merit Medical were

$257.2 million, 54.9%, and $0.55, respectively.

Conference Call

The Company’s management will host a conference call today at

8:00 a.m. ET to discuss its third quarter 2024 results.

To participate in the conference call, dial 1-877-407-0784

(domestic) or +1-201-689-8560 (international) and refer to the

passcode 13745239.

This conference call will also be webcast and can be accessed

from the “Investors” section of the AngioDynamics website at

www.angiodynamics.com. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

A recording of the call will also be available from 10:00 a.m.

ET on Thursday, April 4, 2024, until 11:59 p.m. ET on Thursday,

April 11, 2024. To hear this recording, dial 1-844-512-2921

(domestic) or +1-412-317-6671 (international) and enter the

passcode 13745239.

Use of Non-GAAP Measures

Management uses non-GAAP measures to establish operational goals

and believes that non-GAAP measures may assist investors in

analyzing the underlying trends in AngioDynamics' business over

time. Investors should consider these non-GAAP measures in addition

to, not as a substitute for or as superior to, financial reporting

measures prepared in accordance with GAAP. In this news release,

AngioDynamics has reported pro-forma results, adjusted EBITDA,

adjusted net income and adjusted earnings per share. Management

uses these measures in its internal analysis and review of

operational performance. Management believes that these measures

provide investors with useful information in comparing

AngioDynamics' performance over different periods. By using these

non-GAAP measures, management believes that investors get a better

picture of the performance of AngioDynamics' underlying business.

Management encourages investors to review AngioDynamics' financial

results prepared in accordance with GAAP to understand

AngioDynamics' performance taking into account all relevant

factors, including those that may only occur from time to time but

have a material impact on AngioDynamics' financial results. Please

see the tables that follow for a reconciliation of non-GAAP

measures to measures prepared in accordance with GAAP.

About AngioDynamics, Inc.

AngioDynamics is a leading and transformative medical technology

company focused on restoring healthy blood flow in the body’s

vascular system, expanding cancer treatment options and improving

quality of life for patients.

The Company’s innovative technologies and devices are chosen by

talented physicians in fast-growing healthcare markets to treat

unmet patient needs. For more information, visit

www.angiodynamics.com.

Safe Harbor

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements regarding AngioDynamics' expected future financial

position, results of operations, cash flows, business strategy,

budgets, projected costs, capital expenditures, products,

competitive positions, growth opportunities, plans and objectives

of management for future operations, as well as statements that

include the words such as "expects," "reaffirms," "intends,"

"anticipates," "plans," "believes," "seeks," "estimates,"

"projects, " "optimistic," or variations of such words and similar

expressions, are forward-looking statements. These forward-looking

statements are not guarantees of future performance and are subject

to risks and uncertainties. Investors are cautioned that actual

events or results may differ materially from AngioDynamics'

expectations, expressed or implied. Factors that may affect the

actual results achieved by AngioDynamics include, without

limitation, the scale and scope of the COVID-19 global pandemic,

the ability of AngioDynamics to develop its existing and new

products, technological advances and patents attained by

competitors, infringement of AngioDynamics' technology or

assertions that AngioDynamics' technology infringes the technology

of third parties, the ability of AngioDynamics to effectively

compete against competitors that have substantially greater

resources, future actions by the FDA or other regulatory agencies,

domestic and foreign health care reforms and government

regulations, results of pending or future clinical trials, overall

economic conditions (including inflation, labor shortages and

supply chain challenges including the cost and availability of raw

materials), the results of on-going litigation, challenges with

respect to third-party distributors or joint venture partners or

collaborators, the results of sales efforts, the effects of product

recalls and product liability claims, changes in key personnel, the

ability of AngioDynamics to execute on strategic initiatives, the

effects of economic, credit and capital market conditions, general

market conditions, market acceptance, foreign currency exchange

rate fluctuations, the effects on pricing from group purchasing

organizations and competition, the ability of AngioDynamics to

obtain regulatory clearances or approval of its products, or to

integrate acquired businesses, as well as the risk factors listed

from time to time in AngioDynamics' SEC filings, including but not

limited to its Annual Report on Form 10-K for the year ended May

31, 2023. AngioDynamics does not assume any obligation to publicly

update or revise any forward-looking statements for any reason.

