Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the

Company”), a leading Canadian producer of hot and cold rolled steel

sheet and plate products, announced today that the Toronto Stock

Exchange (the “TSX”) has approved the Company’s intention to renew

its normal course issuer bid (“NCIB”) for a portion of its common

shares (“Shares”) and a portion of its warrants (“Warrants”) to

purchase shares as appropriate opportunities arise from time to

time. The Company believes that the market price of the Shares and

Warrants may not, from time to time, fully reflect their value and

accordingly the purchase of Shares and Warrants would be in the

best interests of the Company and an attractive use of available

funds."

Pursuant to the NCIB, the Company may acquire,

from time to time, over a period of 12 months starting September 5,

2024 and ending September 4, 2025, up to a maximum of 5,206,153 of

its Shares, or 5% of its 104,123,072 issued and outstanding Shares,

and up to a maximum of 1,208,950 of its Warrants, or 5% of its

24,179,000 issued and outstanding Warrants, in each case as of

August 26 2024. In accordance with TSX rules, the number of Shares

that can be purchased pursuant to the NCIB is subject to current

daily maximums of 12,066 Shares (which is equal to 25% of 48,264

Shares, being the average daily trading volume from February 1,

2024 to July 1, 2024) and 1,000 Warrants (as 25% of 1,059 Warrants,

being the average daily trading volume from February 1, 2024 to

July 1, 2024, is less than the 1,000 limit), subject to certain

exceptions prescribed by the TSX, including block purchase

exceptions. In addition, all purchases under the NCIB will be

conducted in accordance with applicable U.S. securities laws.

The NCIB commences on September 5, 2024 and will

terminate on the earlier of September 4, 2025, or such earlier time

as the Company completes its purchases pursuant to the NCIB or

provides notice of termination. Purchases under the NCIB will be

made through the facilities of the TSX, NASDAQ, and/or other

exchanges and through alternative Canadian systems and in

accordance with applicable regulatory requirements at a price per

Share or Warrant equal to the market price at the time of

acquisition. All Shares and Warrants purchased under the NCIB will

be cancelled upon their purchase.

In connection with the NCIB, the Company has

entered into an automatic repurchase plan (the "Plan") with its

designated broker. The Plan is intended to allow for the purchase

of Shares and Warrants under the NCIB at times when it would

ordinarily not be permitted to purchase Shares and Warrants due to

regulatory restrictions and customary self-imposed blackout

periods. The Plan is also intended to meet the requirements of

applicable U.S. securities laws. The Plan constitutes an "automatic

securities purchase plan" for purposes of applicable Canadian

securities legislation and has been reviewed by the TSX.

The Company previously maintained a normal

course issuer bid for the twelve-month period commencing on March

6, 2023 and ending on March 5, 2024, under which the Company sought

and received approval from the TSX to purchase up to 5,178,394 of

its Shares, or approximately 5% of its 103,567,884 issued and

outstanding Shares as of February 28, 2023. The Company did not

purchase any common shares under its previous normal course issuer

bid.

Cautionary

Statement Regarding

Forward-Looking Statements

This news release contains “forward-looking

information” under applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”), including statements regarding the

potential purchase and cancellation of Share and Warrants pursuant

to the NCIB and the Plan, Algoma’s transition to electric arc

furnace (EAF) steelmaking, Algoma’s future as a leading producer of

green steel, Algoma’s modernization of its plate mill facilities,

transformation journey, ability to deliver greater and long-term

value, ability to offer North America a secure steel supply and a

sustainable future, and investment in its people, and

processes. These forward-looking statements generally are

identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “design,” “pipeline,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions. Many

factors could cause actual future events to differ materially from

the forward-looking statements in this document. Readers should

also consider the other risks and uncertainties set forth in the

section entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Information” in Algoma’s Annual Information Form,

filed by Algoma with applicable Canadian securities regulatory

authorities (available under the company’s SEDAR+ profile at

www.sedarplus.com) and with the SEC, as part of Algoma’s Annual

Report on Form 40-F (available at www.sec.gov), as well as in

Algoma’s current reports with the Canadian securities regulatory

authorities and SEC. Forward-looking statements speak only as of

the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and Algoma assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

About Algoma

Steel Group

Inc.

Based in Sault Ste. Marie, Ontario, Canada,

Algoma is a fully integrated producer of hot and cold rolled steel

products including sheet and plate. Driven by a purpose to build

better lives and a greener future, Algoma is positioned to deliver

responsive, customer-driven product solutions to applications in

the automotive, construction, energy, defense, and manufacturing

sectors. Algoma is a key supplier of steel products to customers in

North America and is the only producer of discrete plate products

in Canada. Its state-of-the-art Direct Strip Production Complex

(“DSPC”) is one of the lowest-cost producers of hot rolled sheet

steel (HRC) in North America.

Algoma is on a transformation journey,

modernizing its plate mill and adopting electric arc technology

that builds on the strong principles of recycling and environmental

stewardship to significantly lower carbon emissions. Today Algoma

is investing in its people and processes, working safely, as a team

to become one of North America's leading producers of green

steel.

As a founding industry in their community,

Algoma is drawing on the best of its rich steelmaking tradition to

deliver greater value, offering North America the comfort of a

secure steel supply and a sustainable future as your partner in

steel.

For more information, please contact:

Michael MoracaVice President –

Corporate Development and TreasurerAlgoma Steel Group Inc.Phone:

705.945-3300E-mail: IR@algoma.com

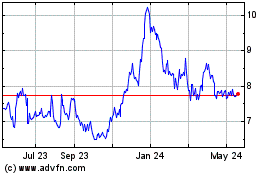

Algoma Steel (NASDAQ:ASTL)

Historical Stock Chart

From Nov 2024 to Dec 2024

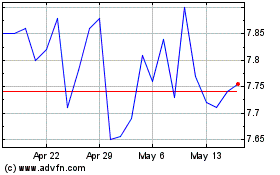

Algoma Steel (NASDAQ:ASTL)

Historical Stock Chart

From Dec 2023 to Dec 2024