Arqit Quantum Inc. (Nasdaq: ARQQ, ARQQW) (“Arqit” or the

“Company”), a leader in quantum safe encryption, today announced

its operational and financial results for the fiscal year ended 30

September 2024.

Operational Highlights for fiscal year

2024

- Arqit reported revenue of $293,000

for the fiscal year. The company executed on contracts during the

period for 13 customers. Most contracts were limited licenses for

demonstration and integration testing of Arqit’s symmetric key

agreement software. Arqit saw an increase in the number of

customers executing such contracts through the period. The company

believes this is a positive indicator of product momentum.

- As previously announced, Arqit was

awarded a multi-year enterprise license contract in the EMEA region

for a government end user that is expected to result in seven

figures in annual recurring revenue in total. Prior to the end of

the 2024 fiscal year, the contract was finalized. Revenue

generation is expected to commence in the current fiscal

period.

- Previously, Sparkle, a top global

telecommunications service operator, announced it completed

demonstrations of a fully automated implementation of an

on-demand MEF Internet Access Service secured by

post-quantum cryptography It is the second Network-as-a-Service

(“Naas”) quantum safe internet use case completed by Sparkle. Its

first use case was an Arqit secured international VPN between Italy

and Germany. Sparkle’s stated roll out this year of its quantum

safe NaaS offerings continues apace supported by Arqit. Take up of

Sparkle’s NaaS offerings by end customers requires licenses for

Arqit’s SKA software which would result in revenue to Arqit.

- The company engaged in

demonstration and integration activity with eight telecom network

operators during the period. Engagements increased from three in

the first half of the fiscal year to an additional five in the

second half.

- Arqit joined Intel Partner Alliance

working in cooperation to develop and execute go-to-market activity

targeting muti-vertical customers across the Telco, Enterprise and

Government customer landscape.

- In September, Arqit was named a

2024 International Data Corp (IDC) Innovator for post quantum

cryptography. The company is one of only five vendors recognized by

IDC that are providing transformative solutions which enterprises

can use to protect classical data and infrastructure with a long

shelf value from the risk of a potential quantum cyberattack.

- On 27 September 2024,

Arqit announced Andy Leaver, a seasoned software company

executive and Operating Partner from Notion Capital, has been

appointed as Chief Executive Officer. Mr. Leaver brings a wealth of

experience to the Chief Executive role having held senior executive

roles at leading software companies including: Ariba, Bazaarvoice,

Hortonworks, SuccessFactors and Workday as well as having been an

adviser to several successful private software scale ups. He has

expertise in driving sustainable revenue growth and scaling

businesses. Notion Capital is a leading European venture capital

firm and early backer of Arqit. Mr. Leaver will act independently

of Notion Capital in his role as CEO.

- Nicola Barbiero was appointed as a

Class I Director on 26 November 2024. Mr. Barbiero has nearly two

decades of experience in investment management and financial

operations. He has been Investment Director of the Heritage Group

since 2020. From 2013 to 2020, he held the positions of CFO and CIO

at Solidarietà Veneto, one of Italy’s largest pension plan

companies. Mr. Barbiero holds a Master’s degree in Economics and

Finance from Ca’ Foscari University of Venice.

- The company previously announced

cost reduction initiatives. Operating costs for the last three

months of fiscal year 2024 averaged $2.3 million per month. Pro

forma for additional operating cost saving which have or will be

actioned shortly, budgeted average monthly operating costs for

fiscal year 2025 are expected to be approximately $2.15

million.

- On 30 September 2024, Arqit entered

into a securities purchase agreement pursuant to which it sold

5,440,000 ordinary shares (on a post reverse share split basis) at

an offering price of $2.50 per share in a registered direct

offering. Gross proceeds to the company were approximately $13.6

million. In a concurrent private placement, Arqit issued

unregistered warrants to purchase up to 5,440,000 shares (on a post

reverse share split basis) with an exercise price of $2.50,

exercisable upon the later of (i) one year from the issuance date,

(ii) the date of the approval by the Arqit’s shareholders of an

increase in authorized capital sufficient to permit the issuance of

shares upon the exercise of the warrants and (iii) the date that

the closing trading price of Arqit’s ordinary shares has exceeded

$5.00 for 60 consecutive trading days. The purchasers were Heritage

Assets SCSP (Arqit director Manfredi Lefebvre d’Ovidio has shared

investment and voting power over the shares held by Heritage Assets

SCSP), existing Arqit shareholder Notion Capital, the beneficial

owner of the Arqit shares held by Ropemaker Nominees Limited, and

Carlo Calabria and Garth Ritchie, each a director of the

Company.