In the United States, the NanoKnife System has received a 510(k)

clearance by the Food and Drug Administration for use in the

surgical ablation of soft tissue and is similarly approved for

commercialization in Canada, the European Union and Australia. The

NanoKnife System has not been cleared for the treatment or therapy

of a specific disease or condition.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED INCOME

STATEMENTS

(in thousands, except per share

data)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma Adjustments (2)

Pro Forma

As Reported (1)

Pro Forma Adjustments (2)

Pro Forma

Feb 29, 2024

Feb 29, 2024

Feb 29, 2024

Feb 28, 2023

Feb 28, 2023

Feb 28, 2023

(unaudited)

(unaudited)

Net sales

$

75,182

(9,211

)

$

65,971

$

80,712

(19,622

)

$

61,090

Cost of sales (exclusive of intangible

amortization)

39,321

(7,038

)

32,283

40,208

(12,096

)

28,112

Gross profit

35,861

(2,173

)

33,688

40,504

(7,526

)

32,978

% of net sales

47.7

%

51.1

%

50.2

%

54.0

%

Operating expenses

Research and development

8,189

(117

)

8,072

6,852

(139

)

6,713

Sales and marketing

25,405

(1,758

)

23,647

25,406

(1,404

)

24,002

General and administrative

10,578

22

10,600

8,839

(306

)

8,533

Amortization of intangibles

3,287

(643

)

2,644

4,739

(1,448

)

3,291

Goodwill impairment (3)

159,476

—

159,476

—

—

—

Change in fair value of contingent

consideration

112

—

112

227

—

227

Acquisition, restructuring and other

items, net

38,116

(6,266

)

31,850

3,369

—

3,369

Total operating expenses

245,163

(8,762

)

236,401

49,432

(3,297

)

46,135

Gain on sale of assets

6,657

(6,657

)

—

—

—

—

Operating loss

(202,645

)

(68

)

(202,713

)

(8,928

)

(4,229

)

(13,157

)

Interest income (expense), net

394

—

394

(736

)

—

(736

)

Other expense, net

(238

)

—

(238

)

—

—

—

Total other income (expense), net

156

—

156

(736

)

—

(736

)

Loss before income tax expense

(benefit)

(202,489

)

(68

)

(202,557

)

(9,664

)

(4,229

)

(13,893

)

Income tax benefit

(12,050

)

—

(12,050

)

(179

)

—

(179

)

Net loss

$

(190,439

)

$

(68

)

$

(190,507

)

$

(9,485

)

$

(4,229

)

$

(13,714

)

Loss per share

Basic

$

(4.73

)

$

(4.73

)

$

(0.24

)

$

(0.35

)

Diluted

$

(4.73

)

$

(4.73

)

$

(0.24

)

$

(0.35

)

Weighted average shares outstanding

Basic

40,234

40,234

39,509

39,509

Diluted

40,234

40,234

39,509

39,509

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses, the

sale of the PICCs and Midlines Businesses and the discontinuation

of the RadioFrequency Ablation and Syntrax products ("the

Businesses") for the three months ended February 29, 2024 and

February 28, 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

(3) The total value of the goodwill

impairment is preliminary, is undergoing further evaluation and

will be adjusted, if necessary, prior to the filing of the

Company’s quarterly report on Form 10-Q.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED INCOME

STATEMENTS

(in thousands, except per share

data)

Nine Months Ended

Nine Months Ended

Actual (1)

Pro Forma Adjustments (2)

Pro Forma

As Reported (1)

Pro Forma Adjustments (2)

