Avis Budget Group, Inc. (

NASDAQ: CAR) announced

financial results for the fourth quarter and full year ended

December 31, 2024 today.

We ended 2024 with fourth quarter revenues of

$2.7 billion, driven by strong leisure holiday travel. Net

loss was nearly $2 billion, and Adjusted EBITDA1 was a loss of

$101 million. Full year revenues were $11.8 billion,

driven by sustained year-over-year demand. Net loss was

$1.8 billion, and Adjusted EBITDA was $628 million.

Our net loss and Adjusted EBITDA results reflect

a change in strategy to significantly accelerate fleet rotations,

which resulted in shortening the useful life of the majority of our

vehicles in the Americas segment. The financial impact of this

decision was a one-time non-cash impairment of $2.3 billion

and other non-cash related charges of $180 million.

“We took the necessary actions to accelerate our

fleet rotation in the Americas segment, which will create more

certainty in our fleet costs and better position us for sustainable

growth for 2025 and beyond. Travel demand is strong, and our brands

are well-positioned to take advantage of this activity,” said Joe

Ferraro, Avis Budget Group Chief Executive Officer. “In the United

States, the December holidays were a record and Martin Luther King

Jr. Day was robust, denoting the strength of leisure activity,

which we believe will continue throughout this year. For these

reasons, I am confident in our ability to generate no less than $1

billion of Adjusted EBITDA in 2025.”

Our liquidity position at the end of the

quarter, including committed and uncommitted facilities, was

approximately $1.1 billion with an additional

$2.8 billion of fleet funding capacity. We have well-laddered

corporate debt maturities.

Financial Highlights

-

In the Americas, fourth quarter vehicle utilization increased by

more than two points compared to 2023. For the full year, rental

days increased 1% compared to 2023.

-

In International, fourth quarter vehicle utilization was up by more

than two points compared to 2023. For the full year, rental days

were 4% higher compared to 2023.

-

In 2024, we repurchased approximately 550,000 shares of common

stock for a total of $45 million under the share repurchase

program.

_________________________1 Adjusted EBITDA and

certain other measures in this release are non-GAAP financial

measures. See "Non-GAAP Financial Measures and Key Metrics" and the

tables that accompany this release for definitions and

reconciliations of these non-GAAP measures to the most comparable

GAAP measures.

CEO TRANSITION

Avis Budget Group today announced that after an

exceptional 45-year career with the Company, Joe Ferraro will

transition from CEO to Board Advisor, effective June 30, 2025.

Brian Choi, the Company’s Chief Transformation Officer, will take

over as CEO, effective July 1, 2025. Additionally, Jagdeep Pahwa,

who has served as a Board member since 2018 and as Chairman of the

Board since May 2024, has been named Executive Chairman.

“We are grateful to Joe for his strong

leadership and invaluable contributions to Avis Budget Group,

particularly during the challenges of the COVID-19 pandemic, which

helped us emerge as a stronger company. I am also excited to

continue working with him in his role as Board Advisor,” said

Pahwa. “We are confident that Brian is well-positioned to lead the

Company going forward. I wish him the best in his new role and look

forward to working closely with him.”

Reflecting on his tenure, Ferraro stated, “It

has been an honor to serve as CEO and to work alongside the

outstanding team at Avis Budget Group, where I have spent my entire

career. Together, we have worked tirelessly to achieve record

results and position the Company for future success. I look forward

to seeing the Company continue a strong trajectory in the years

ahead.”

Incoming CEO Brian Choi stated, “I am honored to

step into the role of CEO and lead this incredible organization

into its next chapter. I want to thank Joe for his leadership,

operational expertise, and invaluable insights. I look forward to

working with my colleagues and Jagdeep to continue innovating our

business, enhancing our customer value proposition, and creating

long-term value for all stakeholders.”

INVESTOR CONFERENCE CALL

We will host a conference call to discuss our

fourth quarter results on February 12, 2025, at 8:30 a.m.

(ET). Investors may access the call on our investor relations

website at ir.avisbudgetgroup.com or by dialing (877) 407-2991. A

replay of the call will be available on our website and at (877)

660-6853 using conference code 13751081.

ABOUT AVIS BUDGET GROUP

We are a leading global provider of mobility

solutions, both through our Avis and Budget brands, which have

approximately 10,250 rental locations in approximately 180

countries around the world, and through our Zipcar brand, which is

the world's leading car sharing network. We operate most of our car

rental locations in North America, Europe and Australasia directly,

and operate primarily through licensees in other parts of the

world. We are headquartered in Parsippany, N.J. More information is

available at avisbudgetgroup.com.

NON-GAAP FINANCIAL MEASURES AND KEY

METRICS

This release includes financial measures such as

Adjusted EBITDA and Adjusted Free Cash Flow, as well as other

financial measures, that are not considered generally accepted

accounting principle (“GAAP”) measures as defined under SEC rules.

Important information regarding such non-GAAP measures is contained

in the tables within this release and in Appendix I, including the

definitions of these measures and reconciliations to the most

comparable U.S. GAAP measures.

We measure performance principally using the

following key metrics: (i) rental days, (ii) revenue per day, (iii)

vehicle utilization, and (iv) per-unit fleet costs. Our rental

days, revenue per day and vehicle utilization metrics are all

calculated based on the actual rental of the vehicle during a

24-hour period. We believe that this methodology provides

management with the most relevant metrics in order to effectively

manage the performance of our business. Our calculations may not be

comparable to the calculations of similarly-titled metrics by other

companies. We present currency exchange rate effects on our key

metrics to provide a method of assessing how our business performed

excluding the effects of foreign currency rate fluctuations.

