Aveanna Healthcare Holdings Inc. (NASDAQ: AVAH), a leading,

diversified home care platform focused on providing care to

medically complex, high-cost patient populations, today announced

financial results for the three and nine-month periods September

28, 2024.

Jeff Shaner, Chief Executive Officer, commented,

“We have delivered another strong operating and financial quarter,

highlighted by revenue, and adjusted EBITDA growth of 6.5% and

32.2%, respectively, when compared to the prior year period.

Additionally, our refreshed outlook demonstrates the positive

momentum from the improved payor rate environment as well as cost

reduction efforts taking hold. Our strategic focus on government

and payor partnerships continues to allow us to deliver more care

to more patients through meaningful investments in our caregivers.

We continue to offer a differentiated, national homecare platform

that delivers a cost-effective, patient-preferred, and clinically

sophisticated solution for our patients and families. I am so proud

of our dedicated team of Aveanna caregivers and leaders, who

deliver on our mission of exceptional care every day.”

Three-Month Periods Ended September 28, 2024 and

September 30, 2023

Revenue was $509.0 million for the three-month

period ended September 28, 2024, as compared to $478.0 million for

the three-month period ended September 30, 2023, an increase of

$31.0 million, or 6.5%. The overall increase in revenue was

attributable to a $24.8 million increase in Private Duty Services

(“PDS”) segment revenue, a $5.1 million increase in Medical

Solutions ("MS") segment revenue, and a $1.2 million increase in

Home Health & Hospice (“HHH”) segment revenue over the

comparable quarter.

Gross margin was $159.7 million, or 31.4% of

revenue, for the three-month period ended September 28, 2024, as

compared to $147.3 million, or 30.8% of revenue, for the

three-month period ended September 30, 2023, an increase of $12.4

million, or 8.4%.

Net loss was $42.8 million for the third quarter

of 2024, as compared to net loss of $102.4 million for the third

quarter of 2023. Net loss per diluted share was $(0.22) for the

third quarter of 2024, as compared to net loss per diluted share of

$(0.54) for the third quarter of 2023. Adjusted net income per

diluted share was $0.02 for the third quarter of 2024, as compared

to adjusted net loss per diluted share of $(0.03) for the third

quarter of 2023. See "Non-GAAP Financial Measures - Adjusted net

income (loss) and Adjusted net income (loss) per diluted share"

below.

Adjusted EBITDA was $47.8 million, or 9.4% of

revenue, for the third quarter of 2024, as compared to $36.2

million, or 7.6% of revenue, for the third quarter of 2023, an

increase of $11.7 million or 32.2%. See "Non-GAAP Financial

Measures - EBITDA and Adjusted EBITDA" below.

Nine-Month Period Ended September 28, 2024 and

September 30, 2023

Revenue was $1,504.6 million for the nine-month

period ended September 28, 2024, as compared to $1,416.4 million

for the nine-month period ended September 30, 2023, an increase of

$88.3 million, or 6.2%. The overall increase in revenue was

attributable to a $77.1 million increase in Private Duty Services

(“PDS”) segment revenue and a $12.4 million increase in Medical

Solutions ("MS") segment revenue, offset by a $1.1 million decrease

in Home Health & Hospice (“HHH”) segment revenue over the

comparable period.

Gross margin was $463.8 million, or 30.8% of

revenue, for the nine-month period ended September 28, 2024, as

compared to $447.0 million, or 31.6% of revenue, for the nine-month

period ended September 30, 2023, an increase of $16.8 million, or

3.8%.

Net loss was $40.1 million for the nine-month

period ended September 28, 2024, as compared to net loss of $108.8

million for the nine-month period ended September 30, 2023. Net

loss per diluted share was $(0.21) for the nine-month period ended

September 28, 2024, as compared to net loss per diluted share of

$(0.57) for the nine-month period ended September 30, 2023.

Adjusted net income per diluted share was $0.01 for the nine-month

period ended September 28, 2024, as compared to adjusted net loss

per diluted share of $(0.09) for the nine-month period ended

September 30, 2023. See "Non-GAAP Financial Measures - Adjusted net

income (loss) and Adjusted net income (loss) per diluted share"

below.

Adjusted EBITDA was $128.4 million, or 8.5% of

revenue, for the nine-month period ended September 28, 2024, as

compared to $100.5 million, or 7.1% of revenue, for the nine-month

period ended September 30, 2023, an increase of $27.8 million or

27.7%. See "Non-GAAP Financial Measures - EBITDA and Adjusted

EBITDA" below.

Liquidity, Cash Flow, and

Debt

- As of September 28, 2024, we had cash of $78.5 million and

incremental borrowing capacity of $37.9 million under our

securitization facility. Our revolver was undrawn, with

approximately $168.2 million of borrowing capacity and

approximately $31.8 million of outstanding letters of credit.

- 2024 net cash provided by operating activities was $19.2

million. Free cash flow was $16.7 million for 2024. See “Non-GAAP

Financial Measures - Free cash flow” below.

- As of September 28, 2024 we had bank debt of $1,480.2 million.

Our interest rate exposure under our credit facilities is currently

hedged with the following instruments:

- $520.0 million notional amount of interest rate swaps that

convert variable rate debt to a fixed rate, and

- $880.0 million notional amount of interest rate caps that cap

our exposure to SOFR at 2.96%.

Matt Buckhalter, Chief Financial Officer,

commented “I am excited to report revenue growth of 6.5% and our

Adjusted EBITDA growth of 32.2% compared to the prior year period.