Pro Forma

Feb 29, 2024

Feb 29, 2024

Feb 29, 2024

Feb 28, 2023

Feb 28, 2023

Feb 28, 2023

(unaudited)

(unaudited)

Net sales

$

232,934

(33,336

)

$

199,598

$

247,678

(60,260

)

$

187,418

Cost of sales (exclusive of intangible

amortization)

116,751

(24,121

)

92,630

119,791

(35,704

)

84,087

Gross profit

116,183

(9,215

)

106,968

127,887

(24,556

)

103,331

% of net sales

49.9

%

53.6

%

51.6

%

55.1

%

Operating expenses

Research and development

24,788

(647

)

24,141

22,023

(391

)

21,632

Sales and marketing

78,237

(4,714

)

73,523

77,956

(4,305

)

73,651

General and administrative

30,723

(52

)

30,671

29,775

(1,241

)

28,534

Amortization of intangibles

10,474

(2,571

)

7,903

14,384

(4,343

)

10,041

Goodwill impairment (3)

159,476

—

159,476

—

—

—

Change in fair value of contingent

consideration

203

—

203

2,084

—

2,084

Acquisition, restructuring and other

items, net

47,516

(6,394

)

41,122

12,009

(17

)

11,992

Total operating expenses

351,417

(14,378

)

337,039

158,231

(10,297

)

147,934

Gain on sale of assets

54,499

(54,499

)

—

—

—

—

Operating loss

(180,735

)

(49,336

)

(230,071

)

(30,344

)

(14,259

)

(44,603

)

Interest income (expense), net

1,047

—

1,047

(1,801

)

—

(1,801

)

Other expense, net

(558

)

—

(558

)

(427

)

—

(427

)

Total other income (expense), net

489

—

489

(2,228

)

—

(2,228

)

Loss before income tax benefit

(180,246

)

(49,336

)

(229,582

)

(32,572

)

(14,259

)

(46,831

)

Income tax benefit

(6,643

)

—

(6,643

)

(1,597

)

—

(1,597

)

Net loss

$

(173,603

)

$

(49,336

)

$

(222,939

)

$

(30,975

)

$

(14,259

)

$

(45,234

)

Loss per share

Basic

$

(4.33

)

$

(5.56

)

$

(0.79

)

$

(1.15

)

Diluted

$

(4.33

)

$

(5.56

)

$

(0.79

)

$

(1.15

)

Weighted average shares outstanding

Basic

40,098

40,098

39,436

39,436

Diluted

40,098

40,098

39,436

39,436

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses, the

sale of the PICCs and Midlines Businesses and the discontinuation

of the RadioFrequency Ablation and Syntrax products ("the

Businesses") for the nine months ended February 29, 2024 and

February 28, 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

(3) The total value of the goodwill

impairment is preliminary, is undergoing further evaluation and

will be adjusted, if necessary, prior to the filing of the

Company’s quarterly report on Form 10-Q.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION

(in thousands, except per share

data)

Reconciliation of Net Loss to non-GAAP Adjusted Net

Loss:

Three Months Ended

Nine Months Ended

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

(unaudited)

(unaudited)

Net loss

$

(190,439

)

$

(9,485

)

$

(173,603

)

$

(30,975

)

Amortization of intangibles

3,287

4,739

10,474

14,384

Change in fair value of contingent

consideration

112

227

203

2,084

Acquisition, restructuring and other

items, net (1)

38,116

3,369

47,516

12,009

Goodwill impairment (2)

159,476

—

159,476

—

Gain on sale of assets

(6,657

)

—

(54,499

)

—

Tax effect of non-GAAP items (3)

(10,174

)

127

(2,716

)

(655

)

Adjusted net loss

$

(6,279

)

$

(1,023

)

$

(13,149

)

$

(3,153

)

Reconciliation of Diluted Loss Per

Share to non-GAAP Adjusted Diluted Loss Per Share:

Three Months Ended

Nine Months Ended

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

(unaudited)