Currency exchange rate effects are calculated by translating the

current-period's results at the prior-period average exchange rates

plus any related gains and losses on currency hedges.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release

constitute “forward-looking statements” as that term is defined in

the Private Securities Litigation Reform Act of 1995. The

forward-looking statements contained herein are subject to known

and unknown risks, uncertainties, assumptions and other factors

that may cause our actual results, performance or achievements to

be materially different from those expressed or implied by any such

forward-looking statements. Forward-looking statements include

information concerning our future financial performance, business

strategy, projected plans and objectives. These statements may be

identified by the fact that they do not relate to historical or

current facts and may use words such as “believes,” “expects,”

“anticipates,” “will,” “should,” “could,” “may,” “would,”

“intends,” “projects,” “estimates,” “plans,” “forecasts,”

“guidance,” and similar words, expressions or phrases. The

following important factors and assumptions could affect our future

results and could cause actual results to differ materially from

those expressed in such forward-looking statements. These factors

include, but are not limited to:

- the high level of competition in

the mobility industry, including from new companies or technology,

and the impact such competition may have on pricing and rental

volume;

- a change in our fleet costs,

including as a result of a change in the cost of new vehicles,

resulting from inflation, tariffs or otherwise, manufacturer

recalls, disruption in the supply of new vehicles, including due to

labor actions, tariffs or otherwise, shortages in semiconductors

used in new vehicle production, and/or a change in the price at

which we dispose of used vehicles either in the used vehicle market

or under repurchase or guaranteed depreciation programs;

- the results of operations or

financial condition of the manufacturers of our vehicles, which

could impact their ability to perform their payment obligations

under our agreements with them, including repurchase and/or

guaranteed depreciation arrangements, and/or their willingness or

ability to make vehicles available to us or the mobility industry

as a whole on commercially reasonable terms or at all;

- levels of and volatility in travel

demand, including future volatility in airline passenger

traffic;

- a deterioration in economic

conditions, resulting in a recession or otherwise, particularly

during our peak season or in key market segments;

- an occurrence or threat of

terrorism, pandemics, severe weather events or natural disasters,

military conflicts, including the ongoing military conflict in

Eastern Europe, or civil unrest in the locations in which we

operate, and the potential effects of sanctions on the world

economy and markets and/or international trade;

- any substantial changes in the cost

or supply of fuel, vehicle parts, energy, labor or other resources

on which we depend to operate our business, including as a result

of pandemics, inflation, tariffs, the ongoing military conflict in

Eastern Europe, and any embargoes on oil sales imposed on or by the

Russian government;

- our ability to successfully

implement or achieve our business plans and strategies, achieve and

maintain cost savings and adapt our business to changes in

mobility;

- political, economic, or commercial

instability and/or political, regulatory, or legal changes in the

countries in which we operate, and our ability to conform to

multiple and conflicting laws or regulations in those

countries;

- the performance of the used vehicle

market from time to time, including our ability to dispose of

vehicles in the used vehicle market on attractive terms;

- our dependence on third-party

distribution channels, third-party suppliers of other services and

co-marketing arrangements with third parties;

- risks related to completed or

future acquisitions or investments that we may pursue, including

the incurrence of incremental indebtedness to help fund such

transactions and our ability to promptly and effectively integrate

any acquired businesses or capitalize on joint ventures,

partnerships and other investments;

- our ability to utilize derivative

instruments, and the impact of derivative instruments we utilize,

which can be affected by fluctuations in interest rates, fuel

prices and exchange rates, changes in government regulations and

other factors;

- our exposure to uninsured or unpaid

claims in excess of historical levels or changes in the number of

incidents or cost per incident, and our ability to obtain insurance

at desired levels and the cost of that insurance;

- risks associated with litigation or

governmental or regulatory inquiries, or any failure or inability

to comply with laws, regulations or contractual obligations or any

changes in laws, regulations or contractual obligations, including

with respect to personally identifiable information and consumer

privacy, labor and employment, and tax;

- risks related to protecting the

integrity of, and preventing unauthorized access to, our

information technology systems or those of our third-party vendors,

licensees, dealers, independent operators and independent

contractors, and protecting the confidential information of our

employees and customers against security breaches, including

physical or cybersecurity breaches, attacks, or other disruptions,

compliance with privacy and data protection regulation, and the

effects of any potential increase in cyberattacks on the world

economy and markets and/or international trade;

- any impact on us from the actions

of our third-party vendors, licensees, dealers, independent

operators and independent contractors and/or disputes that may

arise out of our agreements with such parties;

- any major disruptions in our

communication networks or information systems;

- risks related to tax obligations

and the effect of future changes in tax laws and accounting

standards;

- risks related to our indebtedness,

including our substantial outstanding debt obligations, recent and

future interest rate increases, which increase our financing costs,

downgrades by rating agencies and our ability to incur

substantially more debt;

- our ability to obtain financing for

our global operations, including the funding of our vehicle fleet

through the issuance of asset-backed securities and use of the

global lending markets;

- our ability to meet the financial

and other covenants contained in the agreements governing our

indebtedness, or to obtain a waiver or amendment of such covenants

should we be unable to meet such covenants;

- significant changes in the timing

of our fleet rotation, carrying value of goodwill, or long-lived

assets, including when there are events or changes in circumstances

that indicate the carrying value may exceed the current fair value,

which could result in a significant impairment charge; and

- other business, economic,

competitive, governmental, regulatory, political or technological

factors affecting our operations, pricing or services.

