Amended Current Report Filing (8-k/a)

April 18 2023 - 3:49PM

Edgar (US Regulatory)

0001881741

true

--12-31

0001881741

2023-04-18

2023-04-18

0001881741

AOGO:UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember

2023-04-18

2023-04-18

0001881741

AOGO:ClassCommonStock0.0001ParValuePerShareMember

2023-04-18

2023-04-18

0001881741

AOGO:RedeemableWarrantsEachWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-04-18

2023-04-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

April 18, 2023

AROGO CAPITAL ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41179 |

|

87-1118179 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

848 Brickell Avenue, Penthouse 5,

Miami, FL 33131

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (786) 442-1482

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name

of Each Exchange on Which

Registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

AOGOU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, $0.0001 par value per share |

|

AOGO |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

AOGOW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

EXPLANATORY NOTE

This

Current Report on Form 8-K/A (the “Amended Form 8-K”) is being filed as an

amendment to the Current Report on Form 8-K filed by Arogo Capital Acquisition Corp. (the “Company”)

on March 28, 2023 (the “Original Form 8-K”). The sole purpose of this amendment

is to amend and replace in its entirety the sections under Item 2.03, Item 5.03, and Item 5.07

in the Original Form 8-K with the information set forth in this Amended Form 8-K. This Amended Form 8-K/A

does not otherwise change or update the disclosure set forth in the Original Form 8-K and does not otherwise

reflect events after the Original Form 8-K was filed.

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The Company will deposit

no later than March 29, 2023, the amount $191,666 (the “Extension Payment”) into the trust account of the Company

for its public stockholders, representing $0.0378 per public share, which enables the Company to further extend the period of time

it has to consummate its initial business combination by one month from March 29, 2023, to April 29, 2023, (the “April Extension”).

The April Extension is the first of up to nine monthly extensions permitted under the Certificate of Amendment to the Company’s

Amended and Restated Certificate of Incorporation (the “Charter Amendment”) filed with the Office of the Secretary

of State of Delaware following stockholder approval of the Extension at the Company’s Special Meeting of Stockholders discussed

in Items 5.03 and 5.07 of this report.

Item 5.03. Amendments

to Articles of Incorporation or Bylaws.

On March

24, 2023, Arogo Capital Acquisition Corp. (the “Company”) held a Special Meeting of Stockholders (the “Meeting”).

At the Meeting, the Company’s stockholders approved the Charter Amendment, which extends the date by which the Company must consummate

its initial Business Combination from March 29, 2023 to December 29, 2023, subject to the approval of the Board of Directors of the Company,

provided the sponsor or its designees deposit into the trust account an amount equal to $0.0378 per share for each public share or $191,666,

prior to the commencement of each extension period (the “Extension”). The Company filed the Charter Amendment

with the Office of the Secretary of State of Delaware on March 28, 2023, a copy of which is attached as Exhibit 3.1 to this report and

is incorporated by reference herein.

The

Company also made an amendment to the Company’s investment management trust agreement (the “Trust Agreement”),

dated as of December 23, 2021, by and between the Company and Continental Stock Transfer & Trust Company, allowing the Company to

extend the business combination period from March 29, 2023 to December 29, 2023, and updating certain defined terms in the Trust Agreement

(the “First Amendment to the Trust Agreement”), a form of which is attached as Exhibit 3.2 to this report and

is incorporated by reference herein.

Item 5.07. Submission

of Matters to a Vote of Security Holders.

At

the Meeting, the Company’s stockholders approved the Charter Amendment extending the date by which the Company must consummate the

initial Business Combination from March 29, 2023 to December 29, 2023, (or such earlier date as determined by the Company’s Board

of Directors) (the “Extension Amendment Proposal”).

The

final voting results for the Extension Amendment Proposal were as follows:

| For | | |

Against | | |

Abstain | |

| | 9,989,610 | | |

| 0 | | |

| 0 | |

Also

at the Meeting, the Company’s stockholders approved the proposal to amend the Company’s Trust Agreement, allowing the Company

to extend the business combination period from March 29, 2023 to December 29, 2023, and updating certain defined terms in the Trust Agreement

(the “ Trust Agreement Proposal”).

The

final voting results for the Trust Agreement Proposal were as follows:

| For | | |

Against | | |

Abstain | |

| | 9,989,610 | | |

| 0 | | |

| 0 | |

Stockholders

holding 5,289,280 shares of common stock exercised their right to redeem their shares for cash at an approximate price of $10.33 per share

of the funds in the Trust Account. As a result, approximately $54,675,740 will be removed from the Trust Account to pay such holders.

Following

the redemption, the Company’s remaining shares of Class A common stock outstanding were 5,060,720. The Company must deposit into

the Trust Account $191,666 for the initial extension period (commencing March 29, 2023 and ending April 29, 2023).

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

* Filed Previously

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

AROGO CAPITAL ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Suradech Taweesaengsakulthai |

| |

|

Name: |

Suradech Taweesaengsakulthai |

| |

|

Title: |

Chief Executive Officer |

Dated: April 18, 2023

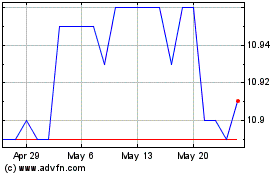

Arogo Capital Acquisition (NASDAQ:AOGO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arogo Capital Acquisition (NASDAQ:AOGO)

Historical Stock Chart

From Jan 2024 to Jan 2025