false

0001157762

0001157762

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 13, 2024

China Automotive Systems, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

000-33123 |

33-0885775 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

No. 1 Henglong Road, Yu Qiao Development Zone

Shashi District, Jing Zhou City

Hubei Province

The People's Republic of China

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code (86) 27-8757 0027

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which

registered |

| Common Stock, $0.0001 par value |

CAAS |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition |

On November 13, 2024, China Automotive Systems,

Inc. issued a press release announcing financial results for the quarter ended September 30, 2024. The press release is attached as Exhibit

99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and in Exhibit

99.1 attached to this Form 8-K is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

China Automotive Systems, Inc. |

| |

(Registrant) |

| |

|

|

| Date: November 13, 2024 |

By: |

/s/ Hanlin Chen |

| |

|

Hanlin Chen |

| |

|

Chairman |

Exhibit 99.1

China

Automotive Systems Reports Sales Increased by 19.4%

in the Third Quarter of 2024

WUHAN,

China, November 13, 2024 -- China Automotive Systems, Inc. (NASDAQ: CAAS) ("CAAS" or the "Company"), a

leading power steering components and systems supplier in China, today announced its unaudited financial results for the third quarter

and nine months ended September 30, 2024.

Third

Quarter 2024 Highlights

| · | Net sales rose 19.4% year-over-year to $164.2 million from $137.5 million in the third quarter of 2023. |

| · | Gross profit increased by 6.5% year-over-year to $26.4 million from $24.8 million in the third quarter of 2023; gross margin was 16.0%

in the third quarter of 2024 compared to 18.0% in the third quarter of 2023. |

| · | Income from operations was $11.1 million for the third quarter of 2024, a nearly 10.0% increase compared to $10.2 million for the

three months ended September 30, 2023. |

| · | Net income attributable to parent company’s common shareholders was $5.5 million, or diluted earnings

per share of $0.18. |

First

Nine Months of 2024 Highlights

| · | Net sales grew by 10.8% year-over-year to $462.2 million, compared to $417.2 million in the first nine months of 2023. |

| · | Gross profit increased by 15.4% year-over-year to $79.7 million, compared to $69.1 million in the first nine months of 2023; gross

margin increased to 17.2% in the first nine months of 2024 from 16.6% in the same period last year. |

| · | Income from operations rose by 22.9% year-over-year to $31.6 million compared to income from operations of $25.7 million in the first

nine months of 2023. |

| · | Net income attributable to parent company’s common shareholders was $20.9 million. |

| · | Diluted earnings per share attributable to parent company’s common shareholders was $0.69. |

| · | Cash and cash equivalents, and pledged cash were $138.8 million, or approximately $4.60 per share, as of September 30, 2024. |

| · | A special cash dividend of $0.80 per common share was paid to shareholders in August 2024. |

Mr. Qizhou Wu, Chief Executive Officer of CAAS, commented, “We are pleased to report sales growth for both the third quarter

and the nine-month periods. Our third quarter’s solid performance was driven by a noteworthy 43.5% year-over-year increase in sales

of Electric Power Steering (“EPS”) products, now accounting for almost 40.0% of our total sales. Additionally, sales of traditional

steering products in the domestic Chinese passenger vehicle market climbed by 29.6% year-over-year, despite a slower industry growth environment.

We are also pleased to see our commercial vehicle market sales rebounded with a 10.5% increase this quarter. Domestic sales were buoyed

by the vehicle replacement cycle and subsidy policies. All business units, with the exception of North America, reported sales growth

in the third quarter of 2024.”

“According

to statistics from the China Association of Automobile Manufacturers, overall automobile sales in China increased by 2.1% year-over-year

in the first nine months of 2024 with passenger car sales up by 3.0% and commercial vehicle sales lower by 1.6%. Sales of new energy

vehicles increased by 32.5% and Chinese vehicle exports rose by 27.3% for the first nine months of 2024.”