We operate in a continuously changing business

environment and new risk factors emerge from time to time. New risk

factors, factors beyond our control, or changes in the impact of

identified risk factors may cause actual results to differ

materially from those set forth in any forward-looking statements.

Accordingly, forward-looking statements should not be relied upon

as a prediction of actual results. Moreover, we do not assume

responsibility if future results are materially different from

those forecasted or anticipated. Other factors and assumptions not

identified above, including those discussed in “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” set forth in Item 2 and "Risk Factors" set forth in

Item 1A in our quarterly reports and in similarly titled sections

set forth in Item 7 and in Item 1A and in other portions of our

2023 Annual Report on Form 10-K filed with the Securities and

Exchange Commission (the “SEC”) on February 16, 2024 (the

“2023 Form 10-K”), may cause actual results to differ materially

from those projected in any forward-looking statements.

Although we believe that our assumptions are

reasonable, any or all of our forward-looking statements may prove

to be inaccurate and we can make no guarantees about our future

performance. Should unknown risks or uncertainties materialize or

underlying assumptions prove inaccurate, actual results could

differ materially from past results and/or those anticipated,

estimated or projected. We undertake no obligation to release any

revisions to any forward-looking statements, to report events or to

report the occurrence of unanticipated events. For any

forward-looking statements contained in any document, we claim the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

For additional information concerning forward-looking statements

and other important factors, refer to our 2023 Form 10-K, Quarterly

Reports on Form 10-Q and other filings with the SEC.

|

Investor Relations Contact: |

Media Relations Contact: |

|

David Calabria, IR@avisbudget.com |

Media Relations Team, ABGPress@edelman.com |

|

|

|

|

*** Tables 1 - 6 and Appendix I attached *** |

|

Table 1 |

|

Avis Budget Group,

Inc.SUMMARY DATA SHEET

(Unaudited)(In millions) |

|

|

|

|

| |

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

% Change |

|

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

|

Income Statement and Other Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

2,710 |

|

|

$ |

2,764 |

|

(2)% |

|

|

$ |

11,789 |

|

|

$ |

12,008 |

|

|

(2)% |

|

|

Income (loss) before income taxes |

|

(2,841 |

) |

|

|

162 |

|

n/m |

|

|

|

(2,627 |

) |

|

|

1,914 |

|

|

n/m |

|

|

Net income (loss) attributable to Avis Budget Group, Inc. |

|

(1,958 |

) |

|

|

259 |

|

n/m |

|

|

|

(1,821 |

) |

|

|

1,632 |

|

|

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(a) |

$ |

(101 |

) |

|

$ |

311 |

|

n/m |

|

|

$ |

628 |

|

|

$ |

2,490 |

|

|

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

Balance Sheet Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

$ |

534 |

|

|

$ |

555 |

|

|

|

|

|

Program cash and restricted cash |

|

|

|

|

|

|

|

|

63 |

|

|

|

89 |

|

|

|

|

|

Vehicles, net |

|

|

|

|

|

|

|

|

17,619 |

|

|

|

21,240 |

|

|

|

|

|

Debt under vehicle programs(b) |

|

|

|

|

|

|

|

|

17,536 |

|

|

|

18,937 |

|

|

|

|

|

Corporate debt |

|

|

|

|

|

|

|

|

5,393 |

|

|

|

4,823 |

|

|

|

|

|

Stockholders' equity attributable to Avis Budget Group, Inc. |

|

|

|

|

|

|

|

|

(2,327 |

) |

|

|

(349 |

) |

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

Segment Results |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

$ |

2,117 |

|

|

$ |

2,167 |

|

|

(2)% |

|

$ |

9,111 |

|

|

$ |

9,347 |

|

|

(3)% |

|

|

International |

|

593 |

|

|

|

597 |

|

|

(1)% |

|

|

2,678 |

|

|

|

2,661 |

|

|

1% |

|

|

Total company |

$ |

2,710 |

|

|

$ |

2,764 |

|

|

(2)% |

|

$ |

11,789 |

|

|

$ |

12,008 |

|

|

(2)% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted

EBITDA(a) |

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

$ |

(63 |

) |

|

$ |

309 |

|

|

n/m |

|

$ |

551 |

|

|

$ |

2,196 |

|

|

n/m |

|

|

International |

|

(11 |

) |

|

|

28 |

|

|

n/m |

|

|

161 |

|

|

|

400 |

|

|

n/m |

|

|

Corporate and other(c) |

|

(27 |

) |

|

|

(26 |

) |

|

n/m |

|

|

(84 |

) |

|

|

(106 |

) |

|

n/m |

|

|

Total company |

$ |

(101 |

) |

|

$ |

311 |

|

|

n/m |

|

$ |

628 |

|

|

$ |

2,490 |

|

|

n/m |

|

__________

|

n/m Not meaningful. |

|

(a) |

Refer to Table 5 for the reconciliation of net income to Adjusted

EBITDA and Appendix I for the related definition of the non-GAAP

financial measure. |

|

(b) |

Includes $751 million and $841 million of Class R notes

due to Avis Budget Rental Car Funding (AESOP) LLC as of

December 31, 2024 and December 31, 2023, respectively,

which are held by us. |

|

(c) |

Includes unallocated corporate expenses which are not attributable

to a particular segment. |

| |

|

|

Table 2 |

|

Avis Budget Group, Inc.CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited)(In millions,

