false

0000007623

0000007623

2024-10-01

2024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 1, 2024

ART’S-WAY MANUFACTURING CO., INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

(State or other jurisdiction of incorporation)

|

| |

|

|

|

000-05131

|

|

42-0920725

|

|

(Commission File Number)

|

|

(IRS Employer

|

| |

|

Identification No.)

|

|

5556 Highway 9

Armstrong, Iowa 50514

|

|

(Address of principal executive offices) (Zip Code)

|

| |

|

(712) 208-8467

|

|

(Registrant’s telephone number, including area code)

|

| |

|

Not Applicable

|

|

(Former name or former address, if changed since last report.)

|

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock $0.01 par value

|

ARTW

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On October 4, 2024, Art’s-Way Manufacturing Co., Inc. (the “Company”) issued a press release announcing its financial results for the three months and nine months ended August 31, 2024. The full text of the press release is set forth in Exhibit 99.1 attached hereto and is incorporated by reference in this Current Report on Form 8-K as if fully set forth herein.

The information contained in this Item 2.02, including Exhibit 99.1 attached hereto and incorporated herein, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Departure of Chief Executive Officer

On October 1, 2024, Art’s-Way Manufacturing Co., Inc. (the “Company”) and David A. King, the Company’s Chief Executive Officer since 2020, mutually agreed to terminate Mr. King’s employment agreement and employment with the Company effective immediately. In connection with such termination, Mr. King resigned as the Company’s Chief Executive Officer and from any other positions he held as an officer or director of the Company or its affiliates, and the Company and Mr. King entered into a Separation Agreement and General Release (the “Separation Agreement”).

Pursuant to the Separation Agreement, and subject to Mr. King not revoking the Separation Agreement within the applicable statutory revocation period, the Company agreed to provide Mr. King with severance pay equal to 12 weeks of salary at current levels, less applicable taxes and withholdings, in installments in accordance with the Company’s regular payroll schedule. In addition, if Mr. King timely elects continued health insurance under COBRA, the Company agreed to pay an amount equal to the monthly employer contribution that the Company would have made to provide health insurance to Mr. King if he had remained employed by the Company for the first three months of coverage following the separation date.

The Separation Agreement further provides for general release and non-disparagement provisions running in favor of the Company, and acknowledges that the confidentiality, non-competition and assignment of invention provisions of the Company’s March 2020 employment agreement with Mr. King will survive the termination of such agreement.

The full text of the Separation Agreement is set forth in Exhibit 1.01 attached hereto and is incorporated by reference in this Current Report on Form 8-K as if fully set forth herein.

Appointment of Chief Executive Officer

On October 4, 2024, the Company’s Board of Directors appointed Marc H. McConnell, Chairman of the Company’s Board of Directors, to serve as President and Chief Executive Officer, effective immediately. In this capacity, Mr. McConnell will serve as the Company’s principal executive officer. Mr. McConnell, age 45, has served as a director of the Company since 2001.

Mr. McConnell is currently the President of Bauer Corporation and McConnell Holdings, Inc. Mr. McConnell previously served as the Chairman of the Board, Chairman of the Audit Committee, Chairman of the Executive Committee of Integrated Financial Holdings, Inc., a financial holding company headquartered in Raleigh, North Carolina. Mr. McConnell had served as a director of Integrated Financial Holdings, Inc. and/or its subsidiary bank, West Town Bank & Trust, since 2009. Effective October 1, 2024, Mr. McConnell was appointed to the board of directors of Capital Bancorp, Inc. following the merger of Integrated Financial Holdings, Inc. with and into Capital Bancorp, Inc. Mr. McConnell will also serve on the board of directors of Capital Bank, N.A., which is a wholly owned subsidiary of Capital Bancorp, Inc. with its main office in Rockville, Maryland. Capital Bancorp, Inc. is a Nasdaq-listed company with a class of securities registered pursuant to Section 12 of the Exchange Act. From May 2019 until August 2024, Mr. McConnell served as a director of Dogwood State Bank, a North Carolina state-charted bank with its main office in Raleigh, North Carolina. Mr. McConnell has served as a director of the American Ladder Institute since 2004 and served as its President from 2006 to 2010. Mr. McConnell was also named a director of the Farm Equipment Manufacturers Association in October 2007, served as its President from 2013 to 2014 and served as its Treasurer from October 2015 to October 2016. Mr. McConnell was appointed to the Art’s Way Board in July 2001 and served as Vice Chairman of the Board from January 2008 to April 2015, at which time he became Art’s Way’s Chairman. He currently resides in Raleigh, North Carolina. Among other attributes, skills, and qualifications, the Board believes that Mr. McConnell’s involvement and experience in the farm equipment manufacturing industry, particularly in leadership positions with similarly situated companies, contribute to his ability to understand the challenges and opportunities facing the Company and to guide its long-term strategies.