“Given

our recent financial performance and positive outlook, our shareholders were rewarded with a special cash dividend of $0.80 per common

share in August of 2024. Also in August 2024, we celebrated the 20th anniversary of our NASDAQ listing,” Mr. Wu concluded.

Mr. Jie

Li, Chief Financial Officer of CAAS, commented, “We continued to maintain a strong balance sheet with cash and cash equivalents

plus pledged cash of $138.8 million, despite spending $9.3 million on cash dividends to shareholders and investing $18.3 million in property,

plant and equipment in the first nine months of 2024. At September 30th, working capital was $156.6 million and positive

cash flow from operations increased by almost 54.0% year-over-year in the first nine months of 2024. We remain well positioned in our

markets for long-term growth.”

Third Quarter of 2024

Net

sales increased by 19.4% year-over-year to $164.2 million in the third quarter of 2024, compared to $137.5 million in the third quarter

of 2023. Net sales of traditional steering products and parts increased by 7.4% year-over-year to $98.6 million for the third quarter

of 2024, compared to $91.8 million for the same quarter in 2023. Net sales of EPS products rose 43.5% year-over-year to $65.6 million

from $45.7 million for the same period in 2023. EPS product sales grew to 39.9% of the total net sales for the third quarter of

2024, compared to 33.2% for the same period in 2023. Sales of Henglong’s passenger vehicle steering systems increased by 29.6% and

sales to Chery Auto rose by 12.4% due to higher demand. Sales to the commercial vehicle markets increased by 10.5%. Export sales to North

American customers decreased to $18.7 million in the third quarter of 2024, compared to $27.6 million in the third quarter of 2023. North

American sales declined primarily due to decreased demand from one customer. Sales in Brazil were $14.3 million in the third quarter of

2024, compared to $13.3 million in the third quarter of 2023. Net product sales for other entities rose 23.4% to $35.2 million compared

to $28.5 million for the third quarter in 2023.

Gross

profit grew by 6.5% year-over-year to $26.4 million from $24.8 million in the third quarter of 2023. Gross margin was 16.0% in

the third quarter of 2024 compared to 18.0% in the third quarter of 2023. The change in gross margin was mainly due to the changes in

the product mix for the three months ended September 30, 2024.

Gain

on other sales was $0.6 million in the third quarter of 2024, compared to $2.2 million in the third quarter of 2023.

Selling

expenses increased by 14.6% year-over-year to $4.4 million compared to $3.8 million in the third quarter of 2023. This expense increase

was primarily due to higher warehouse and logistic costs related to the increased revenue. Selling expenses represented 2.7% of net sales

in the third quarter of 2024, compared to 2.8% in the third quarter of 2023.

General

and administrative expenses (“G&A expenses”) decreased by 17.0% year-over-year to $5.1 million, compared to $6.1

million in the third quarter of 2023, primarily due to the reversal of bad debt provisions for receivables. G&A expenses represented

3.1% of net sales in the third quarter of 2024, compared to 4.4% of net sales in the third quarter of 2023.

Research

and development expenses (“R&D expenses”) decreased by 7.1% year-over-year to $6.4 million compared to $6.9 million in

the third quarter of 2023. This decrease was related to lower R&D miscellaneous expenses caused by a reduction

in R&D activities for new projects. R&D expenses represented 3.9% of net sales in the third quarter of 2024, compared to 5.0%

in the third quarter of 2023.

Other

income was $1.3 million for the third quarter of 2024, which is stable compared to $1.2 million for the three months ended September 30,

2023.

Income

from operations was $11.1 million for the third quarter of 2024, a nearly 10.0% increase compared to $10.2 million for the three months

ended September 30, 2023.

Interest

expense was $0.3 million in the third quarter of 2024 compared to $0.2 million in the third quarter of 2023.

Net

financial expense was $0.2 million in the third quarter of 2024, compared to net financial income of $0.2 million in the third

quarter of 2023. The change in net financial expense/income primarily resulted from an increase in the foreign exchange losses due to

the foreign exchange volatility.

