0001488039false00014880392024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 12, 2024 |

Atossa Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35610 |

26-4753208 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

10202 5th Avenue NE, Suite 200 |

|

Seattle, Washington |

|

98125 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (206) 588-0256 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.18 par value |

|

ATOS |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 12, 2024, Atossa Therapeutics, Inc. (the “Company”) issued a press release announcing the quarter ended June 30, 2024 financial results and providing a Company update. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Items 2.02 and 9.01 of this report, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Atossa Therapeutics, Inc. |

|

|

|

|

Date: |

August 12, 2024 |

By: |

/s/ Heather Rees |

|

|

|

Heather Rees

Chief Financial Officer (Principal Financial and Accounting Officer) |

Exhibit 99.1

Atossa Therapeutics Announces Second Quarter 2024 Financial Results and Provides Corporate Update

•Presented data showing 100% disease control rate after 24-week treatment with (Z)-Endoxifen in 40mg cohort of Phase 2 EVANGELINE study at the American Association for Cancer Research (AACR) Annual Meeting

•Completed enrollment in 80mg PK Run-in Cohort for EVANGELINE trial

•Completed Phase 2 Karisma-Endoxifen clinical trial dosing

•Updated protocol for (Z)-Endoxifen and abemaciclib clinical trial

•Ended second quarter 2024 with $79.5 million in cash and cash equivalents and no debt

SEATTLE, August 12, 2024 (GLOBE NEWSWIRE) -- Atossa Therapeutics, Inc. (Nasdaq: ATOS) (“Atossa” or the “Company”) today announced financial results for the fiscal quarter ended June 30, 2024, and provided an update on recent company developments. Atossa is a clinical-stage biopharmaceutical company developing proprietary innovative medicines in areas of significant unmet medical need in oncology, with a focus on women's breast cancer and other breast conditions.

Key developments from Q2 2024 and the year to date include:

•Completed enrollment in 80mg PK Run-in Cohort for EVANGELINE trial - fully enrolled the 12-patient 80mg pharmacokinetic Run-in Cohort in the Phase 2 EVANGELINE study evaluating (Z)-endoxifen as a neoadjuvant treatment for estrogen receptor-positive (ER+)/Human Epidermal Growth Factor Receptor 2 negative (HER2-) breast cancer.

•Completed Phase 2 Karisma-Endoxifen clinical trial dosing - the last patient received the final dose in the 240-person trial investigating (Z)-endoxifen in premenopausal women with measurable mammographic breast density (MBD).

•Supported Phase 2 study of AI breast cancer risk assessment model - announced support for the SMART study, a Phase 2 trial to validate an AI-driven breast cancer risk assessment model for identifying women at highest risk of developing breast cancer within two years.

•Presented data from 40mg cohort of Phase 2 EVANGELINE clinical trial at AACR - demonstrated 100% disease control rate after 24-weeks of treatment with (Z)-endoxifen.

•Initiated new study evaluating (Z)-endoxifen in combination with abemaciclib (VERZENIO®) with Quantum Leap Healthcare Collaborative™ - new study arm is part of the ongoing I-SPY 2 Endocrine Optimization Pilot Protocol (EOP), which targets patients with newly diagnosed ER+ invasive breast cancer.

•Joined Russell 3000® Index - Atossa Therapeutics was included in the Russell 3000® Index effective June 28, 2024.

•Appointed Heather Rees as Chief Financial Officer - announced the promotion of Heather Rees, formerly Senior Vice President of Finance and Principal Accounting Officer, to the position of CFO.

“The second quarter of 2024 was highlighted by significant advancements in our clinical programs and strategic development initiatives as we seek to maximize our (Z)-endoxifen platform to address areas of unmet need across the breast cancer treatment continuum,” said Steven Quay, M.D., Ph.D., Atossa’s President and Chief Executive Officer. “Over the next several months, we anticipate key data readouts from both our Phase 2 Karisma-Endoxifen clinical trial and the monotherapy arm of our Phase 2 I-SPY 2 clinical trial, setting the stage for what is expected to be a milestone-rich period for Atossa. These potential value drivers are supported by a strong financial foundation, including a cash balance of $79.5 million, which we believe positions Atossa for continued growth through the second half of 2024 and beyond. This is a very exciting time for Atossa.”

Comparison of Three and Six Months Ended June 30, 2024 and 2023

Operating Expenses. Total operating expenses were $7.1 million and $14.1 million for the three and six months ended June 30, 2024, respectively, which was a decrease of $0.7 million and $0.8 million, respectively, from total operating expenses for the three and six months ended June 30, 2023 of $7.8 million and $14.9 million, respectively. Factors contributing to the decrease in operating expenses in the three and six months ended June 30, 2024 are explained below.

