0000882796 False 0000882796 2025-01-10 2025-01-10 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2025

_______________________________

BioCryst Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 000-23186 | 62-1413174 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

4505 Emperor Blvd., Suite 200

Durham, North Carolina 27703

(Address of Principal Executive Offices) (Zip Code)

(919) 859-1302

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | BCRX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 10, 2025, BioCryst Pharmaceuticals, Inc. (the “Company”) issued a press release announcing preliminary, unaudited ORLADEYO® (berotralstat) net revenue and total revenue for the fourth quarter and full fiscal year ended December 31, 2024. The Company also provided guidance for full year 2025 ORLADEYO net revenue and total revenue, full year 2025 operating expenses, and its expectation that the Company will approach quarterly earnings per share profitability in the second half of the fiscal year ending December 31, 2025. The press release also referenced a previously announced, upcoming webcast presentation by the Company at the 43rd Annual J.P. Morgan Healthcare Conference in San Francisco on January 14, 2025 at 6:00 p.m. ET. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

The information furnished on Exhibit 99.1 is incorporated by reference under this Item 7.01 as if fully set forth herein.

The information in this Current Report on Form 8-K, including Exhibit 99.1 furnished hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | BioCryst Pharmaceuticals, Inc. |

| | | |

| | | |

| Date: January 10, 2025 | By: | /s/ Alane Barnes |

| | | Alane Barnes |

| | | Chief Legal Officer |

| | | |

EXHIBIT 99.1

BioCryst Announces Preliminary Full Year 2024 ORLADEYO® (berotralstat) Net Revenue of $437 Million (+34 percent y-o-y)

—ORLADEYO net revenue expected to be between $515-$535 million in 2025—

—Total revenue (including RAPIVAB®) expected to be between $540-$560 million in 2025—

—Company achieved operating profit in 2024 (not including stock-based compensation) and expects to approach quarterly EPS profitability/positive cash flow in 2H 2025—

—New drug application planned in 2025 for ORLADEYO granules in children up to age 12; will address significant unmet need—

—Pipeline advancing into patients with Netherton syndrome (BCX17725) and diabetic macular edema (avoralstat) in 2025—

RESEARCH TRIANGLE PARK, N.C., Jan. 10, 2025 (GLOBE NEWSWIRE) -- BioCryst Pharmaceuticals, Inc. (Nasdaq: BCRX) today announced preliminary, unaudited ORLADEYO® (berotralstat) net revenue and total revenue for the fourth quarter and full year 2024. The company also provided guidance for full year 2025 ORLADEYO net revenue and total revenue, full year 2025 operating expenses, and its expectation that the company will approach quarterly earnings per share (EPS) profitability in the second half of 2025.

“2024 was a year of outstanding execution for the company on multiple fronts and it is exciting to carry this momentum into 2025. We had another year of exceptional ORLADEYO revenue growth moving us significantly closer to peak sales of $1 billion, and we did this while driving the company toward profitability in the near-term. We are excited that this year we expect to submit a new drug application to expand the ORLADEYO label to children under age 12 and to be in patient studies in two new clinical programs (BCX17725 and avoralstat),” said Jon Stonehouse, president and chief executive officer of BioCryst.

Preliminary Fourth Quarter and Full Year 2024 ORLADEYO Revenue and Total Revenue, and 2025 ORLADEYO and Total Revenue Outlook

Preliminary, unaudited ORLADEYO net revenue in the fourth quarter of 2024 was $123.5 million (+36 percent y-o-y). Preliminary, unaudited ORLADEYO net revenue for full year 2024 was $437 million (+34 percent y-o-y).

The company expects full year 2025 global net ORLADEYO revenue will be between $515 million and $535 million.

“ORLADEYO revenue accelerated in 2024, with 34 percent annual growth in the fourth year on the market, compared to 30 percent in 2023. Over 1,200 U.S. physicians have prescribed ORLADEYO, and thousands of patients have benefitted in over 30 countries worldwide as physicians and patients continue to gain confidence in the exceptional efficacy and convenience that are possible with ORLADEYO. As we head into 2025, oral, preventative therapy with ORLADEYO is the new benchmark for HAE, and we are excited to soon bring this new option to children under age 12,” said Charlie Gayer, chief commercial officer of BioCryst.

Preliminary, unaudited total revenue in the fourth quarter of 2024 was $130.8 million (+40 percent y-o-y). Preliminary, unaudited total revenue for full year 2024 was $450 million (+36 percent y-o-y). The company expects full year 2025 total revenue (including RAPIVAB® (peramivir injection)) will be between $540 million and $560 million.

Operating Expense Outlook

The company expects full year 2025 GAAP operating expenses to be between $485 million and $495 million. This includes an estimated $60 million related to stock-based compensation, therefore operating expenses not including stock-based compensation are forecasted at between $425 million and $435 million for the year. This operating expense outlook includes additional commercial investment to support the launch of the company’s pediatric product in HAE, ongoing work on the transition study (APeX-T), and continued generation of real-world evidence to support and enhance the company’s global commercial activities. For R&D, the additional investments include support for clinical activities for both BCX17725 and avoralstat.