McConnell Legacy Investments LLC is the Company’s largest shareholder, holding approximately 42% of the Company’s outstanding common stock. Mr. McConnell is the managing member of McConnell Legacy Investments LLC and has voting and dispositive control over the Company securities held by McConnell Legacy Investments LLC. McConnell Legacy Investments LLC is partially owned by a trust (the “Trust”) under the terms of the Estate of the former Vice Chairman of the Company’s Board of Directors, J. Ward McConnell. The Trust is providing a guarantee of approximately 38% of the balance of our $2,600,000 term loan from Bank Midwest, as required by the United States Department of Agriculture in connection with its guarantee of the same loan. In exchange, the Trust receives a fee of 2% of the guaranteed amount. For fiscal years 2022 and 2023, the fees paid to the Trust, as guarantor, were $16,849 and $16,111, respectively.

Pursuant to the Company's existing director compensation plan, Mr. McConnell currently receives annual compensation of $267,750 for his service as Chairman of the Board, paid in monthly installments. Also pursuant to the director compensation plan, Mr. McConnell receives common stock grants of 1,000 shares on the date of each annual meeting at which he is elected as a director and 1,000 shares of common stock on the last day of each fiscal quarter. The Company's Compensation Committee is in the process of independently reviewing Mr. McConnell’s compensation package in light of his appointment of President and Chief Executive Officer.

|

Item 9.01

|

Financial Statements and Exhibits.

|

| |

(a)

|

Financial statements: None

|

| |

(b)

|

Pro forma financial information: None

|

| |

(c)

|

Shell Company Transactions: None

|

| |

Exhibit Number

|

Description of Exhibit

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 4, 2024

| |

ART’S-WAY MANUFACTURING CO., INC.

/s/ Michael W. Woods

|

| |

Michael W. Woods

Chief Financial Officer

|

Exhibit 10.1

SEPARATION AGREEMENT AND GENERAL RELEASE

THIS SEPARATION AGREEMENT AND GENERAL RELEASE (this “Agreement”) is made by and between Art’s-Way Manufacturing Co., Inc., Inc., a Delaware corporation (the “Company”) and David A. King (“Employee”). Each of the Company and Employee may be referred to herein as a “Party,” or collectively as the “Parties.”

This Agreement sets forth the terms upon which Employee has agreed to fully and finally resolve any and all claims, demands, and/or causes of action Employee may have against the Company, and Company has agreed to provide special separation benefits for which Employee would not have been eligible but for Employee’s execution of this Agreement. For and in consideration of the mutual promises of the Parties contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Agreed-Upon Termination of Employment. Employee’s employment with the Company was terminated by the Parties’ mutual consent effective as of October 1, 2024 (the “Separation Date”). The Parties intend and agree that the termination of Employee’s employment is a termination by mutual written agreement as described in Section 3.1(a) of the Employment Agreement between Employee and the Company dated March 23, 2020 (the “Employment Agreement”). Employee acknowledges and agrees that contemporaneously with the Separation Date, he has resigned from any positions he holds as an officer or director of the Company or any of its affiliates.

2. Payments to Employee. Regardless of whether Employee executes this Agreement, the Company will pay Employee for all earned but unpaid compensation through the Separation Date, less all applicable taxes and withholdings, on the Company’s next regularly scheduled payday after the Separation Date. In addition, and also regardless of whether Employee executes this Agreement, the Company will reimburse Employee for outstanding business expenses in accordance with applicable Company policies, provided that Employee’s request for reimbursement and supporting documentation are delivered to the Company within 10 days after the Separation Date. Except as expressly provided in this Agreement, in the applicable terms of the Company’s employee benefit plans, or as required by applicable law, after the Separation Date Employee will receive no further compensation or benefits from the Company.