except per share data) |

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

Revenues |

$ |

2,710 |

|

|

$ |

2,764 |

|

|

$ |

11,789 |

|

|

$ |

12,008 |

| |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

Operating |

|

1,563 |

|

|

|

1,350 |

|

|

|

6,014 |

|

|

|

5,675 |

|

Vehicle depreciation and lease charges, net |

|

801 |

|

|

|

582 |

|

|

|

2,976 |

|

|

|

1,739 |

|

Selling, general and administrative |

|

312 |

|

|

|

309 |

|

|

|

1,352 |

|

|

|

1,408 |

|

Vehicle interest, net |

|

217 |

|

|

|

223 |

|

|

|

941 |

|

|

|

736 |

|

Non-vehicle related depreciation and amortization |

|

60 |

|

|

|

53 |

|

|

|

237 |

|

|

|

216 |

|

Interest expense related to corporate debt, net: |

|

|

|

|

|

|

|

|

Interest expense |

|

92 |

|

|

|

75 |

|

|

|

358 |

|

|

|

296 |

|

Early extinguishment of debt |

|

18 |

|

|

|

4 |

|

|

|

19 |

|

|

|

5 |

|

Long-lived asset impairment and other related charges |

|

2,470 |

|

|

|

— |

|

|

|

2,470 |

|

|

|

— |

|

Restructuring and other related charges |

|

14 |

|

|

|

4 |

|

|

|

37 |

|

|

|

11 |

|

Transaction-related costs, net |

|

1 |

|

|

|

2 |

|

|

|

3 |

|

|

|

5 |

|

Other (income) expense, net |

|

3 |

|

|

|

— |

|

|

|

9 |

|

|

|

3 |

|

Total expenses |

|

5,551 |

|

|

|

2,602 |

|

|

|

14,416 |

|

|

|

10,094 |

| |

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

(2,841 |

) |

|

|

162 |

|

|

|

(2,627 |

) |

|

|

1,914 |

|

Provision for (benefit from) income taxes |

|

(884 |

) |

|

|

(98 |

) |

|

|

(810 |

) |

|

|

279 |

|

Net income (loss) |

|

(1,957 |

) |

|

|

260 |

|

|

|

(1,817 |

) |

|

|

1,635 |

|

Less: Net income attributable to non-controlling interests |

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

3 |

|

Net income (loss) attributable to Avis Budget Group,

Inc. |

$ |

(1,958 |

) |

|

$ |

259 |

|

|

$ |

(1,821 |

) |

|

$ |

1,632 |

| |

|

|

|

|

|

|

|

|

Earnings (loss) per share |

|

|

|

|

|

|

|

|

Basic |

$ |

(55.66 |

) |

|

$ |

7.18 |

|

|

$ |

(51.23 |

) |

|

$ |

42.57 |

|

Diluted |

$ |

(55.66 |

) |

|

$ |

7.10 |

|

|

$ |

(51.23 |

) |

|

$ |

42.08 |

| |

|

|

|

|

|

|

|

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

35.2 |

|

|

|

36.0 |

|

|

|

35.5 |

|

|

|

38.3 |

|

Diluted |

|

35.2 |

|

|

|

36.4 |

|

|

|

35.5 |

|

|

|

38.8 |

|

|

|

Table 3 |

|

Avis Budget Group, Inc.KEY

METRICS SUMMARY (Unaudited) |

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Rental Days (000’s) |

|

30,877 |

|

|

|

31,009 |

|

|

— |

% |

|

|

128,431 |

|

|

|

127,661 |

|

|

1 |

% |

|

Revenue per Day |

$ |

68.57 |

|

|

$ |

69.89 |

|

|

(2 |

)% |

|

$ |

70.94 |

|

|

$ |

73.22 |

|

|

(3 |

)% |

|

Revenue per Day, excluding exchange rate effects |

$ |

68.64 |

|

|

$ |

69.89 |

|

|

(2 |

)% |

|

$ |

71.01 |

|

|

$ |

73.22 |

|

|

(3 |

)% |

|

Average Rental Fleet |

|

497,713 |

|

|

|

518,928 |

|

|

(4 |

)% |

|

|

510,535 |

|

|

|

507,358 |

|

|

1 |

% |

|

Vehicle Utilization |

|

67.4 |

% |

|

|

65.0 |

% |

|

2.4pps |

|

|

68.7 |

% |

|

|

68.9 |

% |

|

(0.2)pps |

|

Per-Unit Fleet Costs per Month |

$ |

430 |

|

|

$ |

272 |

|

|

58 |

% |

|

$ |

376 |

|

|

$ |

200 |

|

|

88 |

% |

|

Per-Unit Fleet Costs per Month, excluding exchange rate

effects |

$ |

431 |

|

|

$ |

272 |

|

|

58 |

% |

|

$ |

376 |

|

|

$ |

200 |

|

|

88 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Rental Days (000’s) |

|

10,956 |

|

|

|

11,018 |

|

|

(1 |

)% |

|

|

47,274 |

|

|

|

45,644 |

|

|

4 |

% |

|

Revenue per Day |

$ |

54.15 |

|

|

$ |

54.22 |

|

|

— |

% |

|

$ |

56.65 |

|

|

$ |

58.30 |

|

|

(3 |

)% |

|

Revenue per Day, excluding exchange rate effects |

$ |

54.32 |

|

|

$ |

54.22 |

|

|

— |

% |

|

$ |

56.66 |

|

|

$ |

58.30 |

|

|

(3 |

)% |

|

Average Rental Fleet |

|

174,253 |

|

|

|

182,337 |

|

|

(4 |

)% |

|

|

184,549 |

|

|

|

184,147 |

|

|

— |

% |

|

Vehicle Utilization |

|

68.3 |

% |

|

|

65.7 |

% |

|

2.6pps |

|

|

70.0 |

% |

|

|

67.9 |

% |

|

2.1pps |

|

Per-Unit Fleet Costs per Month |

$ |

304 |

|

|

$ |

291 |

|

|

4 |

% |

|

$ |

305 |

|

|

$ |

237 |

|

|

29 |

% |

|

Per-Unit Fleet Costs per Month, excluding exchange rate

effects |

$ |

305 |

|

|

$ |

291 |

|

|

5 |

% |

|

$ |

304 |

|

|

$ |

237 |

|

|

28 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Rental Days (000’s) |

|

41,833 |

|

|

|

42,027 |

|

|

— |

% |

|

|

175,705 |

|

|

|

173,305 |

|

|

1 |

% |

|

Revenue per Day |

$ |

64.79 |

|

|

$ |

65.78 |

|

|

(2 |

)% |

|

$ |

67.10 |

|

|

$ |

69.29 |

|

|

(3 |

)% |

|

Revenue per Day, excluding exchange rate effects |

$ |

64.89 |

|

|

$ |

65.78 |

|

|

(1 |

)% |

|

$ |

67.15 |

|

|

$ |

69.29 |

|

|

(3 |

)% |

|

Average Rental Fleet |

|

671,966 |

|

|

|

701,265 |

|

|

(4 |

)% |

|

|

695,084 |

|

|

|

691,505 |

|

|

1 |

% |

|

Vehicle Utilization |

|

67.7 |

% |

|

|

65.1 |

% |

|

2.6pps |

|

|

69.1 |

% |

|

|

68.7 |

% |

|

0.4pps |

|

Per-Unit Fleet Costs per Month |

$ |

397 |

|

|

$ |

277 |

|

|

43 |

% |

|

$ |

357 |

|

|

$ |

210 |

|

|

70 |

% |

|

Per-Unit Fleet Costs per Month, excluding exchange rate

effects |

$ |

398 |

|

|

$ |

277 |

|

|

44 |

% |

|

$ |

357 |

|

|

$ |

210 |

|

|

70 |

% |

__________Refer to Table 6 for key metrics

calculations and Appendix I for key metrics definitions.

