BLINK CHARGING ANNOUNCES PRELIMINARY FULL-YEAR 2023 REVENUE IN EXCESS OF $140 MILLION, REITERATES ADJUSTED EBITDA PROFITABILITY TARGET

February 14 2024 - 6:45AM

Blink Charging Co. (Nasdaq: BLNK) (“Blink” or the “Company”), a

leading manufacturer, owner, operator, and provider of electric

vehicle (EV) charging equipment and services, today announced that

it anticipates its fourth-quarter 2023 revenue to surpass $42

million. With this achievement, the Company expects full-year 2023

revenue to surpass $140 million, exceeding its previously announced

revenue target of $128 - $133 million.

Brendan Jones, President and CEO, said: “We are

excited about our record-breaking fourth-quarter and full-year 2023

revenue growth. We saw strong demand for both our equipment and

services. This is the result of consistent and systematic steps

that we took to strengthen our product portfolio and service

offerings, supported by our vertical integration strategy and

dedicated customer service team”.

Blink also reaffirms its target of achieving a

positive Adjusted EBITDA run rate by December 2024.

“By adopting the ‘right charger, right

place, right time’ approach, Blink ensures electric vehicle

charging is efficient and readily available, encouraging more

people to make the switch to sustainable transportation,” stated

Brendan Jones, considering preliminary year-end financial

results. The success of Blink’s demonstrated progress reflects

on the proven track record in strategically deploying nationwide EV

charging infrastructure and ensuring widespread charger

availability.

Blink will announce its fourth-quarter 2023

earnings call date, dial-in details, and further information at a

later date.

###

About Blink Charging Blink

Charging Co. (Nasdaq: BLNK), a global leader in electric vehicle

(EV) charging equipment, has contracted, sold, or deployed nearly

85,000 charging ports worldwide, many of which are networked EV

charging stations, enabling EV drivers to easily charge at any of

Blink’s charging locations. Blink’s principal line of products and

services includes the Blink EV charging network (“Blink Network”),

EV charging equipment, EV charging services, and the products and

services of recent acquisitions, including SemaConnect, Blue

Corner, BlueLA and Envoy. The Blink Network uses proprietary,

cloud-based software that operates, maintains, and tracks the EV

charging stations connected to the network and the associated

charging data. With global EV purchases forecasted to half of

passenger cars sold in the US by 2030, Blink has established key

strategic partnerships for rolling out adoption across numerous

location types, including parking facilities, multifamily

residences and condos, workplace locations, health care/medical

facilities, schools and universities, airports, auto dealers,

hotels, mixed-use municipal locations, parks and recreation areas,

religious institutions, restaurants, retailers, stadiums,

supermarkets, and transportation hubs.

For more information, please visit

https://blinkcharging.com/.

EBITDA and Adjusted EBITDA

Definitions EBITDA is defined as earnings (loss)

attributable to Blink Charging Co. before interest income

(expense), provision for income taxes, depreciation and

amortization. Blink Charging believes EBITDA is useful to its

management, securities analysts, and investors in evaluating

operating performance because it is one of the primary measures

used to evaluate the economic productivity of the Company’s

operations, including its ability to obtain and maintain its

customers, its ability to operate its business effectively, the

efficiency of its employees and the profitability associated with

their performance. It also helps Blink Charging’s management,

securities analysts, and investors to meaningfully evaluate and

compare the results of the Company’s operations from period to

period on a consistent basis by removing the impact of its merger

and acquisition expenses, financing transactions, and the

depreciation and amortization impact of capital investments from

its operating results.

The Company also believes that Adjusted EBITDA,

defined as EBITDA adjusted for stock-based compensation expense,

acquisition related costs, and one-time non-recurring expenses,

non-cash impairment charges, and non-cash loss on extinguishment of

notes payable is useful to securities analysts and investors to

evaluate the Company’s core operating results and financial

performance because it excludes items that are significant non-cash

or non-recurring expenses reflected in the Condensed Consolidated

Statements of Operations.

Our definition of Adjusted EBITDA may differ

from other companies reporting similarly named measures. These

measures should be considered in addition to, and not as a

substitute for, or superior to, other measures of financial

performance prepared in accordance with GAAP, such as Net Loss.

Forward-Looking Statements This

press release contains forward-looking statements as defined within

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These

forward-looking statements, and terms such as “anticipate,”

“expect,” “intend,” “may,” “will,” “should” or other comparable

terms, involve risks and uncertainties because they relate to

events and depend on circumstances that will occur in the future.

Those statements include statements regarding the intent, belief or

current expectations of Blink Charging and members of its

management, as well as the assumptions on which such statements are

based. Prospective investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, including achieving projected

fourth quarter and full year 2023 revenue and 2024 adjusted EBITDA

and those described in Blink Charging’s periodic reports filed with

the SEC, and that actual results may differ materially from those

contemplated by such forward-looking statements. Except as required

by federal securities law, Blink Charging undertakes no obligation

to update or revise forward-looking statements to reflect changed

conditions.

Blink Media Contact Nipunika

Coe PR@BlinkCharging.com 305-521-0200 ext. 266

Blink Investor Relations

Contact Vitalie Stelea IR@BlinkCharging.com 305-521-0200

ext. 446

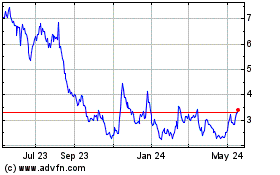

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Dec 2024 to Jan 2025

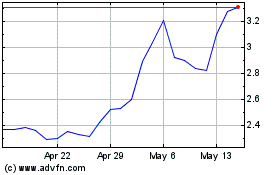

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Jan 2024 to Jan 2025