3. Separation Benefits. In exchange for Employee’s execution and non-revocation of this Agreement, the Company will provide Employee with the following payments and benefits (collectively referred to herein as the “Separation Benefits”):

(a) the Company will pay Employee an amount of severance pay equal to 12 weeks of Employee’s base salary at the rate in effect as of the Separation Date, such amount to be paid less all applicable taxes and withholdings in substantially equal installments in accordance with the Company’s regular payroll schedule beginning on the Company’s first regularly-scheduled payday occurring at least 10 business days after Employee executes and returns this Agreement; and

(b) if Employee timely elects continued health insurance coverage under COBRA, the Company will pay an amount equal to the monthly employer contribution that the Company would have made to provide health insurance to Employee if Employee had remained employed by the Company for the first three months of coverage following the Separation Date.

The Separation Benefits will be forfeited and not paid if Employee (i) has not returned this Agreement signed by Employee within 21 days following the Separation Date, (ii) fails to comply with Section 4 of this Agreement, or (iii) revokes this Agreement as provided in Section 19(g) below. Employee acknowledges and agrees that the Company has no prior legal obligation to furnish the Separation Benefits absent Employee’s entry into this Agreement, and that such benefits will only be provided in exchange for Employee’s entry into this Agreement.

4. Return of Company Property. Employee agrees that Employee will immediately return to the Company all Company documents, files, software, manuals, plans, work notes, or other business papers, and all copies of same, whether paper or electronic, which are in Employee’s possession or under Employee’s control. To the extent that Employee has electronic files or information in Employee’s possession or control that belong to the Company and/or contain confidential or proprietary information about the Company (specifically including but not limited to electronic files or information stored on personal computers, mobile devices, electronic media, or in cloud storage), Employee agrees that Employee will immediately (a) provide the Company with an electronic copy of all of such files or information (in an electronic format that is readily accessible by the Company), and (b) after doing so, permanently delete all such files and information, including all copies and derivatives thereof, from all non-Company-owned computers, mobile devices, electronic media, cloud storage, and other media, devices, and equipment, such that such files and information are permanently deleted and irretrievable. Employee further agrees that Employee will immediately return to Company all Company property, including any keys, credit cards, computers, mobile phones, electronic devices, and any other Company property, all in the same condition as when provide to Employee, reasonable wear and tear excepted. Upon request by the Company, Employee will certify in writing that all such materials have been returned to the Company. Employee will cooperate with the Company in transferring all logins, passwords, and other access information for accounts and systems previously used by Employee in connection with Employee’s employment. Employee will also immediately cease using any secure website, computer network, e-mail system, or phone system or voicemail service provided by the Company for the use of its employees.

5. Post-Employment Obligations. Employee acknowledges and agrees that following the Separation Date he remains bound by the surviving provisions of the Employment Agreement, including but not limited to the provisions of Articles 4-6 thereof (collectively, the “Continuing Obligations”).

6. Comprehensive Release and Waiver.

(a) Parties’ Intent. It is the intent of the Parties that the following comprehensive general release and waiver be construed to effectuate the broadest possible release and/or waiver of rights permitted under applicable law.

(b) General Release of Liability by Employee. Employee, on Employee’s own behalf and on behalf of Employee’s heirs, personal representatives, successors and assigns, hereby releases and forever discharges the Company, each of its parents, subsidiaries, and affiliates, and each and every one of their respective present and former shareholders, directors, officers, members, employees, agents, insurers, predecessors, successors and assigns (collectively, the “Released Parties”), of and from any and all claims, demands, actions, causes of action, damages, costs and expenses which Employee now has or may have by reason of anything occurring, done or omitted to be done as of or prior to the date Employee signs this Agreement including, but not limited to, (i) any and all claims related to Employee’s employment with the Company and the termination of same; (ii) any and all claims for additional compensation or benefits other than the compensation and benefits set forth in this Agreement, including but not limited to wages, commissions, equity awards, deferred compensation, bonuses, or other benefits of any kind; (iii) any and all claims relating to the employment practices or policies of the Company or its affiliates; (iv) any and all common law claims, including but not limited to wrongful discharge, breach of contract, negligent or intentional infliction of emotional distress, or negligent supervision or retention; and (v) any and all claims arising under any federal, state or local law, including, but not limited to, claims under the Employee Retirement Income Security Act, the Family and Medical Leave Act, the Fair Labor Standards Act, Title VII of the Civil Rights Act of 1964, as amended, the Civil Rights Act of 1991, the Age Discrimination in Employment Act, the Older Workers Benefit Protection Act, the Americans with Disabilities Act, the Genetic Information Nondiscrimination Act of 2008, the Uniformed Services Employment and Reemployment Rights Act, the Worker Adjustment and Retraining Notification (WARN) Act, the Families First Coronavirus Response Act, the Iowa Civil Rights Act of 1965, the Iowa Wage Payment Collection Law, and any other federal, state or local law or regulation prohibiting employment discrimination or otherwise governing the employment relationship between Employee and Company (the “Released Claims”), except that notwithstanding anything contained in this Section 6, Employee does not release the Released Parties from (i) any right to defense or indemnification Employee may have pursuant to the bylaws of the Company or any agreement between Employee and the Company, provided, however, that (A) the Company’s execution of this Agreement is not a concession, acknowledgment, or guarantee that Employee has any such rights to defense or indemnification, (B) this Agreement does not create any additional rights for Employee to defense or indemnification, and (C) the Company retains any defenses it may have to such defense or indemnification; (ii) any claim that may arise as a result of any act or omission occurring after Employee’s execution of this Agreement (including but not limited to a breach of this Agreement); (iii) any claims which cannot be released by private agreement as a matter of law.

