Form 8-K - Current report

February 11 2025 - 3:40PM

Edgar (US Regulatory)

false

0001729944

0001729944

2025-02-11

2025-02-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 11, 2025

IMAC

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38797 |

|

83-0784691 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

3401

Mallory Lane, Suite 100

Franklin,

Tennessee |

|

37067 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (844) 266-4622

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

BACK |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01 Other Events.

Consent

of Independent Accounting Firms

On

February 11, 2025, IMAC Holdings, Inc. (the “Company”) filed a definitive proxy statement with the Securities and Exchange

Commission (the “SEC”). The proxy statement solicits stockholder approval of (i) a potential issuance of an excess of 19.99%

of the Company’s outstanding common stock under the Company’s outstanding Series G Preferred Stock and related warrants;

(ii) a potential issuance of an excess of 19.99% of the Company’s outstanding common stock pursuant to the Committed Equity Financing;

and (iii) an amendment to the Company’s Certificate of Incorporation to increase the total number of shares of common stock authorized

for issuance. In connection with the proxy statement filing, the consents of the Company’s former independent accounting firms

are being filed as Exhibits 23.1 and Exhibit 23.2 to this Form 8-K.

On

or about February 11, 2025, the Company will make the definitive proxy statement available to each stockholder entitled to vote at the

special meeting to be held on March 26, 2025. Investors and stockholders of the Company should read the proxy statement and other proxy

materials carefully before making any voting decision because it contains important information about the proposals included in the proxy

statement. The proxy statement and other relevant materials to be filed with the SEC in the future, including any proxy supplements,

may be obtained free of charge at the SEC web site at www.sec.gov. Investors and stockholders also may obtain free copies of documents

filed by the Company with the SEC by requesting them in writing or by telephone at IMAC Holdings, Inc., 3401 Mallory Lane, Suite 100,

Franklin, Tennessee 37067, Attention: Chief Financial Officer, Telephone (844) 266-4622, Email sgardzina@imacholdings.com.

Compliance

with Nasdaq Listing Requirements

As

previously disclosed, the Company received notice from the Nasdaq Stock Market (“Nasdaq”) advising the Company that it no

longer complied with Listing Rule 5550(b)(1) (the “Minimum Equity Rule”) and was not eligible to submit a plan to the Staff

to request an extension of up to 180 calendar days in which to regain compliance with the Minimum Equity Rule, and as a result, the Staff

had determined to delist the Company’s securities from Nasdaq. The Company requested an appeal of this determination and has a

hearing scheduled for March 4, 2025. The Company’s common stock will continue to trade on Nasdaq during the appeal process.

Item

9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

February 11, 2025

| |

IMAC

HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Faith Zaslavsky |

| |

Name: |

Faith

Zaslavsky |

| |

Title: |

Chief

Executive Officer |

Exhibit

23.1

Consent

of Independent Registered Public Accounting Firm

We

hereby consent to the incorporation by reference on Form Schedule 14A of IMAC Holdings, Inc. of our report dated April 16, 2024, on the

consolidated financial statements of IMAC Holdings, Inc. for the year ended December 31, 2023, which report is included in the Annual

Report on Form 10-K/A Amendment No. 1 of IMAC Holdings, Inc.

/s/

Salberg & Company, P.A.

SALBERG

& COMPANY, P.A.

Boca

Raton, Florida

February

10, 2025

Exhibit

23.2

Consent

of Independent Registered Public Accounting Firm

To

the Board of Directors and Stockholders of

IMAC

Holdings, Inc.

We

hereby consent to the use of our report dated March 31, 2023, with exception of Notes 10 and 15 for which the date is September 29, 2023,

and Note 2 for which the date is April 16, 2024, on the consolidated financial statements of IMAC Holdings, Inc. as of and for the year

ended December 31, 2022, which is incorporated by reference on Form 10-K/A for fiscal year ended December 31, 2023 in this Definitive

Proxy Statement (Schedule 14A).

/s/

Cherry Bekaert LLP

Nashville,

Tennessee

February

11, 2025

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity File Number |

001-38797

|

| Entity Registrant Name |

IMAC

Holdings, Inc.

|

| Entity Central Index Key |

0001729944

|

| Entity Tax Identification Number |

83-0784691

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3401

Mallory Lane

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Franklin

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37067

|

| City Area Code |

(844)

|

| Local Phone Number |

266-4622

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

BACK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

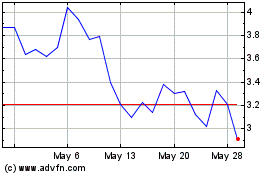

IMAC (NASDAQ:BACK)

Historical Stock Chart

From Jan 2025 to Feb 2025

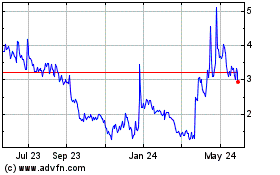

IMAC (NASDAQ:BACK)

Historical Stock Chart

From Feb 2024 to Feb 2025