Barrett Business Services, Inc. (“BBSI” or the “Company”) (NASDAQ:

BBSI), a leading provider of business management solutions,

reported financial results for the first quarter ended

March 31, 2024.

First Quarter 2024 Financial Summary vs. Year-Ago

Quarter

- Revenues up 4% to $265.8 million.

- Gross billings up 7% to $1.91 billion.

- Average worksite employees (“WSEs”) up 3%.

- Net loss of $0.1 million, or $(0.02) per diluted share,

compared to net income of $0.8 million, or $0.12 per diluted

share.

“We started the year on a strong note, with growth from net

client adds driving gross billings expansion in line with our

target,” said BBSI President and CEO Gary Kramer. “We continue to

see positive momentum from our marketing initiatives and new

product offerings, and the roll-out of BBSI Benefits continues to

perform well. We are executing to our plan and expect 2024 to be

another strong year.”

First Quarter 2024 Financial Results

Revenues in the first quarter of 2024 increased 4% to $265.8

million compared to $254.7 million in the first quarter of

2023.

Total gross billings in the first quarter of 2024 increased 7%

to $1.91 billion compared to $1.79 billion in the same year-ago

quarter (see “Key Performance Metrics” below). The increase was

driven by growth in professional employer ("PEO") services,

specifically resulting from increased WSEs from net new clients and

higher average billings per WSE.

Workers’ compensation expense as a percent of gross billings was

2.6% in the first quarter of 2024 and benefited from favorable

prior year liability and premium adjustments of $3.0 million. This

compares to 2.9% in the first quarter of 2023, which included

favorable prior year liability and premium adjustments of $1.1

million.

Net loss for the first quarter of 2024 was $0.1 million, or

$(0.02) per diluted share, compared to net income of $0.8 million,

or $0.12 per diluted share, in the year-ago quarter. The decrease

is primarily attributable to an increase in payroll taxes,

partially offset by decreased workers' compensation expense and an

increase in investment income. Due to seasonality in payroll tax

expense, the Company typically incurs lower margins at the

beginning of each year.

Liquidity

As of March 31, 2024, unrestricted cash and investments

were $123.7 million compared to $152.2 million at the end of 2023.

BBSI remained debt free at quarter end.

Capital Allocation

BBSI’s board of directors has confirmed its regular quarterly

cash dividend of $0.30 per share. The cash dividend will be paid on

May 31, 2024, to all stockholders of record as of May 17, 2024.

Continuing under the Company’s stock repurchase program

established in July 2023, BBSI repurchased 58,877 shares in the

first quarter at an average price of $119.83. At March 31,

2024, approximately $51.9 million remained available under the

repurchase program.

Outlook

BBSI continues to expect the following for 2024:

- Gross billings growth of 6% to 8%

- Growth in the average number of WSEs of 4% to 5%

- Gross margin as a percent of gross billings of 2.95% to

3.15%

- Effective annual tax rate to remain at 26% to 27%

Conference Call

BBSI will conduct a conference call on Wednesday, May 1, 2024,

at 5:00 p.m. Eastern time (2:00 p.m. Pacific time) to discuss its

financial results for the quarter ended March 31, 2024.

BBSI’s CEO Gary Kramer and CFO Anthony Harris will host the

conference call, followed by a question and answer period.

Date: Wednesday, May 1, 2024Time: 5:00 p.m. Eastern time (2:00

p.m. Pacific time)Toll-free dial-in number:

1-877-407-4018International dial-in number:

1-201-689-8471Conference ID: 13746013

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at

1-949-574-3860.

The conference call will be broadcast live and available for

replay here and via the Investors section of the BBSI website at

ir.bbsi.com.

A replay of the conference call will be available after 8:00

p.m. Eastern time on the same day through June 1, 2024.

Toll-free replay number: 1-844-512-2921International replay

number: 1-412-317-6671Replay ID: 13746013

Key Performance Metrics

We report PEO revenues net of direct payroll costs because we

are not the primary obligor for wage payments to our clients’

employees. However, management believes that gross billings and

wages are useful in understanding the volume of our business

activity and serve as important performance metrics in managing our

operations, including the preparation of internal operating

forecasts and establishing executive compensation performance

goals. We therefore present for purposes of analysis gross billings

and wage information for the three months ended March 31, 2024

and 2023.

| |

(Unaudited) |

|

| |

Three Months Ended March 31, |

|

| (in thousands) |

2024 |

|

|

2023 |

|

|

Gross billings |

$ |

1,907,549 |

|

|

$ |

1,789,218 |

|

| PEO and staffing wages |

$ |

1,656,443 |

|

|

$ |

1,551,352 |

|

| |

|

|

|

|

|

|

|

In monitoring and evaluating the performance of our operations,

management also reviews the following ratios, which represent

selected amounts as a percentage of gross billings. Management

believes these ratios are useful in understanding the efficiency

and profitability of our service offerings.