Income

before income tax expenses and equity in earnings of affiliated companies was $11.9 million in the third quarter of 2024, compared to

income before income tax expenses and equity in earnings of affiliated companies of $11.2 million in the third quarter of 2023.

Income

tax expense was $4.0 million in the third quarter of 2024 compared to $0.7 million for the third quarter

of 2023, primarily due to a one-time income tax expense settlement for the subsidiaries in the PRC and an increase

in the Global Intangible Low-Taxed Income (“GILTI”) tax expenses.

Net

income attributable to parent company’s common shareholders was $5.5 million in the third quarter of 2024, compared to net

income attributable to parent company’s common shareholders of $9.5 million in the third quarter of 2023. Diluted earnings per share

was $0.18 in the third quarter of 2024, compared to $0.31 per share in the third quarter of 2023.

The weighted

average number of diluted common shares outstanding was 30,185,702 in the third quarter of 2024, compared to 30,189,363 in the third quarter

of 2023.

First

Nine Months of 2024

Net

sales increased by 10.8% year-over-year to $462.2 million in the first nine months of 2024, compared to $417.2 million in the first nine

months of 2023 primarily due to an increase in sales of both traditional steering and EPS products.

Nine-month gross profit increased by 15.4% year-over-year to $79.7 million from $69.1 million in the corresponding period last year. Nine-month

gross margin increased to 17.2% from 16.6% in the first nine months of 2023. Gain on other sales was $2.8 million in the first nine months

of 2024, compared to $3.6 million in the corresponding period last year. Income from operations increased by 22.9% year-over-year to $31.6

million in the first nine months of 2024 from $25.7 million in the first nine months of 2023.

Net

income attributable to parent company’s common shareholders was $20.9 million in the first nine months of 2024, compared

to net income attributable to parent company’s common shareholders of $26.8 million in the corresponding period in 2023. Diluted

earnings per share in the first nine months of 2024 were $0.69, compared to diluted earnings per share of $0.89 in the first nine months

of 2023.

Balance

Sheet

As

of September 30, 2024, total cash and cash equivalents, and pledged cash were $138.8 million, total accounts receivable including

notes receivable were $314.2 million, accounts payable including notes payable were $271.8 million and short-term loans were $59.7 million.

Total parent company stockholders’ equity was $388.6 million as of September 30, 2024, compared to $367.8 million as of December 31,

2023.

Business

Outlook

Management has raised its

revenue guidance for the full year 2024 to $630.0 million. This target is based on the Company's current views on operating and market

conditions, which are subject to change.

Conference Call

Management

will conduct a conference call on Wednesday, November 13, 2024 at 8:00 A.M. EST/9:00 P.M. Beijing Time to discuss these

results. A question and answer session will follow management's presentation. To participate, please see the dial-in information

below, enter the call 10 minutes before the call start time and ask to be connected to the "China Automotive Systems" conference

call:

Phone Number: +1-888-506-0062 (North America)

Phone Number: +1-973-528-0011 (International)

Mainland China Toll Free:

+86-400-120-3199

Code: 546311

A replay of the call will

be available on the Company’s website under the investor relations section.

About China Automotive

Systems, Inc.

Based in Hubei Province, the People's Republic of China, China Automotive Systems, Inc. is a leading supplier of power steering components

and systems to the Chinese automotive industry, operating through eight Sino-foreign joint ventures. The Company offers a full range of

steering system parts for passenger automobiles and commercial vehicles. The Company currently offers four separate series of power steering

with an annual production capacity of over 8 million sets of steering gears, columns and steering hoses. Its customer base is comprised

of leading auto manufacturers, such as China FAW Group, Corp., Dongfeng Auto Group Co., Ltd., BYD Auto Company Limited, Beiqi

Foton Motor Co., Ltd. and Chery Automobile Co., Ltd. in China, and Stellantis N.V. and Ford Motor Company in North America.