(unaudited)

Diluted loss per share

$

(4.73

)

$

(0.24

)

$

(4.33

)

$

(0.79

)

Amortization of intangibles

0.08

0.12

0.26

0.36

Change in fair value of contingent

consideration

—

0.01

0.01

0.05

Acquisition, restructuring and other

items, net (1)

0.95

0.08

1.18

0.32

Goodwill impairment (2)

3.96

—

3.98

—

Gain on sale of assets

(0.17

)

—

(1.36

)

—

Tax effect of non-GAAP items (3)

(0.25

)

—

(0.07

)

(0.02

)

Adjusted diluted loss per share

$

(0.16

)

$

(0.03

)

$

(0.33

)

$

(0.08

)

Adjusted diluted sharecount (4)

40,234

39,509

40,098

39,436

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

(2) The total value of the goodwill

impairment is preliminary, is undergoing further evaluation and

will be adjusted, if necessary, prior to the filing of the

Company’s quarterly report on Form 10-Q.

(3) Adjustment to reflect the income tax

provision on a non-GAAP basis has been calculated assuming no

valuation allowance on the Company's U.S. deferred tax assets and

an effective tax rate of 23% for the periods ended February 29,

2024 and February 28, 2023.

(4) Diluted shares may differ for non-GAAP

measures as compared to GAAP due to a GAAP loss.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION (Continued)

(in thousands, except per share

data)

Reconciliation of Net Loss to Adjusted EBITDA:

Three Months Ended

Nine Months Ended

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

(unaudited)

(unaudited)

Net loss

$

(190,439

)

$

(9,485

)

$

(173,603

)

$

(30,975

)

Income tax expense (benefit)

(12,050

)

(179

)

(6,643

)

(1,597

)

Interest expense, net

(394

)

736

(1,047

)

1,801

Depreciation and amortization

7,522

7,787

20,895

23,175

Goodwill impairment (1)

159,476

—

159,476

—

Change in fair value of contingent

consideration

112

227

203

2,084

Stock based compensation

2,612

1,803

8,633

8,177

Acquisition, restructuring and other

items, net (2)

36,981

3,369

46,380

12,009

Gain on sale of assets

(6,657

)

—

(54,499

)

—

Adjusted EBITDA

$

(2,837

)

$

4,258

$

(205

)

$

14,674

Per diluted share:

Adjusted EBITDA

$

(0.07

)

$

0.11

$

(0.01

)

$

0.37

(1) The total value of the goodwill

impairment is preliminary, is undergoing further evaluation and

will be adjusted, if necessary, prior to the filing of the

Company’s quarterly report on Form 10-Q.

(2) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION

(in thousands, except per share

data)

Reconciliation of Pro Forma Net Loss to Pro Forma

Adjusted Net Loss:

Pro Forma

Pro Forma

Three Months Ended

Nine Months Ended

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

(unaudited)

(unaudited)

Pro forma net loss

$

(190,507

)

$

(13,714

)

$

(222,939

)

$

(45,234

)

Amortization of intangibles

2,644

3,291

7,903

10,041

Change in fair value of contingent

consideration

112

227

203

2,084

Acquisition, restructuring and other

items, net (1)

31,850

3,369

41,122

11,992

Goodwill impairment (2)

159,476

—

159,476

—

Tax effect of non-GAAP items (3)

(10,101

)

1,432

(1,841

)

3,627

Adjusted pro forma net loss

$

(6,526

)

$

(5,395

)

$

(16,076

)

$

(17,490

)

Reconciliation of Pro Forma Diluted

Loss Per Share to Pro Forma Adjusted Diluted Loss Per

Share:

Pro Forma

Pro Forma

Three Months Ended

Nine Months Ended

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

(unaudited)

(unaudited)

Pro forma diluted loss per share

$

(4.73

)

$

(0.35

)

$

(5.56

)

$

(1.15

)