- As of 30 September 2024, Arqit had

$18.7 million of cash and cash equivalents.

- On 25 September 2024, Arqit

effected a 25:1 reverse share split consolidating its authorized

share capital. The Company effected the reverse share split

in an effort to regain compliance with Nasdaq’s minimum $1.00 bid

price per share requirement. The Company was first notified by

Nasdaq of its failure to maintain a minimum bid price of $1.00 per

share for 30 consecutive trading days under Nasdaq Listing Rule

5550(a)(2) on 19 October 2023. Arqit was notified on 18 October

2024 by Nasdaq that it had regained compliance with Nasdaq’s

listing standards. The Company previously disclosed that the par

value of its ordinary shares following the reverse share split was

$0.000004, however the par value of the Company’s ordinary shares

following the reverse share split is $0.0025.

- In December 2022, Arqit established

an at-the-market equity offering program (the “ATM Program”)

pursuant to which it may issue and sell ordinary shares with an

aggregate offering amount of up to $50.0 million. Effective 15

April 2024, Arqit amended its ATM Program reducing the aggregate

offering amount to $29.0 million. Effective 8 September 2024, Arqit

amended its ATM Program further reducing its offering amount to

$16.0 million. As a result, the remaining balance available for

issuance, net of amounts issued in previous periods, is $4.1

million. Arqit issued 48,803 shares (on a post reverse split basis)

under the ATM Program during fiscal year 2024.

Management Commentary

Fiscal year 2024 was marked by progress across a

number important vectors for the company. From market appreciation

of the need for enhanced encryption to protect against the threats

of today and tomorrow, to important new OEM and network operator

relationships.

Arqit was early in understanding the weaknesses

of today’s legacy public key cryptography architecture and the need

for enhanced encryption, specifically symmetric key agreement

solutions, to combat the pending threat posed by quantum computing

to cyber security. Important governmental and national security

organizations, including the U.S. White House and the National

Security Agency (May 2022), have emphasized the imperative to

upgrade security of critical governmental and enterprise cyber

infrastructure with a bias toward symmetric key agreement

solutions.

2024 has been a year of increasing market

awareness of the need to enhanced cryptography. In October, Gartner

named post quantum cryptography as one of the most important

technology trends for 2025 which represents “a strategic imperative

that requires thoughtful consideration and decisive action.”

International Data Corp (IDC) echoed this theme in its recent IDC

Innovators - Post Quantum Cryptography report. IDC named Arqit one

of the leading vendors addressing the need for enhanced

security.

Arqit has seen a tangible benefit from increased

market awareness. Winning the CTO Outstanding Technology Award for

secure 5G solution at the Mobile World Congress in February 2024

and The Cyber Defense Product of the Year award at the 2024

National Cyber Awards elevated Arqit’s profile as a leading

provider of next generation symmetric key agreement cryptography.

Direct inquiry from OEMs, network operators and government

organizations increased materially during the fiscal year. For the

period, Arqit executed or was engaged in demonstration and testing

initiatives with 13 organizations or enterprises.

As a result, Arqit is moving into a revenue

growth and customer fulfillment phase of its development. Through

its EMEA distribution partner Arqit executed a seven figure,

multi-year annual recurring revenue contract for a significant

governmental end customer. The company believes that additional

governmental and enterprise customer opportunities will result

in-country as result of this marquis end customer engagement.

The rapid development of Arqit’s relationship

with Sparkle reflects a recognition of the cyber threats facing

network operators and their customers. Arqit is working closely

with Sparkle at pace in support of its rollout across its

international fiber network. Other network operators are similarly

cognizant of the threats and, as a result, Arqit has or is engaged

with eight telecom network operators regarding the Arqit

SKA-PlatformTM solution.

In short, the end market is moving toward the

company. Recognition of the need for enhanced cryptography and the

efficacy of Arqit’s symmetric key solution has increased during the

fiscal year. Arqit is beginning to see the benefit in contract wins

and annual recurring revenue backlog. The company enters fiscal

year 2025 with positive momentum.

Internally the company is focusing its resources

and efforts to match the current moment:

- Focusing on the

biggest and most actionable opportunities which reside in telecom,

government and defense

- Executive

changes to meet the phase of development

- Internal

resources and processes refined to meet customer fulfillment

- Reducing costs

to strength operating position

- Increasing its

capital position to close its business case

Commenting, Andy Leaver, Arqit Chief Executive

Officer said: “I am pleased to join Arqit at this important moment

in its development. The company’s symmetric key agreement software

is proven and we are beginning to see market take-up as evidenced

by the important announced contract wins and developing

relationship with network operators. We enter fiscal 2025 on firm

footing.