(c) Non-Litigation Covenant of Employee. Employee, on Employee’s own behalf and on behalf of Employee’s heirs, personal representatives, successors and assigns, agrees and covenants that Employee will not sue or assert any claim against any of the Released Parties on any ground arising out of or related to any of the Released Claims.

(d) Applicability to Known and Unknown Claims. Employee acknowledges that this release applies both to known and unknown claims that may exist between Employee and the Released Parties. Employee expressly waives and relinquishes all rights and benefits which Employee may have under any state or federal statute or common law principle that would otherwise limit the effect of this Agreement to claims known or suspected prior to the date Employee executes this Agreement, and does so understanding and acknowledging the significance and consequences of such specific waiver. In addition, Employee hereby expressly understands and acknowledges that it is possible that unknown losses or claims exist or that present losses may have been underestimated in amount or severity, and Employee explicitly took that into account in giving this release.

7. Confidentiality of this Agreement. Except as described herein, Employee will not at any time, directly or indirectly, discuss with or disclose to anyone the financial terms of this Agreement, including the amounts payable hereunder, but Employee may disclose such financial terms to (a) members of Employee’s immediate family, (b) Employee’s attorneys and tax advisors, (c) the appropriate taxing authorities, or (d) as otherwise required by law or court order.

8. Non-Disparagement; Public Statements. Employee agrees that he will not make any communications, whether written, electronic, oral, or otherwise, to any other person or entity, including, but not limited to posting on social media, blogs, websites, or other internet-based communications media, which denigrate, defame, or otherwise cast aspersions upon the Company, its management, products, services, and/or manner of doing business. The Company agrees that it will instruct the members of its board of directors and its executive leadership not to make any communications, whether written, electronic, oral, or otherwise, to any other person or entity, including, but not limited to posting on social media, blogs, websites, or other internet-based communications media, which denigrate, defame, or otherwise cast aspersions upon Employee. In addition, the Company will present to Employee for review and discussion drafts of internal and external communications with respect to Employee’s separation from the Company. Nothing in this Agreement prohibits any person from providing truthful information and/or testimony in connection with any investigation or proceeding conducted by a governmental agency, or as otherwise required by law.

9. Cooperation.

(a) The Parties agree that certain matters in which the Employee has been involved during Employee’s employment may need the Employee's cooperation with the Company in the future. Accordingly, during the period over which severance is being paid pursuant to Section 3(a) above, Employee will make himself reasonably available to the Chairman of the Board to provide information and answer transitional or institutional questions that may arise after the Separation Date.

(b) Employee agrees that after the Separation Date he will reasonably cooperate with the Company and its officers, directors, employees, agents and legal counsel in connection with any claim, complaint, charge, suit or action previously or hereafter asserted or filed by or against the Company or any of the Released Parties (as defined below) which relates to, arises out of or is connected directly or indirectly with (i) Employee’s employment with the Company, (ii) any other relationship or dealings between Employee and the Company or any of the Released Parties, or (iii) any other matter relating to the Company or any of the Released Parties. Employee’s cooperation with the Company shall continue throughout the pendency of any such claim, complaint, charge, suit or action. The Company will use commercially reasonable efforts to schedule such cooperation at such times as are reasonably agreeable to Employee, taking into account Employee’s other commitments. Further, Employee agrees that, in the event that he is subject to a valid and enforceable subpoena or court order that compels his testimony at a trial, hearing or deposition concerning his relationship with the Company or any other matter relating to the Company or any of the Released Parties, he will promptly notify the Company in writing of such requirement. Employee expressly agrees that he will continue to cooperate with the Company in accordance with this Section after receiving said subpoena or court order. No part of this Agreement will abrogate Employee’s obligation to provide truthful testimony under oath or otherwise violate any legal duty.