Our strategic cost reductions are driving this growth in

profitability, alongside the success of our preferred payor

strategy and improvements in rates from our Government

Affairs efforts. Notably, both our operating cash flow and

free cash flow turned positive year-to-date in the current quarter,

reflecting the success in our overall strategy and the momentum we

have generated in the business. Given our strong performance

through the third quarter, we are raising our guidance to

approximately $2.0 billion in revenue and greater than $168 million

in Adjusted EBITDA. I am pleased with the strides we've made

in executing our business plans, resulting in organic volume

growth, improved clinical outcomes, and enhanced

profitability.”

Revised Full Year 2024

Guidance

The following is our updated guidance reflecting

our current expectations for revenue and Adjusted EBITDA for the

full year 2024:

- Revenue of approximately $2.0 billion, updated from prior

guidance of revenue of greater than $1,985 million

Consistent with prior practice, we are not

providing guidance on net income at this time due to the volatility

of certain required inputs that are not available without

unreasonable efforts, including future fair value adjustments

associated with our interest rate swaps and caps.

Adjusted EBITDA of

greater than $168 million, updated from prior guidance of Adjusted

EBITDA greater than $158 million

Non-GAAP Financial Measures

In addition to our results of operations

prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”), we also evaluate our financial performance

using EBITDA, Adjusted EBITDA, Field contribution, Field

contribution margin, Adjusted net income or loss, Adjusted net

income or loss per diluted share, and Free cash flow. Given our

determination of adjustments in arriving at our computations, these

non-GAAP measures have limitations as analytical tools and should

not be considered in isolation or as substitutes or alternatives to

net income or loss, revenue, operating income or loss, cash flows

from operating activities, total indebtedness or any other

financial measures calculated in accordance with GAAP. The

reconciliations of these non-GAAP financial measures to their most

directly comparable GAAP measures are included in the financial

tables below.

EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA are non-GAAP

financial measures and are not intended to replace financial

performance measures determined in accordance with GAAP, such as

net income or loss. Rather, we present EBITDA and Adjusted EBITDA

as supplemental measures of our performance. We define EBITDA as

net income or loss before interest expense, net; income tax benefit

(expense); and depreciation and amortization. We define Adjusted

EBITDA as EBITDA, adjusted for the impact of certain other items

that are either non-recurring, infrequent, non-cash, unusual, or

items deemed by management to not be indicative of the performance

of our core operations, including impairments of goodwill,

intangible assets, and other long-lived assets; non-cash,

share-based compensation; loss on extinguishment of debt; fees

related to debt modifications; the effect of interest rate

derivatives; acquisition-related and integration costs; legal costs

and settlements associated with acquisition matters; restructuring

costs; other legal matters; and other system transition costs,

professional fees and other costs. As non-GAAP financial measures,

our computations of EBITDA and Adjusted EBITDA may vary from

similarly termed non-GAAP financial measures used by other

companies, making comparisons with other companies on the basis of

this measure impracticable.

We believe our computations of EBITDA and

Adjusted EBITDA are helpful in highlighting trends in our core

operating performance. In determining which adjustments are made to

arrive at EBITDA and Adjusted EBITDA, we consider both (1) certain

non-recurring, infrequent, non-cash or unusual items, which can

vary significantly from year to year, as well as (2) certain other

items that may be recurring, frequent, or settled in cash but which

we do not believe are indicative of our core operating performance.

We use EBITDA and Adjusted EBITDA to assess operating performance

and make business decisions.

We have incurred substantial acquisition-related

costs and integration costs. The underlying acquisition activities

take place over a defined timeframe, have distinct project

timelines and are incremental to activities and costs that arise in

the ordinary course of our business. Therefore, we believe it is

important to exclude these costs from our Adjusted EBITDA because

it provides us a normalized view of our core, ongoing operations

after integrating our acquired companies, which we believe is an

important measure in assessing our performance.

Field contribution and Field contribution

margin

Field contribution and Field contribution margin

are non-GAAP financial measures and are not intended to replace

financial performance measures determined in accordance with GAAP,

such as gross margin and gross margin percentage. Rather, we

present Field contribution and Field contribution margin as

supplemental measures of our performance. We define Field

contribution as gross margin less branch and regional

administrative expenses. Field contribution margin is Field

contribution as a percentage of revenue. As non-GAAP financial

measures, our computations of Field contribution and Field

contribution margin may vary from similarly termed non-GAAP

financial measures used by other companies, making comparisons with

other companies on the basis of these measures impracticable.

Field contribution and Field contribution margin

have limitations as analytical tools and should not be considered

in isolation or as substitutes or alternatives to gross margin,

gross margin percentage, net income or loss, revenue, operating

income or loss, cash flows from operating activities, total

indebtedness or any other financial measures calculated in

accordance with GAAP.

Management believes Field contribution and Field

contribution margin are helpful in highlighting trends in our core

operating performance and evaluating trends in our branch and

regional results, which can vary from year to year. We use Field

contribution and Field contribution margin to make business

decisions and assess the operating performance and results

delivered by our core field operations, prior to corporate and

other costs not directly related to our field operations. These

metrics are also important because they guide us in determining

whether or not our branch and regional administrative expenses are

appropriately sized to support our caregivers and direct patient

care operations. Additionally, Field contribution and Field

contribution margin determine how effective we are in managing our

field supervisory and administrative costs associated with

supporting our provision of services and sale of products.

Adjusted net income (loss) and Adjusted net

income (loss) per diluted share

Adjusted net income (loss) represents net income

(loss) as adjusted for the impact of GAAP income tax, goodwill,

intangible and other long-lived asset impairment charges, non-cash

share-based compensation expense, loss on extinguishment of debt,

interest rate derivatives, acquisition-related costs, integration

costs, legal costs, restructuring costs, other legal matters, other

system transition costs, professional fees and certain other

miscellaneous items on a pre-tax basis. Adjusted net income (loss)

includes a provision for income taxes derived utilizing a combined

statutory tax rate. The combined statutory tax rate is our estimate

of our long-term tax rate. The most comparable GAAP measure is net

income (loss).