Amortization of intangibles

0.07

0.08

0.20

0.25

Change in fair value of contingent

consideration

—

0.01

0.01

0.05

Acquisition, restructuring and other

items, net (1)

0.79

0.08

1.02

0.32

Goodwill impairment (2)

3.96

—

3.98

—

Gain on sale of assets

—

—

—

—

Tax effect of non-GAAP items (3)

(0.25

)

0.04

(0.05

)

0.09

Adjusted pro forma diluted loss per

share

$

(0.16

)

$

(0.14

)

$

(0.40

)

$

(0.44

)

Adjusted diluted sharecount (4)

40,234

39,509

40,098

39,436

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

(2) The total value of the goodwill

impairment is preliminary, is undergoing further evaluation and

will be adjusted, if necessary, prior to the filing of the

Company’s quarterly report on Form 10-Q.

(3) Adjustment to reflect the income tax

provision on a non-GAAP basis has been calculated assuming no

valuation allowance on the Company's U.S. deferred tax assets and

an effective tax rate of 23% for the periods ended February 29,

2024 and February 28, 2023.

(4) Diluted shares may differ for non-GAAP

measures as compared to GAAP due to a GAAP loss.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION (Continued)

(in thousands, except per share

data)

Reconciliation of Pro Forma Net Loss to Pro Forma

Adjusted EBITDA:

Pro Forma

Pro Forma

Three Months Ended

Nine Months Ended

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

(unaudited)

(unaudited)

Pro forma net loss

$

(190,507

)

$

(13,714

)

$

(222,939

)

$

(45,234

)

Income tax benefit

(12,050

)

(179

)

(6,643

)

(1,597

)

Interest expense, net

(394

)

736

(1,047

)

1,801

Depreciation and amortization

6,861

6,288

18,234

18,680

Goodwill impairment (1)

159,476

—

159,476

—

Change in fair value of contingent

consideration

112

227

203

2,084

Stock based compensation

2,141

1,728

8,000

7,924

Acquisition, restructuring and other

items, net (2)

30,714

3,369

39,986

11,992

Pro forma adjusted EBITDA

$

(3,647

)

$

(1,545

)

$

(4,730

)

$

(4,350

)

Per diluted share:

Adjusted EBITDA

$

(0.09

)

$

(0.04

)

$

(0.12

)

$

(0.11

)

(1) The total value of the goodwill

impairment is preliminary, is undergoing further evaluation and

will be adjusted, if necessary, prior to the filing of the

Company’s quarterly report on Form 10-Q.

(2) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

ACQUISITION, RESTRUCTURING,

AND OTHER ITEMS, NET DETAIL

(in thousands)

Three Months Ended

Nine Months Ended

(in thousands)

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

Legal (1)

$

26,063

$

2,614

$

33,202

$

6,899

Mergers and acquisitions (2)

147

—

399

—

Plant closure (3)

5,426

—

6,115

—

Intangible and other asset impairment

(4)

6,260

—

6,260

—

Transition service agreement (5)

(333

)

—

(655

)

—

Manufacturing relocation (6)

—

324

587

1,062

Israeli Innovation Authority prepayment

(7)

—

—

—

3,544

Other (8)

553

431

1,608

504

Total

$

38,116

$

3,369

$

47,516

$

12,009

(1) Legal expenses related to litigation

that is outside the normal course of business. For the three and

nine months ended February 29, 2024, a $22.0 million settlement

expense was recorded as a result of the Settlement Agreement that

was entered into between the Company and BD.

(2) Mergers and acquisitions expense

related to legal and due diligence.

(3) Included in the $6.1 million in plant

closure for the nine months ended February 29, 2024 is $0.7 million

that was previously included in manufacturing relocation.

(4) An impairment of $3.4 million on

intangible assets and an inventory write-off of $2.9 million was

taken in the third quarter of fiscal year 2024 relating to the

abandonment of the Syntrax and RF product lines.

(5) Transition services agreements that

were entered into with Merit and Spectrum.

