false

0000010329

0000010329

2024-07-10

2024-07-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 10, 2024

BASSETT FURNITURE INDUSTRIES, INCORPORATED

(Exact name of registrant as specified in its charter)

|

Virginia

|

000-00209

|

54-0135270

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File No.)

|

(I.R.S. Employer

Identification No.)

|

|

3525 Fairystone Park Highway

Bassett, Virginia

|

24055

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (276) 629-6000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| |

Title of each class

|

|

Trading Symbol

|

|

Name of exchange on which registered

|

| |

Common Stock ($5.00 par value)

|

|

BSET

|

|

NASDAQ

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On July 10, 2024, Bassett Furniture Industries issued a news release relating to the second quarter financial results for the fiscal year ending November 30, 2024. A copy of the news release announcing this information is attached to this report as Exhibit 99.1.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

104

|

Cover Page Interactive Data File (embedded within the inline XBRL document)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| July 10, 2024 |

By:

|

/s/ J. Michael Daniel

|

|

| |

|

J. Michael Daniel

|

|

| |

|

Title: Senior Vice President – Chief Financial & Administrative Officer

|

Exhibit 99

|

Bassett Furniture Industries, Inc.

P.O. Box 626

Bassett, VA 24055

|

Contacts:

J. Michael Daniel

Senior Vice President and

Chief Financial Officer

(276) 629-6614 – Investors

mdaniel@bassettfurniture.com

Peter D. Morrison

Vice President of Communications

(276) 629-6450 – Media

|

For immediate release

Bassett Reports Fiscal Second Quarter Results and Launches Restructuring Plan

(Bassett, Va.) – July 10, 2024 – Bassett Furniture Industries, Inc. (Nasdaq: BSET) reported today its results of operations for its second quarter ended June 1, 2024. The Company also announced a restructuring plan designed to improve long-term operational and financial performance.

Q2 Consolidated Business Highlights: [FY 24 vs. FY 23, unless otherwise specified]

| |

●

|

Revenues decreased 17%.

|

| |

●

|

When comparing to the first quarter of 2024, revenues increased 3.8%, normalizing the first quarter for the extra week due to our fiscal calendar.

|

| |

●

|

Operating loss of $8.5 million which included asset impairment charges of $5.5 million and additional inventory valuation charges of $2.7 million.

|

| |

●

|

Gross margin of 52.5%, which included the increased inventory valuation charges noted above. Excluding the inventory valuation charges, gross profit margin would have been 55.7% (see Table 5).

|

| |

●

|

Loss per share of $0.82 vs. diluted earnings per share $0.24.

|

| |

●

|

Generated $5.8 million of operating cash flow for the quarter.

|

Fiscal 2024 Second Quarter Overview

(Dollars in millions)

| |

|

Sales

|

|

|

Operating Income (Loss)

|

|

| |

|

2nd Qtr

|

|

|

Dollar

|

|

|

%

|

|

|

2nd Qtr

|

|

|

% of

|

|

|

2nd Qtr

|

|

|

% of

|

|

| |

|

2024

|

|

|

2023

|

|

|

Change

|

|

|

Change

|

|

|

2024

|

|

|

Sales

|

|

|

2023

|

|

|

Sales

|

|

|

Consolidated (1)

|

|

$ |

83.4 |

|

|

$ |

100.5 |

|

|

$ |

(17.1 |

) |

|

|

-17.0 |

% |

|

$ |

(8.5 |

) |

|

|

-10.2 |

% |

|

$ |

2.5 |

|

|

|

2.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale

|

|

$ |

52.6 |

|

|

$ |

61.8 |

|

|

$ |

(9.2 |

) |

|

|

-14.9 |

% |

|

$ |

5.7 |

|

|

|

10.8 |

% |

|

$ |

7.0 |

|

|

|

11.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail

|

|

$ |

50.5 |

|

|

$ |

60.8 |

|

|

$ |

(10.3 |

) |

|

|

-16.9 |

% |

|

$ |

(2.2 |

) |

|

|

-4.4 |

% |

|

$ |

0.8 |

|

|

|

1.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate & Other (2)

|

|

$ |

1.1 |

|

|

$ |

2.3 |

|

|

$ |

(1.2 |

) |

|

|

-52.2 |

% |

|

$ |

(6.9 |

) |

|

|

N/A |

|

|

$ |

(6.9 |

) |

|

|

N/A |

|

| (1) |

Our consolidated results include certain intercompany eliminations as well as asset impairment charges of $5.5 million which are not allocated to our segment operating results. See Table 4, “Segment Information” below for an illustration of the effects of these items on our consolidated sales and operating income.