Adjusted net income (loss) per diluted share

represents adjusted net income (loss) on a per diluted share basis

using the weighted-average number of diluted shares outstanding for

the period. The most comparable GAAP measure is net income (loss)

per share, diluted.

Adjusted net income (loss) and adjusted net

income (loss) per diluted share are important to us because they

allow us to assess financial results, exclusive of the items

mentioned above that are not operational in nature or comparable to

those of our competitors.

Free cash flow

Free cash flow is a liquidity measure that

represents operating cash flow, adjusted for the impact of

purchases of property, equipment and software, principal payments

on term loans, notes payable and financing leases, and settlements

with swap counterparties. The most comparable GAAP measure is cash

flow from operations.

We believe free cash flow is helpful in

highlighting the cash generated or used by the Company, after

taking into consideration mandatory payments on term loans, notes

payable and financing leases, as well as cash needed for

non-acquisition related capital expenditures, and cash paid to or

received from derivative counterparties.

Conference Call

Aveanna will host a conference call on Thursday,

November 7, 2024, at 10:00 a.m. Eastern Time to discuss our second

quarter results. The conference call can be accessed live over the

phone by dialing 1-877-407-0789, or for international callers,

1-201-689-8562. A telephonic replay of the conference call will be

available until November 14, 2024, by dialing 1-844-512-2921, or

for international callers, 1-412-317-6671. The passcode for the

replay is 13748484. A live webcast of our conference call will also

be available under the Investor Relations section of our website:

https://ir.aveanna.com/. The online replay will also be available

for one week following the call.

Forward-Looking Statements

Certain matters discussed in this press release

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. All statements

(other than statements of historical facts) in this press release

regarding our prospects, plans, financial position, business

strategy and expected financial and operational results may

constitute forward-looking statements. Forward-looking statements

generally can be identified by the use of terminology such as

“believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,”

“seek,” “will,” “may,” “should,” “would,” “predict,” “project,”

“potential,” “continue,” “could,” “design,” or the negatives of

these terms or variations of them or similar expressions. These

statements are based on certain assumptions that we have made in

light of our experience in the industry as well as our perceptions

of historical trends, current conditions, expected future

developments and other factors we believe are appropriate in these

circumstances. These forward-looking statements are based on our

current expectations and beliefs concerning future developments and

their potential effect on us. Forward-looking statements involve a

number of risks and uncertainties that may cause actual results to

differ materially from those expressed or implied by such

forward-looking statements, such as our ability to successfully

execute our growth strategy, including through organic growth and

the completion of acquisitions, effective integration of the

companies we acquire, unexpected costs of acquisitions and

dispositions, the possibility that expected cost synergies may not

materialize as expected, the failure of Aveanna or the companies we

acquire to perform as expected, estimation inaccuracies in revenue

recognition, our ability to drive margin leverage through lower

costs, unexpected increases in SG&A and other expenses, changes

in reimbursement, changes in government regulations, changes in

Aveanna’s relationships with referral sources, increased

competition for Aveanna’s services or wage inflation, the failure

to retain or attract employees, changes in the interpretation of

government regulations or discretionary determinations made by

government officials, uncertainties regarding the outcome of rate

discussions with managed care organizations and our ability to

effectively collect our cash from these organizations, changes in

the case-mix of our patients, as well as the payor mix and payment

methodologies, legal proceedings, claims or governmental inquiries,

our ability to effectively collect and submit data required under

Electronic Visit Verification regulations, our ability to comply

with the terms and conditions of the CMS Review Choice

Demonstration program, our ability to effectively implement and

transition to new electronic medical record systems or billing and

collection systems, a failure to maintain the security and

functionality of our information systems or to defend against or

otherwise prevent a cybersecurity attack or breach, changes in tax

rates, our substantial indebtedness, the impact of adverse weather,

the impact to our business operations, and other risks set

forth under the heading “Risk Factors” in Aveanna’s Annual Report

on Form 10-K for its 2023 fiscal year filed with the Securities and

Exchange Commission on March 14, 2024, which is available

at www.sec.gov. In addition, these forward-looking statements

necessarily depend upon assumptions, estimates and dates that may

prove to be incorrect or imprecise. Accordingly, forward-looking

statements included in this press release do not purport to be

predictions of future events or circumstances, and actual results

may differ materially from those expressed by forward-looking

statements. All forward-looking statements speak only as of the

date made, and Aveanna undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

About Aveanna Healthcare

Aveanna Healthcare is headquartered in Atlanta,

Georgia and has locations in 33 states providing a broad range of

pediatric and adult healthcare services including nursing,

rehabilitation services, occupational nursing in schools, therapy

services, day treatment centers for medically fragile and

chronically ill children and adults, home health and hospice

services, as well as delivery of enteral nutrition and other

products to patients. The Company also provides case management

services in order to assist families and patients by coordinating

the provision of services between insurers or other payers,

physicians, hospitals, and other healthcare providers. In addition,

the Company provides respite healthcare services, which are

temporary care provider services provided in relief of the

patient’s normal caregiver. The Company’s services are designed to

provide a high quality, lower cost alternative to prolonged

hospitalization. For more information, please

visit www.aveanna.com.