For more information, please visit: http://www.caasauto.com.

Forward-Looking

Statements

This

press release contains statements that are "forward-looking statements" as defined under the Private Securities Litigation Reform

Act of 1995. Forward-looking statements represent our estimates and assumptions only as of the date of this press release. Our actual

results may differ materially from the results described in or anticipated by our forward-looking statements due to certain risks and

uncertainties. As a result, the Company's actual results could differ materially from those contained in these forward-looking statements

due to a number of factors, including those described under the heading "Risk Factors" in the Company's Annual Report on Form 10-K

as filed with the Securities and Exchange Commission on March 28, 2024, and in documents subsequently filed by the Company from time

to time with the Securities and Exchange Commission. Any of these factors and other factors beyond our control, could have an adverse

effect on the overall business environment, cause uncertainties in the regions where we conduct business, cause our business to suffer

in ways that we cannot predict and materially and adversely impact our business, financial condition and results of operations. A prolonged

disruption or any further unforeseen delay in our operations of the manufacturing, delivery and assembly process within any of our production

facilities could continue to result in delays in the shipment of products to our customers, increased costs and reduced revenue. We expressly

disclaim any duty to provide updates to any forward-looking statements made in this press release, whether as a result of new information,

future events or otherwise.

For further

information, please contact:

Jie

Li

Chief

Financial Officer

China

Automotive Systems, Inc.

jieli@chl.com.cn

Kevin

Theiss

Awaken Advisors

+1-212-521-4050

Kevin@awakenlab.com

-Tables Follow –

China Automotive Systems, Inc. and Subsidiaries

Condensed Unaudited Consolidated Statements

of Operations and Comprehensive Income

(In thousands of USD, except share and per share

amounts)

| | |

Three Months Ended September 30, | |

| | |

2024 | | |

2023 | |

| Net product sales ($13,703 and $8,407 sold to related parties for the three months ended September 30, 2024 and 2023) | |

$ | 164,215 | | |

$ | 137,541 | |

| Cost of products sold ($7,217 and $6,266 purchased from related parties for the three months ended September 30, 2024 and 2023) | |

| 137,859 | | |

| 112,784 | |

| Gross profit | |

| 26,356 | | |

| 24,757 | |

| Gain on other sales | |

| 553 | | |

| 2,177 | |

| Less: Operating expenses | |

| | | |

| | |

| Selling expenses | |

| 4,357 | | |

| 3,803 | |

| General and administrative expenses | |

| 5,070 | | |

| 6,108 | |

| Research and development expenses | |

| 6,383 | | |

| 6,870 | |

| Total operating expenses | |

| 15,810 | | |

| 16,781 | |

| Income from operations | |

| 11,099 | | |

| 10,153 | |

| Other income, net | |

| 1,251 | | |

| 1,155 | |

| Interest expense | |

| (271 | ) | |

| (245 | ) |

| Financial (expense)/income, net | |

| (167 | ) | |

| 163 | |

| Income before income tax expenses and equity in earnings of affiliated companies | |

| 11,912 | | |

| 11,226 | |

| Less: Income taxes | |

| 4,042 | | |

| 688 | |

| Add: Equity in earnings of affiliated companies | |

| 203 | | |

| 706 | |

| Net income | |

| 8,073 | | |

| 11,244 | |

| Less: Net income attributable to non-controlling interests | |

| 2,562 | | |

| 1,749 | |

| Accretion to redemption value of redeemable non-controlling interests | |

| (7 | ) | |

| (7 | ) |

| Net income attributable to parent company’s common shareholders | |

$ | 5,504 | | |

$ | 9,488 | |

| Comprehensive income: | |

| | | |

| | |

| Net income | |

$ | 8,073 | | |

$ | 11,244 | |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation gain, net of tax | |