|

Table 4 |

|

Avis Budget Group, Inc.CONSOLIDATED

CONDENSED SCHEDULE OF CASH FLOW AND ADJUSTED FREE

CASH FLOW (Unaudited)(In

millions) |

|

|

|

CONSOLIDATED CONDENSED SCHEDULE OF CASH FLOW |

Year Ended December 31, 2024 |

|

Operating Activities |

|

|

Net cash provided by operating activities |

$ |

3,518 |

|

|

Investing Activities |

|

|

Net cash used in investing activities exclusive of vehicle

programs |

|

(190 |

) |

|

Net cash used in investing activities of vehicle programs |

|

(2,563 |

) |

|

Net cash used in investing activities |

|

(2,753 |

) |

|

Financing Activities |

|

|

Net cash provided by financing activities exclusive of vehicle

programs |

|

532 |

|

|

Net cash used in financing activities of vehicle programs |

|

(1,313 |

) |

|

Net cash used in financing activities |

|

(781 |

) |

|

Effect of changes in exchange rates on cash and cash equivalents,

program and restricted cash |

|

(31 |

) |

|

Net change in cash and cash equivalents, program and restricted

cash |

|

(47 |

) |

|

Cash and cash equivalents, program and restricted cash,

beginning of period |

|

644 |

|

|

Cash and cash equivalents, program and restricted cash, end

of period |

$ |

597 |

|

|

ADJUSTED FREE CASH FLOW(a) |

Year Ended December 31, 2024 |

|

Adjusted EBITDA(b) |

$ |

628 |

|

|

Interest expense related to corporate debt, net (excluding early

extinguishment of debt) |

|

(358 |

) |

|

Working capital and other |

|

(27 |

) |

|

Capital expenditures(c) |

|

(219 |

) |

|

Tax payments, net of refunds |

|

(50 |

) |

|

Vehicle programs and related(d) |

|

(488 |

) |

|

Adjusted Free Cash Flow(b) |

$ |

(514 |

) |

|

Acquisition and related payments, net of acquired cash |

|

(2 |

) |

|

Borrowings, net of debt repayments |

|

630 |

|

|

Repurchases of common stock |

|

(70 |

) |

|

Change in program and restricted cash |

|

(23 |

) |

|

Other receipts (payments), net |

|

(15 |

) |

|

Foreign exchange effects, financing costs and other |

|

(53 |

) |

|

Net change in cash and cash equivalents, program and

restricted cash (per above) |

$ |

(47 |

) |

__________

|

Refer to Appendix I for the definitions of non-GAAP financial

measures Adjusted EBITDA and Adjusted Free Cash Flow. |

|

(a) |

This presentation demonstrates the relationship between Adjusted

EBITDA and Adjusted Free Cash Flow. We believe it is useful to

understand this relationship because it demonstrates how cash

generated by our operations is used. This presentation is not

intended to be reconciliations of these non-GAAP measures, which

are provided on Table 5. |

|

(b) |

Refer to Table 5 for the reconciliations of net income to Adjusted

EBITDA and net cash provided by operating activities to Adjusted

Free Cash Flow. |

|

(c) |

Includes $17 million of cloud computing implementation costs. |

|

(d) |

Includes vehicle-backed borrowings (repayments) that are

incremental to amounts required to fund vehicle and vehicle-related

assets. |

|

|

|

|

Table 5 |

|

Avis Budget Group, Inc.RECONCILIATION OF

NON-GAAP MEASURES

(Unaudited)(In millions) |

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

Reconciliation of Net income to Adjusted

EBITDA: |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

| |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

(1,957 |

) |

|

$ |

260 |

|

|

$ |

(1,817 |

) |

|

$ |

1,635 |

|

Provision for (benefit from) income taxes |

|

(884 |

) |

|

|

(98 |

) |

|

|

(810 |

) |

|

|

279 |

|

Income (loss) before income taxes |

|

(2,841 |

) |

|

|

162 |

|

|

|

(2,627 |

) |

|

|

1,914 |

|

Non-vehicle related depreciation and amortization |

|

60 |

|

|

|

53 |

|

|

|

237 |

|

|

|

216 |

|

Interest expense related to corporate debt, net: |