|

| (2) |

Corporate and Other includes the operations of Noa Home Inc. along with the shared Corporate costs that are benefiting both the Wholesale and Retail segments.

|

“Excluding the additional inventory valuation charges that we recorded, we were pleased with another quarter of strong gross margins, despite lower sales.” said Robert H. Spilman, Jr., Bassett Chairman and Chief Executive Officer. “The environment for housing remains challenging and consumers are choosing to invest in experiences over their homes, a change from the Covid period. We continue to be disciplined on expenses to improve operating efficiency.”

Restructuring Plan

The Company also announced a restructuring plan to more right-size its cost structure and to prepare it for topline growth. The comprehensive strategy builds on the strength of Bassett’s brand quality, design expertise and service, and focuses on driving revenue growth and profitability long-term. The five-point plan includes:

| |

●

|

Drive organic growth through Bassett-branded retail locations, omni-channel capabilities, and enhanced customization positioning to expand dedicated distribution footprint.

|

| |

●

|

Rationalize US wood manufacturing from two locations into one primary location, supported by a small satellite operation.

|

| |

●

|

Optimize inventory and drop unproductive lines.

|

| |

●

|

Improve overall cost structure and invest capital in refurbishment of current retail locations.

|

| |

●

|

Close the Noa Home e-commerce business.

|

“Bassett Furniture has a long history of weathering economic cycles, such as the inflationary environment and slow housing market we’re experiencing in 2024 – factors that led to soft demand in our second quarter,” explained Spilman. “The business climate has remained difficult through the first six months of this year and may not improve in the near future. Accordingly, we are committed to returning to profitability by running a leaner operation, with priority focus on both our inventory position and the overall cost structure. We believe that our restructuring plan, expected to improve our bottom line between $5.5 million and $6.5 million on an annual basis, coupled with our solid balance sheet, puts us in a position to be a considerably stronger company when customer demand inevitably improves. I’m particularly pleased that our Board believes in our ability to improve operations and continue our strong cash generation by increasing our quarterly dividend by 11%.”

Conference Call and Webcast

The Company will hold a conference call to discuss its quarterly results on July 11, 2024, at 9:00 am ET. The public is invited to listen to the conference call by webcast, accessible through the Company’s investor relations website, https://investors.bassettfurniture.com/. Participants can also listen to the conference call via https://edge.media-server.com/mmc/p/332ii2e5. A replay and transcript of the conference call will be available on demand on the investor relations site.

About Bassett Furniture Industries, Inc.

Bassett Furniture Industries, Inc. (NASDAQ: BSET) is a leading manufacturer and marketer of high-quality home furnishings. With 88 company- and licensee-owned stores at the time of this release, Bassett has leveraged its strong brand name in furniture into a network of corporate and licensed stores that focus on providing consumers with a friendly environment for buying furniture and accessories. Bassett’s retail strategy includes stylish, custom-built furniture that features the latest on-trend furniture styles, free in-home design visits, and coordinated decorating accessories. Bassett also has a traditional wholesale business with more than 700 accounts on the open market, across the United States and internationally. For more information, visit the Company’s website at bassettfurniture.com. (BSET-E)

Forward-Looking Statements

Certain of the statements in this release, particularly those preceded by, followed by or including the words “believes,” “plans,” “expects,” “anticipates,” “intends,” “should,” “estimates,” or similar expressions, or those relating to or anticipating financial results or changes in operations for periods beyond the end of the second fiscal quarter of 2024, constitute “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended. For those statements, Bassett claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. In many cases, Bassett cannot predict what factors would cause actual results to differ materially from those indicated in the forward-looking statements. Expectations included in the forward-looking statements are based on preliminary information, as well as certain assumptions which management believes to be reasonable at this time. The following important factors affect Bassett and could cause actual results to differ materially from those indicated in the forward looking statements: the effects of national and global economic or other conditions and future events on the retail demand for home furnishings and the ability of Bassett’s customers and consumers to obtain credit; the success of marketing, logistics, retail and other initiatives; and the economic, competitive, governmental and other factors identified in Bassett’s filings with the Securities and Exchange Commission. Any forward-looking statement that Bassett makes speaks only as of the date of such statement, and Bassett undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indication of future performance, unless expressed as such, and should only be viewed as historical data.