| |

(Unaudited) |

| |

Percentage of Gross Billings |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| PEO and staffing wages |

|

86.8 |

% |

|

|

86.7 |

% |

| Payroll taxes and

benefits |

|

8.5 |

% |

|

|

8.1 |

% |

| Workers' compensation |

|

2.6 |

% |

|

|

2.9 |

% |

| Gross margin |

|

2.1 |

% |

|

|

2.3 |

% |

| |

|

|

|

|

|

|

|

We refer to employees of our PEO clients as WSEs. Management

reviews average and ending WSE growth to monitor and evaluate the

performance of our operations. Average WSEs are calculated by

dividing the number of unique individuals paid in each month by the

number of months in the period. Ending WSEs represents the number

of unique individuals paid in the last month of the period.

| |

(Unaudited) |

| |

Three Months Ended March 31, |

| |

2024 |

|

|

% Change |

|

2023 |

|

|

% Change |

|

Average WSEs |

|

123,050 |

|

|

|

3.1 |

% |

|

|

119,313 |

|

|

|

2.7 |

% |

| Ending WSEs |

|

124,785 |

|

|

|

2.8 |

% |

|

|

121,363 |

|

|

|

2.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About BBSI

BBSI (NASDAQ: BBSI) is a leading provider of business management

solutions, combining human resource outsourcing and professional

management consulting to create a unique operational platform that

differentiates it from competitors. The Company’s integrated

platform is built upon expertise in payroll processing, employee

benefits, workers’ compensation coverage, risk management and

workplace safety programs, and human resource administration.

BBSI’s partnerships help businesses of all sizes improve the

efficiency of their operations. For more information, please visit

www.bbsi.com.

Forward-Looking Statements

Statements in this release about future events and financial

outlook are forward-looking statements. Such statements involve

known and unknown risks, uncertainties and other factors that may

cause the actual results of the Company to be materially different

from any future results expressed or implied by such

forward-looking statements. Factors that could affect future

results include: economic conditions in the Company’s service

areas; the lingering effects of the COVID-19 pandemic; the effects

of inflation on our operating expenses and those of our clients;

the availability of certain fully insured medical and other health

and welfare benefits to qualifying worksite employees; the effect

of changes in the Company’s mix of services on gross margin; the

Company’s ability to attract and retain clients and to achieve

revenue growth; the availability of financing or other sources of

capital; the Company’s relationship with its primary bank lender;

the potential for material deviations from expected future workers’

compensation claims experience; changes in the workers’

compensation regulatory environment in the Company’s primary

markets; litigation costs; security breaches or failures in the

Company’s information technology systems; the collectability of

accounts receivable; changes in executive management; changes in

effective payroll tax rates and federal and state income tax rates;

the carrying value of deferred income tax assets and goodwill; the

effects of conditions in the global capital markets on the

Company’s investment portfolio; and the potential for and effect of

acquisitions, among others. Other important factors that may affect

the Company’s prospects are described in the Company’s 2023 Annual

Report on Form 10-K and in subsequent reports filed with the

Securities and Exchange Commission under the Securities Exchange

Act of 1934. Although forward-looking statements help to provide

complete information about the Company, readers should keep in mind

that forward-looking statements are less reliable than historical

information. The Company undertakes no obligation to update or

revise forward-looking statements in this release to reflect events

or changes in circumstances that occur after the date of this

release.