|

|

|

|

|

|

|

|

Interest expense |

|

92 |

|

|

|

75 |

|

|

|

358 |

|

|

|

296 |

|

Early extinguishment of debt |

|

18 |

|

|

|

4 |

|

|

|

19 |

|

|

|

5 |

|

Long-lived asset impairment and other related charges(a) |

|

2,470 |

|

|

|

— |

|

|

|

2,470 |

|

|

|

— |

|

Restructuring and other related charges |

|

14 |

|

|

|

4 |

|

|

|

37 |

|

|

|

11 |

|

Transaction-related costs, net |

|

1 |

|

|

|

2 |

|

|

|

3 |

|

|

|

5 |

|

Other (income) expense, net |

|

3 |

|

|

|

— |

|

|

|

9 |

|

|

|

3 |

|

Legal matters, net(b) |

|

57 |

|

|

|

— |

|

|

|

64 |

|

|

|

5 |

|

Cloud computing costs(c) |

|

12 |

|

|

|

11 |

|

|

|

45 |

|

|

|

35 |

|

Severe weather-related damages, net(c) |

|

13 |

|

|

|

— |

|

|

|

13 |

|

|

|

— |

|

Adjusted

EBITDA(d) |

$ |

(101 |

) |

|

$ |

311 |

|

|

$ |

628 |

|

|

$ |

2,490 |

| |

|

|

|

|

|

|

|

| Reconciliation of Net

cash provided by operating activities to Adjusted Free Cash

Flow: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

3,518 |

|

|

|

|

Net cash used in investing activities of vehicle programs |

|

|

(2,563 |

) |

|

|

|

Net cash used in financing activities of vehicle programs |

|

|

(1,313 |

) |

|

|

|

Capital expenditures |

|

|

(202 |

) |

|

|

|

Proceeds received on sale of assets and nonmarketable equity

securities |

|

|

3 |

|

|

|

|

Acquisition and disposition-related payments |

|

|

(2 |

) |

|

|

|

Change in program and restricted cash |

|

|

23 |

|

|

|

|

Dividends from equity method investments |

|

|

7 |

|

|

|

|

Other receipts (payments), net |

|

|

15 |

|

|

|

|

Adjusted Free Cash Flow |

|

$ |

(514 |

) |

|

|

__________

|

Refer to Appendix I for the definitions of Adjusted EBITDA and

Adjusted Free Cash Flow, non-GAAP financial measures. |

|

(a) |

Includes an impairment charge of approximately $2.3 billion related

to the acceleration of the rotation of our fleet and a charge of

$180 million related to the write-down of the carrying value of

certain vehicles held for sale within our Americas reportable

segment. |

|

(b) |

Includes $53 million within operating expenses and $4 million

reported within selling, general and administrative expenses for

the three months ended December 31, 2024. Includes $60 million

within operating expenses and $4 million within selling, general

and administrative expenses for the year ended December 31,

2024 and $5 million within operating expenses for the year ended

December 31, 2023. The $60 million recorded within operating

expenses for the year ended December 31, 2024 includes

$46 million relating to our self-insurance reserves for

allocated loss adjustment expense. |

|

(c) |

Reported within operating expenses. |

|

(d) |

Includes stock-based compensation expense and vehicle related

deferred financing fee amortization in the aggregate totaling $12

million and $15 million in the three months ended December 31,

2024 and 2023, respectively, and $52 million and $59 million in the

years ended December 31, 2024 and 2023, respectively. |

|

|

|

|

Table 6 |

|

Avis Budget Group, Inc.KEY METRICS

CALCULATIONS (Unaudited)($ in

millions, except as noted) |

|

|

| |

Three Months Ended December 31, 2024 |

|

Three Months Ended December 31, 2023 |

| |

Americas |

|

International |

|

Total |

|

Americas |

|

International |

|

Total |

|

Revenue per Day (RPD) |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

2,117 |

|

|

$ |

593 |

|

|

$ |

2,710 |

|

|

$ |

2,167 |

|

|

$ |

597 |

|

|

$ |

2,764 |

|

|

Currency exchange rate effects |

|

2 |

|

|

|

3 |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Revenue excluding exchange rate effects |