(c) The Company will reimburse Employee for all reasonable out-of-pocket expenses incurred by Employee in performing his duties under this Section 9, including travel expenses, no later than 30 days after Employee submits reasonable documentation of such expenses.

10. Protected Rights. Nothing in this Agreement, including but not limited to the provisions of Sections 6, 7, 8, and 9, is intended to or will be construed to restrict Employee from exercising any legally-protected rights to the extent such rights cannot be waived by agreement or from complying with any applicable law. Without limiting the preceding sentence, nothing in this Agreement is intended or will be construed to:

(a) Prohibit Employee from providing truthful information and/or testimony in connection with any litigation, investigation, or other proceeding conducted any governmental agency, or from disclosing information to a government agency that Employee in good faith believe reflects a violation of applicable law;

(b) Prohibit Employee from filing a charge or complaint with, or cooperating in any investigation by, any government agency (including but not limited to the Equal Employment Opportunity Commission, the Iowa Civil Rights Commission, the Division of Labor of Iowa Workforce Development, or the National Labor Relations Board), to the extent permitted by law, but Employee expressly releases, waives, and disclaims any right to compensation, monetary damages, attorneys’ fees and/or costs related to or arising from any such charge, complaint or lawsuit filed by Employee or on Employee’s behalf, individually or collectively, involving any of the Released Parties;

(c) Prohibit Employee from discussing terms and conditions of employment or otherwise exercising protected rights under Section 7 of the National Labor Relations Act; or

(d) Prohibit Employee from receiving a bounty or similar award from the SEC in connection with whistleblower programs administered by the SEC.

11. Relief and Enforcement. Employee acknowledges and agrees that any breach of the provisions of the Continuing Obligations or Sections 7 or 8 of this Agreement would cause irreparable injury to the Company and that money damages would not provide an adequate remedy to the Company. In the event of a breach by Employee of the Continuing Obligations or Sections 7 or 8 of this Agreement, (a) the Company will be entitled to immediately cease payment of any remaining installments of the Separation Benefits, (b) Employee will immediately return to the Company the total amount of Separation Benefits previously made to Employee, less $1,000, which amount Employee may retain as consideration for the release of claims in Section 6 above, and (c) the Company shall be entitled to temporary, preliminary and permanent injunctive relief restraining Employee from further breaches of this Agreement or the Continuing Obligations. Nothing contained in this Section 11 prohibits the Company from pursuing any other equitable or legal remedies for any such breach or threatened breach, including recovery from Employee of any monetary damages that the Company may suffer by reason of any such breach or threatened breach.

12. Applicable Law. This Agreement will be governed and interpreted by the laws of the State of Iowa without giving effect to any choice or conflict of law principles of any jurisdiction.

13. Entire Agreement. This Agreement constitutes the entire agreement between the Parties with respect to the subject matter addressed herein and supersedes all other agreements or understandings (whether written or oral and whether express or implied) that may exist between the Parties with respect to such subject matter. Without limiting the foregoing, the Parties acknowledge and agree that this Agreement does not supersede or replace the surviving provisions of the Employment Agreement.

14. Successors and Assigns. This Agreement will be binding upon and inure to the benefit of the Parties and their respective successors, permitted assigns and, in the case of Employee, personal representatives. Employee may not assign, delegate or otherwise transfer any of Employee’s rights, interests or obligations in this Agreement without the prior written approval of the Company.

15. Amendments and Waivers. No amendment of any provision of this Agreement will be valid unless the amendment is in writing and signed by the Company and Employee. No waiver of any provision of this Agreement will be valid unless the waiver is in writing and signed by the waiving Party. The failure of a Party at any time to require performance of any provision of this Agreement will not affect such Party’s rights at a later time to enforce such provision. No waiver by a Party of any breach of this Agreement will be deemed to extend to any other breach hereunder or affect in any way any rights arising by virtue of any other breach.

16. Severability. Each provision of this Agreement is severable from every other provision of this Agreement. Any determination by a court of competent jurisdiction that a provision of this Agreement is invalid or unenforceable will not affect the validity or enforceability of any other provision hereof. Any provision of this Agreement held invalid or unenforceable only in part or degree will remain in full force and effect to the extent not held invalid or unenforceable.