|

Table 1

|

|

BASSETT FURNITURE INDUSTRIES, INC. AND SUBSIDIARIES

|

|

Condensed Consolidated Statements of Operations - unaudited

|

|

(In thousands, except for per share data)

|

| |

|

Quarter Ended

|

|

|

Six Months

|

|

| |

|

June 1, 2024

|

|

|

May 27, 2023

|

|

|

June 1, 2024

|

|

|

May 27, 2023

|

|

| |

|

|

|

|

|

Percent of

|

|

|

|

|

|

|

Percent of

|

|

|

|

|

|

|

Percent of

|

|

|

|

|

|

|

Percent of

|

|

| |

|

Amount

|

|

|

Net Sales

|

|

|

Amount

|

|

|

Net Sales

|

|

|

Amount

|

|

|

Net Sales

|

|

|

Amount

|

|

|

Net Sales

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales of furniture and accessories

|

|

$ |

83,410 |

|

|

|

100.0 |

% |

|

$ |

100,519 |

|

|

|

100.0 |

% |

|

$ |

169,964 |

|

|

|

100.0 |

% |

|

$ |

208,217 |

|

|

|

100.0 |

% |

|

Cost of furniture and accessories sold

|

|

|

39,650 |

|

|

|

47.5 |

% |

|

|

47,686 |

|

|

|

47.4 |

% |

|

|

78,337 |

|

|

|

46.1 |

% |

|

|

98,187 |

|

|

|

47.2 |

% |

|

Gross profit

|

|

|

43,760 |

|

|

|

52.5 |

% |

|

|

52,833 |

|

|

|

52.6 |

% |

|

|

91,627 |

|

|

|

53.9 |

% |

|

|

110,030 |

|

|

|

52.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

46,707 |

|

|

|

56.0 |

% |

|

|

51,366 |

|

|

|

51.1 |

% |

|

|

96,931 |

|

|

|

57.0 |

% |

|

|

105,861 |

|

|

|

50.8 |

% |

|

Asset impairment charges

|

|

|

5,515 |

|

|

|

6.6 |

% |

|

|

- |

|

|

|

0.0 |

% |

|

|

5,515 |

|

|

|

3.2 |

% |

|

|

- |

|

|

|

0.0 |

% |

|

Gain on revaluation of contingent consideration

|

|

|

- |

|

|

|

0.0 |

% |

|

|

1,013 |

|

|

|

1.0 |

% |

|

|

- |

|

|

|

0.0 |

% |

|

|

1,013 |

|

|

|

0.5 |

% |

|

Income (loss) from operations

|

|

|

(8,462 |

) |

|

|

-10.1 |

% |

|

|

2,480 |

|

|

|

2.5 |

% |

|

|

(10,819 |

) |

|

|

-6.4 |

% |

|

|

5,182 |

|

|

|

2.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

627 |

|

|

|

0.8 |

% |

|

|

569 |

|

|

|

0.6 |

% |

|

|

1,383 |

|

|

|

0.8 |

% |

|

|

721 |

|

|

|

0.3 |

% |

|

Other loss, net

|

|

|

(276 |

) |

|

|

-0.3 |

% |

|

|

(505 |

) |

|

|

-0.5 |

% |

|

|

(380 |

) |

|

|

-0.2 |

% |

|

|

(1,072 |

) |

|

|

-0.5 |

% |

|

Income (loss) before income taxes

|

|

|

(8,111 |

) |

|

|

-9.7 |

% |

|

|

2,544 |

|

|

|

2.5 |

% |

|

|

(9,816 |

) |

|

|

-5.8 |

% |

|

|

4,831 |

|

|

|

2.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit)