(6) Expenses to relocate certain

manufacturing lines out of Queensbury, NY.

(7) In the first quarter of fiscal year

2023, a $3.5 million payment was made to the Israeli Innovation

Authority to fully satisfy the obligation related to grant funds

that were provided to Eximo for development of the Auryon laser

prior to the acquisition in the second quarter of fiscal year

2020.

(8) Included in the $1.6 million in other

for the nine months ended February 29, 2024 is $0.9 million of

deferred financing fees that were written-off in conjunction with

the sale of the Dialysis and BioSentry businesses and concurrent

extinguishment of the debt.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

NET SALES BY PRODUCT CATEGORY

AND BY GEOGRAPHY

(in thousands)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma Adj. (2)

Pro Forma

As Reported (1)

Pro Forma Adj. (2)

Pro Forma

Actual

Pro Forma

Feb 29, 2024

Feb 29, 2024

Feb 29, 2024

Feb 28, 2023

Feb 28, 2023

Feb 28, 2023

% Growth

Currency Impact

Constant Currency Growth

% Growth

Currency Impact

Constant Currency Growth

(unaudited)

(unaudited)

Net Sales

Med Tech

$

25,844

$

(190

)

$

25,654

$

22,874

$

(91

)

$

22,783

13.0%

12.6%

Med Device

49,338

(9,021

)

40,317

57,838

(19,531

)

38,307

(14.7)%

5.2%

$

75,182

$

(9,211

)

$

65,971

$

80,712

$

(19,622

)

$

61,090

(6.9)%

0.0%

(6.9)%

8.0%

0.0%

8.0%

Net Sales

United States

$

62,342

$

(6,521

)

$

55,821

$

67,620

$

(14,932

)

$

52,688

(7.8)%

5.9%

International

12,840

(2,690

)

10,150

13,092

(4,690

)

8,402

(1.9)%

0.0%

(1.9)%

20.8%

$

75,182

$

(9,211

)

$

65,971

$

80,712

$

(19,622

)

$

61,090

(6.9)%

0.0%

(6.9)%

8.0%

0.0%

8.0%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses, the

sale of the PICCs and Midlines Businesses and the discontinuation

of the RadioFrequency Ablation and Syntrax products ("the

Businesses") for the three months ended February 29, 2024 and

February 28, 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

GROSS PROFIT BY PRODUCT

CATEGORY

(in thousands)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma Adj. (2)

Pro Forma

As Reported (1)

Pro Forma Adj. (2)

Pro Forma

Actual

Pro Forma

Feb 29, 2024

Feb 29, 2024

Feb 29, 2024

Feb 28, 2023

Feb 28, 2023

Feb 28, 2023

% Change

% Change

(unaudited)

(unaudited)

Med Tech

$

15,857

$

(83

)

$

15,774

$

14,774

$

(93

)

$

14,681

7.3

%

7.4

%

Gross profit % of sales

61.4

%

61.5

%

64.6

%

64.5

%

Med Device

$

20,004

$

(2,090

)

$

17,914

$

25,730

$

(7,433

)

$

18,297

(22.3

)%

(2.1

)%

Gross profit % of sales

40.5

%

44.4

%

44.5

%

47.7

%

Total

$

35,861

$

(2,173

)

$

33,688

$

40,504

$

(7,526

)

$

32,978

(11.5

)%

2.2

%

Gross profit % of sales

47.7

%

51.1

%

50.2

%

54.0

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses, the

sale of the PICCs and Midlines Businesses and the discontinuation

of the RadioFrequency Ablation and Syntrax products ("the

Businesses") for the three months ended February 29, 2024 and

February 28, 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

NET SALES BY PRODUCT CATEGORY

AND BY GEOGRAPHY

(in thousands)

Nine Months Ended

Nine Months Ended

Actual (1)

Pro Forma Adj. (2)

Pro Forma

As Reported (1)

Pro Forma Adj. (2)