| 6,584 | | |

| 3,580 | |

| Comprehensive income | |

| 14,657 | | |

| 14,824 | |

| Less: Comprehensive income attributable to non-controlling interests | |

| 3,287 | | |

| 3,590 | |

| Accretion to redemption value of redeemable non-controlling interests | |

| (7 | ) | |

| (7 | ) |

| Comprehensive income attributable to parent company | |

$ | 11,363 | | |

$ | 11,227 | |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders per share - | |

| | | |

| | |

| Basic | |

$ | 0.18 | | |

$ | 0.31 | |

| Diluted | |

$ | 0.18 | | |

$ | 0.31 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding - | |

| | | |

| | |

| Basic | |

| 30,185,702 | | |

| 30,185,702 | |

| Diluted | |

| 30,185,702 | | |

| 30,189,363 | |

China Automotive Systems, Inc. and Subsidiaries

Condensed Unaudited Consolidated Statements

of Operations and Comprehensive Income

(In thousands of USD, except share and per share

amounts)

| | |

Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | |

| Net product sales ($38,613 and $35,177 sold to related parties for the nine months ended September 30, 2024 and 2023) | |

$ | 462,217 | | |

$ | 417,194 | |

| Cost of products sold ($21,874 and $20,592 purchased from related parties for the nine months ended September 30, 2024 and 2023) | |

| 382,490 | | |

| 348,101 | |

| Gross profit | |

| 79,727 | | |

| 69,093 | |

| Gain on other sales | |

| 2,787 | | |

| 3,572 | |

| Less: Operating expenses | |

| | | |

| | |

| Selling expenses | |

| 13,044 | | |

| 10,981 | |

| General and administrative expenses | |

| 18,035 | | |

| 16,132 | |

| Research and development expenses | |

| 19,879 | | |

| 19,866 | |

| Total operating expenses | |

| 50,958 | | |

| 46,979 | |

| Income from operations | |

| 31,556 | | |

| 25,686 | |

| Other income, net | |

| 5,389 | | |

| 4,620 | |

| Interest expense | |

| (712 | ) | |

| (770 | ) |

| Financial (expense)/income, net | |

| (869 | ) | |

| 3,704 | |

| Income before income tax expenses and equity in earnings of affiliated companies | |

| 35,364 | | |

| 33,240 | |

| Less: Income taxes | |

| 7,893 | | |

| 3,004 | |

| Add: Equity in (losses)/earnings of affiliated companies | |

| (1,379 | ) | |

| 359 | |

| Net income | |

| 26,092 | | |

| 30,595 | |

| Less: Net income attributable to non-controlling interests | |

| 5,159 | | |

| 3,799 | |

| Accretion to redemption value of redeemable non-controlling interests | |

| (22 | ) | |

| (22 | ) |

| Net income attributable to parent company’s common shareholders | |

$ | 20,911 | | |

$ | 26,774 | |

| Comprehensive income: | |

| | | |

| | |

| Net income | |

$ | 26,092 | | |

$ | 30,595 | |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation gain/(loss), net of tax | |

| 3,390 | | |

| (8,752 | ) |

| Comprehensive income | |

| 29,482 | | |

| 21,843 | |

| Less: Comprehensive income attributable to non-controlling interests | |

| 5,659 | | |

| 4,831 | |

| Accretion to redemption value of redeemable non-controlling interests | |

| (22 | ) | |

| (22 | ) |

| Comprehensive income attributable to parent company | |

$ | 23,801 | | |

$ | 16,990 | |

| | |

| | | |

| | |

| Net income attributable to parent company’s common shareholders per share - | |

| | | |

| | |

| Basic | |

$ | 0.69 | | |

$ | 0.89 | |

| Diluted | |

$ | 0.69 | | |

$ | 0.89 | |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding - | |

| | | |

| | |

| Basic | |

| 30,185,702 | | |

| 30,185,702 | |

| Diluted | |

| 30,185,702 | | |

| 30,190,660 | |

China Automotive Systems, Inc.