|

|

|

(910 |

) |

|

|

-1.1 |

% |

|

|

468 |

|

|

|

0.5 |

% |

|

|

(1,422 |

) |

|

|

-0.8 |

% |

|

|

1,310 |

|

|

|

0.6 |

% |

|

Net income (loss)

|

|

|

(7,201 |

) |

|

|

-8.6 |

% |

|

|

2,076 |

|

|

|

2.1 |

% |

|

|

(8,394 |

) |

|

|

-4.9 |

% |

|

|

3,521 |

|

|

|

1.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings (loss) per share

|

|

$ |

(0.82 |

) |

|

|

|

|

|

$ |

0.24 |

|

|

|

|

|

|

$ |

(0.96 |

) |

|

|

|

|

|

$ |

0.40 |

|

|

|

|

|

|

Table 2

|

|

BASSETT FURNITURE INDUSTRIES, INC. AND SUBSIDIARIES

|

|

Condensed Consolidated Balance Sheets

|

|

(In thousands)

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

Assets

|

|

June 1, 2024

|

|

|

November 25, 2023

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

42,646 |

|

|

$ |

52,407 |

|

|

Short-term investments

|

|

|

17,814 |

|

|

|

17,775 |

|

|

Accounts receivable, net

|

|

|

13,495 |

|

|

|

13,736 |

|

|

Inventories, net

|

|

|

56,875 |

|

|

|

62,982 |

|

|

Recoverable income taxes

|

|

|

2,896 |

|

|

|

2,574 |

|

|

Other current assets

|

|

|

9,377 |

|

|

|

8,480 |

|

|

Total current assets

|

|

|

143,103 |

|

|

|

157,954 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

79,802 |

|

|

|

83,981 |

|

| |

|

|

|

|

|

|

|

|

|

Other long-term assets

|

|

|

|

|

|

|

|

|

|

Deferred income taxes, net

|

|

|

6,085 |

|

|

|

4,645 |

|

|

Goodwill and other intangible assets

|

|

|

14,213 |

|

|

|

16,067 |

|

|

Right of use assets under operating leases

|

|

|

94,748 |

|

|

|

100,888 |

|

|

Other

|

|

|

7,313 |

|

|

|

6,889 |

|

|

Total long-term assets

|

|

|

122,359 |

|

|

|

128,489 |

|

|

Total assets

|

|

$ |

345,264 |

|

|

$ |

370,424 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

12,188 |

|

|

$ |

16,338 |

|

|

Accrued compensation and benefits

|

|

|

8,424 |

|

|

|

8,934 |

|

|

Customer deposits

|

|

|

23,021 |

|

|

|

22,788 |

|

|

Current portion of operating lease obligations

|

|

|

18,293 |

|

|

|

18,827 |

|

|

Other accrued expenses

|

|

|

9,056 |

|

|

|

11,003 |

|

|

Total current liabilities

|

|

|

70,982 |

|

|

|

77,890 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term liabilities

|

|

|

|

|

|

|

|

|

|

Post employment benefit obligations

|

|

|

10,758 |

|

|

|

10,207 |

|

|

Long-term portion of operating lease obligations

|

|

|

90,646 |

|

|

|

97,357 |

|

|

Other long-term liabilities

|

|

|

1,218 |

|

|

|

1,529 |

|

|

Total long-term liabilities

|

|

|

102,622 |

|

|

|

109,093 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

43,808 |

|

|

|

43,842 |

|

|

Retained earnings

|

|

|

127,807 |

|

|

|

139,354 |

|

|

Additional paid-in-capital

|

|

|

52 |

|

|

|

93 |

|

|

Accumulated other comprehensive income (loss)

|

|

|

(7 |

) |

|

|

152 |

|

|

Total stockholders' equity

|

|

|

171,660 |

|

|

|

183,441 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

345,264 |

|

|

$ |

370,424 |

|

|

Table 3

|

|

BASSETT FURNITURE INDUSTRIES, INC. AND SUBSIDIARIES

|

|

Consolidated Statements of Cash Flows - unaudited

|

|

(In thousands)