Pro Forma

Actual

Pro Forma

Feb 29, 2024

Feb 29, 2024

Feb 29, 2024

Feb 28, 2023

Feb 28, 2023

Feb 28, 2023

% Growth

Currency Impact

Constant Currency Growth

% Growth

Currency Impact

Constant Currency Growth

(unaudited)

(unaudited)

Net Sales

Med Tech

$

77,068

$

(443

)

$

76,625

$

70,193

$

(302

)

$

69,891

9.8%

9.6%

Med Device

155,866

(32,893

)

122,973

177,485

(59,958

)

117,527

(12.2)%

4.6%

$

232,934

$

(33,336

)

$

199,598

$

247,678

$

(60,260

)

$

187,418

(6.0)%

0.0%

(6.0)%

6.5%

0.0%

6.5%

Net Sales

United States

$

190,743

$

(23,098

)

$

167,645

$

208,274

$

(46,496

)

$

161,778

(8.4)%

3.6%

International

42,191

(10,238

)

31,953

39,404

(13,764

)

25,640

7.1%

(0.2)%

6.9%

24.6%

$

232,934

$

(33,336

)

$

199,598

$

247,678

$

(60,260

)

$

187,418

(6.0)%

0.0%

(6.0)%

6.5%

0.0%

6.5%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses, the

sale of the PICCs and Midlines Businesses and the discontinuation

of the RadioFrequency Ablation and Syntrax products ("the

Businesses") for the nine months ended February 29, 2024 and

February 28, 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

GROSS PROFIT BY PRODUCT

CATEGORY

(in thousands)

Nine Months Ended

Nine Months Ended

Actual (1)

Pro Forma Adj. (2)

Pro Forma

As Reported (1)

Pro Forma Adj. (2)

Pro Forma

Actual

Pro Forma

Feb 29, 2024

Feb 29, 2024

Feb 29, 2024

Feb 28, 2023

Feb 28, 2023

Feb 28, 2023

% Change

% Change

(unaudited)

(unaudited)

Med Tech

$

48,400

$

(155

)

$

48,245

$

44,816

$

(163

)

$

44,653

8.0

%

8.2

%

Gross profit % of sales

62.8

%

63.0

%

63.8

%

63.9

%

Med Device

$

67,783

$

(9,060

)

$

58,723

$

83,071

$

(24,393

)

$

58,678

(18.4

)%

—

%

Gross profit % of sales

43.5

%

47.7

%

46.8

%

49.9

%

Total

$

116,183

$

(9,215

)

$

106,968

$

127,887

$

(24,556

)

$

103,331

(9.2

)%

3.5

%

Gross profit % of sales

49.9

%

53.6

%

51.6

%

55.1

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses, the

sale of the PICCs and Midlines Businesses and the discontinuation

of the RadioFrequency Ablation and Syntrax products ("the

Businesses") for the nine months ended February 29, 2024 and

February 28, 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands)

Feb 29, 2024

May 31, 2023

(unaudited)

(audited)

Assets

Current assets:

Cash and cash equivalents

$

78,451

$

44,620

Accounts receivable, net

49,475

52,826

Inventories

58,068

55,325

Prepaid expenses and other

10,913

4,617

Current assets held for sale

—

6,154

Total current assets

196,907

163,542

Property, plant and equipment, net

37,040

44,384

Other assets

8,045

10,676

Intangible assets, net

81,570

111,144

Goodwill

—

159,238

Non-current assets held for sale

—

43,653

Total assets

$

323,562

$

532,637

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

35,152

$

40,445

Accrued liabilities

30,963

26,617

Current portion of contingent

consideration

9,500

14,761

Other current liabilities

10,259

2,002

Total current liabilities

85,874

83,825

Long-term debt

—

49,818

Deferred income taxes

5,871

12,813

Contingent consideration

—

4,535

Other long-term liabilities

15,822

3,350

Total liabilities

107,567

154,341

Stockholders' equity

215,995

378,296

Total Liabilities and Stockholders'