and Subsidiaries

Condensed Unaudited Consolidated Balance Sheets

(In thousands of USD unless otherwise indicated)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 98,310 | | |

$ | 114,660 | |

| Pledged cash | |

| 40,514 | | |

| 40,534 | |

| Accounts and notes receivable, net - unrelated parties | |

| 295,515 | | |

| 261,237 | |

| Accounts and notes receivable, net - related parties | |

| 18,658 | | |

| 8,169 | |

| Inventories | |

| 108,880 | | |

| 112,392 | |

| Other current assets | |

| 28,245 | | |

| 27,083 | |

| Total current assets | |

| 590,122 | | |

| 564,075 | |

| Non-current assets: | |

| | | |

| | |

| Property, plant and equipment, net | |

| 100,703 | | |

| 101,359 | |

| Land use rights, net | |

| 9,130 | | |

| 9,233 | |

| Long-term investments | |

| 60,236 | | |

| 60,173 | |

| Other non-current assets | |

| 68,841 | | |

| 31,600 | |

| Total assets | |

$ | 829,032 | | |

$ | 766,440 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term loans | |

$ | 59,744 | | |

$ | 48,005 | |

| Accounts and notes payable-unrelated parties | |

| 259,134 | | |

| 240,739 | |

| Accounts and notes payable-related parties | |

| 12,658 | | |

| 12,839 | |

| Accrued expenses and other payables | |

| 65,253 | | |

| 44,771 | |

| Other current liabilities | |

| 36,718 | | |

| 37,385 | |

| Total current liabilities | |

| 433,507 | | |

| 383,739 | |

| Long-term liabilities: | |

| | | |

| | |

| Long-term tax payable | |

| — | | |

| 8,781 | |

| Other non-current liabilities | |

| 6,266 | | |

| 5,498 | |

| Total liabilities | |

$ | 439,773 | | |

$ | 398,018 | |

| | |

| | | |

| | |

| Mezzanine equity: | |

| | | |

| | |

| Redeemable non-controlling interests | |

| 635 | | |

| 613 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.0001 par value – Authorized – 80,000,000 shares; Issued – 32,338,302 and 32,338,302 shares as of September 30, 2024 and December 31, 2023, respectively, including treasury stock | |

$ | 3 | | |

$ | 3 | |

| Additional paid-in capital | |

| 69,722 | | |

| 63,731 | |

| Retained earnings- | |

| | | |

| | |

| Appropriated | |

| 12,174 | | |

| 11,851 | |

| Unappropriated | |

| 281,271 | | |

| 284,832 | |

| Accumulated other comprehensive income | |

| (5,368 | ) | |

| (8,258 | ) |

| Treasury stock – 2,152,600 and 2,152,600 shares as of September 30, 2024 and December 31, 2023, respectively | |

| (7,695 | ) | |

| (7,695 | ) |

| Total parent company stockholders’ equity | |

| 350,107 | | |

| 344,464 | |

| Non-controlling interests | |

| 38,517 | | |

| 23,345 | |

| Total stockholders’ equity | |

| 388,624 | | |

| 367,809 | |

| Total liabilities, mezzanine equity and stockholders’ equity | |

$ | 829,032 | | |

$ | 766,440 | |

China Automotive Systems, Inc. and Subsidiaries

Condensed Unaudited Consolidated Statements

of Cash Flows

(In thousands of USD unless otherwise indicated)

| | |

Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 26,092 | | |

$ | 30,595 | |

| Adjustments to reconcile net income from operations to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 14,574 | | |