The focus for this fiscal year is on seamless

execution of executed contracts and closing additional

opportunities with existing customers as well as converting

demonstration and testing engagements into fulsome contractual

relationships.

Arqit has taken the necessary operational steps

to capitalize on the market moving in our direction and our proven

solution to meet the market’s need for stronger encryption. Focus

and execution are the operative words for the fiscal year

2025.”

Fiscal Year 2024 Financial

Highlights

The following is a summary of Arqit’s operating

results for the twelve month period ended 30 September 2024.

Comparison is made, where applicable, to the comparable period

ended 30 September 2023.

- Generated

$293,000 in revenue for fiscal year 2024 as compared to $640,000 in

revenue for the comparable period in 2023. The decrease was due to

no significant perpetual enterprise licenses sold in fiscal year

2024. In fiscal year 2023, the company sold two such licenses with

high upfront revenue which represented a significant portion of

revenue during that period. Arqit has intentionally moved from

perpetual licenses toward operational licenses with prospective

annual recurring revenue. The transition results in lower upfront

revenue associated with a perpetual license. While generating lower

upfront revenue, operational licenses are expected to result in

growing annual recurring revenue as consumption of our symmetric

key agreement software increases.

- Arqit

SKA-Platform™ contract revenue totaled $293,000 of which $102,000

was professional services in support of contract activity. Most

contracts were limited licenses for demonstration and integration

testing of Arqit’s symmetric key agreement software.

- Arqit

SKA-Platform™ revenue for fiscal year 2024 was generated from

contracts with 13 customers.

- Six contracts

represented a license for Arqit SKA-PlatformTM as a Service

- Four contracts

represented licenses for Arqit NetworkSecure™

- Three contracts

were for professional services

- Arqit

SKA-Platform™ revenue for fiscal year 2023 was $640,000 from seven

contracts, the bulk of which was from two perpetual licenses.

- Administrative

expenses1 for the period were $23.5 million versus $55.2 million

for fiscal year 2023. Lower share based compensation, employee

expenses and legal and professional fees were the largest drivers

of the variance between periods. Arqit’s headcount as of fiscal

year end was 82 as compared to 147 as of fiscal year end 2023.

Administrative expense for the period includes a negative $1.6

million non-cash charge for share based compensation versus a $14.1

million charge for the comparable period in 2023.

- Operating loss

for the period was $24.6 million versus a loss of $54.5 million for

fiscal year 2023. The variance in operating loss between periods

primarily reflects lower administrative expenses for fiscal year

2024.

- Loss before tax

from continuing operations for the period was $23.9 million.

Adjusted loss before tax for the period was $23.9 million2 which in

management’s view reflects the underlying business performance once

the non-cash change in warrant value is deducted from loss before

tax. For fiscal year 2023, loss before tax from continuing

operations was $44.1 million and adjusted loss before tax was $54.7

million. The variance between periods is primarily due to lower

administrative expenses, impairment losses on trade receivables,

impairment losses on intangible assets and the change in fair value

of warrants.

- During the

fiscal year 2024, Arqit determined that its satellite assets were

no longer considered as “held for sale”. As a result, the satellite

assets have been fully impaired, and an impairment loss was

recognized as part of “loss from discontinued operations, net of

tax”.

- Arqit ended

fiscal year 2024 with cash and cash equivalents of $18.7 million

versus a cash balance of $44.5 million as of Arqit’s 2023 fiscal

year end.

- During the

period 180,106 restricted share units were granted under Arqit’s

equity incentive plan. A total of 87,319 restricted share units and

25,306 options were granted to employees, officers and directors

under the plan were outstanding at 30 September 2024.

______________________1 Administrative expenses

are equivalent to operating expenses.2 Adjusted loss before tax is

a non-IFRS measure. For a discussion of this measure, how its

calculated and a reconciliation to the most comparable measure

calculated in accordance with IFRS, please see “Use of Non-IFRS

Financial Measures” below.

Conference Call

Arqit will host a conference call at 11:00 a.m.

ET / 8:00 a.m. PT on December 5, 2024 with the Company’s CEO, Andy

Leaver, and CFO, Nick Pointon. A live webcast of the call will be

available on the “News & Events” page of the Company’s website

at ir.arqit.uk. To access the call by phone, please go to this link

(registration link) and you will be provided with dial in details.

To avoid delays, we encourage participants to dial into the

conference call fifteen minutes ahead of the scheduled start time.

