Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

January 25 2024 - 4:05PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration No. 333-255834

Atlanticus Holdings Corporation

9.25% Senior Notes due 2029

|

Term Sheet

|

|

Term Sheet dated January 25, 2024 to the Preliminary Prospectus Supplement dated January 24, 2024 of Atlanticus Holdings Corporation. This Term Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. The information in this Term Sheet supplements the Preliminary Prospectus Supplement and supersedes the information in the Preliminary Prospectus Supplement to the extent it is inconsistent with the information in the Preliminary Prospectus Supplement. Capitalized terms used in this Term Sheet but not defined have the meanings given to them in the Preliminary Prospectus Supplement.

|

|

Issuer

|

Atlanticus Holdings Corporation

|

| |

|

|

Title of Securities

|

9.25% Senior Notes Due 2029 (the “Notes”)

|

| |

|

|

Type:

|

SEC Registered

|

| |

|

|

Trade Date

|

January 26, 2024

|

| |

|

|

Settlement Date

|

January 30, 2024

|

| |

|

|

Listing

|

Expected NASDAQ “ATLCZ”

|

| |

|

|

Size

|

$50,000,000

|

| |

|

|

Option

|

Up to $7,500,000

|

| |

|

|

Maturity Date

|

January 31, 2029

|

| |

|

|

Rating

|

The Notes have received an “A” rating from Egan-Jones, an independent, unaffiliated rating agency. Ratings are not a recommendation to purchase, hold or sell notes, inasmuch as the ratings do not comment as to market price or suitability for a particular investor. The ratings are based upon current information furnished to the rating agency by the Issuer and information obtained by the rating agency from other sources. The ratings are only accurate as of the date thereof and may be changed, superseded or withdrawn as a result of changes in, or unavailability of, such information, and therefore a prospective purchaser should check the current ratings before purchasing the Notes. Each rating should be evaluated independently of any other rating.

|

| |

|

|

Annual Coupon:

|

9.25%, paid quarterly in arrears

|

|

Interest Payment Dates

|

January 15, April 15, July 15 and October 15, commencing April 15, 2024, and at maturity

|

| |

|

|

Price to the Public

|

100%

|

| |

|

|

Day Count

|

30/360

|

| |

|

|

Optional Redemption

|

We may redeem the Notes for cash in whole or in part at any time at our option. Prior to January 31, 2026, the redemption price will be $25.00 per $25.00 principal amount of Notes, plus a “make-whole” premium calculated as described in the Preliminary Prospectus Supplement. Thereafter, we may redeem the Notes for cash (i) on or after January 31, 2026 and prior to January 31, 2027 at a price equal to $25.50 per $25.00 principal amount of Notes, (ii) on or after January 31, 2027 and prior to January 31, 2028 at a price equal to $25.25 per $25.00 principal amount of Notes, and (iii) on or after January 31, 2028 at a price equal to $25.00 per $25.00 principal amount of Notes, plus (in each case noted above) accrued and unpaid interest to, but excluding, the date of redemption.

|

| |

|

|

Minimum

Denomination/Multiples

Purchase of the Notes Upon

Delisting Event

|

$25.00/$25.00

Upon the occurrence of a Delisting Event, the Company must offer to purchase the Notes at 100% of their principal amount, plus accrued and unpaid interest, if any, to but excluding the date of the purchase.

|

| |

|

|

CUSIP/ISIN

|

04914Y 409 / US04914Y4098

|

| |

|

|

Book-Running Managers

|

B. Riley Securities, Inc.

|

| |

Janney Montgomery Scott LLC

|

| |

Ladenburg Thalmann & Co. Inc.

|

| |

William Blair & Company, L.L.C.

|

| |

BTIG, LLC

|

| |

|

|

Co-Manager

|

Brownstone Investment Group, LLC

|

This communication is intended for the sole use of the person to whom it is provided by the issuer.

The issuer has filed a registration statement (including a base prospectus dated May 13, 2021) and a preliminary prospectus supplement dated January 24, 2024 with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering.

You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and related preliminary prospectus supplement if you request them from B. Riley Securities at 1300 17th Street, Suite 1300, Arlington, VA 22209, or by calling (703) 312-9580, or by emailing prospectuses@brileyfin.com.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER E-MAIL SYSTEM.

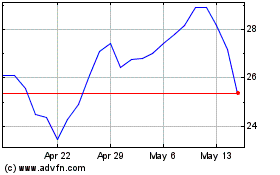

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

From Jan 2025 to Feb 2025

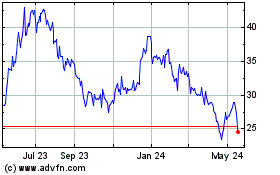

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

From Feb 2024 to Feb 2025