UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment

No. 5)

ARQIT QUANTUM

INC.

(Name of Issuer)

ORDINARY SHARES

(Title of Class of Securities)

G0567U127

(CUSIP Number)

D2BW Limited

c/o Arqit Limited

3 Orchard Place

London SW1H 0BF, United Kingdom

+44 203 91 70155

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 30, 2024

(Date of Event which Requires Filing of this

Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

| CUSIP No. G0567U127 |

| 1. |

Name of Reporting Person |

| |

I.R.S. Identification Nos. of above persons (entities only) |

| |

D2BW Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) ¨ |

| |

(b) ¨ |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

OO, BK |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

United Kingdom |

| Number of |

7. |

Sole Voting Power |

| Shares |

|

0 |

| Beneficially |

8. |

Shared Voting Power |

| Owned by |

|

831,823(1) |

| Each |

9. |

Sole Dispositive Power |

| Reporting |

|

0 |

| Person With |

10. |

Shared Dispositive Power |

| |

|

831,823(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person |

| |

831,823(1) |

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11) |

| |

7.2%(2) |

| 14. |

Type of Reporting Person (See Instructions) |

| |

OO |

(1) Share amounts have been adjusted to reflect

the impact of a 25:1 reverse share split of the Issuer’s Ordinary Shares that became effective on September 25, 2024.

(2) Based upon 11,545,354 Ordinary Shares issued

and outstanding as of September 30, 2024.

| CUSIP No. G0567U127 |

| 1. |

Name of Reporting Person |

| |

David Williams |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) ¨ |

| |

(b) ¨ |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

OO, BK |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

United Kingdom |

| Number of |

7. |

Sole Voting Power |

| Shares |

|

3,098(1) |

| Beneficially |

8. |

Shared Voting Power |

| Owned by |

|

1,304,168(1)(2) |

| Each |

9. |

Sole Dispositive Power |

| Reporting |

|

3,098(1) |

| Person With |

10. |

Shared Dispositive Power |

| |

|

871,823(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person |

| |

1,307,266(1)(2) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11) |

| |

11.3%(3) |

| 14. |

Type of Reporting Person (See Instructions) |

| |

IN |

(1) Share amounts have been adjusted to reflect

the impact of a 25:1 reverse share split of the Issuer’s Ordinary Shares that became effective on September 25, 2024.

(2) Includes 432,345 shares over which David Williams

holds an irrevocable proxy that entitles him to vote the shares. See Item 4.

(3) Based upon 11,545,354 Ordinary Shares issued

and outstanding as of September 30, 2024.

| CUSIP No. G0567U127 |

| 1. |

Name of Reporting Person |

| |

David Bestwick |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) ¨ |

| |

(b) ¨ |

| 3. |

SEC Use Only |

| 4. |

Source of Funds (See Instructions)

OO, BK |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or Place of Organization

United Kingdom |

| Number of |

7. |

Sole Voting Power |

| Shares |

|

242,989(1) |

| Beneficially |

8. |

Shared Voting Power |

| Owned by |

|

871,823(1) |

| Each |

9. |

Sole Dispositive Power |

| Reporting |

|

242,989(1) |

| Person With |

10. |

Shared Dispositive Power |

| |

|

871,823(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person |

| |

1,114,812(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13. |

Percent of Class Represented by Amount in Row (11) |

| |

9.7%(2) |

| 14. |

Type of Reporting Person (See Instructions) |

| |

IN |

(1) Share amounts have been adjusted to reflect

the impact of a 25:1 reverse share split of the Issuer’s Ordinary Shares that became effective on September 25, 2024.

(2) Based upon 11,545,354 Ordinary Shares issued

and outstanding as of September 30, 2024.

Explanatory Note

This Amendment No. 5 (this

“Amendment”) amends and supplements the statement on Schedule 13D filed with the Securities and Exchange Commission on September

17, 2021, as amended on October 12, 2021, February 3, 2023, April 14, 2024, and September 16, 2024 (the “Filing”), by D2BW

Limited, David Williams and David Bestwick (collectively, the “Reporting Persons”) with respect to the ordinary shares, par

value $0.000004 per share (“Ordinary Shares”) of Arqit Quantum Inc., an exempted limited liability company organized under

the laws of the Cayman Islands (the “Issuer”). Information reported in the Filing remains in effect except to the extent

that it is amended, restated or superseded by information contained in this Amendment. Capitalized terms used but not defined in this

Amendment have the respective meanings set forth in the Filing.

