ASTROTECH BOARD UNANIMOUSLY REJECTS UNSOLICITED ACQUISITION PROPOSAL FROM BML INVESTMENT PARTNERS, L.P.

June 30 2023 - 3:41PM

Astrotech Corporation (Nasdaq: ASTC) (the “Company” or “Astrotech”)

today announced that its Board of Directors (the “Board”) has

unanimously rejected the unsolicited acquisition proposal from BML

Investment Partners, L.P. (“BML”), received on June 26, 2023, to

acquire all of the outstanding shares of common stock of the

Company for $17.25 per share in cash (the “Proposal”). After a

thorough review, in consultation with management and its legal

advisors, the Board unanimously determined to reject the Proposal

because it is not in the best interest of the Company’s

stockholders for the reasons set forth below.

“We are confident that the completion of our key

strategic projects has the potential to deliver greater value to

our stockholders than the current non-binding

proposal. Our board has

reviewed the BML proposal and believes

that it is grossly

undervalued,”

stated Thomas B. Pickens III, CEO and CTO of

Astrotech.

The Proposal is

Opportunistic and Significantly Undervalues the

Company

The Board believes that the Proposal significantly undervalues

the Company and prioritizes the short-term gain of BML at the

expense of the Company’s stockholders. The Board believes the

Proposal is an opportunistic attempt by BML to purchase the

Company’s shares at a discounted price that significantly

undervalues the Company’s business.

- The offer price of $17.25 per share

represents a significant 34% discount to the per share value of the

Company’s cash and short term investments as of March 31, 2023. The

cash and short-term investments represent the Company’s primary

liquidity source for funding the development of its products and

execution of its long-term business strategy.

- The offer price represents a more

than $10 million discount to cash for which BML is expecting to

benefit to the detriment and disregard of our shareholders.

- The offer price represents an even

greater discount when considering the value of the Company’s key

mass spectrometry technology that is the foundation of our current

and future products, and therefore does not reflect the Company’s

true intrinsic value or prospects.

- The Company has continued to drive

stockholder value by expanding its offerings in existing and new

markets to capitalize on opportunities for new business.

The Proposal

Would Deprive Stockholders of

Long-Term Value

The Board believes that the Company’s stockholders will best be

served by the Company continuing to pursue its long-term business

strategy because the Board believes that the long-term value of the

Company is greater than the short-term liquidation or sale value

represented by the Proposal. As a result, the Proposal would deny

the Company’s stockholders the full benefits of the Company’s

developing business opportunities in bringing products to market

and its overall growth strategy. For example, the Proposal does not

take into account the successful results of the AgLAB Maximum Value

Process™ method (AgLAB subsidiary) or the recent purchase order for

17 TRACER 1000 systems (1st Detect subsidiary). The partnership

with Cleveland Clinic to develop the BreathTest-1000TM (BreathTech

subsidiary) is another project that has the potential to create

long-term value.

BML Is Seeking Short-Term Gain at the Expense of

Long-Term Value for Stockholders

The Board believes that BML’s aim is to realize a short-term

gain at the expense of the Company’s other stockholders. The Board

believes that BML’s strategy of potentially liquidating the

Company, as stated in BML’s Schedule 13D, would result in unfair

profits to BML at the expense of all other stockholders because the

offer price of $17.25 per share is significantly less than the per

share value of the Company’s cash and short-term equivalents.

Consistent with its history involving other public companies, the

Board believes BML is targeting Astrotech for liquidation because

the market value of Astrotech’s common stock is less than the book

value of its cash and short-term investments. If BML were to

acquire the Company at $17.25 per share (excluding shares directly

held by BML), BML would expend an aggregate $25 million for the

remaining 87% of Company shares that it does not own, and BML would

then own 100% of a Company with a value of $26.17 per share, based

solely on the book value of the cash and short-term investments as

of March 31, 2023. If BML were then to liquidate the Company

shortly thereafter, BML would realize a gain on all of its shares

that would represent a significant premium over what all other

stockholders would receive based on the Proposal, to the sole

benefit of BML.

The Proposal is Subject to Financing

Uncertainties

The Proposal states that BML has funds “readily available” to

close a transaction but provides no details or evidence of any

financing commitments, sources, methods, discussions or other

customary disclosure regarding how BML plans to fund over $25

million in cash consideration.

Our Commitment

The Company’s Board is committed to delivering long-term value

to stockholders by executing on its strategic business plans and

growing the Company’s mass spectrometry technology and business

lines. The Board will continue to work on behalf of stockholders to

grow Astrotech’s business and generate increasing value for its

stockholders generally over the limited opportunistic interests of

the few.

About Astrotech Corporation

Astrotech (Nasdaq: ASTC) is a mass spectrometry company

that launches, manages, and commercializes scalable companies based

on its innovative core technology through its wholly-owned

subsidiaries. 1st Detect develops,

manufactures, and sells trace detectors for use in the security and

detection market. AgLAB is developing chemical

analyzers for use in the agriculture

market. BreathTech is developing a breath

analysis tool to provide early detection of lung diseases.

Astrotech is headquartered in Austin, Texas. For information,

please visit www.astrotechcorp.com.

Forward-Looking Statements

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. Furthermore, there can be no assurance

that the non-binding proposal will result in a formal offer or that

any such offer will ultimately result in a completed transaction.

These factors include, but are not limited to, the severity and

duration of the COVID-19 pandemic and its impact on the U.S. and

worldwide economy, the timing, scope and effect of further U.S. and

international governmental, regulatory, fiscal, monetary and public

health responses to the COVID-19 pandemic, the Company’s use of

proceeds from the common stock offerings, whether we can

successfully complete the development of our new products and

proprietary technologies, whether we can obtain the FDA and other

regulatory approvals required to market our products under

development in the United States or abroad, whether the market will

accept our products and services and whether we are successful in

identifying, completing and integrating acquisitions, as well as

other risk factors and business considerations described in the

Company’s Securities and Exchange Commission filings including the

Company’s most recent Annual Report on Form 10-K. Any

forward-looking statements in this document should be evaluated in

light of these important risk factors. Although the Company

believes the expectations reflected in its forward-looking

statements are reasonable and are based on reasonable assumptions,

no assurance can be given that these assumptions are accurate or

that any of these expectations will be achieved (in full or at all)

or will prove to have been correct. Moreover, such statements are

subject to a number of assumptions, risks and uncertainties, many

of which are beyond the control of the Company, which may cause

actual results to differ materially from those implied or expressed

by the forward-looking statements. In addition, any forward-looking

statements included in this press release represent the Company’s

views only as of the date of its publication and should not be

relied upon as representing its views as of any subsequent date.

The Company assumes no obligation to correct or update these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

law.

Company Contact: Jaime Hinojosa, Chief Financial Officer, Astrotech Corporation, (512) 485-9530

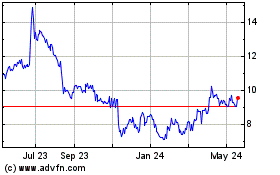

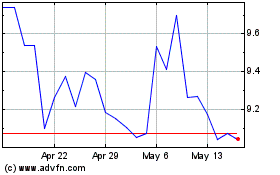

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Feb 2024 to Feb 2025