R&D Expenses. The following table provides a breakdown of major categories within R&D expense for the three and six months ended June 30, 2024 and 2023, together with the dollar change in those categories (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

Increase (Decrease) |

|

|

% Increase (Decrease) |

|

2024 |

|

|

2023 |

|

|

Increase (Decrease) |

|

|

% Increase (Decrease) |

Research and Development Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinical and non-clinical trials |

|

$ |

2,501 |

|

|

$ |

2,538 |

|

|

$ |

(37 |

) |

|

(1)% |

|

$ |

5,384 |

|

|

$ |

4,874 |

|

|

$ |

510 |

|

|

10% |

|

Compensation |

|

|

679 |

|

|

|

899 |

|

|

|

(220 |

) |

|

(24)% |

|

|

1,305 |

|

|

|

1,932 |

|

|

|

(627 |

) |

|

(32)% |

|

Professional fees and other |

|

|

373 |

|

|

|

268 |

|

|

|

105 |

|

|

39% |

|

|

613 |

|

|

|

407 |

|

|

|

206 |

|

|

51% |

|

Research and Development Expense Total |

|

$ |

3,553 |

|

|

$ |

3,705 |

|

|

$ |

(152 |

) |

|

(4)% |

|

$ |

7,302 |

|

|

$ |

7,213 |

|

|

$ |

89 |

|

|

1% |

|

|

|

|

• |

Clinical and non-clinical trial expense decreased for the three months ended June 30, 2024 compared to the prior year period by $37 thousand. Clinical and non-clinical trial expense increased by $0.5 million for the six months ended June 30, 2024 compared to the prior year period due to an increase in spending for the (Z)-endoxifen trials, including an increase in drug development costs. |

|

|

|

|

• |

The decrease in R&D compensation expense of $0.2 million and $0.6 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods was primarily due to a decrease in non-cash stock-based compensation expense of $0.3 million and $0.7 million for the three and six months ended June 30, 2024, respectively. Non-cash stock-based compensation expense decreased compared to the prior year periods due to the weighted average fair value of stock options amortizing in the 2024 periods being lower. |

|

|

|

|

• |

The increase in R&D professional fees and other expense of $0.1 million and $0.2 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods was primarily attributable to higher consulting fees in 2024 related to our (Z)-endoxifen program. |

General and Administrative (G&A) Expenses. The following table provides a breakdown of major categories within G&A expenses for the three and six months ended June 30, 2024 and 2023, together with the dollar change in those categories (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

Increase (Decrease) |

|

|

% Increase (Decrease) |

|

2024 |

|

|

2023 |

|

|

Increase (Decrease) |

|

|

% Increase (Decrease) |

General and Administrative Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation |

|

$ |

1,031 |

|

|

$ |

2,534 |

|

|

$ |

(1,503 |

) |

|

(59)% |

|

$ |

2,356 |

|

|

$ |

4,619 |

|

|

$ |

(2,263 |

) |

|

(49)% |

|

Professional fees and other |

|

|

2,269 |

|

|

|

1,213 |

|

|

|

1,056 |

|

|

87% |

|

|

3,949 |

|

|

|

2,376 |

|

|

|

1,573 |

|

|

66% |

|

Insurance |

|

|

252 |

|

|

|

341 |

|

|

|

(89 |

) |

|

(26)% |

|

|

479 |

|

|

|

683 |

|

|

|

(204 |

) |

|

(30)% |

|

General and Administrative Expense Total |

|

$ |

3,552 |

|

|

$ |

4,088 |

|

|

$ |

(536 |

) |

|

(13)% |

|

$ |

6,784 |

|

|

$ |

7,678 |

|

|

$ |

(894 |

) |

|

(12)% |

|

|

|

|

• |

The decrease in G&A compensation expense of $1.5 million and $2.3 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods was due to a decrease in both cash compensation and non-cash stock-based compensation expense. Non-cash stock-based compensation expense decreased by $0.9 million and $1.7 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods due to the weighted average fair value of stock options amortizing in 2024 being lower. Cash compensation decreased by $0.6 million for the three and six months ended June 30, 2024, compared to the prior year periods due to salary and bonus severance expense for our former CFO of $0.6 million in the three and six months ended June 30, 2023. |

|

|

|

|

• |

G&A professional fees and other expense increased by $1.1 million and $1.6 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods due to the increase in legal fees of $0.7 million and $0.8 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods due to higher patent-related activity as well as other legal matters. Investor relations expenses increased by $0.3 million and $0.5 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods due to an increase in investor outreach costs. Accounting fees also increased by $0.3 million for the six months ended June 30, 2024 compared to the prior year period due to a change in the Company's accounting firm as well as increased complexity of the business. |

|

|

|

|

• |

The decrease in G&A insurance expense of $0.1 million and $0.2 million for the three and six months ended June 30, 2024, respectively, compared to the prior year periods was due to lower negotiated insurance premiums for the same or better coverage in 2024. |