On September 25, 2024, the

Issuer effected a 25:1 reverse share split (the “Reverse Share Split”), pursuant to which the authorized share capital of

the Issuer was consolidated as follows: from $50,000 divided into 469,000,001 Ordinary Shares of a par value of $0.0001 each and 30,999,999

preference shares of a par value of $0.0001 each, to $50,000 divided into 18,760,000 Ordinary Shares of a par value of $0.000004 each

and 1,240,000 preference shares of a par value of $0.000004 each. Unless otherwise noted, all amounts of Ordinary Shares reported by the

Reporting Persons in this Amendment reflect the Reverse Share Split.

This Amendment is made to

report certain transfers by Mr. Williams of Ordinary Shares and amend Item 2 of the Schedule 13D.

The

information set forth below updates the Filing and a response to each separate Item below shall be deemed to be a response to all Items

where such information is relevant. Information with respect to each Reporting Person is given solely by such Reporting Person and no

Reporting Person assumes responsibility for the accuracy or completeness of the information furnished by another Reporting Person, except

as otherwise provided in Rule 13d-1(k).

ITEM 2. IDENTITY AND

BACKGROUND

Item 2 of the Schedule

13D is hereby amended and restated in its entirety as follows:

D2BW Limited is a private

company limited by shares organized under the laws of England & Wales, and owned by Mr. Williams and Mr. Bestwick, with its principal

business office address at 11 Bresseden Place, London SW1E 5BY, United Kingdom. The principal business of D2BW Limited

is purchasing, holding and selling securities for investment purposes. The

directors of D2BW Limited are Mr. Williams and Mr. Bestwick.

Mr. Williams and Mr. Bestwick

are citizens of the United Kingdom, who have their principal business office address at 11 Bresseden Place, London SW1E 5BY, United Kingdom. Mr. Bestwick is a consultant to the Issuer.

During the last five years,

none of the Reporting Persons has been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or

(ii) a party to any civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of which such person

was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws, or finding any violation with respect to such laws.

ITEM 4. PURPOSE OF

TRANSACTION

Item 4 of the Schedule

13D is hereby amended and supplemented as follows:

Pursuant

to a settlement agreement entered into in connection with a divorce, on September 30, 2024, Mr. Williams transferred 432,335 Ordinary

Shares to his ex-wife. Pursuant to the settlement agreement, Mr. Williams’ ex-wife granted Mr. Williams a voting proxy over such

Ordinary Shares until the earlier of the completion of the sale of their former matrimonial home or December 31, 2024. Accordingly, Mr.

Williams retains shared beneficial ownership over such Ordinary Shares.

The

settlement agreement also limits the volume of sales of the Issuer’s Ordinary Shares that may be made by Mr. Williams and his ex-wife,

as follows: until midnight on December 31, 2024, such persons may not sell, respectively (i) on any given day such number of shares in

excess of 10% of the daily trading volume of the Ordinary Shares averaged over the preceding three months and (ii) in any event more than

100,000 Ordinary Shares in the aggregate; provided that such limitations will earlier lapse in the event that there is an extraordinary

shift in the value of the Ordinary Shares whereby the Ordinary Shares increase or decrease in value by more than 33% in a two-day period

or the price of the Ordinary Shares falls below $6.00 per share or rises above $20.00 per share.

Additionally,

on September 30, 2024, Mr. Williams transferred 51,065 Ordinary Shares to D2BW Limited, an entity owned and controlled by Mr. Williams

and Mr. Bestwick. After such transfer, the Reporting Persons have shared voting and dispositive control over such shares.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

Item 5 of the Schedule

13D is hereby amended and restated as follows:

(a) - (b) As

of the date hereof, each Reporting Person’s beneficial ownership is as follows (based upon 11,545,354 Ordinary Shares issued and

outstanding as of September 30, 2024):