|

2,119 |

|

|

|

596 |

|

|

|

2,715 |

|

|

|

2,167 |

|

|

|

597 |

|

|

|

2,764 |

|

|

Rental days (000's) |

|

30,877 |

|

|

|

10,956 |

|

|

|

41,833 |

|

|

|

31,009 |

|

|

|

11,018 |

|

|

|

42,027 |

|

|

RPD excluding exchange rate effects (in $'s) |

$ |

68.64 |

|

|

$ |

54.32 |

|

|

$ |

64.89 |

|

|

$ |

69.89 |

|

|

$ |

54.22 |

|

|

$ |

65.78 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Utilization |

|

|

|

|

|

|

|

|

|

|

|

|

Rental days (000's) |

|

30,877 |

|

|

|

10,956 |

|

|

|

41,833 |

|

|

|

31,009 |

|

|

|

11,018 |

|

|

|

42,027 |

|

|

Average rental fleet |

|

497,713 |

|

|

|

174,253 |

|

|

|

671,966 |

|

|

|

518,928 |

|

|

|

182,337 |

|

|

|

701,265 |

|

|

Number of days in period |

|

92 |

|

|

|

92 |

|

|

|

92 |

|

|

|

92 |

|

|

|

92 |

|

|

|

92 |

|

|

Available rental days (000's) |

|

45,790 |

|

|

|

16,031 |

|

|

|

61,821 |

|

|

|

47,741 |

|

|

|

16,775 |

|

|

|

64,516 |

|

|

Vehicle utilization |

|

67.4 |

% |

|

|

68.3 |

% |

|

|

67.7 |

% |

|

|

65.0 |

% |

|

|

65.7 |

% |

|

|

65.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Per-Unit Fleet Costs |

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle depreciation and lease charges, net |

$ |

642 |

|

|

$ |

159 |

|

|

$ |

801 |

|

|

$ |

424 |

|

|

$ |

158 |

|

|

$ |

582 |

|

|

Currency exchange rate effects |

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Vehicle depreciation excluding exchange rate effects |

$ |

643 |

|

|

$ |

159 |

|

|

$ |

802 |

|

|

$ |

424 |

|

|

$ |

158 |

|

|

$ |

582 |

|

|

Average rental fleet |

|

497,713 |

|

|

|

174,253 |

|

|

|

671,966 |

|

|

|

518,928 |

|

|

|

182,337 |

|

|

|

701,265 |

|

|

Per-unit fleet costs (in $'s) |

$ |

1,293 |

|

|

$ |

914 |

|

|

$ |

1,195 |

|

|

$ |

816 |

|

|

$ |

872 |

|

|

$ |

831 |

|

|

Number of months in period |

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

Per-unit fleet costs per month excluding exchange rate effects (in

$'s) |

$ |

431 |

|

|

$ |

305 |

|

|

$ |

398 |

|

|

$ |

272 |

|

|

$ |

291 |

|

|

$ |

277 |

|

|

|

Year Ended December 31, 2024 |

|

Year Ended December 31, 2023 |

|

|

Americas |

|

International |

|

Total |

|

Americas |

|

International |

|

Total |

|

Revenue per Day (RPD) |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

9,111 |

|

|

$ |

2,678 |

|

|

$ |

11,789 |

|

|

$ |

9,347 |

|

|

$ |

2,661 |

|

|

$ |

12,008 |

|

|

Currency exchange rate effects |

|

8 |

|

|

|

1 |

|

|

|

9 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Revenue excluding exchange rate effects |

|

9,119 |

|

|

|

2,679 |

|

|

|

11,798 |

|

|

|

9,347 |

|

|

|

2,661 |

|

|

|

12,008 |

|

|

Rental days (000's) |

|

128,431 |

|

|

|

47,274 |

|

|

|

175,705 |

|

|

|

127,661 |

|

|

|

45,644 |

|

|

|

173,305 |

|

|

RPD excluding exchange rate effects (in $'s) |

$ |

71.01 |

|

|

$ |

56.66 |

|

|

$ |

67.15 |

|

|

$ |

73.22 |

|

|

$ |

58.30 |

|

|

$ |

69.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle Utilization |

|

|

|

|

|

|

|

|

|

|

|

|

Rental days (000's) |

|

128,431 |

|

|

|

47,274 |

|

|

|

175,705 |

|

|

|

127,661 |

|

|

|

45,644 |

|

|

|

173,305 |

|

|

Average rental fleet |

|

510,535 |

|

|

|

184,549 |

|

|

|

695,084 |

|

|

|

507,358 |

|

|

|

184,147 |

|

|

|

691,505 |

|

|

Number of days in period |

|

366 |

|

|

|

366 |

|

|

|

366 |

|

|

|

365 |

|

|

|

365 |

|

|

|

365 |

|

|

Available rental days (000's) |

|

186,856 |

|

|

|

67,545 |

|

|

|

254,401 |

|

|

|

185,186 |

|

|

|

67,213 |

|

|

|

252,399 |

|

|

Vehicle utilization |

|

68.7 |

% |

|

|

70.0 |

% |

|

|

69.1 |

% |

|

|

68.9 |

% |

|

|

67.9 |

% |

|

|

68.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per-Unit Fleet Costs |

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle depreciation and lease charges, net |

$ |

2,301 |

|

|

$ |

675 |

|

|

$ |

2,976 |

|

|

$ |

1,215 |

|

|

$ |

524 |

|

|

$ |

1,739 |

|

|

Currency exchange rate effects |

|

2 |

|

|

|

(2 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Vehicle depreciation excluding exchange rate effects |