17. Construction. The section headings in this Agreement are inserted for convenience only and are not intended to affect the interpretation of this Agreement. The word “including” in this Agreement means “including without limitation.” This Agreement will be construed as if drafted jointly by the Company and Employee and no presumption or burden of proof will arise favoring or disfavoring the Company or Employee by virtue of the authorship of any provision in this Agreement. All words in this Agreement will be construed to be of such gender or number as the circumstances require.

18. Counterparts; Electronic Delivery. This Agreement may be executed in one or more counterparts, each of which will be deemed an original but all of which together will constitute one instrument reflecting the terms of the Agreement. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signature complying with the U.S. ESIGN Act of 2000, e.g., DocuSign) or other transmission method and any counterpart so delivered will be deemed to have been duly and validly delivered and be valid and effective for all purposes.

19. Representations and Affirmations. In entering into this Agreement, Employee further represents and acknowledges that:

(a) Employee is voluntarily entering into and signing this Agreement;

(b) The claims waived, released and discharged in the above Section 6 include any and all claims Employee has or may have arising out of or related to Employee’s employment with the Company and the termination of that employment, including any and all claims under the Age Discrimination in Employment Act;

(c) Those claims waived, released and discharged in this Agreement do not include, and Employee is not waiving, releasing or discharging, any claims that may arise after the date Employee signs this Agreement;

(d) The payments conditioned upon Employee’s execution of this Agreement constitute consideration that Employee was not entitled to receive before the effective date of this Agreement;

(e) Employee was given at least 21 days within which to consider this Agreement;

(f) The Company has advised Employee of Employee’s right to consult with an attorney regarding this Agreement before executing the Agreement and encouraged Employee to exercise that right;

(g) Employee may revoke this Agreement at any time within seven days after the date Employee signs this Agreement, but to be effective, any revocation must be made in writing and received by the Company, addressed to the attention of Marc H. McConnell, Chairman of the Board, at the Company’s headquarters by hand delivery or delivery by a recognized overnight carrier (such as FedEx) within the seven day period;

(h) This document will not become effective or enforceable until the eighth day after the date Employee signs this Agreement (on which day this Agreement will automatically become effective and enforceable unless previously revoked within that seven-day period); and

(i) Employee acknowledges and agrees that Employee has no cause to believe that any violation of any local, state or federal law has occurred with respect to Employee’s employment or separation of employment from the Company, and that except as expressly provided in Sections 2 and 3 of this Agreement, Employee retains no rights to receive any additional compensation, payments, bonuses, equity awards, or benefits from Company in the capacity as an employee of the Company.

[Signature Page Immediately Follows]

EMPLOYEE HAS CAREFULLY READ THIS ENTIRE DOCUMENT, AND FULLY UNDERSTANDS EACH AND EVERY TERM.

IN WITNESS WHEREOF, the Company has caused this Agreement to be signed by its duly authorized officer, and Employee has hereunto set his hand and seal.

Dated: October 1, 2024

|

EMPLOYEE:

/s/David A. King

David A. King

|

COMPANY:

/s/Marc H. McConnell

Marc H. McConnell

Chairman of the Board

Art’s Way Manufacturing Co., Inc.

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

October 4, 2024

ART’S WAY MANUFACTURING REPORTS PROGRESS DESPITE DIFFICULT MARKET CONDITIONS IN THIRD QUARTER OF FISCAL 2024; CEO TRANSITION

ARMSTRONG, IOWA, October 4, 2024 – Art’s Way Manufacturing Co., Inc. (Nasdaq: ARTW) (the “Company”), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the third quarter of fiscal 2024 and nine months ended August 31, 2024. The Company also reports that it has reached a mutual separation agreement with President and CEO David King effective October 1, 2024.