|

| |

|

Six Months

|

|

| |

|

June 1, 2024

|

|

|

May 27, 2023

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(8,394 |

) |

|

$ |

3,521 |

|

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

5,291 |

|

|

|

4,909 |

|

|

Non-cash asset impairment charges

|

|

|

5,515 |

|

|

|

- |

|

|

Gain on revaluation of contingent consideration

|

|

|

- |

|

|

|

(1,013 |

) |

|

Inventory valuation charges

|

|

|

3,879 |

|

|

|

2,475 |

|

|

Deferred income taxes

|

|

|

(1,440 |

) |

|

|

392 |

|

|

Other, net

|

|

|

689 |

|

|

|

1,388 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

241 |

|

|

|

3,005 |

|

|

Inventories

|

|

|

2,228 |

|

|

|

15,145 |

|

|

Other current and long-term assets

|

|

|

(1,217 |

) |

|

|

953 |

|

|

Right of use assets under operating leases

|

|

|

8,707 |

|

|

|

9,105 |

|

|

Customer deposits

|

|

|

233 |

|

|

|

(12,022 |

) |

|

Accounts payable and other liabilities

|

|

|

(6,930 |

) |

|

|

(8,715 |

) |

|

Obligations under operating leases

|

|

|

(10,721 |

) |

|

|

(10,255 |

) |

|

Net cash provided by (used in) operating activities

|

|

|

(1,919 |

) |

|

|

8,888 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(3,683 |

) |

|

|

(7,405 |

) |

|

Proceeds from disposal of discontinued operations, net

|

|

|

- |

|

|

|

1,000 |

|

|

Other

|

|

|

(383 |

) |

|

|

(637 |

) |

|

Net cash used in investing activities

|

|

|

(4,066 |

) |

|

|

(7,042 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Cash dividends

|

|

|

(3,153 |

) |

|

|

(2,832 |

) |

|

Other issuance of common stock

|

|

|

179 |

|

|

|

177 |

|

|

Repurchases of common stock

|

|

|

(489 |

) |

|

|

(3,450 |

) |

|

Taxes paid related to net share settlement of equity awards

|

|

|

(161 |

) |

|

|

(109 |

) |

|

Repayments of finance lease obligations

|

|

|

(153 |

) |

|

|

(137 |

) |

|

Net cash used in financing activities

|

|

|

(3,777 |

) |

|

|

(6,351 |

) |

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

1 |

|

|

|

(42 |

) |

|

Change in cash and cash equivalents

|

|

|

(9,761 |

) |

|

|

(4,547 |

) |

|

Cash and cash equivalents - beginning of period

|

|

|

52,407 |

|

|

|

61,625 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents - end of period

|

|

$ |

42,646 |

|

|

$ |

57,078 |

|

|

Table 4

|

|

BASSETT FURNITURE INDUSTRIES, INC. AND SUBSIDIARIES

|

|

Segment Information - unaudited

|

|

(In thousands)

|

| |

|

Quarter Ended

|

|

|

Six Months

|

|

| |

|

June 1, 2024

|

|

|

May 27, 2023

|

|

|

June 1, 2024

|

|

|

May 27, 2023

|

|

|

Sales Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale sales of furniture and accessories

|

|

$ |

52,609 |

|

|

$ |

61,774 |

|

|

$ |

107,310 |

|

|

$ |

131,658 |

|

|

Less: Sales to retail segment

|

|

|

(20,751 |

) |

|

|

(24,330 |

) |

|

|

(44,514 |

) |

|

|

(54,429 |

) |

|

Wholesale sales to external customers

|

|

|

31,858 |

|

|

|

37,444 |

|

|

|

62,796 |

|

|

|

77,229 |

|

|

Retail sales of furniture and accessories

|

|

|

50,468 |

|

|

|

60,778 |

|

|

|

104,222 |

|

|

|

125,740 |

|

|

Corporate & Other - Noa Home (1)

|

|

|

1,084 |

|

|

|

2,297 |

|

|

|

2,946 |

|

|

|

5,248 |

|

|

Consolidated net sales of furniture and accessories

|

|

$ |

83,410 |

|

|

$ |

100,519 |

|

|

$ |

169,964 |

|

|

$ |

208,217 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) before Income Taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wholesale

|

|

$ |

5,687 |

|

|

$ |

7,005 |

|

|

$ |

12,446 |

|

|

$ |

15,999 |

|

|

Retail

|

|

|

(2,222 |

) |

|

|

755 |

|

|

|

(3,834 |

) |

|

|

2,285 |

|

|

Net expenses - Corporate and other (1)