Investor Contact

Matt Buckhalter

Chief Financial Officer

Ir@aveanna.com

Cash Flow and Information about

Indebtedness

The following table sets forth a summary of our

cash flows from operating, investing, and financing activities for

the periods presented:

| |

For the nine-month periods ended |

|

| (dollars in

thousands) |

September 28, 2024 |

|

|

September 30, 2023 |

|

|

Net cash provided by operating activities |

$ |

19,231 |

|

|

$ |

25,677 |

|

| Net cash

used in investing activities |

$ |

(4,790) |

|

|

$ |

(7,226) |

|

| Net cash

provided by financing activities |

$ |

20,079 |

|

|

$ |

10,626 |

|

| Cash and

cash equivalents at beginning of period |

$ |

43,942 |

|

|

$ |

19,217 |

|

| Cash and

cash equivalents at end of period |

$ |

78,462 |

|

|

$ |

48,294 |

|

The following table presents our long-term

indebtedness as of September 28, 2024:

| (dollars in

thousands) |

|

|

|

|

|

Instrument |

Interest Rate |

|

September 28, 2024 |

|

|

2021 Extended Term Loan (1) |

S + 3.75% |

|

$ |

895,150 |

|

| Second Lien

Term Loan (1) |

S +

7.00% |

|

|

415,000 |

|

| Revolving

Credit Facility (1) |

S +

3.75% |

|

|

- |

|

|

Securitization Facility |

S +

3.15% |

|

|

170,000 |

|

| Total

indebtedness |

|

|

$ |

1,480,150 |

|

| (1) S =

Greater of 0.50% or one-month SOFR, plus a CSA |

|

|

|

|

| |

|

|

|

|

Results of Operations

The following table summarizes our consolidated

results of operations for the periods indicated (amounts in

thousands, except per share data):

|

|

For the three-month periods ended |

|

For the nine-month periods ended |

|

|

|

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

|

|

Revenue |

$ |

509,023 |

|

$ |

478,010 |

|

$ |

1,504,634 |

|

$ |

1,416,368 |

|

| Cost of

revenue, excluding depreciation and amortization |

|

349,324 |

|

|

330,746 |

|

|

1,040,814 |

|

|

969,384 |

|

| Branch and

regional administrative expenses |

|

88,184 |

|

|

91,004 |

|

|

264,070 |

|

|

273,967 |

|

| Corporate

expenses |

|

31,894 |

|

|

27,446 |

|

|

91,981 |

|

|

84,735 |

|

| Goodwill

impairment |

|

- |

|

|

105,136 |

|

|

- |

|

|

105,136 |

|

| Depreciation

and amortization |

|

2,587 |

|

|

2,962 |

|

|

8,332 |

|

|

10,494 |

|

|

Acquisition-related costs |

|

150 |

|

|

428 |

|

|

150 |

|

|

466 |

|

| Other

operating expense (income) |

|

2,860 |

|

|

(3,360) |

|

|

5,271 |

|

|

(6,593) |

|

| Operating

income (loss) |

|

34,024 |

|

|

(76,352) |

|

|

94,016 |

|

|

(21,221) |

|

| Interest

income |

|

100 |

|

|

50 |

|

|

297 |

|

|

238 |

|

| Interest

expense |

|

(39,245) |

|

|

(39,599) |

|

|

(118,505) |

|

|

(113,542) |

|

| Other

(expense) income |

|

(22,211) |

|

|

14,143 |

|

|

2,329 |

|

|

27,124 |

|

| Loss before

income taxes |

|

(27,332) |

|

|

(101,758) |

|

|

(21,863) |

|

|

(107,401) |

|

| Income tax

expense |

|

(15,511) |

|

|

(631) |

|

|

(18,246) |

|

|

(1,387) |

|

| Net

loss |

$ |

(42,843) |

|

$ |

(102,389) |

|

$ |

(40,109) |

|

$ |

(108,788) |

|

| Net loss per

share: |

|

|

|

|

|

|

|

|

| Net loss per

share, basic and diluted |

$ |

(0.22) |

|

$ |

(0.54) |

|

$ |

(0.21) |

|

$ |

(0.57) |

|

| Weighted

average shares of common stock outstanding, basic and diluted |

|

193,361 |

|

|

189,139 |

|

|

192,734 |

|

|

189,632 |

|

The following tables summarize our consolidated

key performance measures, including Field contribution and Field

contribution margin, which are non-GAAP measures, for the periods

indicated:

| |

For the three-month periods ended |

|

| (dollars in

thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

Revenue |

$ |

509,023 |

|

$ |

478,010 |

|

$ |

31,013 |

|

|

6.5% |

|

| Cost of

revenue, excluding depreciation and amortization |

|

349,324 |

|

|

330,746 |

|

|

18,578 |

|

|

5.6% |

|

| Gross

margin |

$ |

159,699 |

|

$ |

147,264 |

|

$ |

12,435 |

|

|

8.4% |

|

|

Gross margin percentage |

|

31.4% |

|

|

30.8% |

|

|

|

|

|

| Branch and

regional administrative expenses |

|

88,184 |

|

|

91,004 |

|

|

(2,820) |

|

|

-3.1% |

|

| Field

contribution |

$ |

71,515 |

|

$ |

56,260 |

|

$ |

15,255 |

|

|

27.1% |

|

|

Field contribution margin |

|

14.0% |

|

|

11.8% |

|

|

|

|

|

| Corporate

expenses |

$ |

31,894 |

|

$ |

27,446 |

|

$ |

4,448 |

|

|

16.2% |

|

|

As a percentage of revenue |

|

6.3% |

|

|

5.7% |

|

|

|

|

|

| Operating

income (loss) |

$ |

34,024 |

|

$ |

(76,352) |

|

$ |

110,376 |

|

|

144.6% |

|

|

As a percentage of revenue |

|

6.7% |

|

|

-16.0% |

|

|

|

|

|

| |

For the nine-month periods ended |

|

| (dollars in

thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

Revenue |

$ |

1,504,634 |

|

$ |

1,416,368 |

|

$ |

88,266 |

|

|

6.2% |

|

| Cost of

revenue, excluding depreciation and amortization |

|

1,040,814 |

|

|

969,384 |

|

|

71,430 |

|

|

7.4% |

|

| Gross

margin |

$ |

463,820 |

|

$ |

446,984 |

|

$ |

16,836 |

|

|

3.8% |

|

|

Gross margin percentage |

|

30.8% |

|

|

31.6% |

|

|

|

|

|

| Branch and

regional administrative expenses |

|

264,070 |

|

|

273,967 |

|

|

(9,897) |

|

|

-3.6% |

|

| Field

contribution |

$ |

199,750 |

|

$ |

173,017 |

|

$ |

26,733 |

|

|

15.5% |

|

|

Field contribution margin |

|

13.3% |

|

|

12.2% |

|

|

|

|

|

| Corporate

expenses |

$ |

91,981 |

|

$ |

84,735 |

|

$ |

7,246 |

|

|

8.6% |

|

|

As a percentage of revenue |

|

6.1% |

|

|

6.0% |

|

|

|

|

|

| Operating

income (loss) |

$ |

94,016 |

|

$ |

(21,221) |

|

$ |

115,237 |

|

|

543.0% |

|

|

As a percentage of revenue |

|

6.2% |

|

|

-1.5% |

|

|

|

|

|

The following tables summarize our key

performance measures by segment for the periods indicated:

| |

PDS |

|

|

| |

For the three-month periods ended |

|

|

| (dollars and

hours in thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

| Revenue |

$ |

409,558 |

|

$ |

384,750 |

|

$ |

24,808 |

|

|

6.4% |

|

|

| Cost of

revenue, excluding depreciation and amortization |

|

299,731 |

|

|

280,288 |

|

|

19,443 |

|

|

6.9% |

|

|

| Gross

margin |

$ |

109,827 |

|

$ |

104,462 |

|

$ |

5,365 |

|

|

5.1% |

|

|

|

Gross margin percentage |

|

26.8% |

|

|

27.2% |

|

|

|

|

-0.4% |

|

(4) |

|

| Hours |

|

10,474 |

|

|

10,090 |

|

|

384 |

|

|

3.8% |

|

|

|

Revenue rate |

$ |

39.10 |

|

$ |

38.13 |

|

$ |

0.97 |

|

|

2.6% |

|

(1) |

|

| Cost of

revenue rate |

$ |

28.62 |

|

$ |

27.78 |

|

$ |

0.84 |

|

|

3.1% |

|

(2) |

|

| Spread

rate |

$ |

10.48 |

|

$ |

10.35 |

|

$ |

0.13 |

|

|

1.3% |

|

(3) |

|

| |

|

|

|

|

|

|

|

|

|

| |

HHH |

|

|

| |

For the three-month periods ended |

|

|

| (dollars and

admissions/episodes in thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

| Revenue |

$ |

54,139 |

|

$ |

52,989 |

|

$ |

1,150 |

|

|

2.2% |

|

|

| Cost of

revenue, excluding depreciation and amortization |

|

24,948 |

|

|

27,597 |

|

|

(2,649) |

|

|

-9.6% |

|

|

| Gross

margin |

$ |

29,191 |

|

$ |

25,392 |

|

$ |

3,799 |

|

|

15.0% |

|

|

|

Gross margin percentage |

|

53.9% |

|

|

47.9% |

|

|

|

|

6.0% |

|

(4) |

|

| Home health

total admissions (5) |

|

8.9 |

|

|

9.3 |

|

|

(0.4) |

|

|

-4.3% |

|

|

| Home health

episodic admissions (6) |

|

6.8 |

|

|

7.0 |

|

|

(0.2) |

|

|

-2.9% |

|

|

| Home health

total episodes (7) |

|

11.3 |

|

|

11.2 |

|

|

0.1 |

|

|

0.9% |

|

|

| Home health

revenue per completed episode (8) |

$ |

3,104 |

|

$ |

3,046 |

|

$ |

58 |

|

|

1.9% |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

MS |

|

|

| |

For the three-month periods ended |

|

|

| (dollars and

UPS in thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

| Revenue |

$ |

45,326 |

|

$ |

40,271 |

|

$ |

5,055 |

|

|

12.6% |

|

|

| Cost of

revenue, excluding depreciation and amortization |

|

24,645 |

|

|

22,861 |

|

|

1,784 |

|

|

7.8% |

|

|

| Gross

margin |

$ |

20,681 |

|

$ |

17,410 |

|

$ |

3,271 |

|

|

18.8% |

|

|

|

Gross margin percentage |

|

45.6% |

|

|

43.2% |

|

|

|

|

2.4% |

|

(4) |

|

| Unique

patients served (“UPS”) |

|

92 |

|

|

88 |

|

|

4 |

|

|

4.5% |

|

|

| Revenue

rate |

$ |

492.67 |

|

$ |

457.63 |

|

$ |

35.04 |

|

|

8.1% |

|

(1) |

|

| Cost of

revenue rate |

$ |

267.88 |

|

$ |

259.78 |

|

$ |

8.10 |

|

|

3.3% |

|

(2) |

|

| Spread

rate |

$ |

224.79 |

|

$ |

197.84 |

|

$ |

26.94 |

|

|

14.3% |

|

(3) |

|

| |

PDS |

|

|

| |

For the nine-month periods ended |

|

|

| (dollars and

hours in thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

| Revenue |

$ |

1,212,418 |

|

$ |

1,135,365 |

|

$ |

77,053 |

|

|

6.8% |

|

|

| Cost of

revenue, excluding depreciation and amortization |

|

891,588 |

|

|

815,221 |

|

|

76,367 |

|

|

9.4% |

|

|

| Gross

margin |

$ |

320,830 |

|

$ |

320,144 |

|

$ |

686 |

|

|

0.2% |

|

|

|

Gross margin percentage |

|

26.5% |

|

|

28.2% |

|

|

|

|

-1.7% |

|

(4) |

|

| Hours |

|

31,074 |

|

|

29,738 |

|

|

1,336 |

|

|

4.5% |

|

|

|

Revenue rate |

$ |

39.02 |

|

$ |

38.18 |

|

$ |

0.84 |

|

|

2.3% |

|

(1) |

|

| Cost of

revenue rate |

$ |

28.69 |

|

$ |

27.41 |

|

$ |

1.28 |

|

|

4.9% |

|

(2) |

|

| Spread

rate |

$ |

10.33 |

|

$ |

10.77 |

|

$ |

(0.44) |

|

|

-4.3% |

|

(3) |

|

| |

|

|

|

|

|

|

|

|

|

| |

HHH |

|

|

| |

For the nine-month periods ended |

|

|

| (dollars and

admissions/episodes in thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

| Revenue |

$ |

163,382 |

|

$ |

164,525 |

|

$ |

(1,143) |

|

|

-0.7% |

|

|

| Cost of

revenue, excluding depreciation and amortization |

|

75,814 |

|

|

87,189 |

|

|

(11,375) |

|

|

-13.0% |

|

|

| Gross

margin |

$ |

87,568 |

|

$ |

77,336 |

|

$ |

10,232 |

|

|

13.2% |

|

|

|

Gross margin percentage |

|

53.6% |

|

|

47.0% |

|

|

|

|

6.6% |

|

(4) |

|

| Home health

total admissions (5) |

|

28.4 |

|

|

30.9 |

|

|

(2.5) |

|

|

-8.1% |

|

|

| Home health

episodic admissions (6) |

|

21.5 |

|

|

21.8 |

|

|

(0.3) |

|

|

-1.4% |

|

|

| Home health

total episodes (7) |

|

35.0 |

|

|

34.2 |

|

|

0.8 |

|

|

2.3% |

|

|

| Home health

revenue per completed episode (8) |

$ |

3,089 |

|

$ |

3,022 |

|

$ |

67 |

|

|

2.2% |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

MS |

|

|

| |

For the nine-month periods ended |

|

|

| (dollars and

UPS in thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

Change |

|

% Change |

|

|

| Revenue |

$ |

128,834 |

|

$ |

116,478 |

|

$ |

12,356 |

|

|

10.6% |

|

|

| Cost of

revenue, excluding depreciation and amortization |

|

73,412 |

|

|

66,974 |

|

|

6,438 |

|

|

9.6% |

|

|

| Gross

margin |

$ |

55,422 |

|

$ |

49,504 |

|

$ |

5,918 |

|

|

12.0% |

|

|

|

Gross margin percentage |

|

43.0% |

|

|

42.5% |

|

|

|

|

0.5% |

|

(4) |

|

| Unique

patients served (“UPS”) |

|

278 |

|

|

258 |

|

|

20 |

|

|

7.8% |

|

|

| Revenue

rate |

$ |

463.43 |

|

$ |

451.47 |

|

$ |

11.96 |

|

|

2.8% |

|

(1) |

|

| Cost of

revenue rate |

$ |

264.07 |

|

$ |

259.59 |

|

$ |

4.48 |

|

|

1.8% |

|

(2) |

|

| Spread

rate |

$ |

199.36 |

|

$ |

191.88 |

|

$ |

7.48 |

|

|

4.2% |

|

(3) |

|

- Represents the period over period

change in revenue rate, plus the change in revenue rate

attributable to the change in volume.

- Represents the period over period

change in cost of revenue rate, plus the change in cost of revenue

rate attributable to the change in volume.

- Represents the period over period

change in spread rate, plus the change in spread rate attributable

to the change in volume.

- Represents the change in margin

percentage year over year (or quarter over quarter).

- Represents home health episodic and

fee-for-service admissions.

- Represents home health episodic

admissions.

- Represents episodic admissions and

recertifications.

- Represents Medicare revenue per

completed episode.

The following table reconciles gross margin and

gross margin percentage to Field contribution and Field

contribution margin:

| |

For the three-month periods ended |

|

For the nine-month periods ended |

|

| (dollars in

thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

|

|

Gross margin |

$ |

159,699 |

|

$ |

147,264 |

|

$ |

463,820 |

|

$ |

446,984 |

|

| Branch and

regional administrative expenses |

|

88,184 |

|

|

91,004 |

|

|

264,070 |

|

|

273,967 |

|

| Field

contribution |

$ |

71,515 |

|

$ |

56,260 |

|

$ |

199,750 |

|

$ |

173,017 |

|

| Revenue |

$ |

509,023 |

|

$ |

478,010 |

|

$ |

1,504,634 |

|

$ |

1,416,368 |

|

| Field

contribution margin |

|

14.0% |

|

|

11.8% |

|

|

13.3% |

|

|

12.2% |

|

The following table reconciles net loss to

EBITDA and Adjusted EBITDA:

| |

|

For the three-month periods ended |

|

For the nine-month periods ended |

|

| (dollars in

thousands) |

|

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

|

|

Net loss |

|

$ |

(42,843) |

|

$ |

(102,389) |

|

$ |

(40,109) |

|

$ |

(108,788) |

|

| Interest

expense, net |

|

|

39,145 |

|

|

39,549 |

|

|

118,208 |

|

|

113,304 |

|

| Income tax

expense |

|

|

15,511 |

|

|

631 |

|

|

18,246 |

|

|

1,387 |

|

| Depreciation

and amortization |

|

|

2,587 |

|

|

2,962 |

|

|

8,332 |

|

|

10,494 |

|

| EBITDA |

|

|

14,400 |

|

|

(59,247) |

|

|

104,677 |

|

|

16,397 |

|

| Goodwill,

intangible and other long-lived asset impairment |

|

|

2,904 |

|

|

106,841 |

|

|

5,304 |

|

|

107,222 |

|

| Non-cash

share-based compensation |

|

|

4,902 |

|

|

5,116 |

|

|

12,483 |

|

|

10,143 |

|

| Interest

rate derivatives (1) |

|

|

22,141 |

|

|

(14,120) |

|

|

(2,218) |

|

|

(26,865) |

|

|

Acquisition-related costs (2) |

|

|

150 |

|

|

428 |

|

|

150 |

|

|

465 |

|

| Integration

costs (3) |

|

|

262 |

|

|

497 |

|

|

949 |

|

|

1,732 |

|

| Legal costs

and settlements associated with acquisition matters (4) |

|

|

848 |

|

|

346 |

|

|

1,423 |

|

|

(4,796) |

|

|

Restructuring (5) |

|

|

1,599 |

|

|

985 |

|

|

4,787 |

|

|

5,733 |

|

| Other legal

matters (6) |

|

|

214 |

|

|

- |

|

|

1,112 |

|

|

(5,000) |

|

| Other system

transition costs, professional fees and other (7) |

|

|

421 |

|

|

(4,655) |

|

|

(296) |

|

|

(4,504) |

|

| Total

adjustments |

|

$ |

33,441 |

|

$ |

95,438 |

|

$ |

23,694 |

|

$ |

84,130 |

|

| Adjusted

EBITDA |

|

$ |

47,841 |

|

$ |

36,191 |

|

$ |

128,371 |

|

$ |

100,527 |

|

The following table reconciles net loss to

adjusted net income (loss) and presents adjusted net income (loss)

per diluted share:

| |

For the three-month periods ended |

|

For the nine-month periods ended |

|

| (dollars in

thousands, except share and per share data) |

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

|

|

Net loss |

$ |

(42,843) |

|

$ |

(102,389) |

|

$ |

(40,109) |

|

$ |

(108,788) |

|

|

Income tax expense |

|

15,511 |

|

|

631 |

|

|

18,246 |

|

|

1,387 |

|

|

Goodwill, intangible and other long-lived asset impairment |

|

2,904 |

|

|

106,841 |

|

|

5,304 |

|

|

107,222 |

|

|

Non-cash share-based compensation |

|

4,902 |

|

|

5,116 |

|

|

12,483 |

|

|

10,143 |

|

|

Interest rate derivatives (1) |

|

22,141 |

|

|

(14,120) |

|

|

(2,218) |

|

|

(26,865) |

|

|

Acquisition-related costs (2) |

|

150 |

|

|

428 |

|

|

150 |

|

|

465 |

|

|

Integration costs (3) |

|

262 |

|

|

497 |

|

|

949 |

|

|

1,732 |

|

|

Legal costs and settlements associated with acquisition matters

(4) |

|

848 |

|

|

346 |

|

|

1,423 |

|

|

(4,796) |

|

|

Restructuring (5) |

|

1,599 |

|

|

985 |

|

|

4,787 |

|

|

5,733 |

|

|

Other legal matters (6) |

|

214 |

|

|

- |

|

|

1,112 |

|

|

(5,000) |

|

|

Other system transition costs, professional fees and other (7) |

|

421 |

|

|

(4,655) |

|

|

(296) |

|

|

(4,504) |

|

| Total

adjustments |

|

48,952 |

|

|

96,069 |

|

|

41,940 |

|

|

85,517 |

|

| Adjusted

pre-tax income (loss) |

|

6,109 |

|

|

(6,320) |

|

|

1,831 |

|

|

(23,271) |

|

| Income tax

(expense) benefit on adjusted pre-tax income (loss) (8) |

|

(1,527) |

|

|

1,580 |

|

|

(458) |

|

|

5,818 |

|

| Adjusted net

income (loss) |

$ |

4,582 |

|

$ |

(4,740) |

|

$ |

1,373 |

|

$ |

(17,453) |

|

| Weighted

average shares outstanding, diluted |

|

193,361 |

|

|

189,139 |

|

|

192,734 |

|

|

189,632 |

|

| Adjusted net

income (loss) per diluted share (9) |

$ |

0.02 |

|

$ |

(0.03) |

|

$ |

0.01 |

|

$ |

(0.09) |

|

The following footnotes are applicable to tables

above that reconcile (i) net loss to EBITDA and Adjusted EBITDA and

(ii) net loss to adjusted net income (loss).

- Represents valuation adjustments

and settlements associated with interest rate derivatives that are

not included in interest expense, net. Such items are included in

other (expense) income.

- Represents transaction costs

incurred in connection with planned, completed, or terminated

acquisitions, which include investment banking fees, legal

diligence and related documentation costs, and finance and

accounting diligence and documentation, as presented on the

Company’s consolidated statements of operations.

- Represents (i) costs associated

with our Integration Management Office, which focuses on our

integration efforts and transformational projects such as systems

conversions and implementations, material cost reduction and

restructuring projects, among other things, of $0.2 million and

$0.8 million for the three and nine-month periods ended September

28, 2024, respectively, and $0.3 million and $1.1 million for the

three and nine-month periods ended September 30, 2023,

respectively; and (ii) transitionary costs incurred to integrate

acquired companies into our field and corporate operations of $0.1

million for the nine-month period ended September 28, 2024, no such

cost was recorded during the three-month period ended September 28,

2024, and $0.2 million and $0.6 million for the three and

nine-month periods ended September 30, 2023, respectively.