| 13,666 | |

| Reversal of credit losses | |

| (903 | ) | |

| (450 | ) |

| Deferred income taxes | |

| — | | |

| (1,017 | ) |

| Equity in earnings/(losses) of affiliated companies | |

| 1,379 | | |

| (359 | ) |

| Loss on property, plant and equipment disposals | |

| 1,133 | | |

| 79 | |

| (Increase)/decrease in: | |

| | | |

| | |

| Accounts and notes receivable | |

| (40,350 | ) | |

| (24,315 | ) |

| Inventories | |

| 4,653 | | |

| 6,070 | |

| Other current assets | |

| 874 | | |

| (1,391 | ) |

| Other non-current assets | |

| (874 | ) | |

| (517 | ) |

| Increase/(decrease) in: | |

| | | |

| | |

| Accounts and notes payable | |

| 12,996 | | |

| (6,198 | ) |

| Accrued expenses and other payables | |

| 4,945 | | |

| 849 | |

| Long-term taxes payable | |

| (7,025 | ) | |

| (5,268 | ) |

| Other current liabilities | |

| (952 | ) | |

| (1,004 | ) |

| Net cash provided by operating activities | |

| 16,542 | | |

| 10,740 | |

| Cash flows from investing activities: | |

| | | |

| | |

| Cash received from property, plant and equipment sales | |

| 1,359 | | |

| 664 | |

| Payments to acquire property, plant and equipment (including $4,597 and $6,414 paid to related parties for the nine months ended September 30, 2024 and 2023, respectively) | |

| (18,268 | ) | |

| (12,184 | ) |

| Payments to acquire intangible assets | |

| (383 | ) | |

| (2,437 | ) |

| Investments under the equity method | |

| (2,283 | ) | |

| (7,729 | ) |

| Purchase of short-term investments | |

| (58,472 | ) | |

| (55,290 | ) |

| Proceeds from maturities of short-term investments | |

| 25,373 | | |

| 48,281 | |

| Cash received from long-term investments | |

| 1,396 | | |

| 3,115 | |

| Net cash used in investing activities | |

| (51,278 | ) | |

| (25,580 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from bank loans | |

| 64,461 | | |

| 42,828 | |

| Repayments of bank loans | |

| (54,394 | ) | |

| (48,147 | ) |

| Dividends paid to the common shareholders | |

| (9,318 | ) | |

| — | |

| Cash received from capital contributions of a non-controlling interest | |

| 15,504 | | |

| — | |

| Net cash provided by/(used in) financing activities | |

| 16,253 | | |

| (5,319 | ) |

| Effects of exchange rate on cash, cash equivalents and pledged cash | |

| 2,113 | | |

| (3,671 | ) |

| Net decrease in cash, cash equivalents and pledged cash | |

| (16,370 | ) | |

| (23,830 | ) |

| Cash, cash equivalents and pledged cash at beginning of the period | |

| 155,194 | | |

| 158,951 | |

| Cash, cash equivalents and pledged cash at end of the period | |

$ | 138,824 | | |

$ | 135,121 | |

v3.24.3

Cover

|

Nov. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2024

|

| Entity File Number |

000-33123

|

| Entity Registrant Name |

China Automotive Systems, Inc.

|

| Entity Central Index Key |

0001157762

|

| Entity Tax Identification Number |

33-0885775

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

No. 1 Henglong Road, Yu Qiao Development Zone

|

| Entity Address, Address Line Two |

Shashi District

|

| Entity Address, Address Line Three |

Jing Zhou City

|

| Entity Address, City or Town |

Hubei Province

|

| Entity Address, Country |

CN

|

| City Area Code |

86

|

| Local Phone Number |

27-8757 0027

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

CAAS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

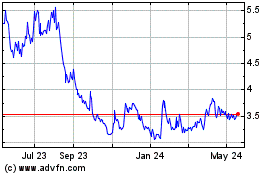

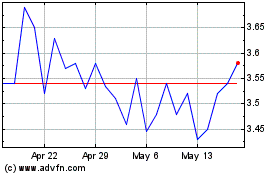

China Automotive Systems (NASDAQ:CAAS)

Historical Stock Chart

From Oct 2024 to Nov 2024

China Automotive Systems (NASDAQ:CAAS)

Historical Stock Chart

From Nov 2023 to Nov 2024