|

|

|

(6,942 |

) |

|

|

(6,949 |

) |

|

|

(14,537 |

) |

|

|

(14,720 |

) |

|

Inter-company elimination

|

|

|

530 |

|

|

|

656 |

|

|

|

621 |

|

|

|

605 |

|

|

Asset impairment charges

|

|

|

(5,515 |

) |

|

|

- |

|

|

|

(5,515 |

) |

|

|

|

|

|

Gain on revaluation of contingent consideration

|

|

|

- |

|

|

|

1,013 |

|

|

|

- |

|

|

|

1,013 |

|

|

Consolidated income (loss) from operations

|

|

|

(8,462 |

) |

|

|

2,480 |

|

|

|

(10,819 |

) |

|

|

5,182 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

627 |

|

|

|

569 |

|

|

|

1,383 |

|

|

|

721 |

|

|

Other loss, net

|

|

|

(276 |

) |

|

|

(505 |

) |

|

|

(380 |

) |

|

|

(1,072 |

) |

|

Consolidated income (loss) before income taxes

|

|

$ |

(8,111 |

) |

|

$ |

2,544 |

|

|

$ |

(9,816 |

) |

|

$ |

4,831 |

|

|

(1) Corporate and Other includes the operations of Noa Home Inc. along with the shared Corporate costs that are benefiting both the Wholesale and Retail segments.

|

|

Table 5

|

|

BASSETT FURNITURE INDUSTRIES, INC. AND SUBSIDIARIES

|

|

Adjusted Gross Profit

|

|

(In thousands)

|

| |

|

Quarter Ended

|

|

|

Six Months Ended

|

|

| |

|

June 1, 2024

|

|

|

May 27, 2023

|

|

|

June 1, 2024

|

|

|

May 27, 2023

|

|

| |

|

|

|

|

|

Percent of

|

|

|

|

|

|

|

Percent of

|

|

|

|

|

|

|

Percent of

|

|

|

|

|

|

|

Percent of

|

|

| |

|

Amount

|

|

|

Net Sales

|

|

|

Amount

|

|

|

Net Sales

|

|

|

Amount

|

|

|

Net Sales

|

|

|

Amount

|

|

|

Net Sales

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit as reported

|

|

$ |

43,760 |

|

|

|

52.5 |

% |

|

$ |

52,833 |

|

|

|

52.6 |

% |

|

$ |

91,627 |

|

|

|

52.5 |

% |

|

$ |

110,030 |

|

|

|

52.8 |

% |

|

Additional inventory valuation charges

|

|

|

2,701 |

|

|

|

3.2 |

% |

|

|

1,003 |

|

|

|

1.0 |

% |

|

|

2,701 |

|

|

|

1.6 |

% |

|

|

1,003 |

|

|

|

0.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit as adjusted

|

|

$ |

46,461 |

|

|

|

55.7 |

% |

|

$ |

53,836 |

|

|

|

53.6 |

% |

|

$ |

94,328 |

|

|

|

55.5 |

% |

|

$ |

111,033 |

|

|

|

53.3 |

% |

v3.24.2

Document And Entity Information

|

Jul. 10, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BASSETT FURNITURE INDUSTRIES, INCORPORATED

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 10, 2024

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

000-00209

|

| Entity, Tax Identification Number |

54-0135270

|

| Entity, Address, Address Line One |

3525 Fairystone Park Highway

|

| Entity, Address, City or Town |

Bassett

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

24055

|

| City Area Code |

276

|

| Local Phone Number |

629-6000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BSET

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000010329

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

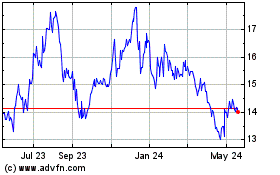

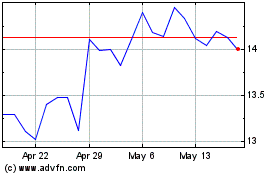

Bassett Furniture Indust... (NASDAQ:BSET)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bassett Furniture Indust... (NASDAQ:BSET)

Historical Stock Chart

From Jul 2023 to Jul 2024