Transitionary costs incurred to integrate acquired companies

include IT consulting costs and related integration support costs;

salary, severance and retention costs associated with duplicative

acquired company personnel until such personnel are exited from the

Company; accounting, legal and consulting costs; expenses and

impairments related to the closure and consolidation of overlapping

markets of acquired companies, including lease termination and

relocation costs; costs associated with terminating legacy acquired

company contracts and systems; and one-time costs associated with

rebranding our acquired companies and locations to the Aveanna

brand.

- Represents legal and forensic

costs, as well as settlements associated with resolving legal

matters arising during or as a result of our acquisition-related

activities. This primarily includes (i) costs of $0.4 million and

$1.0 million for the three and nine-month periods ended September

28, 2024, respectively, and $0.0 million and $0.3 million for the

three and nine-month periods ended September 30, 2023,

respectively, to comply with the U.S. Department of Justice,

Antitrust Division’s grand jury subpoena related to nurse wages and

hiring activities in certain of our markets, in connection with a

terminated transaction, and (ii) release of reserve of $3.6 million

for the nine-month period ended September 30, 2023, related to the

settlement of a legal matter resulting from a 2020

acquisition.

- Represents costs associated with

restructuring our branch and regional administrative footprint as

well as our corporate overhead infrastructure costs in order to

appropriately size our resources to current volumes, including: (i)

branch and regional salary and severance costs; (ii) corporate

salary and severance costs; and (iii) rent and lease termination

costs associated with the closure of certain office locations.

Restructuring costs also include compensation, severance and

related benefits costs associated with an executive transition plan

initiated in the first quarter of 2024.

- Represents activity related to

accrued legal settlements and the related costs and expenses

associated with certain judgments and arbitration awards rendered

against the Company where certain insurance coverage is in

dispute.

- Represents: (i) costs associated

with the implementation of, and transition to, new electronic

medical record systems, billing and collection systems, duplicative

system costs while such transformational projects are in-process,

and other system transition costs of $0.6 million and $1.3 million

for the three-month and nine-month periods ended September 30,

2023, respectively, no such cost was recorded in other presented

periods; (ii) a $5.1 million non-cash gain on the acquisition of

certain business licenses and other net assets in the three and

nine-month periods ended September 30, 2023, there were no such

gains recorded in any other periods, and (iii) other costs or

(income) that are either non-cash or non-core to the Company’s

ongoing operations of $0.4 million and $(0.3) million for the three

and nine-month periods ended September 28, 2024, respectively, and

$(0.2) million and $(0.8) million for the three and nine-month

periods ended September 30, 2023, respectively.

- Derived utilizing a combined

statutory rate of 25% for the for the three and nine-month periods

ended September 28, 2024, and September 30, 2023, respectively, and

applied to the respective adjusted pre-tax loss.

- Adjustments used to reconcile net

loss per diluted share on a GAAP basis to adjusted net income

(loss) per diluted share are comprised of the same adjustments,

inclusive of the tax impact, used to reconcile net loss to adjusted

net income (loss) divided by the weighted-average diluted shares

outstanding during the period.

The table below reflects the increase or

decrease, and aggregate impact, to the line items included on our

consolidated statements of operations based upon the adjustments

used in arriving at Adjusted EBITDA from EBITDA for the periods

indicated.

| |

For the three-month periods ended |

|

For the nine-month periods ended |

|

| (dollars in

thousands) |

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

|

|

Cost of revenue, excluding depreciation and amortization |

$ |

281 |

|

$ |

166 |

|

$ |

457 |

|

$ |

(4,512) |

|

| Branch and

regional administrative expenses |

|

2,515 |

|

|

2,765 |

|

|

5,389 |

|

|

6,129 |

|

| Corporate

expenses |

|

5,421 |

|

|

4,445 |

|

|

14,756 |

|

|

10,629 |

|

| Goodwill

impairment |

|

- |

|

|

105,136 |

|

|

- |

|

|

105,136 |

|

|

Acquisition-related costs |

|

150 |

|

|

428 |

|

|

150 |

|

|

465 |

|

| Other

operating expense (income) |

|

(8) |

|

|

(5,090) |

|

|

2,112 |

|

|

(8,735) |

|

| Other

(expense) income |

|

25,082 |

|

|

(12,412) |

|

|

830 |

|

|

(24,982) |

|

| Total

adjustments |

$ |

33,441 |

|

$ |

95,438 |

|

$ |

23,694 |

|

$ |

84,130 |

|

The following table reconciles the net cash

provided by operating activities to free cash flow:

| |

|

For the nine-month period ended |

|

| (dollars in

thousands) |

|

September 28, 2024 |

|

|

Net cash provided by operating activities |

|

$ |

19,231 |

|

| Purchases of

property and equipment, and software |

|

|

(4,790) |

|

| Principal

payments of term loans |

|

|

(4,600) |

|

| Principal

payments of notes payable and financing lease obligations |

|

|

(4,802) |

|

| Settlements

with swap counterparties |

|

|

11,681 |

|

| Free cash

flow |

|

$ |

16,720 |

|

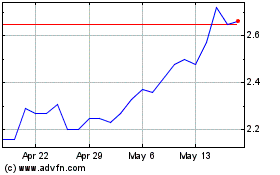

Aveanna Healthcare (NASDAQ:AVAH)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aveanna Healthcare (NASDAQ:AVAH)

Historical Stock Chart

From Jan 2024 to Jan 2025