|

Barrett Business Services, Inc.Condensed

Consolidated Balance Sheets(Unaudited) |

|

|

|

|

March 31, |

|

|

December 31, |

|

| (in thousands) |

2024 |

|

|

2023 |

|

|

ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

51,267 |

|

|

$ |

71,168 |

|

|

Investments |

|

72,410 |

|

|

|

81,027 |

|

|

Trade accounts receivable, net |

|

200,368 |

|

|

|

171,407 |

|

|

Income taxes receivable |

|

7,727 |

|

|

|

7,987 |

|

|

Prepaid expenses and other |

|

18,513 |

|

|

|

18,443 |

|

|

Restricted cash and investments |

|

125,010 |

|

|

|

97,470 |

|

|

Total current assets |

|

475,295 |

|

|

|

447,502 |

|

| Property, equipment and

software, net |

|

51,222 |

|

|

|

50,295 |

|

| Operating lease right-of-use

assets |

|

20,719 |

|

|

|

19,898 |

|

| Restricted cash and

investments |

|

141,609 |

|

|

|

145,583 |

|

| Goodwill |

|

47,820 |

|

|

|

47,820 |

|

| Other assets |

|

6,346 |

|

|

|

6,222 |

|

| Deferred income taxes |

|

4,789 |

|

|

|

4,218 |

|

| Total assets |

$ |

747,800 |

|

|

$ |

721,538 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

5,697 |

|

|

$ |

6,593 |

|

|

Accrued payroll, payroll taxes and related benefits |

|

256,061 |

|

|

|

234,080 |

|

|

Current operating lease liabilities |

|

6,345 |

|

|

|

6,623 |

|

|

Current premium payable |

|

65,820 |

|

|

|

35,276 |

|

|

Other accrued liabilities |

|

7,516 |

|

|

|

10,674 |

|

|

Workers' compensation claims liabilities |

|

46,555 |

|

|

|

50,006 |

|

|

Total current liabilities |

|

387,994 |

|

|

|

343,252 |

|

| Long-term workers'

compensation claims liabilities |

|

111,499 |

|

|

|

117,757 |

|

| Long-term premium payable |

|

33,435 |

|

|

|

37,812 |

|

| Long-term operating lease

liabilities |

|

15,594 |

|

|

|

14,590 |

|

| Customer deposits and other

long-term liabilities |

|

9,689 |

|

|

|

8,987 |

|

| Stockholders' equity |

|

189,589 |

|

|

|

199,140 |

|

| Total liabilities and

stockholders' equity |

$ |

747,800 |

|

|

$ |

721,538 |

|

|

Barrett Business Services,

Inc.Consolidated Statements of

Operations(Unaudited) |

|

| |

|

|

| |

Three Months Ended |

|

|

|

March 31, |

|

| (in thousands, except per

share amounts) |

2024 |

|

|

2023 |

|

| Revenues: |

|

|

|

|

|

|

Professional employer services |

$ |

246,189 |

|

|

$ |

232,307 |

|

|

Staffing services |

|

19,593 |

|

|

|

22,360 |

|

|

Total revenues |

|

265,782 |

|

|

|

254,667 |

|

| Cost of revenues: |

|

|

|

|

|

|

Direct payroll costs |

|

14,717 |

|

|

|

16,871 |

|

|

Payroll taxes and benefits |

|

161,895 |

|

|

|

144,582 |

|

|

Workers' compensation |

|

49,603 |

|

|

|

51,670 |

|

|

Total cost of revenues |

|

226,215 |

|

|

|

213,123 |

|

|

Gross margin |

|

39,567 |

|

|

|

41,544 |

|

| Selling, general and

administrative expenses |

|

42,414 |

|

|

|

41,226 |

|

| Depreciation and

amortization |

|

1,852 |

|

|

|

1,677 |

|

|

Loss from operations |

|

(4,699 |

) |

|

|

(1,359 |

) |

| Other income (expense): |

|

|

|

|

|

|

Investment income, net |

|

3,274 |

|

|

|

2,315 |

|

|

Interest expense |

|

(44 |

) |

|

|

(38 |

) |

|

Other, net |

|

66 |

|

|

|

36 |

|

|

Other income, net |

|

3,296 |

|

|

|

2,313 |

|

|

(Loss) income before income taxes |

|

(1,403 |

) |

|

|

954 |

|

| (Benefit from) provision for

income taxes |

|

(1,267 |

) |

|

|

135 |

|

|

Net (loss) income |

$ |

(136 |

) |

|

$ |

819 |

|

| Basic (loss) income per common

share |

$ |

(0.02 |

) |

|

$ |

0.12 |

|

| Weighted average basic common

shares outstanding |

|

6,570 |

|

|

|

6,866 |

|

| Diluted (loss) income per

common share |

$ |

(0.02 |

) |

|

$ |

0.12 |

|

| Weighted average diluted

common shares outstanding |

|

6,570 |

|

|

|

6,985 |

|

| |

Investor Relations: Gateway Group, Inc.Cody

Slach Tel 1-949-574-3860 BBSI@gateway-grp.com

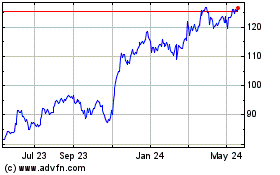

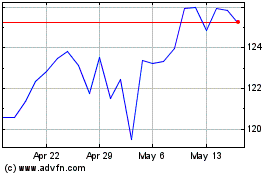

Barrett Business Services (NASDAQ:BBSI)

Historical Stock Chart

From Apr 2024 to May 2024

Barrett Business Services (NASDAQ:BBSI)

Historical Stock Chart

From May 2023 to May 2024