Interest Income. Interest income was $1.1 million and $2.2 million for the three and six months ended June 30, 2024, respectively, an increase of $0.1 million and $0.4 million, respectively, from interest income of $1.0 million and $1.8 million for the three and six months ended June 30, 2023, respectively. The increase was due to a change in the mix of our money market accounts which yielded a higher rate of return in 2024.

Impairment Charge on Investment in Equity Securities. For the three and six months ended June 30, 2024, there were no impairment charges related to our investment in equity securities. For the three and six months ended June 30, 2023, we wrote down our investment in equity securities by $3.0 million due to impairment of our investment in DCT.

About (Z)-Endoxifen

(Z)-endoxifen is the most potent Selective Estrogen Receptor Modulator (SERM) for estrogen receptor inhibition and also causes estrogen receptor degradation. It has also been shown to have efficacy in the setting of patients with tumor resistance to other hormonal treatments. In addition to its potent anti-estrogen effects, (Z)-endoxifen has been shown to target PKCβ1, a known oncogenic protein, at clinically attainable blood concentrations. Finally, (Z)-endoxifen appears to deliver similar or even greater bone agonistic effects while resulting in little or no endometrial proliferative effects compared with standard treatments, like tamoxifen.

Atossa is developing a proprietary oral formulation of (Z)-endoxifen that does not require liver metabolism to achieve therapeutic concentrations and is encapsulated to bypass the stomach, as acidic conditions in the stomach convert a significant proportion of (Z)-endoxifen to the inactive (E)-endoxifen. Atossa’s (Z)-endoxifen has been shown to be well tolerated in Phase 1 studies and in a small Phase 2 study of women with breast cancer. (Z)-endoxifen is currently being studied in five Phase 2 trials: one in healthy women with measurable breast density, one in women diagnosed with ductal carcinoma in situ, and two other studies including the EVANGELINE study in women with ER+/HER2- breast cancer. Atossa’s (Z)-endoxifen is protected by three issued U.S. patents and numerous pending patent applications.

About Atossa Therapeutics

Atossa Therapeutics, Inc. is a clinical-stage biopharmaceutical company developing innovative medicines in areas of significant unmet medical need in oncology with a focus on using (Z)-endoxifen to prevent and treat breast cancer. For more information, please visit www.atossatherapeutics.com.

Contact

Tiberend Strategic Advisors, Inc.

Jason Rando

917-930-6346

jrando@tiberend.com

FORWARD LOOKING STATEMENTS

This press release contains certain information that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We may identify these forward-looking statements by the use of words such as “expect,” “potential,” “continue,” “may,” “will,” “should,” “could,” “would,” “seek,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “future,” or other comparable words. Forward-looking statements in this press release are subject to risks and uncertainties that may cause actual results, outcomes, or the timing of actual results or outcomes, such as data related to the (Z)-endoxifen program and the potential of (Z)-endoxifen as a breast cancer prevention and treatment agent, and potential milestones and growth opportunities for the Company, to differ materially from those projected or anticipated, including risks and uncertainties associated with: macroeconomic conditions and increasing geopolitical instability; the expected timing of releasing data; any variation between interim and final clinical results; actions and inactions by the FDA and foreign regulatory bodies; the outcome or timing of regulatory approvals needed by Atossa, including those needed to continue our planned (Z)-endoxifen trials; our ability to satisfy regulatory requirements; our ability to remain compliant with the continued listing requirements of the Nasdaq Stock Market; our ability to successfully develop and commercialize new therapeutics; the success, costs and timing of our development activities, including our ability to successfully initiate or complete our clinical trials, including our (Z)-endoxifen trials; our anticipated rate of patient enrollment; our ability to contract with third-parties and their ability to perform adequately; our estimates on the size and characteristics of our potential markets; our ability to successfully defend litigation and other similar complaints and to establish and maintain intellectual property rights covering our products; whether we can successfully complete our clinical trial of oral (Z)-endoxifen in women with mammographic breast density and our trials of (Z)-endoxifen in women with breast cancer, and whether the studies will meet their objectives; our expectations as to future financial performance, expense levels and capital sources, including our ability to raise capital; our ability to attract and retain key personnel; our anticipated working capital needs and expectations around the sufficiency of our cash reserves; and other risks and uncertainties detailed from time to time in Atossa’s filings with the Securities and Exchange Commission, including without limitation its Annual Reports on Form 10-K and Quarterly Reports on 10-Q. Forward-looking statements are presented as of the date of this press release. Except as required by law, we do not intend to update any forward-looking statements, whether as a result of new information, future events or circumstances or otherwise.