A replay of the webcast will also be available for a limited time

at ir.arqit.uk.

About Arqit

Arqit Quantum Inc. (Nasdaq: ARQQ, ARQQW) (Arqit)

supplies a unique encryption software service which makes the

communications links of any networked device, cloud machine or data

at rest secure against both current and future forms of attack on

encryption – even from a quantum computer. Compatible with NSA CSfC

Components and meeting the demands of NSA CSfC Symmetric Key

Management Requirements Annexe 1.2. and RFC 8784, Arqit’s Symmetric

Key Agreement Platform uses a lightweight software agent that

allows end point devices to create encryption keys locally in

partnership with any number of other devices. The keys are

computationally secure and facilitate Zero Trust Network Access. It

can create limitless volumes of keys with any group size and

refresh rate and can regulate the secure entrance and exit of a

device in a group. The agent is lightweight and will thus run on

the smallest of end point devices. The product sits within a

growing portfolio of granted patents. It also works in a standards

compliant manner which does not oblige customers to make a

disruptive rip and replace of their technology. Arqit is winner of

two GSMA Global Mobile Awards, The Best Mobile Security Solution

and The CTO Choice Award for Outstanding Mobile Technology, at

Mobile World Congress 2024, recognised for groundbreaking

innovation at the 2023 Institution of Engineering and Technology

Awards and winner of the National Cyber Awards’ Innovation in Cyber

Award and the Cyber Security Awards’ Cyber Security Software

Company of the Year Award. Arqit is ISO 27001 Standard

certified. www.arqit.uk

Media relations enquiries:

Arqit: pr@arqit.uk

Investor relations

enquiries:

Arqit:

investorrelations@arqit.uk

Use of Non-IFRS Financial

Measures

Arqit presents adjusted loss before tax, which

is a financial measure not calculated in accordance with IFRS.

Although Arqit's management uses this measure as an aid in

monitoring Arqit's on-going financial performance, investors should

consider adjusted loss before tax in addition to, and not as a

substitute for, or superior to, financial performance measures

prepared in accordance with IFRS. Adjusted loss before tax is

defined as loss before tax excluding change in fair value of

warrants, which is non-cash. There are limitations associated with

the use of non-IFRS financial measures, including that such

measures may not be comparable to similarly titled measures used by

other companies due to potential differences among calculation

methodologies. There can be no assurance whether (i) items excluded

from the non-IFRS financial measures will occur in the future, or

(ii) there will be cash costs associated with items excluded from

the non-IFRS financial measures. Arqit compensates for these

limitations by using adjusted loss before tax as a supplement to

IFRS loss before tax and by providing the reconciliation for

adjusted loss before tax to IFRS loss before tax, as the most

comparable IFRS financial measure.

IFRS and Non-IFRS loss before

tax

Arqit presents its consolidated statement of

comprehensive income according to IFRS and in line with SEC

guidance. Consequently, the changes in warrant values are included

within that statement in arriving at loss before tax. The changes

in warrant values are non-cash. After this adjustment is made to

Arqit’s IFRS loss before tax of $23.9 million, Arqit’s non-IFRS

adjusted loss before tax is $23.9 million, as shown in the

reconciliation table below.

|

|

Year end 30Sept.

2024$’000 |

Year end 30Sept.

2023$’000 |

|

Loss)/profit before tax from continuing operations on an IFRS

basis |

$ |

(23,977 |

) |

$ |

(44,113 |

) |

|

Change in fair value of warrants |

$(6 |

) |

|

$(10,638 |

) |

|

Adjusted loss before tax |

$ |

(23,983 |

) |

$ |

(54,751 |

) |

The change in fair value of warrants arises as

IFRS requires our outstanding warrants to be carried at fair value

within liabilities with the change in value from one reporting date

to the next being reflected against profit or loss in the period.

It is non-cash and will cease when the warrants are exercised, are

redeemed, or expire.

Other Accounting

Information

As of 30 September 2024, we had $14.9 million of

total liabilities, of which none was related to our outstanding

warrants, which are classified as liabilities rather than equity

according to IFRS and SEC guidance, the warrant liability is

calculated as the fair value of the warrants as of 30 September

2024. We had total assets of $26.7 million including cash of

$18.7 million.

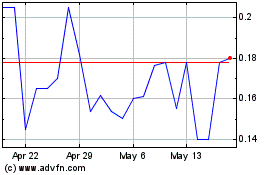

Arqit Quantum (NASDAQ:ARQQW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arqit Quantum (NASDAQ:ARQQW)

Historical Stock Chart

From Feb 2024 to Feb 2025