| |

|

For the Three Months Ended

|

|

| |

|

(Consolidated – Continuing Operations)

|

|

| |

|

August 31, 2024

|

|

|

August 31, 2023

|

|

|

Sales

|

|

$ |

5,876,000 |

|

|

$ |

8,117,000 |

|

|

Operating Income

|

|

$ |

154,000 |

|

|

$ |

468,000 |

|

|

Net Income (Loss)

|

|

$ |

2,000 |

|

|

$ |

241,000 |

|

|

EPS (Basic)

|

|

$ |

0.00 |

|

|

$ |

0.05 |

|

|

EPS (Diluted)

|

|

$ |

0.00 |

|

|

$ |

0.05 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,071,512 |

|

|

|

5,009,041 |

|

|

Diluted

|

|

|

5,071,512 |

|

|

|

5,009,041 |

|

| |

|

For the Nine Months Ended

|

|

| |

|

(Consolidated – Continuing Operations)

|

|

| |

|

August 31, 2024

|

|

|

August 31, 2023

|

|

|

Sales

|

|

$ |

18,329,000 |

|

|

$ |

23,429,000 |

|

|

Operating Income (Loss)

|

|

$ |

(58,000 |

) |

|

$ |

1,445,000 |

|

|

Net Income (Loss)

|

|

$ |

(427,000 |

) |

|

$ |

921,000 |

|

|

EPS (Basic)

|

|

$ |

(0.08 |

) |

|

$ |

0.18 |

|

|

EPS (Diluted)

|

|

$ |

(0.08 |

) |

|

$ |

0.18 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,054,092 |

|

|

|

5,000,185 |

|

|

Diluted

|

|

|

5,054,092 |

|

|

|

5,000,185 |

|

Sales: Our consolidated corporate sales from continuing operations for the three- and nine-month periods ended August 31, 2024 were $5,876,000 and $18,329,000 compared to $8,117,000 and $23,429,000 during the same respective periods in fiscal 2023, a $2,241,000, or 27.6%, decrease for the three months and a decrease of $5,100,000, or 21.8% decrease for the nine months.

Our third quarter sales in our Agricultural Products segment were $2,988,000 compared to $5,530,000 during the same period of fiscal 2023, a decrease of $2,542,000, or 46.0%. For the nine months ended August 31, 2024, our sales were $11,779,000 compared to $17,343,000, a decrease of $5,564,000, or 32.1% for the same period of 2023. In February of 2024, the US Department of Agriculture reported a 25% expected decline in farm income levels for 2024 due to weaker row crop prices and expected increases in production expenses. Our sales year to date have fallen in line with the USDA's early sentiments on projected farm income. In September 2024, the USDA revised their projection to an expected 9.6% decrease in net farm income. This number is propped up by large feedlot operations where livestock prices remain above the five-year average and in general animal/animal product cash receipts are expected to be up 7.1% from 2023. Incoming whole good orders remained slow in the third quarter of fiscal 2024 as row crop prices including corn, soybeans and wheat were down 18-24% from the five-year average. Sugar prices remain around 8% above the five-year average as of this report, but the overall agriculture economy sentiment is negative. High interest rates continue to put pressure on farmer's bottom lines and are prohibitive to equipment financing arrangements and floorplan programs. We enacted initial cost cutting measures in the first quarter of fiscal 2024 to partially mitigate the effect on cash flow from decreased sales, including layoffs of non-production employees and offering early retirement incentives to employees at retirement age. We also entered the Iowa Work Force Development's voluntary workshare program in April 2024, which eliminates the need for additional production layoffs by allowing us to cut employee's hours while employees receive unemployment benefits for lost hours. We remain focused on trimming operating expenses and reducing overall inventory while remaining efficient in our production process. From a sales standpoint, we continue to work with dealers to help move field inventory to generate more sales opportunities for our products. We are targeting new dealer acquisitions to penetrate geographic markets in which we lack a substantial presence.

Our third quarter sales in our Modular Buildings segment were $2,888,000 compared to $2,587,000 for the same period in fiscal 2023, an increase of $301,000, or 11.6%. For the nine months ended August 31, 2024 our sales were $6,550,000 compared to $6,086,000 for the same period of fiscal 2023, an increase of $464,000, or 7.6%. Two large research projects are driving the sales increase for the three- and nine- month periods. We expect a strong finish to fiscal 2024 as we close out one of the two large research products in the fourth quarter.

Net Income (Loss): Consolidated net income from continuing operations was $2,000 for the three-month period ended August 31, 2024, compared to net income of $241,000 for the same period in fiscal 2023. For the nine months ended August 31, 2024, our consolidated net loss was $427,000 compared to net income of $921,000 for the same period of fiscal 2023. While we had positive operating income from continuing operations for the second straight fiscal quarter, high interest rates have put a strain on our bottom line in fiscal 2024. We expect it may be another twelve months before we see some sales stabilization in the Agricultural Products segment due to ongoing market conditions. Inventory reduction, debt retirement and cost cutting to maximize cash flow will be key over the next 18 months to weather the current conditions. The Modular Buildings segment recorded revenue increases and profitability for both the three and nine months ended August 31, 2024. We anticipate continued positive performance from this segment for the remainder of fiscal 2024 as we close out current backlog.