$ |

2,303 |

|

|

$ |

673 |

|

|

$ |

2,976 |

|

|

$ |

1,215 |

|

|

$ |

524 |

|

|

$ |

1,739 |

|

|

Average rental fleet |

|

510,535 |

|

|

|

184,549 |

|

|

|

695,084 |

|

|

|

507,358 |

|

|

|

184,147 |

|

|

|

691,505 |

|

|

Per-unit fleet costs (in $'s) |

$ |

4,512 |

|

|

$ |

3,649 |

|

|

$ |

4,282 |

|

|

$ |

2,395 |

|

|

$ |

2,847 |

|

|

$ |

2,515 |

|

|

Number of months in period |

|

12 |

|

|

|

12 |

|

|

|

12 |

|

|

|

12 |

|

|

|

12 |

|

|

|

12 |

|

|

Per-unit fleet costs per month excluding exchange rate effects (in

$'s) |

$ |

376 |

|

|

$ |

304 |

|

|

$ |

357 |

|

|

$ |

200 |

|

|

$ |

237 |

|

|

$ |

210 |

|

__________Our calculation of rental days and

revenue per day may not be comparable to the calculation of

similarly-titled metrics by other companies. Currency exchange rate

effects are calculated by translating the current-period's results

at the prior-period average exchange rates plus any related gains

and losses on currency hedges.

|

Appendix I |

|

Avis Budget Group, Inc. |

|

DEFINITIONS OF NON-GAAP MEASURES AND KEY

METRICS |

|

|

Adjusted EBITDAThe accompanying

press release presents Adjusted EBITDA, which is a non-GAAP measure

most directly comparable to net income (loss). Adjusted EBITDA is

defined as income (loss) from continuing operations before

non-vehicle related depreciation and amortization; long-lived asset

impairment and other related charges; restructuring and other

related charges; early extinguishment of debt costs; non-vehicle

related interest; transaction-related costs, net; legal matters,

net, which includes amounts recorded in excess of $5 million,

related primarily to unprecedented self-insurance reserves for

allocated loss adjustment expense, class action lawsuits and

personal injury matters; non-operational charges related to

shareholder activist activity, which includes third-party advisory,

legal and other professional fees; COVID-19 charges, net; cloud

computing costs; other (income) expense, net; severe

weather-related damages in excess of $5 million, net of

insurance proceeds; and income taxes. We have revised our

definition of Adjusted EBITDA to exclude severe weather-related

damages in excess of $5 million, net of insurance proceeds. We

did not revise prior years' Adjusted EBITDA amounts because there

were no other charges similar in nature to these.

We believe Adjusted EBITDA is useful as a

supplemental measure in evaluating the performance of our operating

businesses and in comparing our results from period to period. We

also believe that Adjusted EBITDA is useful to investors because it

allows them to assess our results of operations and financial

condition on the same basis that management uses internally.

Adjusted EBITDA is a non-GAAP measure and should not be considered

in isolation or as a substitute for net income or other income

statement data prepared in accordance with U.S. GAAP. Our

presentation of Adjusted EBITDA may not be comparable to

similarly-titled measures used by other companies. A reconciliation

of Adjusted EBITDA from net income (loss) recognized under U.S.

GAAP is provided on Table 5.

Adjusted Free Cash

FlowRepresents net cash provided by operating activities

adjusted to reflect the cash inflows and outflows relating to

capital expenditures, the investing and financing activities of our

vehicle programs, asset sales, if any, and to exclude restructuring

and other related charges; early extinguishment of debt costs;

transaction-related costs; legal matters; non-operational charges

related to shareholder activist activity; COVID-19 charges; other

(income) expense; and severe weather-related damages. We have

revised our definition of Adjusted Free Cash Flow to exclude severe

weather-related damages. We did not revise prior years' Adjusted

Free Cash Flow amounts because there were no other charges similar

in nature to these.

We believe that Adjusted Free Cash Flow is

useful in measuring the cash generated that is available to be used

to repay debt obligations, repurchase stock, pay dividends and

invest in future growth through new business development activities

or acquisitions. Adjusted Free Cash Flow should not be construed as

a substitute in measuring operating results or liquidity, and our

presentation of Adjusted Free Cash Flow may not be comparable to

similarly-titled measures used by other companies. A reconciliation

of Adjusted Free Cash Flow from net cash provided by operating

activities recognized under U.S. GAAP is provided on Table 5.

Adjusted EBITDA

MarginRepresents Adjusted EBITDA as a percentage of

revenues.

Available Rental DaysDefined as

Average Rental Fleet times the numbers of days in a given

period.

Average Rental FleetRepresents

the average number of vehicles in our fleet during a given period

of time.

Currency Exchange Rate

EffectsRepresents the difference between current-period

results as reported and current-period results translated at the

prior-period average exchange rates plus any related currency

hedges.

Gross Adjusted EBITDARepresents

Adjusted EBITDA with the add-back of vehicle depreciation and

vehicle interest.

Net Corporate DebtRepresents

corporate debt minus cash and cash equivalents.

Net Corporate

LeverageRepresents Net Corporate Debt divided by Adjusted

EBITDA for the twelve months prior to the date of calculation.

Total Net Debt RatioRepresents

total debt less cash and cash equivalents divided by Gross Adjusted

EBITDA for the twelve months prior to the date of calculation.

Per-Unit Fleet CostsRepresents

vehicle depreciation, lease charges and gain or loss on vehicles

sales, divided by Average Rental Fleet.

Rental DaysRepresents the total

number of days (or portion thereof) a vehicle was rented during a

24-hour period.

Revenue per DayRepresents

revenues divided by Rental Days.

Vehicle UtilizationRepresents

Rental Days divided by Available Rental Days.

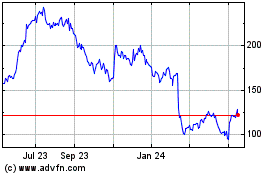

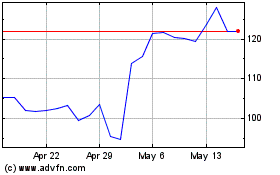

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Feb 2024 to Feb 2025