ATOSSA THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

79,526 |

|

|

$ |

88,460 |

|

Restricted cash |

|

|

110 |

|

|

|

110 |

|

Prepaid materials |

|

|

1,095 |

|

|

|

1,487 |

|

Prepaid expenses and other current assets |

|

|

987 |

|

|

|

2,162 |

|

Total current assets |

|

|

81,718 |

|

|

|

92,219 |

|

Investment in equity securities |

|

|

1,710 |

|

|

|

1,710 |

|

Other assets |

|

|

2,430 |

|

|

|

2,323 |

|

Total assets |

|

$ |

85,858 |

|

|

$ |

96,252 |

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,056 |

|

|

$ |

806 |

|

Accrued expenses |

|

|

1,907 |

|

|

|

973 |

|

Payroll liabilities |

|

|

939 |

|

|

|

1,654 |

|

Other current liabilities |

|

|

1,794 |

|

|

|

1,803 |

|

Total current liabilities |

|

|

5,696 |

|

|

|

5,236 |

|

Total liabilities |

|

|

5,696 |

|

|

|

5,236 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

Convertible preferred stock - $0.001 par value; 10,000,000 shares authorized;

582 shares issued and outstanding as of June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common stock - $0.18 par value; 350,000,000 and 175,000,000 shares authorized

as of June 30, 2024 and December 31, 2023, respectively; 125,757,416

and 125,304,064 shares issued and outstanding as of June 30, 2024 and

December 31, 2023, respectively |

|

|

22,874 |

|

|

|

22,792 |

|

Additional paid-in capital |

|

|

256,978 |

|

|

|

255,987 |

|

Treasury stock, at cost; 1,320,046 shares of common stock at June 30, 2024 and

December 31, 2023 |

|

|

(1,475 |

) |

|

|

(1,475 |

) |

Accumulated deficit |

|

|

(198,215 |

) |

|

|

(186,288 |

) |

Total stockholders' equity |

|

|

80,162 |

|

|

|

91,016 |

|

Total liabilities and stockholders' equity |

|

$ |

85,858 |

|

|

$ |

96,252 |

|

ATOSSA THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(amounts in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

3,553 |

|

|

$ |

3,705 |

|

|

|

$ |

7,302 |

|

|

$ |

7,213 |

|

General and administrative |

|

|

3,552 |

|

|

|

4,088 |

|

|

|

|

6,784 |

|

|

|

7,678 |

|

Total operating expenses |

|

|

7,105 |

|

|

|

7,793 |

|

|

|

|

14,086 |

|

|

|

14,891 |

|

Operating loss |

|

|

(7,105 |

) |

|

|

(7,793 |

) |

|

|

|

(14,086 |

) |

|

|

(14,891 |

) |

Impairment charge on investment in equity securities |

|

|

— |

|

|

|

(2,990 |

) |

|

|

|

— |

|

|

|

(2,990 |

) |

Interest income |

|

|

1,073 |

|

|

|

983 |

|

|

|

|

2,211 |

|

|

|

1,833 |

|

Other expense, net |

|

|

(17 |

) |

|

|

(30 |

) |

|

|

|

(52 |

) |

|

|

(63 |

) |

Loss before income taxes |

|

|

(6,049 |

) |

|

|

(9,830 |

) |

|

|

|

(11,927 |

) |

|

|

(16,111 |

) |

Income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

Net loss |

|

|

(6,049 |

) |

|

|

(9,830 |

) |

|

|

|

(11,927 |

) |

|

|

(16,111 |

) |

Net loss per share of common stock - basic and diluted |

|

$ |

(0.05 |

) |

|

$ |

(0.08 |

) |

|

|

$ |

(0.10 |

) |

|

$ |

(0.13 |

) |

Weighted average shares outstanding used to compute

net loss per share - basic and diluted |

|

|

125,732,140 |

|

|

|

126,622,798 |

|

|

|

|

125,525,959 |

|

|

|

126,623,450 |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

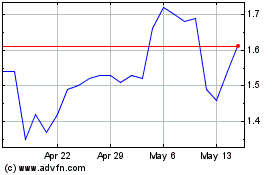

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Jan 2024 to Jan 2025