Profitability Outlook

In 2024, revenue growth significantly exceeded operating expense growth. The company expects this pattern to continue, and over the next three years the company expects an annual CAGR for revenue of around 20 percent, compared to a projected annual operating expense CAGR of closer to five percent over the same period. Building on its significant operating profit in 2024 (not including stock-based compensation), the company expects to approach quarterly positive EPS and positive cash flow in the second half of 2025, and to be profitable on an EPS basis, with positive cash flow, for full year 2026.

Presentation Tuesday at 43rd Annual J.P. Morgan Healthcare Conference

On Tuesday, January 14, 2025 at 6:00 p.m. ET, the company will present at the 43rd Annual J.P. Morgan Healthcare Conference in San Francisco. Links to a live audio webcast and replay of the presentation may be accessed in the Investors section of BioCryst’s website at www.biocryst.com.

About BioCryst Pharmaceuticals

BioCryst Pharmaceuticals is a global biotechnology company with a deep commitment to improving the lives of people living with hereditary angioedema and other rare diseases. BioCryst leverages its expertise in structure-guided drug design to develop first-in-class or best-in-class oral small-molecule and protein therapeutics to target difficult-to-treat diseases. BioCryst has commercialized ORLADEYO® (berotralstat), the first oral, once-daily plasma kallikrein inhibitor, and is advancing a pipeline of small-molecule and protein therapies. For more information, please visit www.biocryst.com or follow us on LinkedIn.

Non-GAAP Financial Measures

The information furnished in this release includes non-GAAP financial measures that differ from measures calculated in accordance with generally accepted accounting principles in the United States of America (GAAP). In particular, we provide the non-GAAP financial measure of expected full year 2025 GAAP operating expense, adjusted to show the expected results without including our estimated stock-based compensation expense.

We believe providing this non-GAAP measure, which shows our expectations with this item adjusted, is valuable and useful since it allows management and investors to better understand the company’s expected financial performance in the absence of certain non-cash items, such as stock-based compensation, and allows investors to more accurately understand our expectations and compare them to future results. This non-GAAP measure also corresponds with the way we expect Wall Street analysts to compare our results. Non-GAAP measures should be considered only as supplements to, and not as substitutes for or in isolation from, our other measures of financial information prepared in accordance with GAAP, such as GAAP revenue, operating income, net income and earnings per share.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding preliminary, unaudited revenue results and future results, performance or achievements. These statements involve known and unknown risks, uncertainties and other factors which may cause BioCryst’s actual results, performance or achievements to be materially different from any preliminary, unaudited revenue results and future results, performance or achievements expressed or implied by the forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Some of the factors that could affect the forward-looking statements contained herein include: BioCryst’s completion of its customary closing, review and audit procedures for the fourth quarter and full year 2024, which may cause actual revenue results for these periods to differ materially from the preliminary, unaudited revenue results; BioCryst’s ability to successfully implement or maintain its commercialization plans for ORLADEYO; BioCryst’s ability to successfully progress its pipeline development plans as described herein; the results of BioCryst’s partnerships with third parties may not meet BioCryst’s current expectations; risks related to government actions, including that decisions and other actions, including as they relate to pricing, may not be taken when expected or at all, or that the outcomes of such decisions and other actions may not be in line with BioCryst’s current expectations; the commercial viability of ORLADEYO, including its ability to achieve sustained market acceptance and demand; ongoing and future preclinical and clinical development of product candidates may take longer than expected and may not have positive results; BioCryst may not be able to enroll the required number of subjects in planned clinical trials of product candidates; BioCryst may not advance human clinical trials with product candidates as expected; the FDA or other applicable regulatory agency may require additional studies beyond the studies planned for products and product candidates, may not provide regulatory clearances which may result in delay of planned clinical trials, may impose certain restrictions, warnings, or other requirements on products and product candidates, may impose a clinical hold with respect to product candidates, or may withhold, delay or withdraw market approval for products and product candidates; product candidates, if approved, may not achieve market acceptance; BioCryst’s ability to successfully commercialize its products and product candidates; BioCryst’s ability to successfully manage its growth and compete effectively; risks related to the international expansion of BioCryst’s business; timing for achieving and sustainability of profitability and positive cash flow may not meet management’s expectations; statements and projections regarding financial guidance and goals and the attainment of such goals may differ from actual results based on market factors and BioCryst’s ability to execute its operational and budget plans; and actual financial results may not be consistent with expectations, including that revenue, operating expenses and cash usage may not be within management’s expected ranges. Please refer to the documents BioCryst files periodically with the Securities and Exchange Commission, specifically BioCryst’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, which identify important factors that could cause actual results to differ materially from those contained in BioCryst’s projections and forward-looking statements.

BCRXW

Contact:

John Bluth

+1 919 859 7910

jbluth@biocryst.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

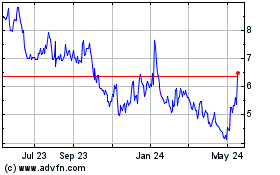

BioCryst Pharmaceuticals (NASDAQ:BCRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

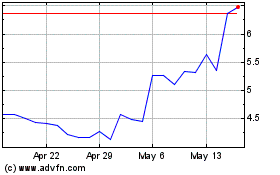

BioCryst Pharmaceuticals (NASDAQ:BCRX)

Historical Stock Chart

From Feb 2024 to Feb 2025