Equity

$

323,562

$

532,637

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

Three Months Ended

Nine Months Ended

Feb 29, 2024

Feb 28, 2023

Feb 29, 2024

Feb 28, 2023

(unaudited)

(unaudited)

Cash flows from operating

activities:

Net loss

$

(190,439

)

$

(9,485

)

$

(173,603

)

$

(30,975

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

7,522

7,838

20,895

23,316

Non-cash lease expense

484

635

1,441

1,883

Stock based compensation

2,612

1,803

8,633

8,177

Gain on disposal of assets

(6,657

)

—

(54,499

)

—

Transaction costs for disposition

(2,657

)

—

(5,084

)

—

Change in fair value of contingent

consideration

112

227

203

2,084

Impairment loss on indefinite-lived

intangible assets (1)

159,476

—

159,476

—

Deferred income taxes

(12,140

)

(227

)

(7,189

)

(1,752

)

Change in accounts receivable

allowances

458

168

1,007

560

Fixed and intangible asset impairments and

disposals

6,845

57

7,084

144

Write-off of other assets

—

—

869

—

Other

299

(274

)

161

(317

)

Changes in operating assets and

liabilities:

Accounts receivable

1,668

1,778

2,345

759

Inventories

2,019

(423

)

(6,825

)

(12,254

)

Prepaid expenses and other

(2,587

)

3,539

(7,566

)

(392

)

Accounts payable, accrued and other

liabilities

20,459

(4,266

)

19,493

(7,109

)

Net cash provided by (used in)

operating activities

(12,526

)

1,370

(33,159

)

(15,876

)

Cash flows from investing

activities:

Additions to property, plant and

equipment

(607

)

(666

)

(1,952

)

(2,756

)

Additions to placement and evaluation

units

(1,239

)

(1,480

)

(3,245

)

(4,922

)

Cash paid in acquisition

(3,250

)

—

(3,250

)

(540

)

Proceeds from sale of assets

34,500

—

134,500

—

Net cash provided by (used in)

investing activities

29,404

(2,146

)

126,053

(8,218

)

Cash flows from financing

activities:

Repayment of long-term debt

—

—

(50,000

)

(45,000

)

Proceeds from borrowings on long-term

debt

—

—

—

70,000

Deferred financing costs on long-term

debt

—

—

—

(751

)

Payment of acquisition related contingent

consideration

—

—

(10,000

)

—

Proceeds from exercise of stock options

and employee stock purchase plan

694

941

752

1,171

Net cash provided by (used in)

financing activities

694

941

(59,248

)

25,420

Effect of exchange rate changes on cash

and cash equivalents

(17

)

89

185

(40

)

Increase in cash and cash

equivalents

17,555

254

33,831

1,286

Cash and cash equivalents at beginning of

period

60,896

29,857

44,620

28,825

Cash and cash equivalents at end of

period

$

78,451

$

30,111

$

78,451

$

30,111

(1) The total value of the goodwill

impairment is preliminary, is undergoing further evaluation and

will be adjusted, if necessary, prior to the filing of the

Company’s quarterly report on Form 10-Q.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240404578502/en/

Investors: AngioDynamics, Inc. Stephen Trowbridge, Executive

Vice President & CFO (518) 795-1408

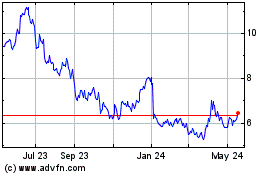

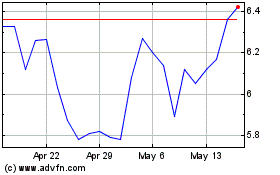

AngioDynamics (NASDAQ:ANGO)

Historical Stock Chart

From Sep 2024 to Oct 2024

AngioDynamics (NASDAQ:ANGO)

Historical Stock Chart

From Oct 2023 to Oct 2024