| D2BW Limited |

|

Ordinary

Shares |

|

| (a) |

Amount beneficially owned: |

|

831,823 |

|

| (b) |

Percent of class: |

|

7.2 |

% |

| (c) |

Number of shares as to which the person has: |

|

|

|

| |

(i) |

Sole power to vote or to direct the vote |

|

0 |

|

| |

(ii) |

Shared power to vote or to direct the vote |

|

831,823 |

|

| |

(iii) |

Sole power to dispose or to direct the disposition of |

|

0 |

|

| |

(iv) |

Shared power to dispose or to direct the disposition of |

|

831,823 |

|

| David Williams (1)(2) |

|

Ordinary

Shares |

|

| (a) |

Amount beneficially owned: |

|

1,307,266 |

|

| (b) |

Percent of class: |

|

11.3 |

% |

| (c) |

Number of shares as to which the person has: |

|

|

|

| |

(i) |

Sole power to vote or to direct the vote |

|

3,098 |

|

| |

(ii) |

Shared power to vote or to direct the vote |

|

1,304,168 |

|

| |

(iii) |

Sole power to dispose or to direct the disposition of |

|

3,098 |

|

| |

(iv) |

Shared power to dispose or to direct the disposition of |

|

871,823 |

|

| David Bestwick (1)(3) |

|

Ordinary

Shares |

|

| (a) |

Amount beneficially owned: |

|

1,114,812 |

|

| (b) |

Percent of class: |

|

9.7 |

% |

| (c) |

Number of shares as to which the person has: |

|

|

|

| |

(i) |

Sole power to vote or to direct the vote |

|

242,989 |

|

| |

(ii) |

Shared power to vote or to direct the vote |

|

871,823 |

|

| |

(iii) |

Sole power to dispose or to direct the disposition of |

|

242,989 |

|

| |

(iv) |

Shared power to dispose or to direct the disposition of |

|

871,823 |

|

(1) Mr. Williams

and Mr. Bestwick collectively own all of the outstanding share capital of D2BW Limited, and hold voting power over 40,000 Ordinary

Shares owned by the Williams and Bestwick Foundation, and are therefore deemed beneficial owners of the Ordinary Shares of the Issuer

directly held by D2BW Limited and the Williams and Bestwick Foundation.

(2) In addition to the

831,823 Ordinary Shares of the Issuer owned by D2BW Limited and 40,000 Ordinary Shares owned by the Williams and Bestwick Foundation,

Mr. Williams has shared ownership over 432,345 shares over which he holds an irrevocable voting proxy, and has sole direct ownership

of an additional 3,098 Ordinary Shares of the Issuer, including shares that were issued upon the vesting of restricted share units that

were granted to Mr. Williams in connection with his services to the Issuer.

(3) In addition to the

831,823 Ordinary Shares of the Issuer owned by D2BW Limited and 40,000 Ordinary Shares owned by the Williams and Bestwick Foundation,

Mr. Bestwick directly owns an additional 242,989 Ordinary Shares of the Issuer, including shares that were issued upon the vesting

of restricted share units that were granted to Mr. Bestwick in connection with his services to the Issuer.

As a result of the voting

proxy discussed in Item 4, Mr. Williams and his ex-wife may be deemed to be a group for the purposes of Section 13(d)(3) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). Notwithstanding such voting proxy, the filing of this Amendment shall

not be construed as an admission that Mr. Williams is, for purposes of Section 13(d) or 13(g) of the Exchange Act, or for any other purpose,

the beneficial owner of any securities directly held by his ex-wife. Mr. Williams assumes no responsibility for any information contained

in any filing made pursuant to Section 13 of the Exchange Act by his ex-wife and expressly disclaims beneficial ownership of any securities

owned or acquired by his ex-wife.

Each Reporting Person disclaims

beneficial ownership in the Ordinary Shares reported on this Schedule 13D except to the extent of the Reporting Person’s respective

pecuniary interest therein. The filing of this Amendment shall not be construed as an admission that a Reporting Person beneficially owns

those shares held by any other Reporting Person.

(c) Except as set

forth in Item 3, within the last 60 days, no reportable transactions were effected by any Reporting Person.

(d) No persons

other than the Reporting Persons has the right to receive or the power to direct the receipt of dividends from the disposition of the

Ordinary Shares to which this Schedule 13D relates.

(e) Not applicable.

ITEM 6. CONTRACTS,

ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

Item 6 of the Schedule

13D is hereby amended and supplemented as follows:

To the extent applicable,

the information in Items 3 and 4 is incorporated by reference herein.

SIGNATURES

After reasonable inquiry and

to the best of my knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and

correct.

Dated: October 2, 2024

| |

D2BW Limited |

| |

|

| |

By:

/s/ David Williams |

| |

Name: David Williams |

| |

Title: Director |

| |

|

| |

DAVID WILLIAMS |

| |

|

| |

/s/ David Williams |

| |

|

| |

DAVID BESTWICK |

| |

|

| |

/s/ David Bestwick |

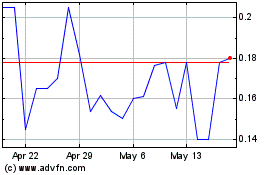

Arqit Quantum (NASDAQ:ARQQW)

Historical Stock Chart

From Jan 2025 to Feb 2025

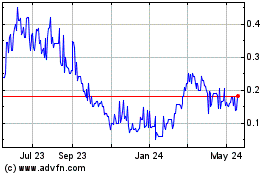

Arqit Quantum (NASDAQ:ARQQW)

Historical Stock Chart

From Feb 2024 to Feb 2025