Income (Loss) per Share: Loss per basic and diluted share for the third quarter of fiscal 2024 was $0.00, compared to income per basic and diluted share of $0.05 for the same period in fiscal 2023. Loss per basic and diluted share for the first nine months of fiscal 2024 was $0.08, compared to income per basic and diluted share of $0.18 for the same period in fiscal 2023.

CEO Transition: Effective October 1, 2024 the Company reached a mutual separation agreement with President and CEO David King. Current Chairman of the Board Marc McConnell will serve as President and Chief Executive Officer moving forward and the Company will realize a net overhead reduction. Marc has served on Art’s Way’s Board of Directors since 2001, served as Vice Chairman from January 2008 to April 2015 and has since served as Art’s Way’s Chairman of the Board. Marc’s experience in the farm equipment manufacturing and finance industries, longevity on the Company’s Board, and passion for the Company, its employees, and dealers alike make Marc well suited to step in to guide the Company moving forward.

“We at Art’s Way have great appreciation for David King’s years of leadership and positive impact on the Company.” said Chairman Marc McConnell. “His vision and work to rebrand and reposition Art’s Way in the marketplace made a large impact on the Company and is an imprint that will remain for years to come. His guidance through COVID, the supply chain crisis, and severe swings in the agricultural equipment market was vital and effective. We wish David only the best with new opportunities in the future and sincerely thank him for his service to the Company, its employees, dealers, and shareholders.”

“Moving forward I look forward to leading the Company, realizing that we find ourselves facing challenging market conditions in agriculture. We will continue to prioritize innovation, quality, and customer service as we seek to further build our brand and standing in the marketplace while also managing costs very closely as we work through the current market cycle. We are pleased to be aided in great part by the growth and profitability in our Modular Buildings segment where we have benefited from great leadership and growing market opportunities in recent times that we expect to continue. Overall, there remains a great deal of opportunity for the Company and its shareholders long-term.”

Art’s-Way Manufacturing Co., Inc.

Art’s Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art’s Way Manufacturing in Armstrong, Iowa and Art’s Way Scientific in Monona, Iowa. Art’s Way manure spreaders, forage boxes, high dump carts, bale processors, graders, land planes, sugar beet harvesters and grinder mixers are designed to optimize production, increase efficiency and meet the growing demands of customers. Art’s Way Manufacturing has two reporting segments: Agricultural Products and Modular Buildings.

For more information, contact: Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

marc.mcconnell@artsway.com

Or visit the Company’s website at www.artsway.com/

Cautionary Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts, including the Company’s expectations regarding: (i) the Company’s business position; (ii) demand and potential growth within the Company’s business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company’s ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company’s business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company’s products; credit-worthiness of the Company’s customers; the Company’s ability to operate at lower expense levels; the Company’s ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company’s ability to renew or obtain financing on reasonable terms; the Company’s ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and its effect on the Company’s supply chain and demand for its products, domestic and international economic conditions; the Company’s ability to attract and maintain an adequate workforce in a competitive labor market; any future COVID-19 setbacks; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company’s operating segments; obstacles related to liquidation of product lines and segments; and other factors detailed from time to time in the Company’s Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

v3.24.3

Document And Entity Information

|

Oct. 01, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ART’S-WAY MANUFACTURING CO., INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 01, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-05131

|

| Entity, Tax Identification Number |

42-0920725

|

| Entity, Address, Address Line One |

5556 Highway 9

|

| Entity, Address, City or Town |

Armstrong

|

| Entity, Address, State or Province |

IA

|

| Entity, Address, Postal Zip Code |

50514

|

| City Area Code |

712

|

| Local Phone Number |

208-8467

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

ARTW

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000007623

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

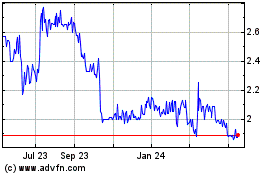

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Oct 2024 to Nov 2024

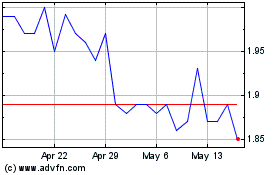

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Nov 2023 to Nov 2024